2. Yes, it’s been a minute since our last inflation thread, there’s a lot to catch up on, and we’re sorry it’s been so long, but oh, boy…what can we say? It’s been a strange and hectic year, and like our friends at @rocketshipja would tell you, it’s been a case of:

3. We’ve heard the vicious rumours, too - that we’ve forgotten our fans and followers who read these inflation threads, because we’ve graduated to an inflation TV show and that we “get rich an’ switch.”

4. We can assure you that nothing is further from the truth, and we’re here now to “mash down dat lie”!

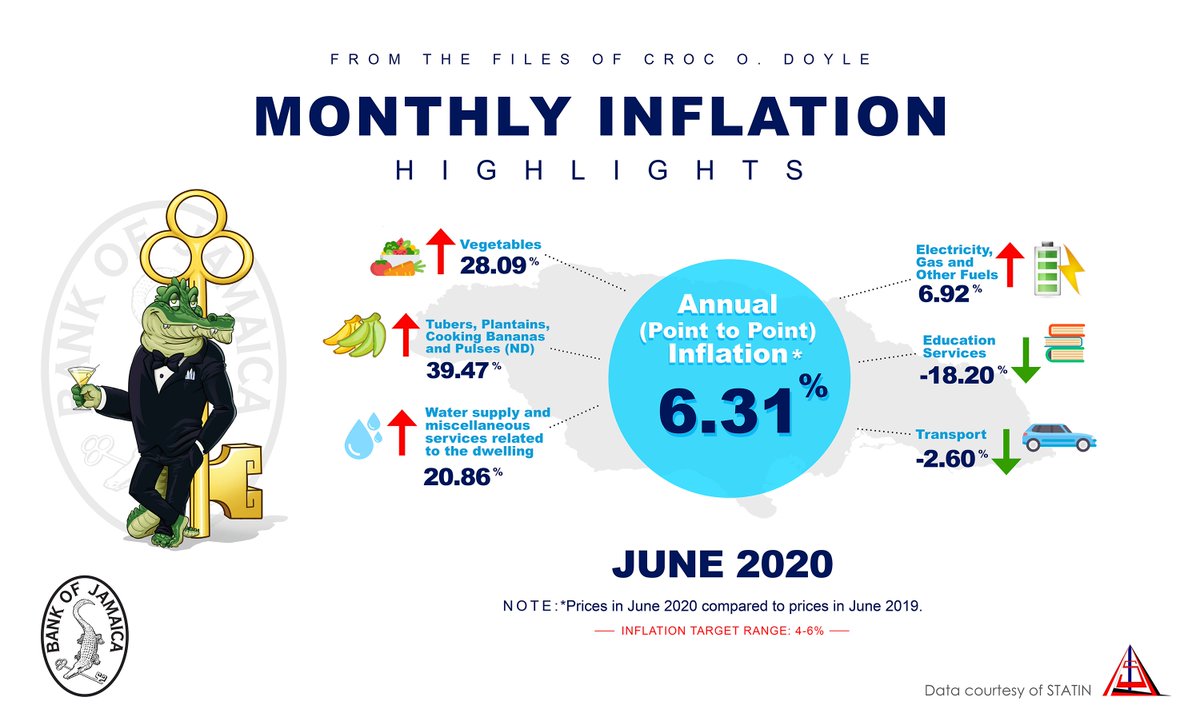

5. Now that we’ve settled that, let’s get down to business. After registering 4.7% in May, annual inflation breached the target range slightly in June 2020 as it shot up to 6.3%. NOTE CAREFULLY, THOUGH, THAT THIS SPIKE WAS TEMPORARY.

6. As we highlighted in our ‘Wild West’ inflation thread in August, inflation targeting is a lot more complex than the simplicity of shooting at a target, as it’s not about precisely hitting a static target every single time.

7. Compared to June 2019, the June 2020 spike emanated mostly from a 10.7% jump in the Food & Non-Alcoholic Beverages category, pushed in turn by a 34.1% rise in agricultural food prices, largely due to adverse weather conditions.

8. Further breakdowns in this category saw the vital and volatile vegetable category posting an increase of 28%.

9. In terms of monthly inflation, prices in June 2020 rose by 1.4% compared to May 2020, again due largely to increases in agricultural food prices plus clothing and footwear costs.

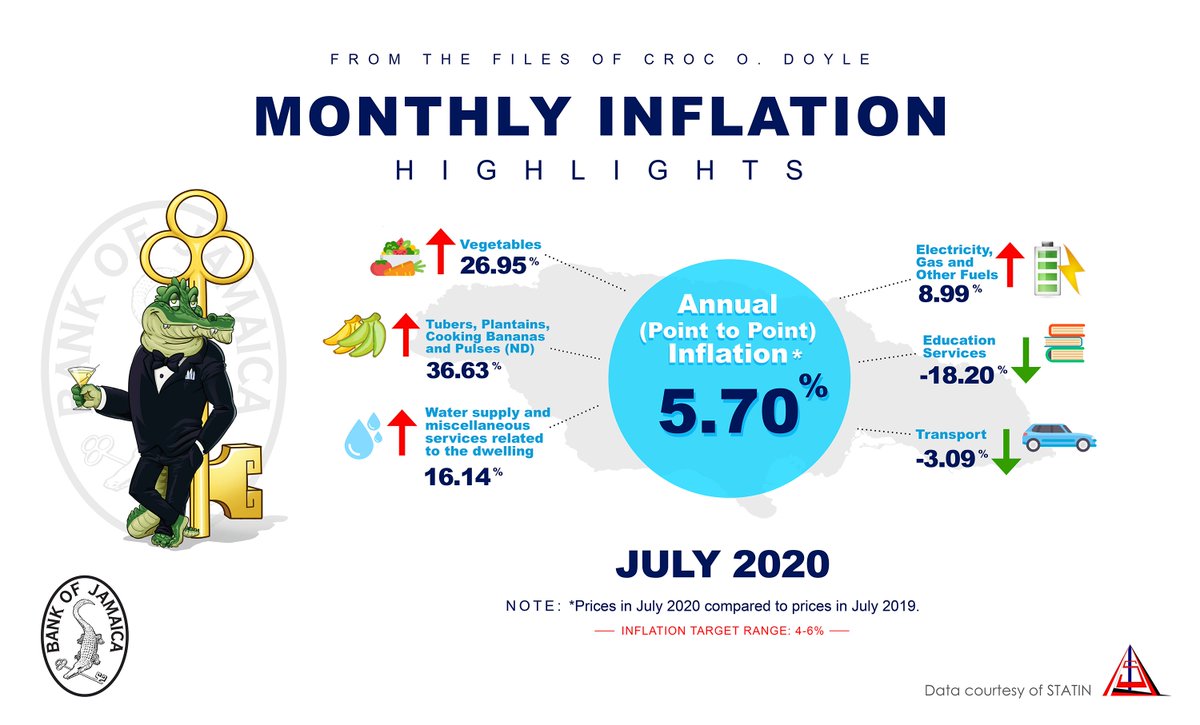

10. Did we mention temporary? For July 2020, the inflation outturn made a hasty retreat from June’s spike to fall back where it belongs, within the target range, registering 5.7%.

11. On a monthly basis, however, prices in July 2020 rose by 0.5% compared to June 2020, largely reflecting higher prices for agricultural produce as well as for clothing and footwear.

12. Agricultural food prices again accounted for most of the upward movement, increasing by 28.1% compared to July 2019, and in turn pushing the Food & Non-Alcoholic Beverages division to a 9.5% annual increase.

13. Perhaps due to the COVID-19 effect of increased demand, there was a significant increase in prices for personal care products, particularly items such as bath soaps, toothpaste, and toilet paper.

14. In addition, there were price increases for clothing and footwear items, as well as water and electricity rates, while declines came in transport-related costs, as petrol prices remain lower than a year before.

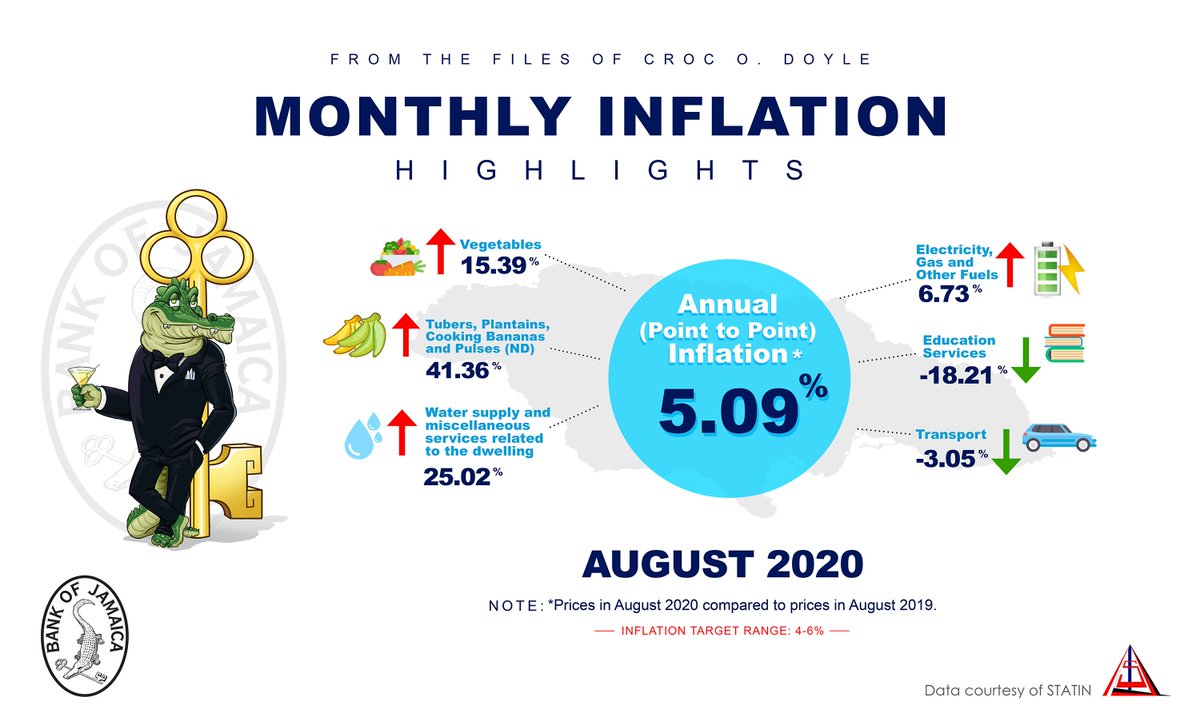

15. The 5.1% recorded for August 2020 was a reduction compared to 5.7% in July, but was above the 4% recorded for the same point in August 2019. In terms of monthly inflation, prices in August 2020 rose by just 0.2% compared to July 2020.

16. Contributing to this outturn, the largest price increase was again recorded in the Food & Non-Alcoholic Beverages category, which increased by 8.0% compared to August 2019.

17. In a continuing trend, the biggest increase in this category came from higher agricultural food prices, which increased by 20.4% over August 2019, again influenced by adverse weather conditions.

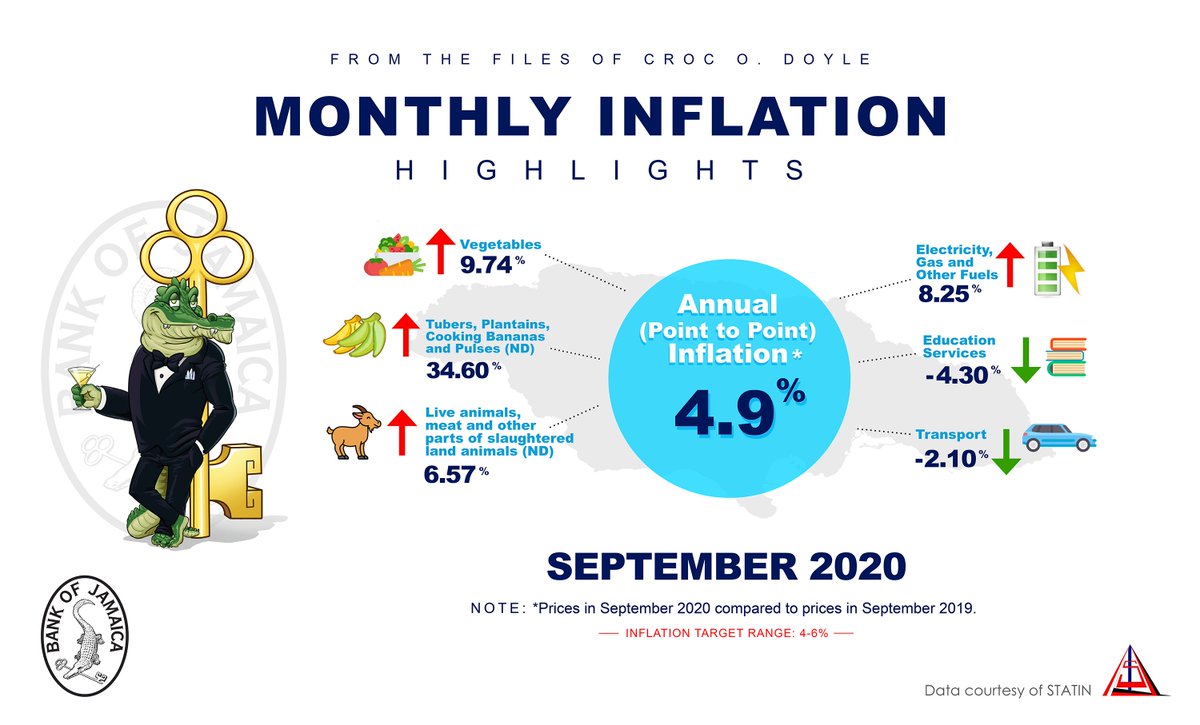

18. For September, inflation was 4.9% relative to a year ago, and this was just below the midpoint of the inflation target.

19. The main inflation catalyst continued to be the Food & Non-Alcoholic Beverages division, which increased by 7.5% compared to a year earlier, with weather-influenced agricultural food prices again driving the overall category, increasing in annual terms by 15.9%.

20. Similar to what we saw in August, during September we continued to observe a COVID-19 related spike in prices for personal care products, particularly items such as bath soaps, toothpaste, and toilet paper.

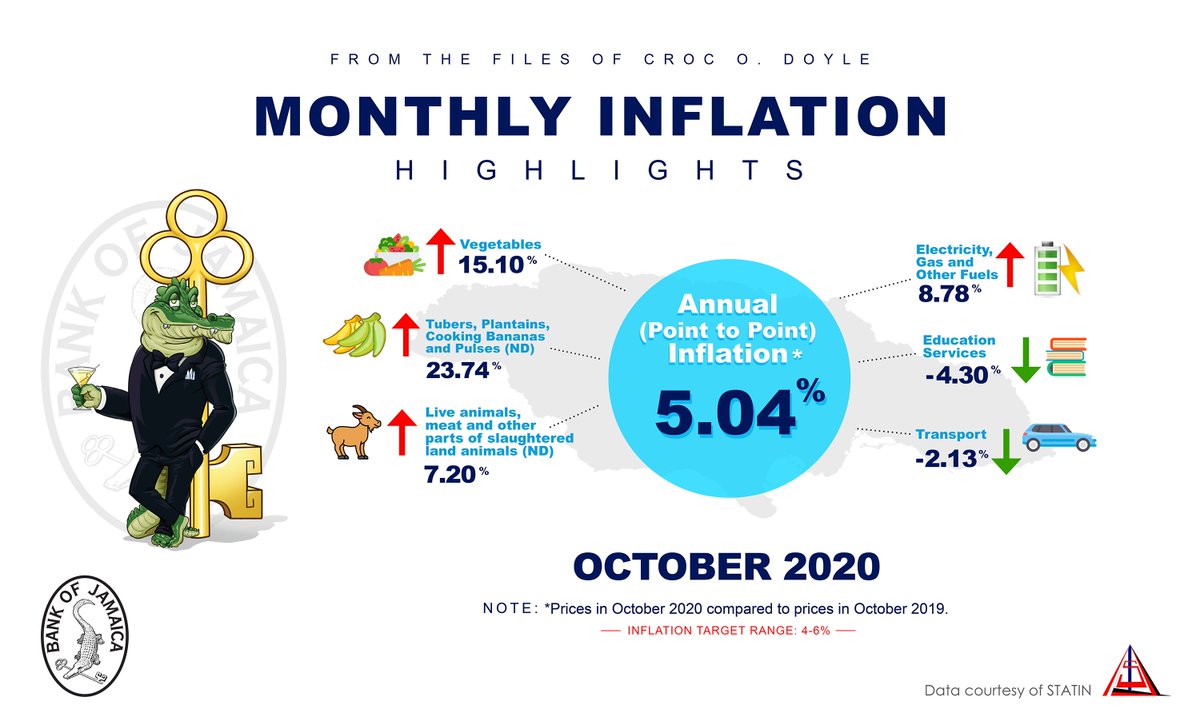

21. October was a good month overall, as inflation settled dead-on in the center of the target range, at 5%.

22. Again, however, higher prices for items such as tomatoes, sweet peppers, and lettuce resulted in the vegetable subcategory spiking at 15.1%, while “tubers, plantains, cooking bananas and pulses” climbed to nearly 24%.

23. COVID-19 complications aside, the persistent inflation catalyst all year has been agricultural food prices, with local agriculture reeling from the effects of prolonged drought for months, only to be flooded with excess rainfall right after. #wewantjustice

24. It may not always seem that way, but we should note that thanks to the increased use of technology, Jamaican agriculture is much more resilient to drought conditions than it used to be years ago, and inflation of late would have been higher otherwise.

25. Now, unfortunately, it seems we also have to figure out how to be more resilient to getting too much rain.

26. The importance of our domestic agriculture and its potential to boost our economic progress cannot be overstated, but especially for sustaining our food security during a pandemic while battling the brutal ravages of maliciously unfriendly weather, we salute our farmers!

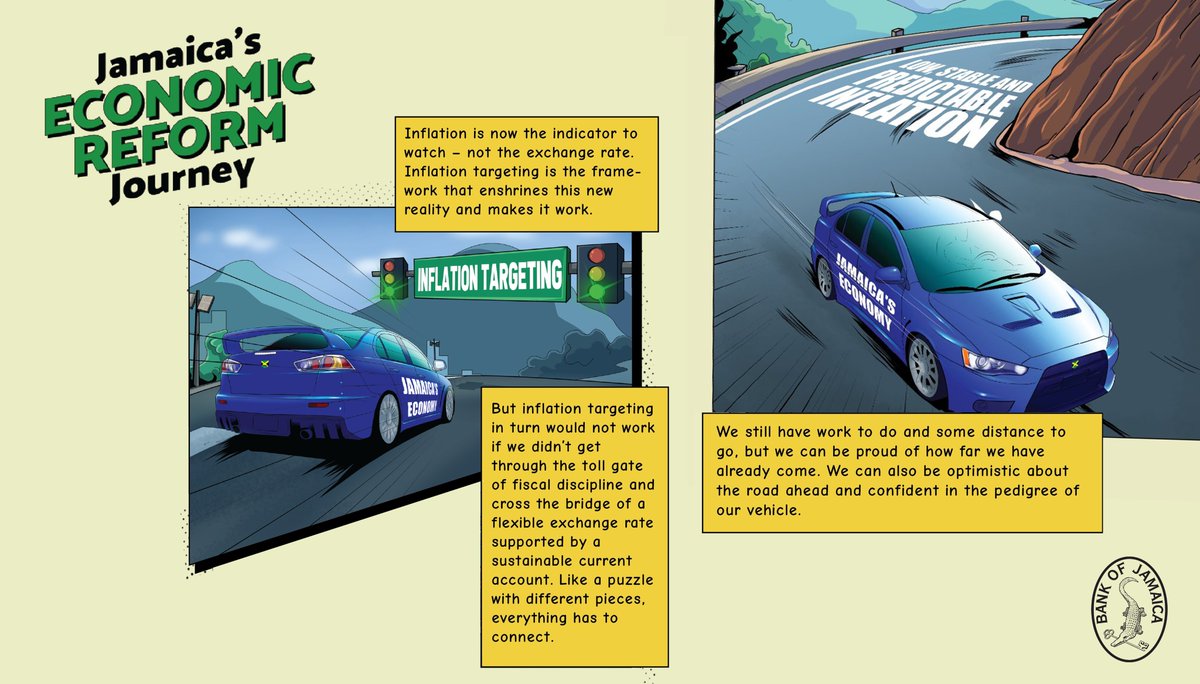

27. Our farmers have not been the only ones who have grown more resilient to inflation, however. So has the entire economy, and at long last, we now enjoy a fully entrenched low inflation environment, which has its benefits.

28. Part of what this means is that while unavoidable shocks can sometimes induce spikes in inflation, they can only be temporary, as our track record indicates that we will quickly pull inflation back down to normal levels after any spike.

29. Repairing our road network will be a much more complicated matter, but where the impact of recent flood rains on inflation next year is concerned, don’t worry – we’ll handle it.

30. For more detailed information on the monthly inflation results, please check out our Inflation Watch series with our resident economists on our YouTube channel. bit.ly/3g4L809

31.

• • •

Missing some Tweet in this thread? You can try to

force a refresh