theblockcrypto.com/genesis/85329/…

Cred's downfall left more questions than answers, which is, unfortunately, common in the still-nascent cryptocurrency industry. #Bitcoin

Luckily, there is a trail of online ‘bread crumbs’ 🍞and court filings that help paint a picture. 👨🎨

Cred's downfall left more questions than answers, which is, unfortunately, common in the still-nascent cryptocurrency industry. #Bitcoin

Luckily, there is a trail of online ‘bread crumbs’ 🍞and court filings that help paint a picture. 👨🎨

It is best to start at the inception of Libra Credit, which conducted an ICO in Q2 2018. #Ethereum

The company successfully raised $26.4M in the LBA Token offering between May 1st and May 5th, 2018. 💰

The company successfully raised $26.4M in the LBA Token offering between May 1st and May 5th, 2018. 💰

Little did investors know that the $LBA Token would descend toward the abyss post-ICO. 📉📉📉

This is an all too familiar tale from the ICO-era of digital assets. 🙄

Unfortunately for the Cred community, the damage doesn’t stop with a token that lost over 96% of its value. 🙁

This is an all too familiar tale from the ICO-era of digital assets. 🙄

Unfortunately for the Cred community, the damage doesn’t stop with a token that lost over 96% of its value. 🙁

Libra Credit eventually rebranded to Cred, and Cred Inc. is the company that would later file for #bankruptcy. 💀

There is a lot of controversy surrounding Cred Capital, the entity at the center of the two California civil lawsuits.👩⚖️

There is a lot of controversy surrounding Cred Capital, the entity at the center of the two California civil lawsuits.👩⚖️

A former employee allegedly transferred $2M in #Bitcoin from Cred Capital. 🖥️

blockchair.com/bitcoin/transa…

blockchair.com/bitcoin/transa…

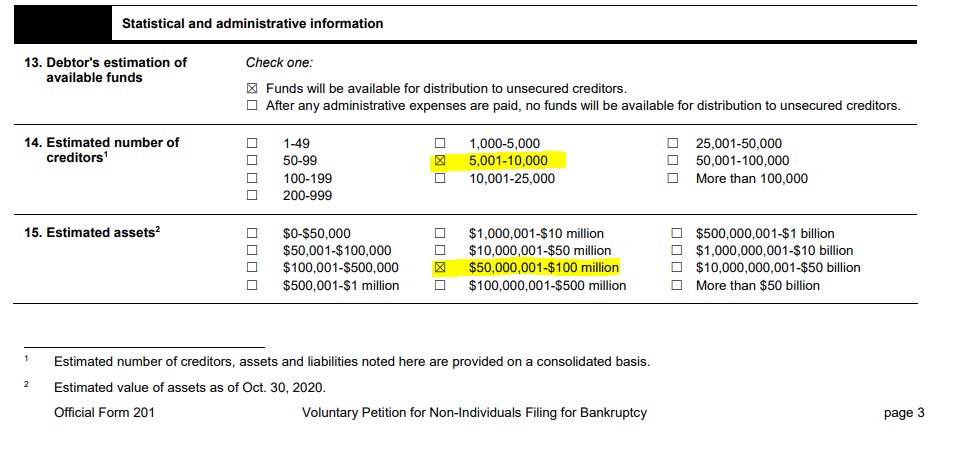

Bankruptcy document #1, #Chapter11 Voluntary Petition, showed that Cred Inc. had an estimated:

▶️5,001-10,000 creditors

▶️$50,000,001-$100 million in assets

▶️$100,000,001-$500 million in liabilities

#Bitcoin $ETH $BTC

▶️5,001-10,000 creditors

▶️$50,000,001-$100 million in assets

▶️$100,000,001-$500 million in liabilities

#Bitcoin $ETH $BTC

Cred Inc. Pro-Forma Assets and Liabilities, revealed:

