A thread on National Pension Scheme (NPS)

This is the simplest yet the most comprehensive piece around. Do ‘re-tweet’ and help us reach more investors ☺

(1/n)

This is the simplest yet the most comprehensive piece around. Do ‘re-tweet’ and help us reach more investors ☺

(1/n)

Government realized that committing 2 pay a pre defined fixed pension based on a formula may nt b sustainable & hence decided to move 2 contributing some amount over & above the salary of the employee, where even employee contributes from the salary into a common account (2/n)

The common account will keep accumulating investments and returns, from which pension can be received depending on whatever is accumulated. That account is National Pension Scheme (NPS) (3/n)

Government employees who joined on or after 1/1/04 automatically become a part of NPS & other corporate salaried employees and self-employed can also opt for the NPS (4/n)

Imagine an NPS 2 b like ur MF investment, there r choices to pick from & someone will manage the funds. NPS can be categorized as government & non-government. Non government is further classified as corporate (Corporate Employees) and All India citizens (Self Employed) (5/n)

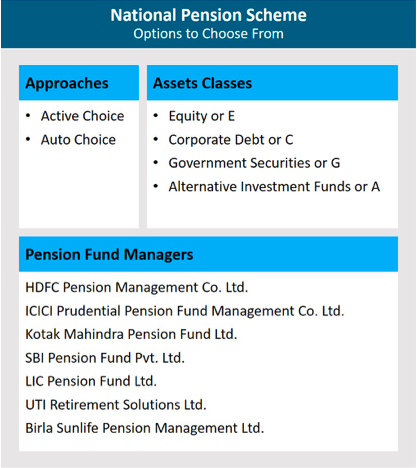

NPS offers the below options to choose from,

(a) 2 approaches – You can choose active or auto fund management

(b) 4 Asset classes – You can choose between Equity, Debt and Alternative

(c) 7 fund managers – You can choose between 7 Fund Managers (6/n)

(a) 2 approaches – You can choose active or auto fund management

(b) 4 Asset classes – You can choose between Equity, Debt and Alternative

(c) 7 fund managers – You can choose between 7 Fund Managers (6/n)

Contribution to NPS can be made in 2 buckets, Tier I and II accounts. Tier I is the default account for all subscribers which comes in with lock-in (cant redeem before retirement*) but there are tax advantages. (7/n)

Tier II account is optional, which gives you flexibility to invest & redeem anytime but the tax advantage is missing. (8/n)

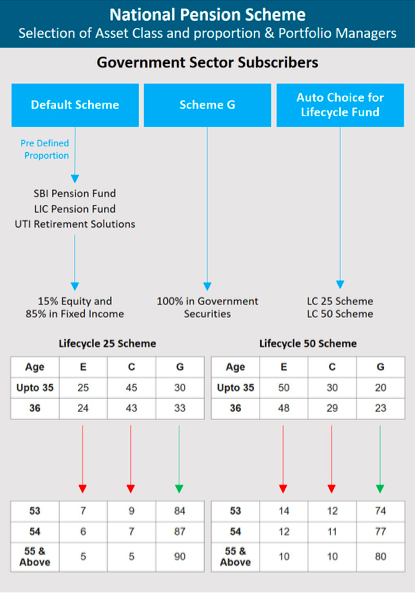

Government employees will have the following options to choose from in Tier I account

(a) Default

(b) Scheme G

(c) Auto – Lifecycle 25 scheme or Lifecycle 50 scheme (9/n)

(a) Default

(b) Scheme G

(c) Auto – Lifecycle 25 scheme or Lifecycle 50 scheme (9/n)

Non-Government employees will have the following options to choose from in Tier I account

(a) Active Choice

(b) Auto – Lifecycle 25 scheme, Lifecycle 50 scheme or Lifecycle scheme 75 (10/n)

(a) Active Choice

(b) Auto – Lifecycle 25 scheme, Lifecycle 50 scheme or Lifecycle scheme 75 (10/n)

Tier II account investment options for all subscribers (Government & Non-Government) is same as Tier I of non-government

Why would a government employee choose Tier II?

Can also get active choice and Lifecycle 75 scheme, which is not available in Tier I (11/n)

Why would a government employee choose Tier II?

Can also get active choice and Lifecycle 75 scheme, which is not available in Tier I (11/n)

Non-Government employees may choose Tier II for liquidity as it allows to be redeemed anytime unlike Tier I, which is locked till retirement

P.S. – We don’t recommend Tier II investments (12/n)

P.S. – We don’t recommend Tier II investments (12/n)

Contribution 2 NPS qualifies for 1.5L under 80C & an additional 50K is also tax deductible

@ maturity, 60% of the accumulated corpus can b redeemed tax-free but the remaining 40% has 2b invested with an Insurance company 4 annuity. Detailed understanding of the same in the blog

@ maturity, 60% of the accumulated corpus can b redeemed tax-free but the remaining 40% has 2b invested with an Insurance company 4 annuity. Detailed understanding of the same in the blog

We believe, some section of investors can invest in this. For the details of who should & who should not, read our detailed blog on the same by @stepbystep888. I can promise u this is the most comprehensive article on NPS around. Go follow him

fpa.edu.in/blog/all-you-w… (END)

fpa.edu.in/blog/all-you-w… (END)

• • •

Missing some Tweet in this thread? You can try to

force a refresh