*MNUCHIN TO PLACE $455 BLN UNSPENT CARES MONEY IN GENERAL FUND ... *TREASURY NEEDS CONGRESSIONAL APPROVAL TO USE GENERAL-FUND MONEY

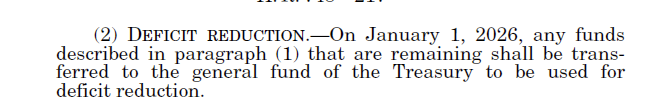

Transferring to the general fund before Jan 1, 2026 would be in violation of the CARES Act

Transferring to the general fund before Jan 1, 2026 would be in violation of the CARES Act

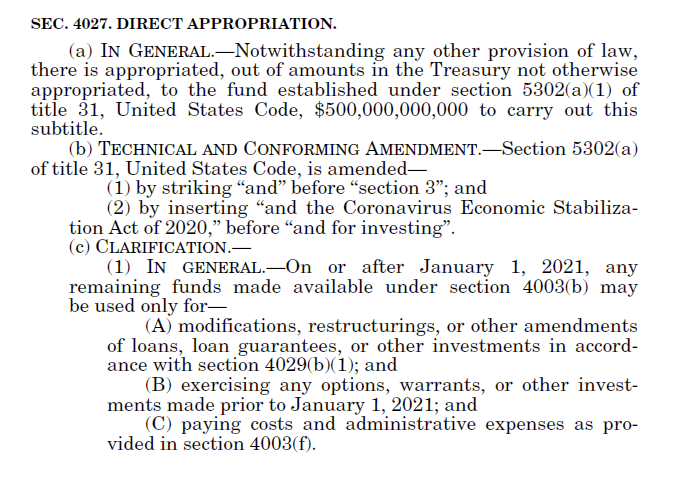

4027(a) is very clear that Congress' $500B appropriation to the ESF was to "carry out this subtitle."

4027(c)(2) is the only place in the subtitle that permits a transfer to the general fund, and it specifies that this is only "On January 1, 2026" (not "by" or "no later than")

4027(c)(2) is the only place in the subtitle that permits a transfer to the general fund, and it specifies that this is only "On January 1, 2026" (not "by" or "no later than")

Section 4027 of the CARES Act is quite clear about the timeline and set of purposes for which the ESF appropriation may be used:

Needless to say, the Fed should play no part in this if the return of funds is for the explicit purpose of violating the CARES Act. This is just partisan hardball; compliance with Mnuchin's intent to violate the CARES Act would only hurt the Fed's future crisis-response capacity

• • •

Missing some Tweet in this thread? You can try to

force a refresh