So wtf is Keep3r Network?

Thread on #KP3R and its role in governing the @kp3r_network devops coordination protocol 🔒

Thread on #KP3R and its role in governing the @kp3r_network devops coordination protocol 🔒

Keep3r Network provides a way for protocols to post 'jobs' - or smart contract call requests - to 'keepers' - or those willing to perform those tasks.

Think liquidations, fee collections, oracle calls or collateral unlocks.

Great explainer by @Ceazor7 🔽

Think liquidations, fee collections, oracle calls or collateral unlocks.

Great explainer by @Ceazor7 🔽

https://twitter.com/Ceazor7/status/1333075407852105729?s=20

If you need a job done constantly, Keep3r provides a way to post it on a public job board, and allow keepers to pay the gas to perform it in exchange for a reward.

Jobs can be paid in #KP3R, $ETH, or tokens like $AAVE

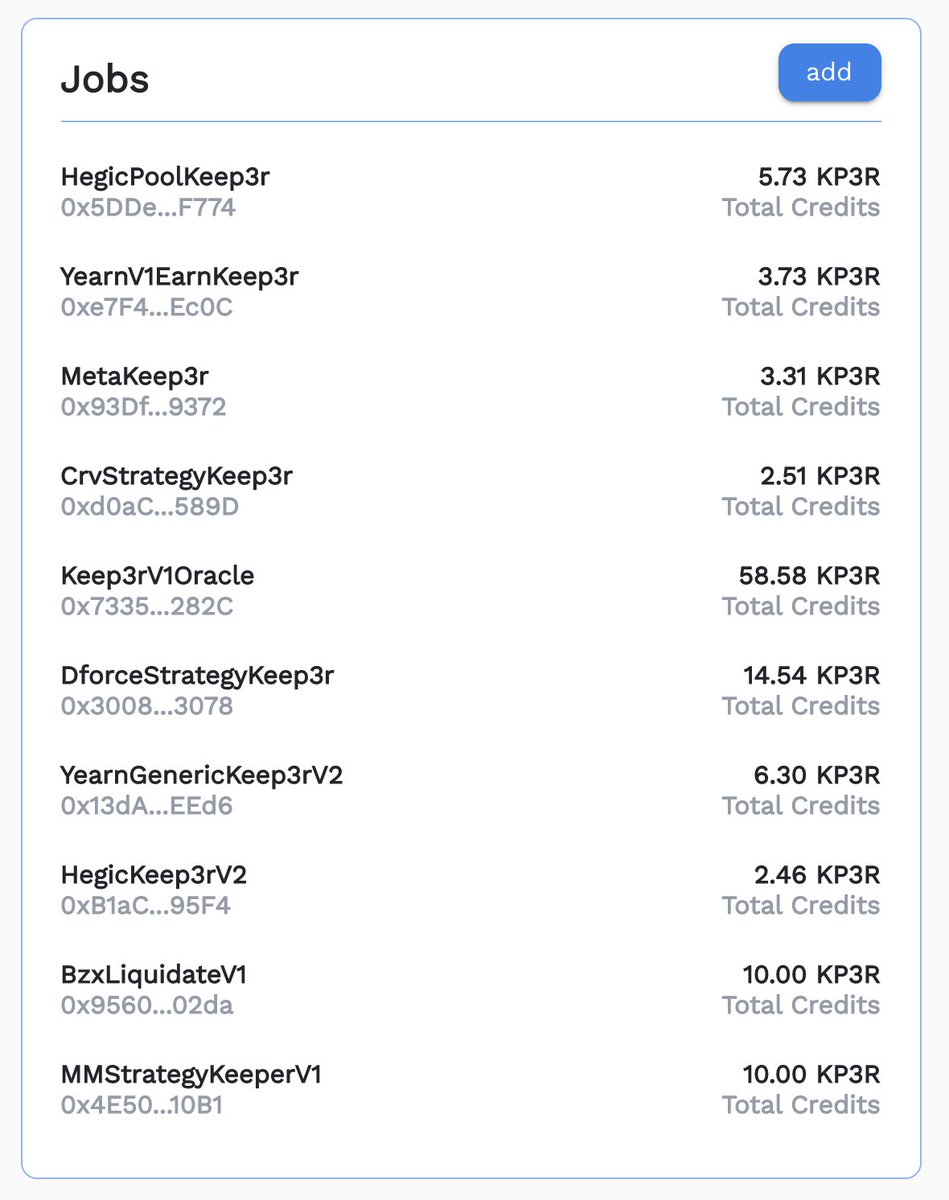

Existing Jobs at keep3r.network 🧠

Jobs can be paid in #KP3R, $ETH, or tokens like $AAVE

Existing Jobs at keep3r.network 🧠

The harder the job, the more sophisticated the keeper needs to be.

Jobs can require bonds, meaning a keeper needs to stake #KP3R to execute the task and collect their loot.

769 keepers have bonded 3115 KP3R (~$1M) to complete 4000 jobs.

h/t @zashtonEth keep3r.live

Jobs can require bonds, meaning a keeper needs to stake #KP3R to execute the task and collect their loot.

769 keepers have bonded 3115 KP3R (~$1M) to complete 4000 jobs.

h/t @zashtonEth keep3r.live

So who's using this?

Here's a case study from @Macarse on how keepers are unlocking @HegicOptions collateral for withdraws upon expiry 🌔

TLDR: Post #KP3R credits that are consumed by keepers as different options are unlocked.

Here's a case study from @Macarse on how keepers are unlocking @HegicOptions collateral for withdraws upon expiry 🌔

TLDR: Post #KP3R credits that are consumed by keepers as different options are unlocked.

https://twitter.com/Macarse/status/1333244453402923010?s=20

Teams can make direct payments, spending ETH or tokens.

Alternatively, they can provide liquidity and get #KP3R credit.

This opex vs capex tradeoff allows those testing in prod to pay less for jobs by removing unused credits at any time.

docs.keep3r.network/jobs

Alternatively, they can provide liquidity and get #KP3R credit.

This opex vs capex tradeoff allows those testing in prod to pay less for jobs by removing unused credits at any time.

docs.keep3r.network/jobs

We can extrapolate this to any time a smart contract needs to be called to harvest tokens or verify an onchain interaction.

While anyone can create a job, only those whitelisted through #KP3R governance can be posted.

Ongoing requests on the Keep3r forum

gov.yearn.finance/c/projects/kee…

While anyone can create a job, only those whitelisted through #KP3R governance can be posted.

Ongoing requests on the Keep3r forum

gov.yearn.finance/c/projects/kee…

And why would people govern this whitelist?

Keep3r takes a 0.03% fee when a job is paid in ETH or tokens other than #KP3R.

The treasury currently holds ~$13.8M, $5.5M of which is currently earning yield on @AlphaFinanceLab 🚀

etherscan.io/address/0xf7aa…

Keep3r takes a 0.03% fee when a job is paid in ETH or tokens other than #KP3R.

The treasury currently holds ~$13.8M, $5.5M of which is currently earning yield on @AlphaFinanceLab 🚀

etherscan.io/address/0xf7aa…

Now, the goal is to get more keepers to bond #KP3R.

The more bonded #KP3R, the more trusted keepers can be to act honestly and perform complex work.

Bonds are subject to a 14 day cooldown, meaning job owners can be confident keepers will not enter and exit maliciously.

The more bonded #KP3R, the more trusted keepers can be to act honestly and perform complex work.

Bonds are subject to a 14 day cooldown, meaning job owners can be confident keepers will not enter and exit maliciously.

Key Takeaways:

- Keep3r generalizes expediting onchain tasks using a trusted bounty system.

- Keepers are earning handsome fees, and more jobs are being posted every day

- While highly technical, the protocol serves a crucial backend role as #DeFi expands.

- Keep3r generalizes expediting onchain tasks using a trusted bounty system.

- Keepers are earning handsome fees, and more jobs are being posted every day

- While highly technical, the protocol serves a crucial backend role as #DeFi expands.

Learn more at docs.keep3r.network

List of #KP3R governance topics andrecronje.medium.com/keep3r-network…

Special thanks to @AndreCronjeTech for dealing with my dumb questions 🙈

List of #KP3R governance topics andrecronje.medium.com/keep3r-network…

Special thanks to @AndreCronjeTech for dealing with my dumb questions 🙈

Disclaimer: @kp3r_network is a community run account not officially affiliated with the project.

Keep3r has no official socials and all discussions happen on the forum.

Stay safe out there!

Keep3r has no official socials and all discussions happen on the forum.

Stay safe out there!

• • •

Missing some Tweet in this thread? You can try to

force a refresh