Q2 GDP at –7.5% buttresses recovery as captured by several high frequency indicators. Economic impact is primarily due to #COVID19, good news is falling daily cases are due to lower transmission & not due to lower testing. To sustain economic recovery, caution must continue.(1/7)

➡️High PMI Indices for Manufacturing and Services with manufacturing PMI at a decadal high

➡️Broad based recovery is underway

(2/7)

➡️Broad based recovery is underway

(2/7)

➡️Index of Industrial Production enters positive territory

➡️Index of 8-core industries regains previous year levels in September

(3/7)

➡️Index of 8-core industries regains previous year levels in September

(3/7)

V-shaped recovery in use-based Industries especially in consumer goods, especially consumer durables, and investment, especially capital and infrastructure goods suggest strong revival of both consumption and investment, which together account for about 90% of India’s GDP (4/7)

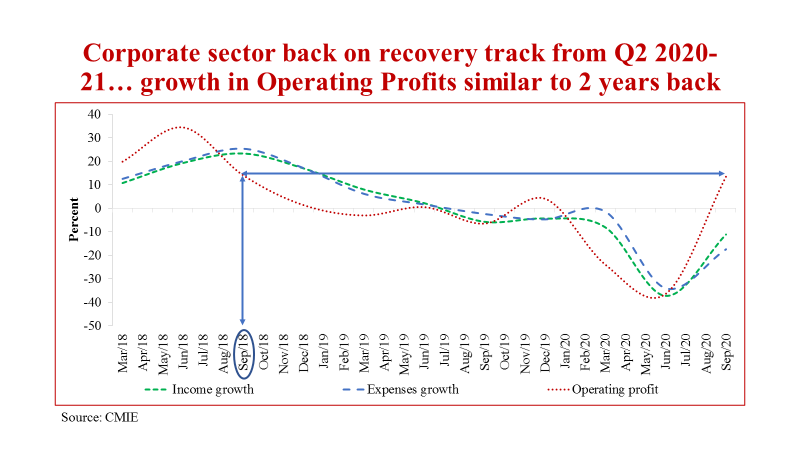

Corporate sector back on track in Q2 2020-21 after two quarters of contraction, level of operating profits similar to that in Sep 2018 (5/7)

➡️Steel production and consumption gathers momentum signalling revival of construction activity.

➡️Power consumption and E-way bills clocked double digit growth in October suggesting buoyancy in industrial and commercial activities (6/7)

➡️Power consumption and E-way bills clocked double digit growth in October suggesting buoyancy in industrial and commercial activities (6/7)

➡️Recovery ignites optimism, but a cautious optimism

➡️Sustainability of the recovery critically depends on keeping the pandemic in control

(7/7)

➡️Sustainability of the recovery critically depends on keeping the pandemic in control

(7/7)

• • •

Missing some Tweet in this thread? You can try to

force a refresh