Even Bill Gates sat down with Playboy (in 1994). He was all over the internet and how it would change the world.

web.archive.org/web/2010080107…

web.archive.org/web/2010080107…

Netflix, Yelp, social media:

"Video on demand, finding people with common interests, picking a doctor"

"You'll want to know what movies others liked, based on what you thought of other movies. Afterward, you can even share what you thought."

"Community will expand"

"Video on demand, finding people with common interests, picking a doctor"

"You'll want to know what movies others liked, based on what you thought of other movies. Afterward, you can even share what you thought."

"Community will expand"

So very 90's: "we're involved in a new generation of fax machines"

Meanwhile, his "wallet PC" is the iPhone: "buttons replaced with a graphics interface. Digital keys, tickets, money, maps."

Meanwhile, his "wallet PC" is the iPhone: "buttons replaced with a graphics interface. Digital keys, tickets, money, maps."

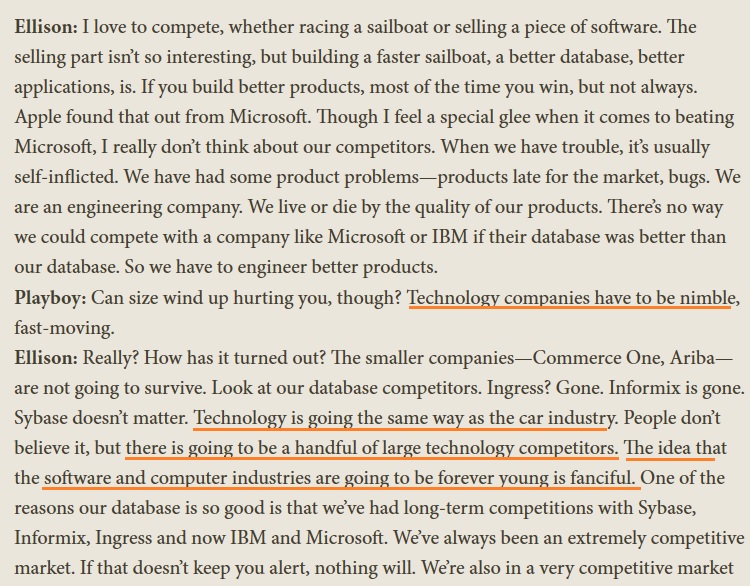

Competition and the need to build moats/monopolies: "People underestimate how effective capitalism is at keeping even the most successful companies on edge."

Software vs. hardware:

"Think of computer power as almost free. Why be in the business of making something that's almost free?

What is the scarce resource? What limits being able to get value out of that infinite computing power?"

"Think of computer power as almost free. Why be in the business of making something that's almost free?

What is the scarce resource? What limits being able to get value out of that infinite computing power?"

Innovation as evolutionary process:

"This would have happened without us. Somebody would have done a standard operating system. The information highway is going to happen."

"This would have happened without us. Somebody would have done a standard operating system. The information highway is going to happen."

"Fear should guide you, but it should be latent. I have some latent fear. I consider failure on a regular basis."

Being a "technologist": "I devote maybe ten percent to business thinking."

"Let's look around these shelves and see if there are any business books. Oops."😂

Both Jobs and Gates took LSD?🤔

"Let's look around these shelves and see if there are any business books. Oops."😂

Both Jobs and Gates took LSD?🤔

"Is the one success of Microsoft enough for you?"

"It's like saying to somebody who's been married 50 years, 'Well, hell, you've only had one wife. What's wrong with you?' I mean, I'm committed to one company. This is the industry I've decided to work in."

"It's like saying to somebody who's been married 50 years, 'Well, hell, you've only had one wife. What's wrong with you?' I mean, I'm committed to one company. This is the industry I've decided to work in."

• • •

Missing some Tweet in this thread? You can try to

force a refresh