1/6

Currently, 49% of addresses eligible to claim $1INCH tokens have done so.

They took 75% of what was originally available on a $1INCH distributor smart contract. This is primarily because many big claimers are liquidity providers, and they needed to create markets.

Currently, 49% of addresses eligible to claim $1INCH tokens have done so.

They took 75% of what was originally available on a $1INCH distributor smart contract. This is primarily because many big claimers are liquidity providers, and they needed to create markets.

2/6

The chart shows the distribution of the first actions which were taken by the wallet owners with all their 1INCH tokens.

Only 19% are holding tokens or stake them in the @1inchExchange ecosystem.

Almost 25% of wallets sold all their tokens at once after a claim.

The chart shows the distribution of the first actions which were taken by the wallet owners with all their 1INCH tokens.

Only 19% are holding tokens or stake them in the @1inchExchange ecosystem.

Almost 25% of wallets sold all their tokens at once after a claim.

3/6

29% transferred all their tokens to another address. This is because these are mainly additional user wallets.

The “Others” includes wallets that performed actions with parts of the claimed tokens, such as sending tokens to several addresses or selling them in parts.

29% transferred all their tokens to another address. This is because these are mainly additional user wallets.

The “Others” includes wallets that performed actions with parts of the claimed tokens, such as sending tokens to several addresses or selling them in parts.

4/6

The picture changes as expected if we look at the volumes of tokens split by action:

- 7M was sold immediately without hesitation.

- 15M 1INCH changed from one owner to another.

- 40.5M tokens were sold or changed owners in multiple transactions.

The picture changes as expected if we look at the volumes of tokens split by action:

- 7M was sold immediately without hesitation.

- 15M 1INCH changed from one owner to another.

- 40.5M tokens were sold or changed owners in multiple transactions.

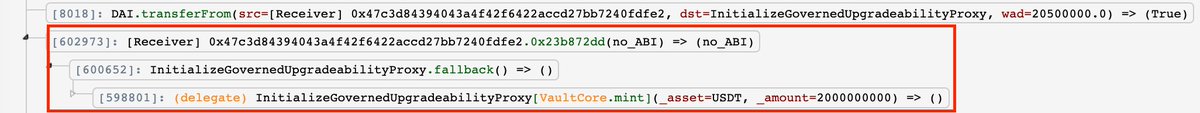

5/6 One of the whales (0xa0f7) that claimed 9.7M tokens deserves special attention.

He has already sold 6.7M 1INCH on Binance, and the remaining 3M in the staking contract gives them 80% of the total DAO voting power.

He has already sold 6.7M 1INCH on Binance, and the remaining 3M in the staking contract gives them 80% of the total DAO voting power.

6/6 Hopefully, token distribution models that include a fair airdrop will bring not only easy money to users but also a large community interested in the long-term success of the protocols.

• • •

Missing some Tweet in this thread? You can try to

force a refresh