▶️$136.499M in Liabilities

▶️$67.839M in Assets

So, nearly a $69M financial hole! 🕳️

▶️$114.6M Customer crypto deposits😰

▶️$20.8M in collateral for customer loans

#Bitcoin $BTC $ETH

▶️$136.499M in Liabilities

▶️$67.839M in Assets

So, nearly a $69M financial hole! 🕳️

▶️$114.6M Customer crypto deposits😰

▶️$20.8M in collateral for customer loans

#Bitcoin $BTC $ETH

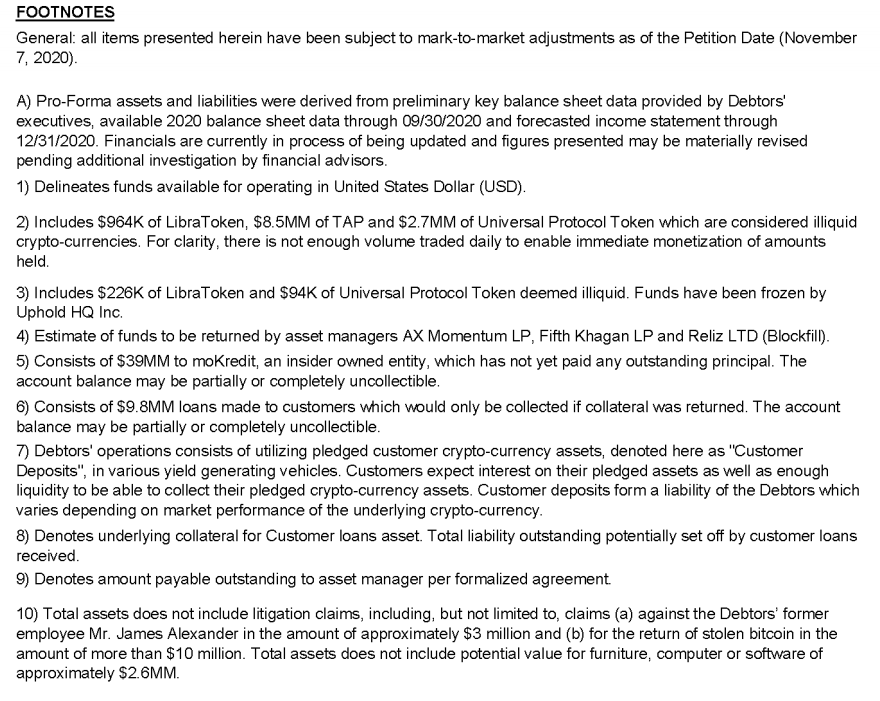

However, as every good financial analyst knows, it's all about the #footnotes. 🧐

Footnote #2 reveals:

▶️$12.1M of the $14.7M or 82.5% of the cryptocurrency listed as assets are considered #illiquid.🥶

▶️$964k of the illiquid cryptocurrency consists of $LBA Token.

Footnote #2 reveals:

▶️$12.1M of the $14.7M or 82.5% of the cryptocurrency listed as assets are considered #illiquid.🥶

▶️$964k of the illiquid cryptocurrency consists of $LBA Token.

Footnote #3 reveals:

▶️$320K or 65.4% of the frozen cryptocurrency consists of the illiquid $LBA Token ($226K) and Universal Protocol $UPT ($94K).

▶️These funds were frozen by Uphold, which had a partnership with Cred that was discontinued on 10/23

support.uphold.com/hc/en-us/artic…

▶️$320K or 65.4% of the frozen cryptocurrency consists of the illiquid $LBA Token ($226K) and Universal Protocol $UPT ($94K).

▶️These funds were frozen by Uphold, which had a partnership with Cred that was discontinued on 10/23

support.uphold.com/hc/en-us/artic…

Footnote #5 reveals:

▶️Cred issued $39M in loans to moKredit, an insider owned entity.

▶️moKredit has not paid back any of the loan principal to date and part or all of it may be uncollectible.

▶️Cred issued $39M in loans to moKredit, an insider owned entity.

▶️moKredit has not paid back any of the loan principal to date and part or all of it may be uncollectible.

Footnote #10 reveals:

▶️$3M in potential assets is not shown on the financials due to the pending litigation with the former employee.

▶️Another $10M+ of stolen #Bitcoin is not included either on the financials, although there are no further details on this theft. 🤔

▶️$3M in potential assets is not shown on the financials due to the pending litigation with the former employee.

▶️Another $10M+ of stolen #Bitcoin is not included either on the financials, although there are no further details on this theft. 🤔

Doc #16 had a graph of #Bitcoin’s price in USD from 3/16/20 to November 2020.

According to the declaration:

▶️The $BTC price increase was unfavorable to Cred's financial position as they would owe more in Customer deposit liabilities.

According to the declaration:

▶️The $BTC price increase was unfavorable to Cred's financial position as they would owe more in Customer deposit liabilities.

@jdorman81, speculated that Cred was likely writing covered calls against the illiquid cryptocurrency, which was probably used as collateral.

https://twitter.com/jdorman81/status/1326170532677476352?s=20

Further, with the help of @joshua_j_lim, and bankruptcy document #11,

@jdorman81 believes that Cred was allegedly issuing free call options to employees and bearing all of the downside risks.

@jdorman81 believes that Cred was allegedly issuing free call options to employees and bearing all of the downside risks.

https://twitter.com/jdorman81/status/1326237516022706176?s=20

Overall, it appears that Cred’s risk management 🛑 was not up to the rigorous requirements that should be in place for a market as volatile as cryptocurrency. 📈📉🎢

The details are still fuzzy, and only time can provide clarity as more details become public.⏲️

#Bitcoin $BTC

The details are still fuzzy, and only time can provide clarity as more details become public.⏲️

#Bitcoin $BTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh