Financial History: Sunday Reads

• An Exciting Announcement

• The Bubble Triangle

• The First Bubble: New Evidence

• Speculative Finance: Cycle Mania

• Fraud & Financial Scandals

• Another 20's Bubble?

investoramnesia.com/2020/11/22/bub…

• An Exciting Announcement

• The Bubble Triangle

• The First Bubble: New Evidence

• Speculative Finance: Cycle Mania

• Fraud & Financial Scandals

• Another 20's Bubble?

investoramnesia.com/2020/11/22/bub…

"Wall Street Bubbles; Always the Same"

(1901)

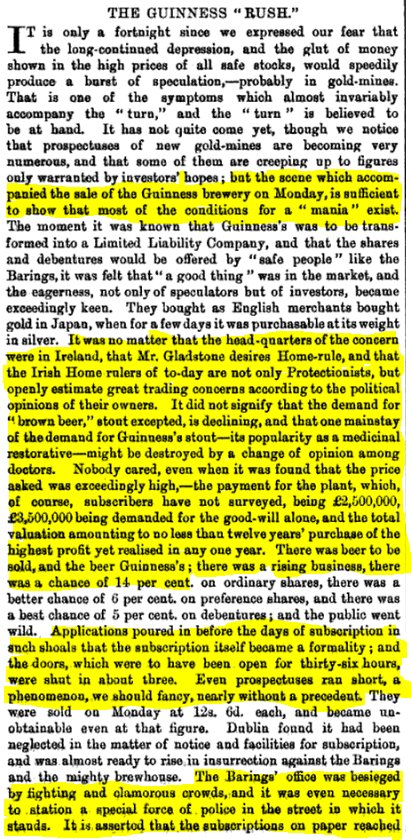

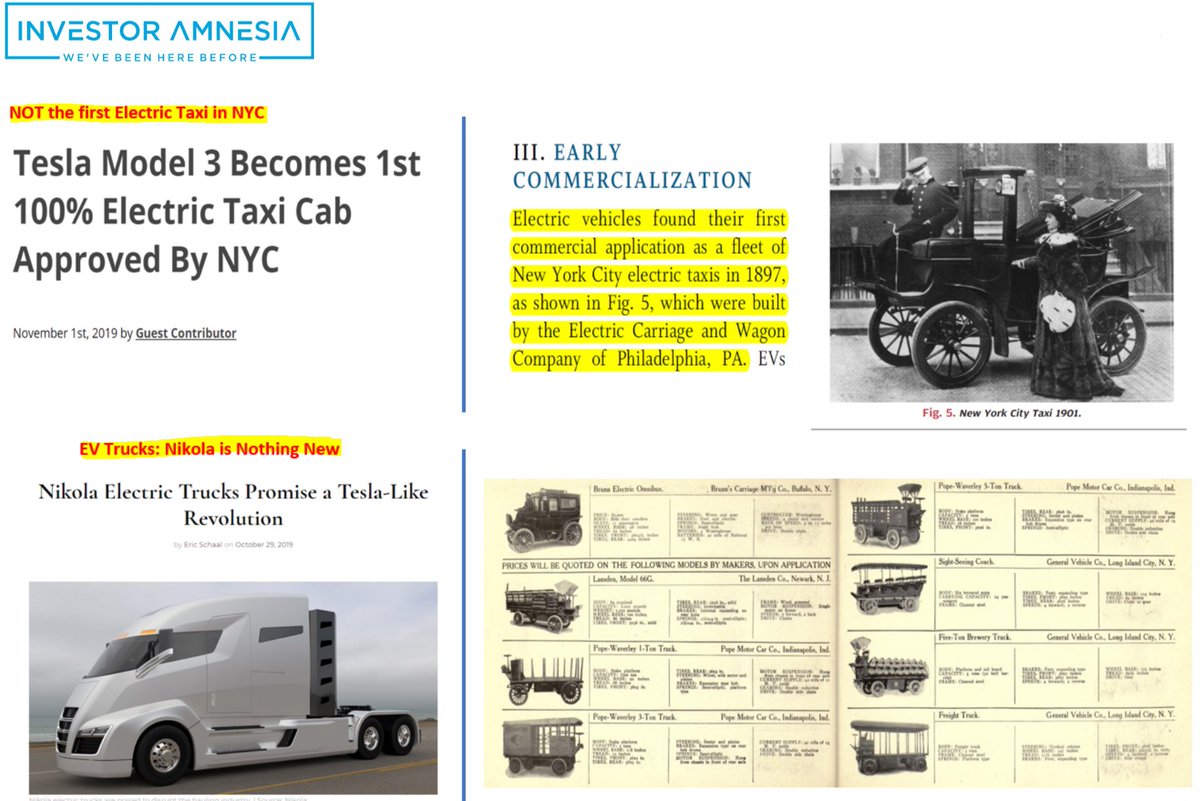

Blows my mind when people 100+ years ago say stuff like this, and nothing has changed.

(1901)

Blows my mind when people 100+ years ago say stuff like this, and nothing has changed.

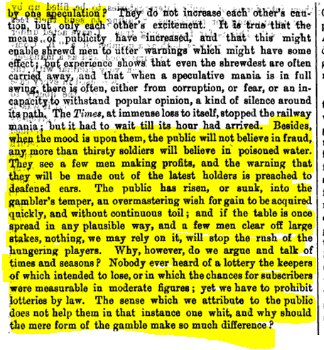

Little things like this illustration just really demonstrate how little human nature changes over the course of centuries.

For all the progress we've made as a society, 100+ years ago people stated "every bubble is the same", and it still holds true.

Crazy!

For all the progress we've made as a society, 100+ years ago people stated "every bubble is the same", and it still holds true.

Crazy!

I mean, this is basically an uglier version of the same scene almost *another* 100 years back.

(blowing 'bubbles' into a speculator's desperate arms)

(blowing 'bubbles' into a speculator's desperate arms)

And while it doesn't fit the pattern perfectly...

I'll take any excuse to share this depiction of the 1720 bubbles where speculators were literally defecating and farting stock certificates

I'll take any excuse to share this depiction of the 1720 bubbles where speculators were literally defecating and farting stock certificates

• • •

Missing some Tweet in this thread? You can try to

force a refresh