1/11

I really like @FTX_Official and their flexibility, but let’s see how it started. One of their most interesting innovations during their launch were leveraged tokens - tokenized margin positions with daily rebalancing.

I really like @FTX_Official and their flexibility, but let’s see how it started. One of their most interesting innovations during their launch were leveraged tokens - tokenized margin positions with daily rebalancing.

2/11

It’s worth noting that leveraged tokens were launched by @AlamedaResearch about two months before FTX launched them. They even got their own website: leveragedtokens.com

It’s worth noting that leveraged tokens were launched by @AlamedaResearch about two months before FTX launched them. They even got their own website: leveragedtokens.com

3/11

In fact, the operation mechanism of the tokens, with the exception of tokenization, was transferred from the traditional market - where such an instrument is called a leveraged ETF.

In fact, the operation mechanism of the tokens, with the exception of tokenization, was transferred from the traditional market - where such an instrument is called a leveraged ETF.

4/11

Notably, crypto leveraged ETFs appeared on the Crypton exchange almost a year earlier. Apparently, this was an unsuccessful attempt to launch a crypto exchange by Alameda at the end of May 2018.

Notably, crypto leveraged ETFs appeared on the Crypton exchange almost a year earlier. Apparently, this was an unsuccessful attempt to launch a crypto exchange by Alameda at the end of May 2018.

5/11

After the FTX launch, Crypton was shut down on June 10, 2019, although the home page mentioning leveraged ETFs and spot markets is still available. It also mentions the exchange’s token, Crypton Coin, which apparently never existed on the blockchain.

After the FTX launch, Crypton was shut down on June 10, 2019, although the home page mentioning leveraged ETFs and spot markets is still available. It also mentions the exchange’s token, Crypton Coin, which apparently never existed on the blockchain.

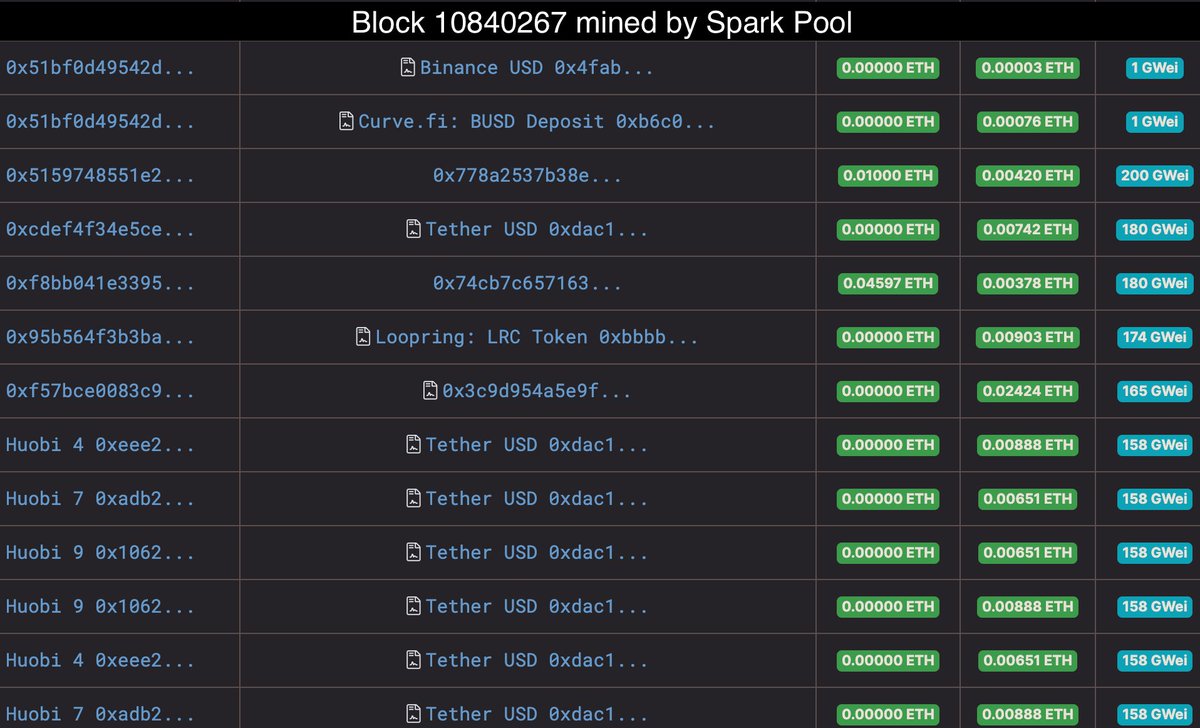

6/11

The two mentioned exchanges also link at least four things:

- using the Material Design style, which Alameda also uses on the OTC portal and the leveraged tokens website.

- mention of FTX in the upper left corner of the Crypton API documentation.

The two mentioned exchanges also link at least four things:

- using the Material Design style, which Alameda also uses on the OTC portal and the leveraged tokens website.

- mention of FTX in the upper left corner of the Crypton API documentation.

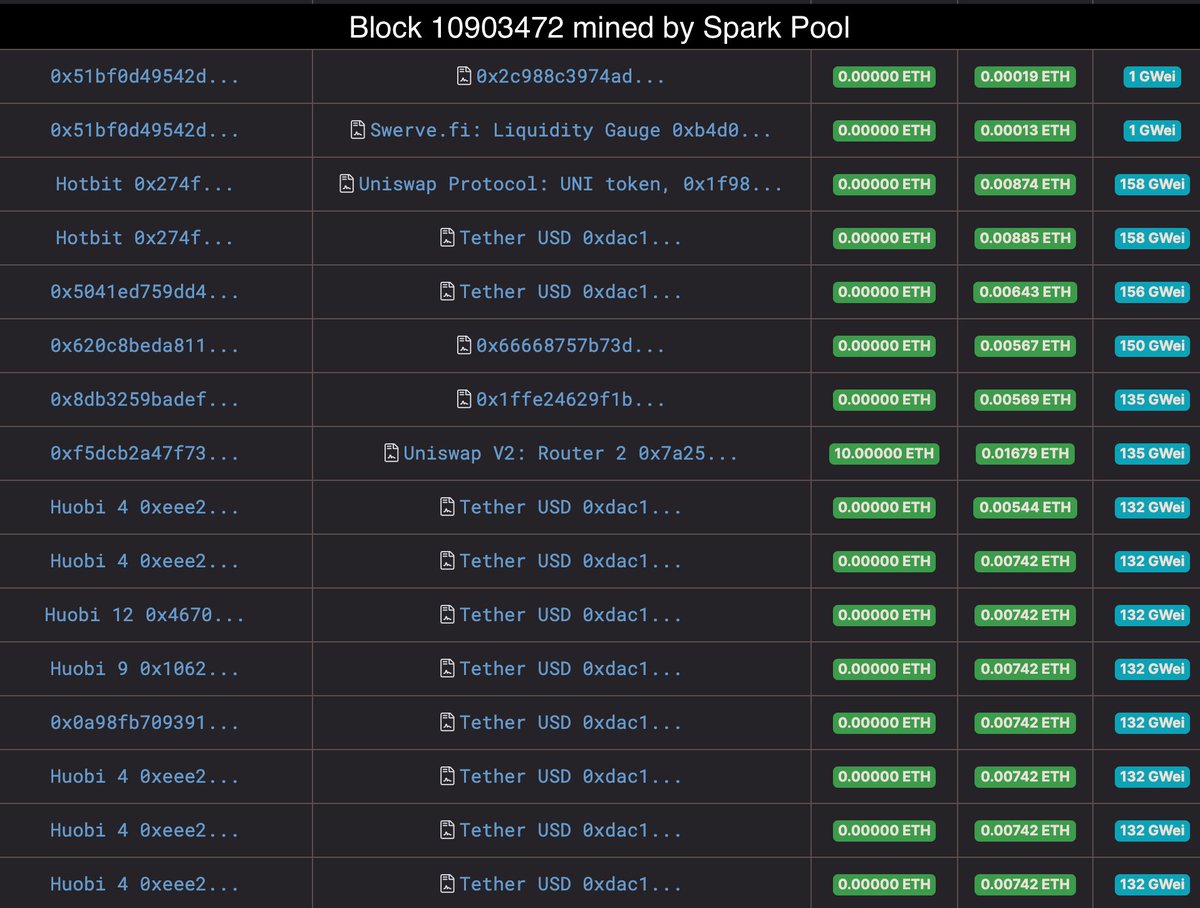

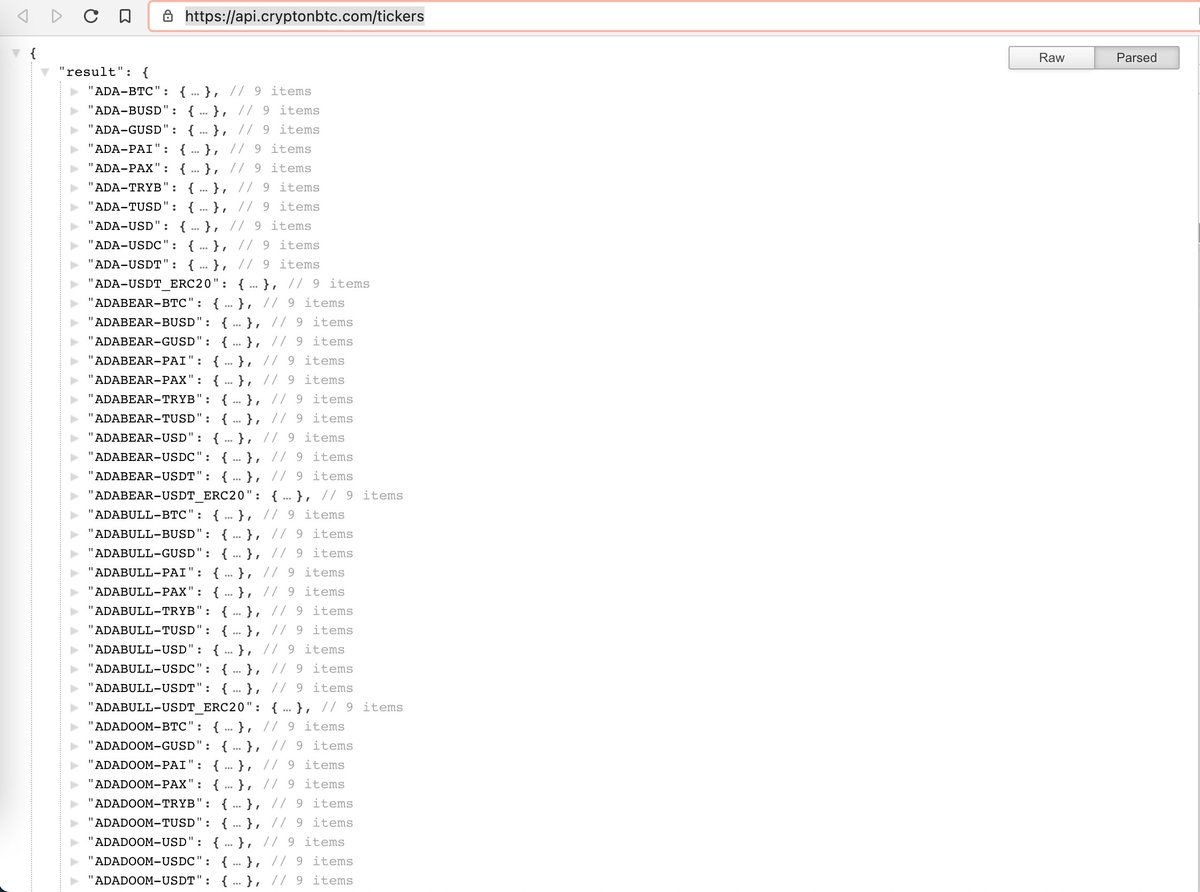

7/11

- the presence of tickers in the responses of the still working API, which could appear only after the exchange was shutting down and are available only on FTX, for example, ADADOOM-TRYB.

- the presence of tickers in the responses of the still working API, which could appear only after the exchange was shutting down and are available only on FTX, for example, ADADOOM-TRYB.

8/11

- test deploy of leveraged tokens. Instruments on Crypton had position names that were not familiar to us, like BULL or BEAR. Instead, the names of the positions contained the name of the ETF and its leverage, for example BTC3X, which means 3X long BTC ETF. =>

- test deploy of leveraged tokens. Instruments on Crypton had position names that were not familiar to us, like BULL or BEAR. Instead, the names of the positions contained the name of the ETF and its leverage, for example BTC3X, which means 3X long BTC ETF. =>

9/11

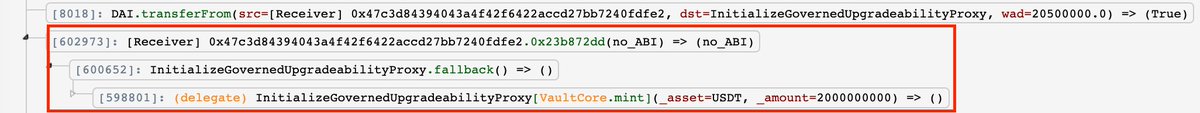

Simultaneously with the release of the leveraged tokens whitepaper in March 2019, test tokens appeared on Ethereum, which had a name format similar to those on Crypton. =>

Simultaneously with the release of the leveraged tokens whitepaper in March 2019, test tokens appeared on Ethereum, which had a name format similar to those on Crypton. =>

10/11

3 days after that, the BULL token was launched, which is a 3X long BTC position on FTX. The contract code is identical, except for a small refactoring and the addition of two public variables to the contract, storing info about the underlying asset and leverage.

3 days after that, the BULL token was launched, which is a 3X long BTC position on FTX. The contract code is identical, except for a small refactoring and the addition of two public variables to the contract, storing info about the underlying asset and leverage.

11/11

To sum up, there is an irrefutable link between FTX and the little-known Crypton. The question remains, was it an unfortunate ancestor of FTX, or did Alameda, which also provides MM services, eventually buy Crypton and evolved it into FTX? I think @SBF_Alameda can answer it

To sum up, there is an irrefutable link between FTX and the little-known Crypton. The question remains, was it an unfortunate ancestor of FTX, or did Alameda, which also provides MM services, eventually buy Crypton and evolved it into FTX? I think @SBF_Alameda can answer it

• • •

Missing some Tweet in this thread? You can try to

force a refresh