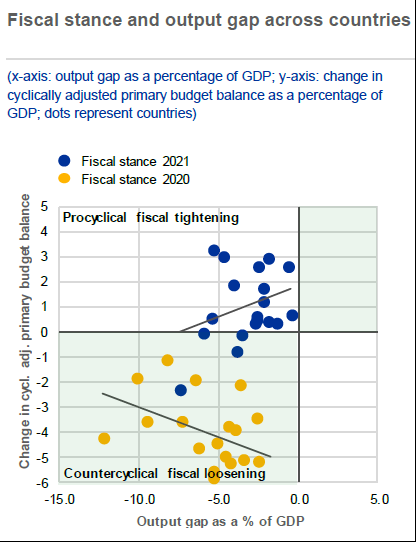

The excellent ECB Financial Stability Review, ecb.europa.eu/pub/pdf/fsr/ec… illustrates well the 2 main risks I see for the EA economy next year: possible insufficient fiscal stimulus and weakening of bank credit supply. The FSR mentions “a slightly tighter fiscal stance" in 2021 1/

The FSR correct statement “fiscal tightening at a time when output gaps are still projected to be negative could exacerbate the current economic situation.”, caused some stir and many comments in social media. The same regarding the accompanying chart 2/

The FSR uses the Commission forecasts showing a slight increase of the cyclically-adjusted primary budget balance from -3.2% this year to -2.9% in 2021. 0.3% is a small change not comparable with the mistake of 2012/13 when it went from -0.6% in 2011 to +0.5 & +1.4 in 2012/13 3/

I think the primary balance will end-up higher than those forecasts because families and firms will continue to need a lot of support in the first half of the year. Moreover, growth in 2021 is dependent on public expenditure as other demand components will not be very buoyant. 4/

As the FSR says: “A premature withdrawal of policy support and a protracted pandemic could prolong the recession and have permanent scarring effects.” Besides extending income transfers to families and firms, more public investment is indispensable for a robust recovery 5/

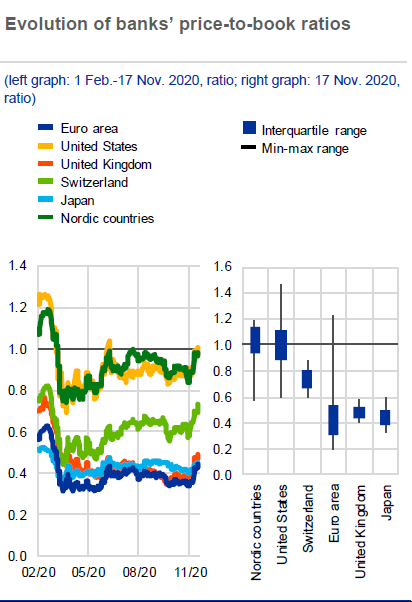

Regarding banks, their problem is lack of profitability, low stock prices abysmal Price-to-Book ratios (chart). Consequently difficulty in raising capital in the market when more will be necessary to absorb further losses from bad loans later on. 6/

More loan losses impacting capital are coming this year, with Governments discontinuing guarantees. The FSR reminds: “Bank capital buffers should remain available to absorb losses for an extended period, and any impediments to banks using buffers should be addressed” 7/

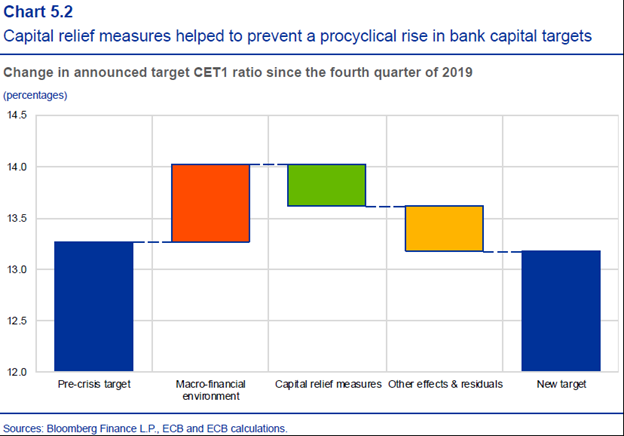

However, the releasable buffers are small and either the markets or the supervisors apparently won´t condone big reductions of capital ratios (see chart). In this case, the end result might be deleveraging and a reduction of credit growth with negative economic consequences 8/

That means that capital and not liquidity will be the operative constraint to credit supply. Still, it will be appropriate to extend TLTRO III allotments until the end of the year, to provide some stimulus to credit supply, especially induced by the rate bonification in place 9/

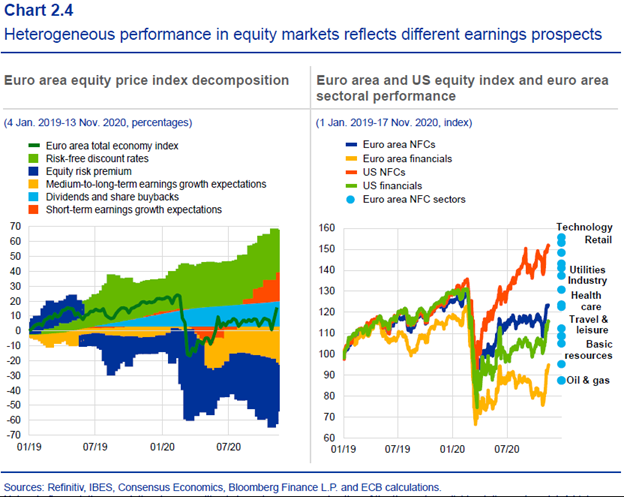

Bank stocks suffered again this year despite the overall boost provided by monetary policy. This decomposition of stock valuations shows the positive contributions of lower discount rates and dividend/buybacks offsetting the negative effect of earnings and the equity premium 10/

Monetary policy improved the Financial Conditions Index to easing levels above the pre-pandemic times (chart), but this refers only to creating incentives for economic agents increasing real expenditures, which cannot happen significantly in this type of crisis 11/

As the indirect incentives of Monetary policy are showing diminishing returns, only fiscal stimulus in the form of public expenditure with income transfers and investment creates real demand for goods and services to offset the deceleration of private spending. 12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh