In the world of Web3, Q3 2020 was defined by the growth of non-fungible tokens (NFTs) and the rise of community tokens.

Here's what you missed in Q3 and what you need to know going forward.👇🏻

Here's what you missed in Q3 and what you need to know going forward.👇🏻

Read the full Web3 Q3’20 report to learn about the various themes of this quarter including:

• The insane market growth of NFTs

• Culture investing

• Rise of community tokens

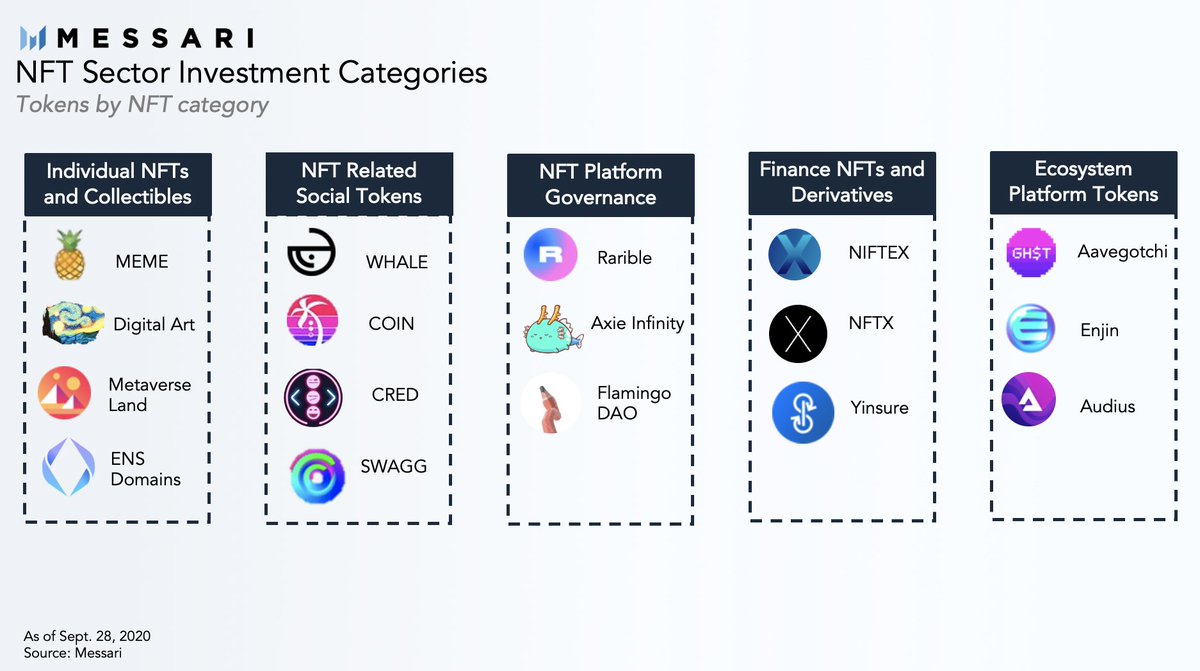

• Investable NFT categories

• Franchise tokens

Much more in the report!

messari.io/article/q3-202…

• The insane market growth of NFTs

• Culture investing

• Rise of community tokens

• Investable NFT categories

• Franchise tokens

Much more in the report!

messari.io/article/q3-202…

Cumulative lifetime NFT sales volume exceeded $130 million. Beyond the sheer volume of NFTs transacted, one metric is most telling.

The average NFT purchase price increased in Q3, reaching an avg of $161, the highest since the launch of CryptoPunks and Cryptokitties in 2017!

The average NFT purchase price increased in Q3, reaching an avg of $161, the highest since the launch of CryptoPunks and Cryptokitties in 2017!

The number of users is also on the rise with OpenSea crossing the 25,000 user market and recording record volume in the month of Sept.

Wash trading has been an issue in the NFT sector.

In an effort to curb wash trading and increase sustainability, Rarible introduced buyer and seller fees on Sept 22, which already generate over $350,000 in fee revenue. Annualize this equates to nearly $5m in fee revenue.

In an effort to curb wash trading and increase sustainability, Rarible introduced buyer and seller fees on Sept 22, which already generate over $350,000 in fee revenue. Annualize this equates to nearly $5m in fee revenue.

The second major theme of the quarter was the rise of community tokens.

Platforms like Patreon and Substack already proved that individual creators can enjoy a great lifestyle supported by a few thousand loyal fans. a16z.com/2020/02/06/100…

Platforms like Patreon and Substack already proved that individual creators can enjoy a great lifestyle supported by a few thousand loyal fans. a16z.com/2020/02/06/100…

Individuals whether they be artists, athletes, writers, or educators can leverage their personal brands to create business empires beyond their existing realms of expertise.

Creator tokens are a new mechanism for incentivizing a loyal fan base and monetizing content.

Creator tokens are a new mechanism for incentivizing a loyal fan base and monetizing content.

The foundation for community tokens and culture marketplaces is being paved:

• @withFND crossed 100k sales

• @ourZORA 400k sales in Sept

• OurZora @RAC token launch

• @TheMetaFactory launching $ROBOT

• @rally_io network launches $RLY

• @Collab_Land_ passes 40k users

• @withFND crossed 100k sales

• @ourZORA 400k sales in Sept

• OurZora @RAC token launch

• @TheMetaFactory launching $ROBOT

• @rally_io network launches $RLY

• @Collab_Land_ passes 40k users

There are notable tradeoffs to tokenizing one’s value such which I cover in the report, some of which include:

• Discounting one’s potential future worth

• Limitations of scaling particular benefits such as exclusive access to a creator/community

• Unknown legal consequences

• Discounting one’s potential future worth

• Limitations of scaling particular benefits such as exclusive access to a creator/community

• Unknown legal consequences

As social/community tokens grow as an investable category, the most promising areas of investment will surround strong existing communities and well-established organizations.

messari.io/article/game-c…

messari.io/article/game-c…

Franchise tokens, such as Chiliz fan tokens provide a new form of brand loyalty and engagement. The top tokens are worth over $120 million in fully diluted market cap.

Within the Web 3 space, the largest addressable markets – and most lucrative investments – will be in platforms that democratize and create communities whether in

gaming, music, media, or another industry.

Read the report to see where Web3 is going in Q4

messari.io/article/q3-202…

gaming, music, media, or another industry.

Read the report to see where Web3 is going in Q4

messari.io/article/q3-202…

• • •

Missing some Tweet in this thread? You can try to

force a refresh