“Even the most simple understandings are lost in the public debate about budget deficits and public debt. The Flat Earth Theorists who whip up deficit hysteria each day like to stun people with large numbers.”

“We would then learn that budget deficits are just the mirror image of non-government savings. Saving is usually considered to be something we should aim for. Increased wealth is also something we usually aspire to.”

#SpendingReview

bilbo.economicoutlook.net/blog/?p=10384&…

#SpendingReview

bilbo.economicoutlook.net/blog/?p=10384&…

“As a matter of accounting between the sectors, a government budget deficit adds net financial assets (adding to non government savings) available to the private sector and a budget surplus has the opposite effect. “

bilbo.economicoutlook.net/blog/?p=332

bilbo.economicoutlook.net/blog/?p=332

“It is actually rather obvious but all government spending involves money creation.”

bilbo.economicoutlook.net/blog/?p=352

bilbo.economicoutlook.net/blog/?p=352

“In short, we should reject any notion that the emerging federal deficits are damaging and will indebt the future generations.”

#SpendingReview

bilbo.economicoutlook.net/blog/?p=381

#SpendingReview

bilbo.economicoutlook.net/blog/?p=381

“People think QE, as used in the US and UK since the financial crisis, and still in use in the EU and Japan, is free money for the banks and will lead to rampant inflation. It really isn’t and it really doesn’t.”

@_ClaireConnelly via @Renegade_Inc

renegadeinc.com/what-is-quanti…

@_ClaireConnelly via @Renegade_Inc

renegadeinc.com/what-is-quanti…

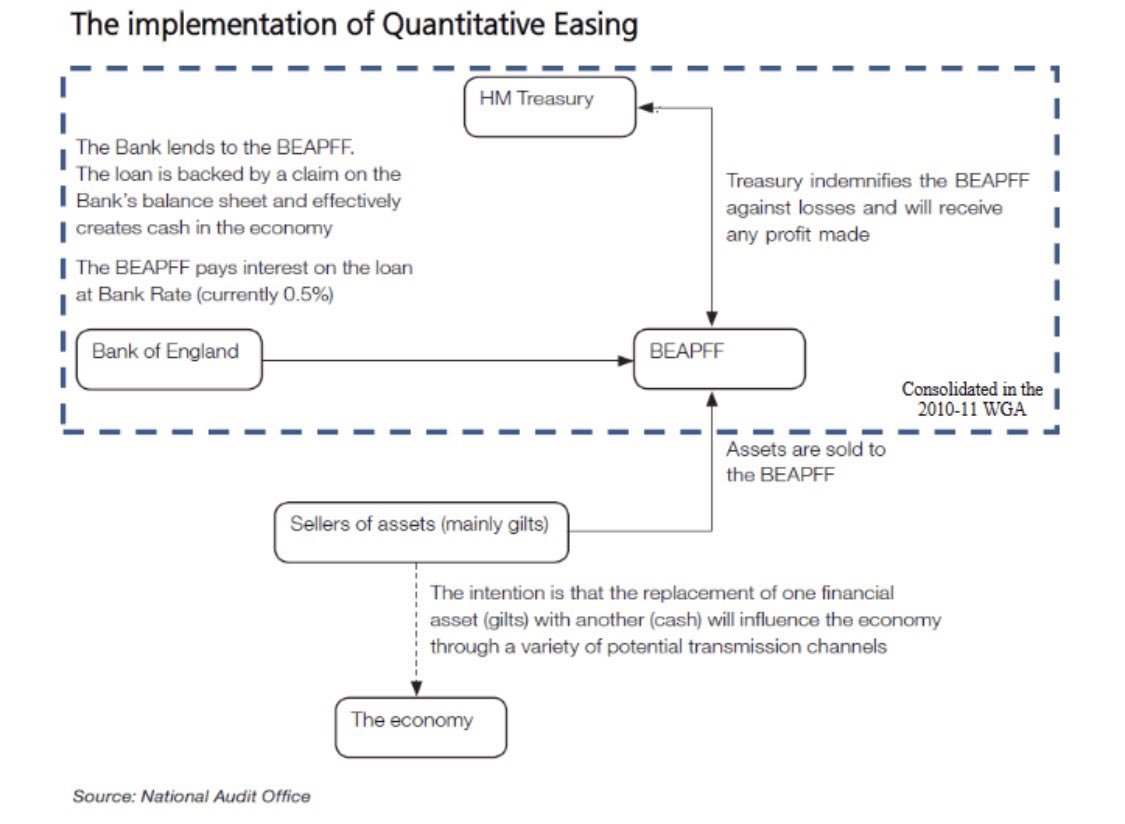

QE is a tool used by the Bank of England to buy things like government gilts and other bonds in the open market.

QE does not print money and does not cause inflation.

QE does not print money and does not cause inflation.

For the economy, it is an exchange of assets: gilts for bank deposits. Since bank deposits generally pay less interest than gilts, the economy receives less interest income.

gimms.org.uk/fact-sheets/qu…

gimms.org.uk/fact-sheets/qu…

Neoliberalism has narrowed government security to government bonds. MMT wants to reverse it to its original wider remit - with greater use of National Savings and the Ways and Means Account.

The Bank of England leverages the largess of HM Treasury, the source of Sterling.

The Bank of England leverages the largess of HM Treasury, the source of Sterling.

MMT says you don't need tradeable fixed rate bonds. It can all be done with daily cash management and National Savings deposit accounts that pension funds can access - which then clears out a whole raft of inefficient financial engineering.

#CorporateWelfare

#Banking #MMT

#CorporateWelfare

#Banking #MMT

“the myth of Bank of England “independence”, and illustrate the central, driving role of HM Treasury in the UK financial system and the primacy of Parliament in determining spending and resourcing in the UK.”

#MMT

gimms.org.uk/category/mmt-l…

#MMT

gimms.org.uk/category/mmt-l…

• • •

Missing some Tweet in this thread? You can try to

force a refresh