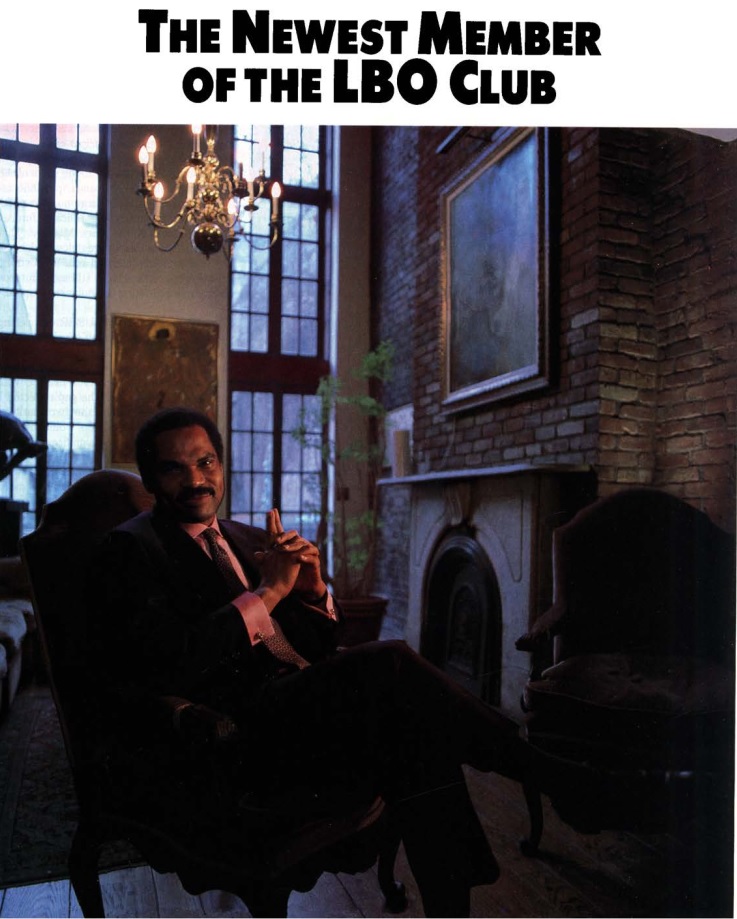

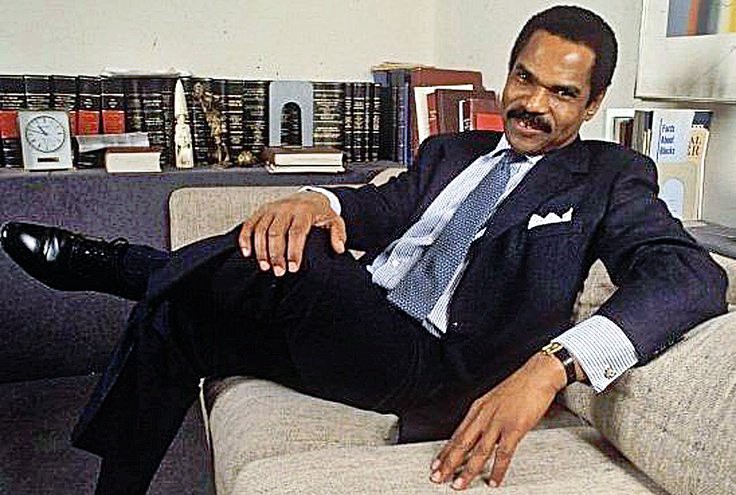

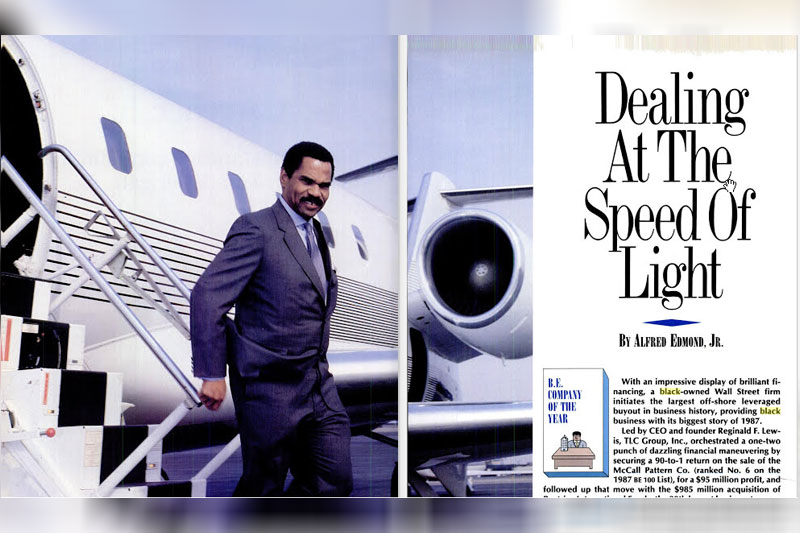

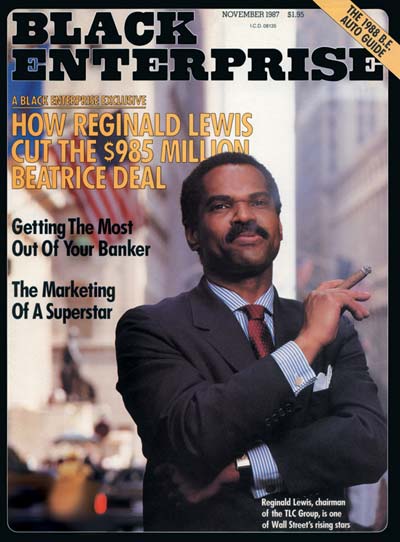

In 1987, an unknown black lawyer rocked Wall Street with the $985 million LBO of Beatrice International.

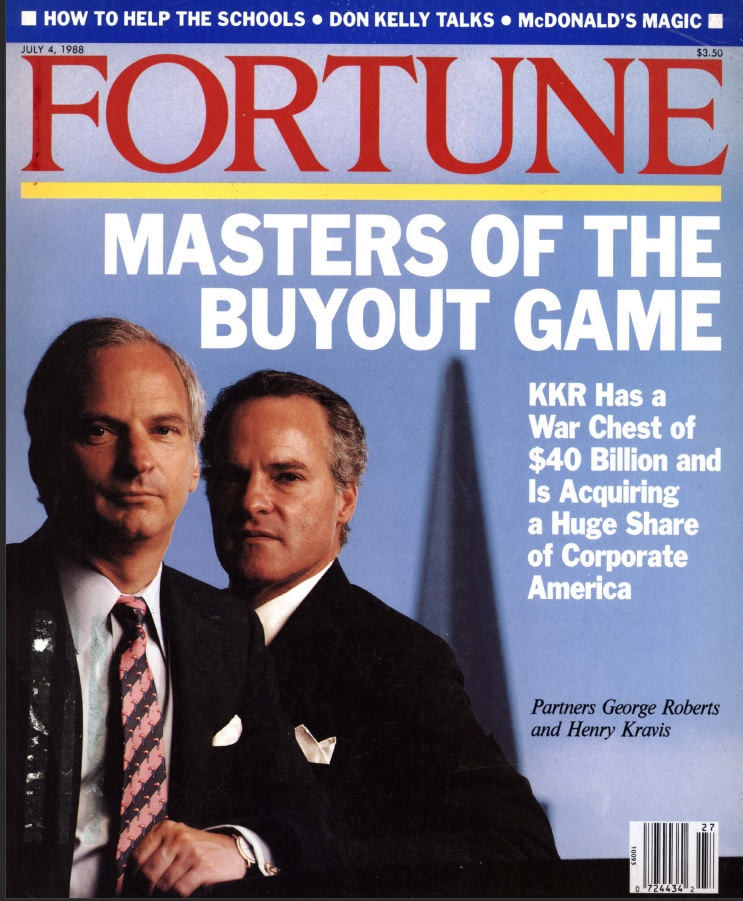

Reginald Lewis had bootstrapped his way to the top of the buyout world, negotiating with the likes of Henry Kravis and Michael Milken.

Reginald Lewis had bootstrapped his way to the top of the buyout world, negotiating with the likes of Henry Kravis and Michael Milken.

Kenneth Frazier, CEO of Merck: “Reg Lewis opened up a world of possibilities for an entire generation of black business leaders. I distinctly recall my reaction when he engineered the acquisition of Beatrice Foods. I said to myself, “Who is this brother?’”

Lewis grew up in Baltimore and wanted to play professional football. However, after an injury he ingeniously worked his way into Harvard Law School.

He joined a prestigious law firm but was told he wouldn't make partner.

So he set out on his own.

He joined a prestigious law firm but was told he wouldn't make partner.

So he set out on his own.

He hustled for years, working nights and weekends and sometimes tapping his savings to make payroll.

Meanwhile, he watched his clients succeed in the emerging world of private equity.

Meanwhile, he watched his clients succeed in the emerging world of private equity.

An idea took shape: why get paid by the hour when he could do his own deals instead?

Or in his words: “Why the fuck do we have to prove ourselves over and over? I’ve got to go to the other side of the table. This is not the way I want to spend the rest of my life.”

Or in his words: “Why the fuck do we have to prove ourselves over and over? I’ve got to go to the other side of the table. This is not the way I want to spend the rest of my life.”

His early deals all fell apart, prompting him to question everything.

Over time he learned how to build an effective team, how to turn the company's management team into allies, and how to source enough deals to spot the ones worth pursuing.

Over time he learned how to build an effective team, how to turn the company's management team into allies, and how to source enough deals to spot the ones worth pursuing.

“Many of your strengths can indeed be weaknesses. I was the finder of the deal, financial analyst, fundraiser, quasi-legal officer, and chief strategist. For five years, I had gone about it all wrong, using an approach that could get me close, but not get the job done.”

“I became a prospectus junkie and read all the deals which were publicly reported. It is amazing how much you can learn from public records about how people go about things.”

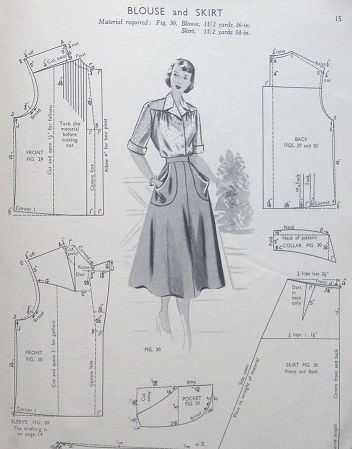

Finally, he got his break when he read about the merger of two massive conglomerates and an unloved subsidiary that was for sale: McCall Pattern.

A leader in the shrinking market of home sewing patterns. An unsexy business with strong cash flows at a low valuation.

A leader in the shrinking market of home sewing patterns. An unsexy business with strong cash flows at a low valuation.

This time he had his team in place. He charmed the management team with equity upside. And Bear Stearns raised the debt.

He paid $22.5 million for the business - and contributed only $500k of his own equity. Cash which he had borrowed against personal real estate.

He paid $22.5 million for the business - and contributed only $500k of his own equity. Cash which he had borrowed against personal real estate.

It was private equity 101: they improved the facility's utilization, stopped competing for market share with discounts, sold real estate, optimized working capital.

He sold the company four years later: the equity investors realized a 90x return on their investment.

He sold the company four years later: the equity investors realized a 90x return on their investment.

The ink was barely dry when a banker told him about Beatrice, a food conglomerate being dismantled by KKR. Lewis was still exhausted but he decided to dig in.

It was the opposite of McCall: a good business, global, $2.5 billion in sales, and a highly competitive deal.

It was the opposite of McCall: a good business, global, $2.5 billion in sales, and a highly competitive deal.

But Lewis liked what he saw and decided to submit a bid.

This was the response: “We have received from your group an offer to buy Beatrice International for $950 million. We have a small problem - nobody knows who the hell you are!"

This was the response: “We have received from your group an offer to buy Beatrice International for $950 million. We have a small problem - nobody knows who the hell you are!"

KKR thought he wasn't credible.

He had no fund of his own.

The stock market crashed.

The collection of 64 companies in 31 countries had scores of minority owners. The tax structure made a vanilla impossible.

The timeline to closing was hair-raising.

He had no fund of his own.

The stock market crashed.

The collection of 64 companies in 31 countries had scores of minority owners. The tax structure made a vanilla impossible.

The timeline to closing was hair-raising.

Even Lewis became doubtful. When his wife reassured him, he said:

“What do you know about deals?”

“I don’t know anything about them,” she countered. “But I know you. And you can do it.”

“What do you know about deals?”

“I don’t know anything about them,” she countered. “But I know you. And you can do it.”

Lewis was an absolute force of nature and I found his story and biography deeply inspiring.

I published my deep dive here:

neckar.substack.com/p/reginald-lew…

I published my deep dive here:

neckar.substack.com/p/reginald-lew…

“People who get their thrills from talking about big deals end up not doing them. The fewer words, the better. It's action that counts, not words. That's the cardinal rule of deal-making.” Reginald Lewis

“I know I have cancer of the brain,” he told his wife, “I used my brain as a weapon to go forward and to disprove a lie about people of color, and I had no protection.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh