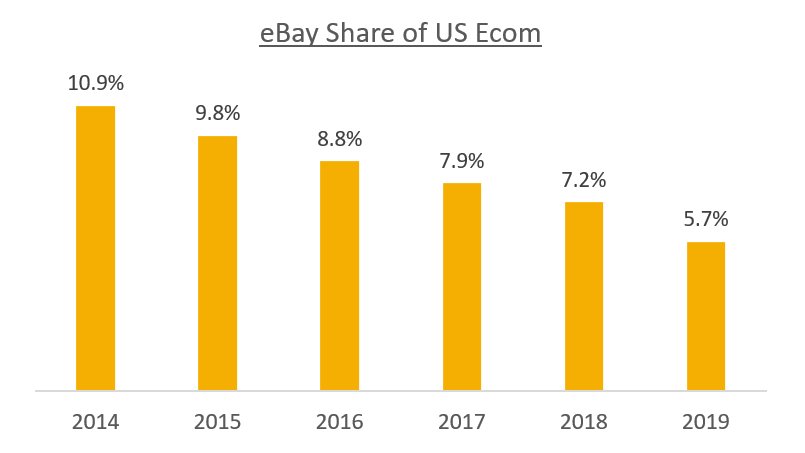

1/ Back in 2014, eBay was the 2nd largest ecom player in the US, with over 10% share.

But that has slowly eroded over the years...

Read more below on my takeaways 👇

And read throughs to the rise of Shopify, DoorDash, and Shopee vs incumbent marketplaces.

But that has slowly eroded over the years...

Read more below on my takeaways 👇

And read throughs to the rise of Shopify, DoorDash, and Shopee vs incumbent marketplaces.

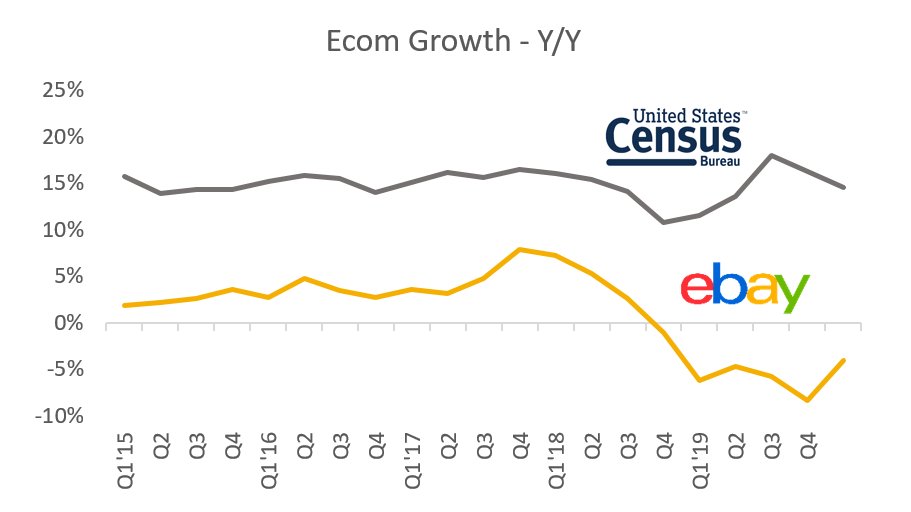

2/ eBay GMV has barely grown from 2014-19, hovering between $30-35B.

Meanwhile US ecom doubled from $300B to $600B+

Meanwhile US ecom doubled from $300B to $600B+

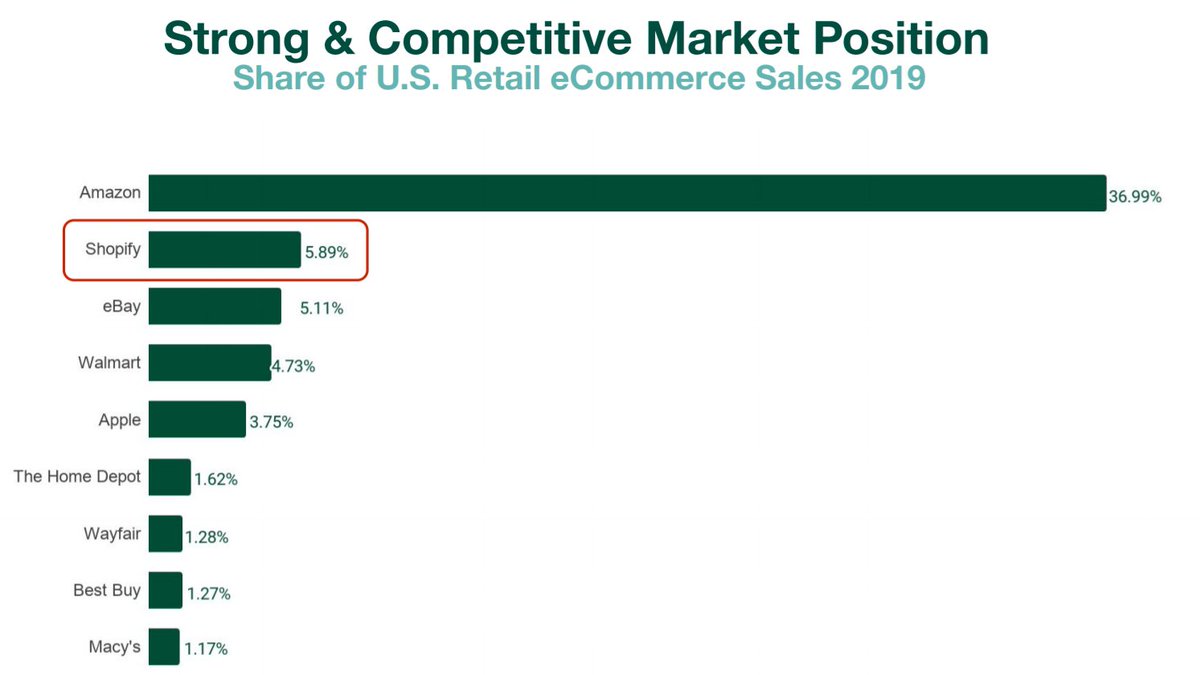

3/ In fact, Shopify overtook eBay in market share last year.

