1/ Asset Allocation Via Clustering: How Useful Is My Stylebox? Are Most Hedge Funds the Same? (Stock)

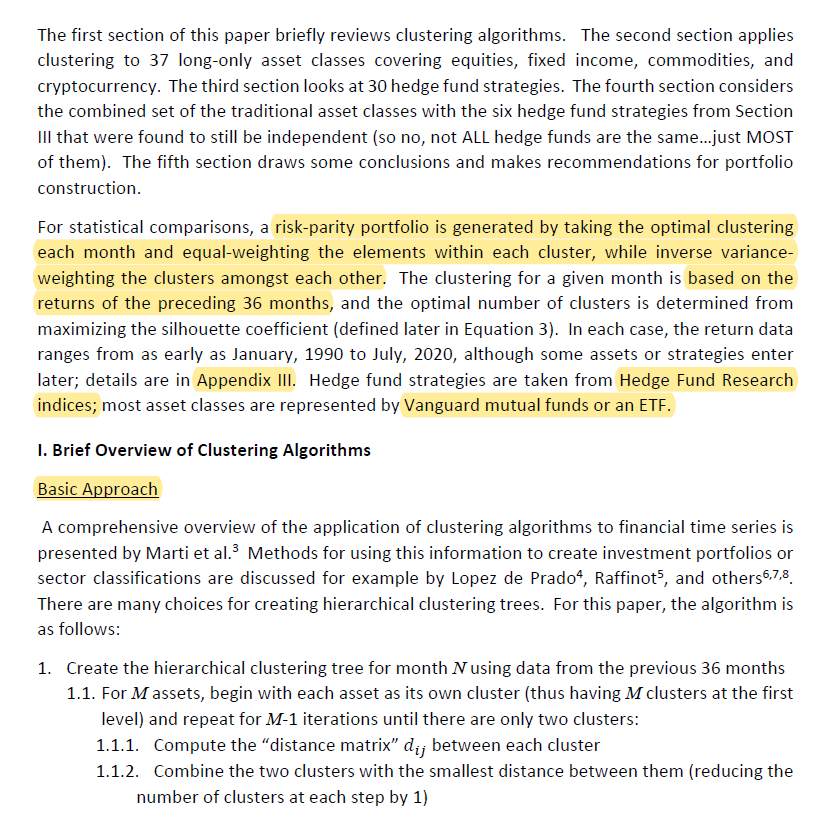

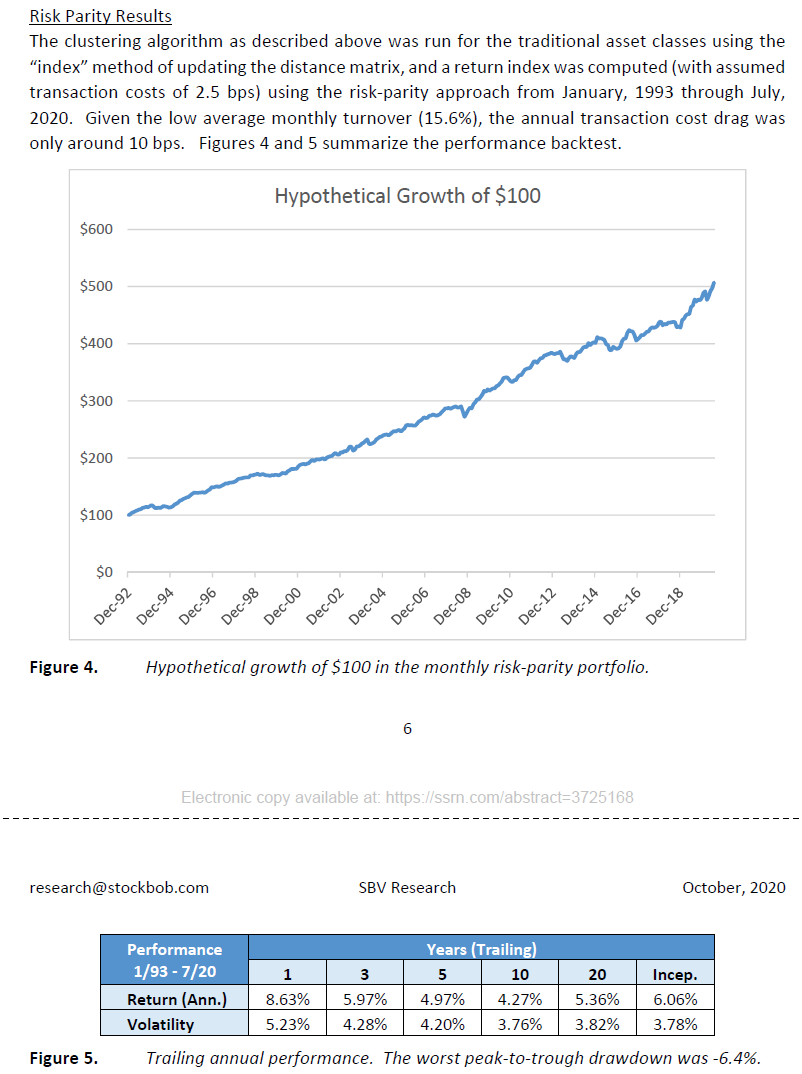

"We apply clustering algorithms to asset classes and HF strategies (1990-2020) to investigate cluster stability and compute the returns of risk parity."

papers.ssrn.com/sol3/papers.cf…

"We apply clustering algorithms to asset classes and HF strategies (1990-2020) to investigate cluster stability and compute the returns of risk parity."

papers.ssrn.com/sol3/papers.cf…

2/ "What can machine learning clustering algorithms tell us about which asset classes tend to move together and which have historically stayed further apart? Which hedge fund strategies provide the best diversification in portfolios?"

3/ "We find very little benefit to traditional “style box” diversification over our rolling 3-year periods. While they could make sense to access better alpha, tactical factor exposure, or portfolio beta management, they exhibited only rare opportunities for diversification.

4/ "The Foreign Equity complex was slightly more useful.

"For other equity subtypes (REITs, MLPs), the picture begins to improve.

"While Miners looked the most unlike Equity, the last time they stood separately was nearly 20 years ago; otherwise they look like Precious Metals."

"For other equity subtypes (REITs, MLPs), the picture begins to improve.

"While Miners looked the most unlike Equity, the last time they stood separately was nearly 20 years ago; otherwise they look like Precious Metals."

5/ "Commodities cluster with Equity 69% of the time, and when they look like something else, it’s usually Precious Metals.

"The true standout, however, is Bitcoin, which has always formed its own cluster since its inception in this analysis (September 2017)."

"The true standout, however, is Bitcoin, which has always formed its own cluster since its inception in this analysis (September 2017)."

6/ "Over time there is naturally an Equity cluster (with a slight break between Domestic and Foreign), 1-3 Bond-like clusters, a Bitcoin cluster, and often a Precious Metal cluster. (The wild cards are generally HY, EMB, MLP, REIT, and Minr, which drift around.)"

7/ "Unlike the traditional asset classes, where the optimal number of clusters was noisy but relatively steady over time, the alternative asset classes display a distinct down-trend in the optimal number of independent clusters."

Surprise, surprise:

Surprise, surprise:

https://twitter.com/ReformedTrader/status/1233573232881438720

8/ "Can the inclusion of alternative strategies improve the diversification of traditional portfolios?

"Although most of the benefit appeared in the 1990s, risk-adjusted performance improved over most time periods" with the inclusion of alternatives.

"Although most of the benefit appeared in the 1990s, risk-adjusted performance improved over most time periods" with the inclusion of alternatives.

9/ "The average number of clusters increased from 4.9 for the traditional portfolio to 5.7 for the combined portfolio, indicating the alternative strategies did indeed succeed in producing an additional diversifying cluster, on average."

10/ "Having shown that MERFX is generating a new cluster 40% of the time, the question becomes whether it corresponds to the same “Merger Arbitrage” cluster of ED:Mer.

"Comparing to times when ED:Mer also was a unique cluster, we find the time overlap of being unique was 92%."

"Comparing to times when ED:Mer also was a unique cluster, we find the time overlap of being unique was 92%."

11/ "Style box diversification is nearly useless.

"Gold/silver, MLPs, REITs may be useful.

"Bonds come in three flavors (Treasuries, Corporates, and Munis) based on credit, not duration.

"Bitcoin has been a terrific diversifier.

"Most hedge funds have collapsed into Equity."

"Gold/silver, MLPs, REITs may be useful.

"Bonds come in three flavors (Treasuries, Corporates, and Munis) based on credit, not duration.

"Bitcoin has been a terrific diversifier.

"Most hedge funds have collapsed into Equity."

• • •

Missing some Tweet in this thread? You can try to

force a refresh