The distribution of systems is a growing trend, not just in crypto, but in the broader tech industry.

Edge computing is dispersing data centers.

Agtech is enabling more localized and urbanized production.

The distribution of GPS – a vital technology – is less discussed. 👇🏻

Edge computing is dispersing data centers.

Agtech is enabling more localized and urbanized production.

The distribution of GPS – a vital technology – is less discussed. 👇🏻

1/The U.S Department of Homeland Security designates 16 critical infrastructure sectors whose assets, systems, and networks – whether physical or virtual – are considered so vital to the U.S.

GPS which relies on satellites underpins 14 of these sectors.

messari.io/article/how-fo…

GPS which relies on satellites underpins 14 of these sectors.

messari.io/article/how-fo…

2/ GPS is relied on for more than just location data.

All GPS clocks are synchronized to within nanoseconds and are able to provide a unified reliable time.

GPS time is used for crucial processes like bouncing calls between cell towers and time-stamp financial trades.

All GPS clocks are synchronized to within nanoseconds and are able to provide a unified reliable time.

GPS time is used for crucial processes like bouncing calls between cell towers and time-stamp financial trades.

3/ However, GPS has tradeoffs. The ease of access also makes GPS easily exploited, jammed, or spoofed – the act of using malicious software to broadcast phony signals and fool receivers.

GPS spoofing can affect everything from credit card processors to drones.

GPS spoofing can affect everything from credit card processors to drones.

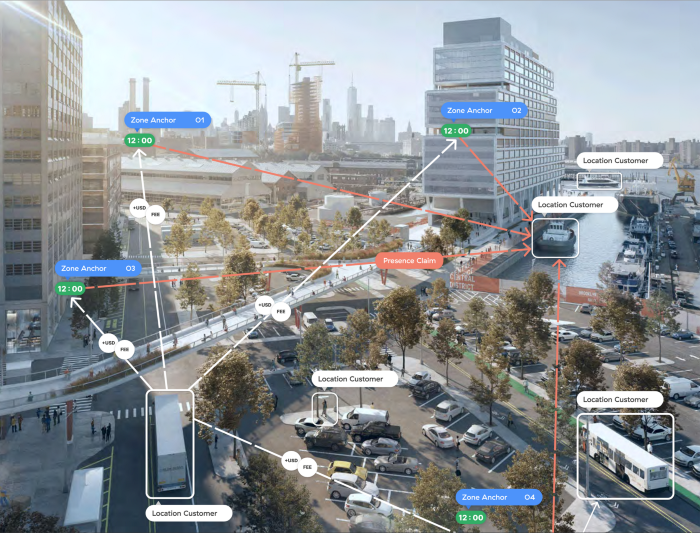

4/ The Foam protocol – developed by Foamspace – provides the tools to enable a crowdsourced map and decentralized location services.

Unlike GPS which runs via satellites, Foam combines terrestrial radios and an incentivized mapping service that anyone can participate in.

Unlike GPS which runs via satellites, Foam combines terrestrial radios and an incentivized mapping service that anyone can participate in.

5/ Foam’s proof of location service is incredibly audacious since it requires both a hardware component and the emergence of greater blockchain scalability. While Foam is still experimenting with its hardware devices, the protocol has made some exciting progress in recent months.

6/ Check out the full analysis for the latest on Foam, a breakdown of Foam’s Proof of Location services, and more on how Foam aims to become an alternative to GPS.

messari.io/article/how-fo…

messari.io/article/how-fo…

• • •

Missing some Tweet in this thread? You can try to

force a refresh