2019 US Share

-> 5.9% Shopify

-> 5.7% eBay (before re-statement)

2019 US Share

-> 5.9% Shopify

-> 5.7% eBay (before re-statement)

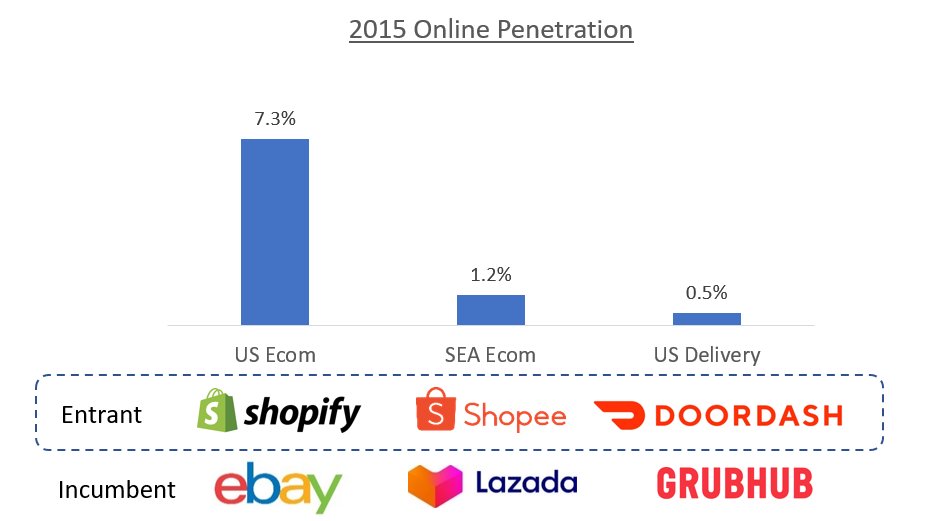

4/ Shopify didn't win by directly taking away eBay GMV.

Instead, US ecom penetration was still low at 6-7% back in 2014.

Shopify created a better experience for sellers & buyers via new D2C brands.

In doing so, captured disproportionate share of new habits and behavior formed.

Instead, US ecom penetration was still low at 6-7% back in 2014.

Shopify created a better experience for sellers & buyers via new D2C brands.

In doing so, captured disproportionate share of new habits and behavior formed.

5/ When I look at eBay, I'm reminded of how many other markets played out.

Where low penetration eroded the first-mover advantage investors often ascribe to "network effect" businesses.

For perspective:

DoorDash was founded in 2013.

Shopee was started in 2015.

Where low penetration eroded the first-mover advantage investors often ascribe to "network effect" businesses.

For perspective:

DoorDash was founded in 2013.

Shopee was started in 2015.

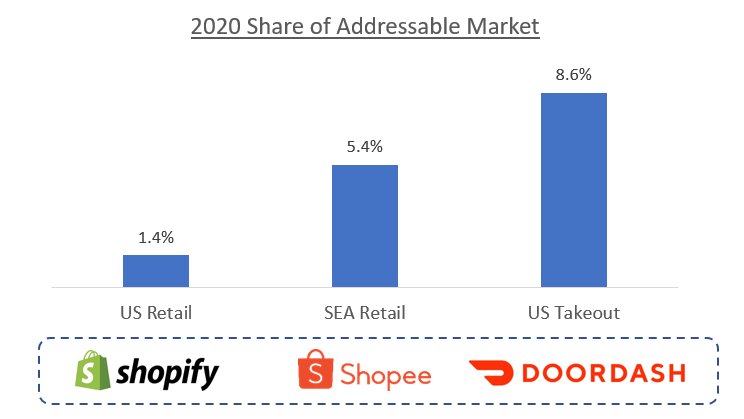

6/ Online penetration in these categories was extremely low even as of 2015.

This provided plenty runway for new, scrappier entrants to build massive businesses, and overtake incumbents.

2020 Market Share

DoorDash 50%

Shopee 40%

This provided plenty runway for new, scrappier entrants to build massive businesses, and overtake incumbents.

2020 Market Share

DoorDash 50%

Shopee 40%

7/ Key lesson is the importance of backing exceptional founders like Tony Xu, Tobi Lutke and Forrest Li

Particularly in early markets still forming.

They understood innovating & growing the pie mattered much more

In a way that incumbents and many investors at the time did not.

Particularly in early markets still forming.

They understood innovating & growing the pie mattered much more

In a way that incumbents and many investors at the time did not.

8/ Even at their scale, they are all just getting started.

All have single digit share of their total addressable market.

With visionary founder-CEOs leading the charge 🚀

All have single digit share of their total addressable market.

With visionary founder-CEOs leading the charge 🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh