A wonkish thread on how destructive Mnuchin's decision to terminate emergency lending programs could be, even though those programs have been lightly used so far. 1/ nytimes.com/2020/11/20/opi…

When I think about these programs, my main analogy is the eurozone crisis of 2011-13 — a crisis that was resolved by a promise to lend if necessary, even though no actual lending took place 2/

At the time, borrowing costs for southern European nations were soaring, and default seemed imminent. But the Belgian economist Paul De Grauwe argued that solvency wasn't really the issue 3/ voxeu.org/article/managi…

As he noted, Spain's fiscal position wasn't significantly worse than Britain's — yet Britain had very low borrowing costs while Spain was in crisis 4/

He argued that it was a self-fulfilling liquidity crisis. Investors were afraid that Spain would run out of cash, and were fleeing out of that concern — creating the very cash crunch they feared. 5/

But Britain didn't have that problem because unlike Spain, which was on the euro, it had debts in its own currency — and the Bank of England could always print money to pay the bills if necessary 6/

This suggested that the European Central Bank could stop the panic simply by promising to provide cash if needed. And in July 2012 Mario Draghi said three words: "Whatever it takes" 7/

Sure enough, the euro crisis rapidly ended, with Spanish (and Italian and Portuguese) interest rates rapidly declining 8/

The funny thing was that OMT — "outright monetary transactions", direct ECB lending to governments — never actually happened. The mere prospect that it *could* happen ended the crisis 9/

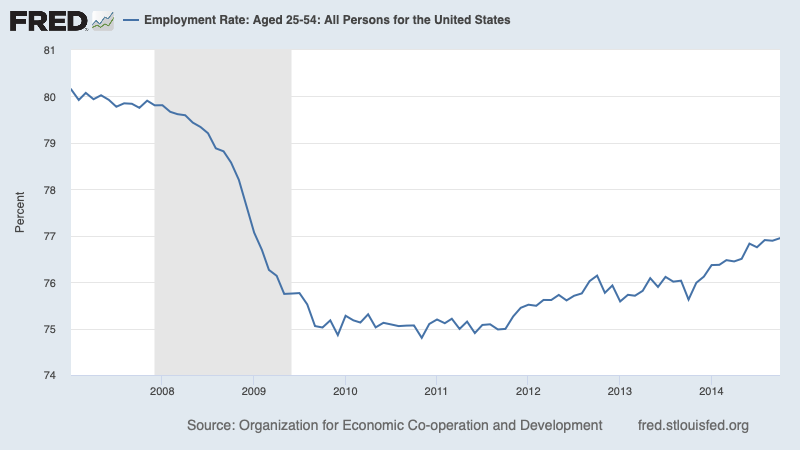

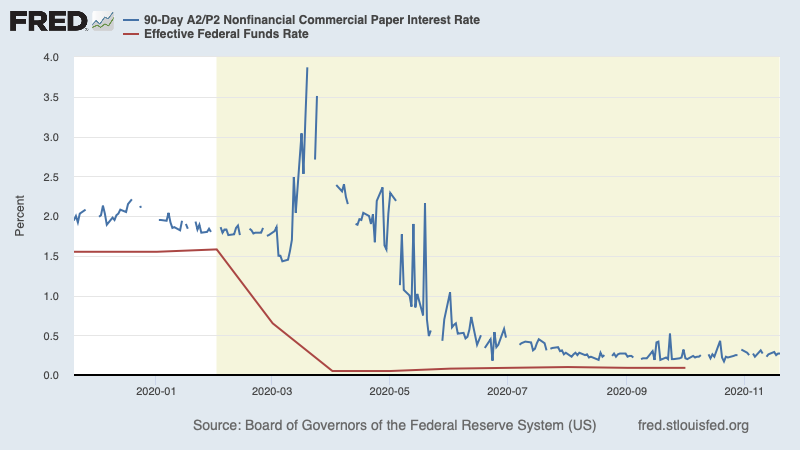

We had a somewhat similar experience in March/April, when the coming of the pandemic created a panic in financial markets — which was controlled more by the Fed's willingness to lend than by its actual lending 10/

Which brings us back to Mnuchin, who is snatching away some of the tools the Fed has to manage a crisis — just as the pandemic is exploding again. Those tools weren't used much — but they provided an important backstop 11/

Is Mnuchin engaged in malicious sabotage? His rationales are extremely weak — and what about the Trump team would lead you to give anyone on it the benefit of the doubt? 12/

• • •

Missing some Tweet in this thread? You can try to

force a refresh