Raising my $TSLA PT to $830 from $720, reflecting increase in TSLA EV share from 22% to 25%.

Oct YTD TSLA share now 25% vs 17% in FY’19, despite slew of new EV offerings.

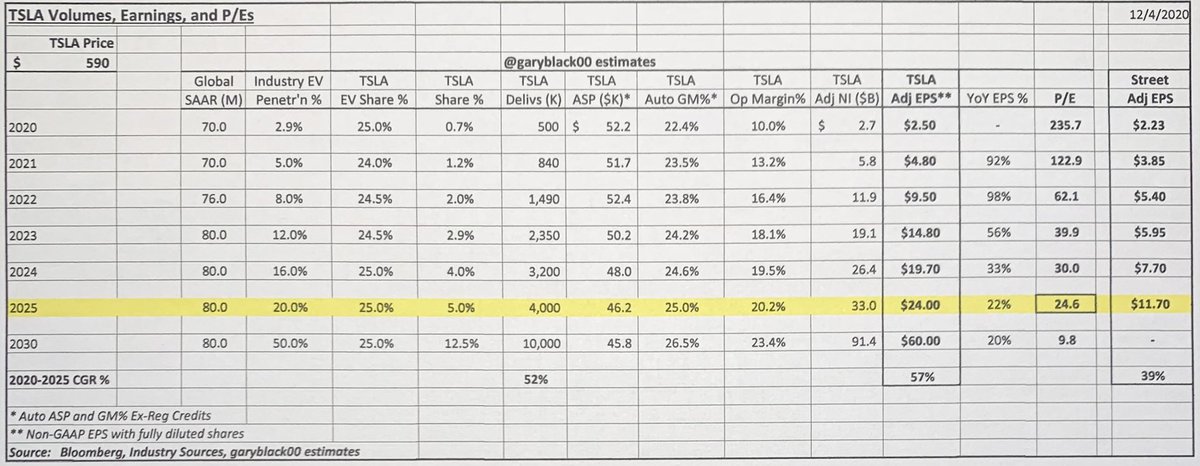

$830 PT over 6-12 mos reflects FY’25 EPS of $24 (was $21) @ 50x P/E = $1,200, disct’d back @ 9.5% = $830.

Oct YTD TSLA share now 25% vs 17% in FY’19, despite slew of new EV offerings.

$830 PT over 6-12 mos reflects FY’25 EPS of $24 (was $21) @ 50x P/E = $1,200, disct’d back @ 9.5% = $830.

2/ At $590, $TSLA underpriced at 62x FY’22 EPS $9.50 (Street $5.40), and 40x FY’23 EPS $14.80 (Street $5.95) with 50%+ 5-yr vol and EPS growth. At 1.2x FY’22 PEG, only mega-cap growth name cheaper than TSLA is $FB at 1.1x PEG (avg R1G PEG 2.0x). At $830 PT, TSLA has +40% upside.

3/ My new $TSLA non-GAAP EPS:

FY’20: $2.50 (no chg)

FY’21: $4.80 (no chg)

FY’22: $9.50 (vs $8.70)

FY’23: $14.80 (vs $13.00)

FY’24: $19.70 (vs $16.60)

FY’25: $24.00 (vs $21.00)

My new TSLA FY’25 delivs are 4,000K vs 3,520K prior (equal to 5.0% overall SOM vs 4.4% prior)

FY’20: $2.50 (no chg)

FY’21: $4.80 (no chg)

FY’22: $9.50 (vs $8.70)

FY’23: $14.80 (vs $13.00)

FY’24: $19.70 (vs $16.60)

FY’25: $24.00 (vs $21.00)

My new TSLA FY’25 delivs are 4,000K vs 3,520K prior (equal to 5.0% overall SOM vs 4.4% prior)

4/ Despite slew of new ICE-brand EVs, $TSLA EV share continues to grow, from 17% in 2019 to 25% Oct YTD. This is the most misunderstood dynamic by TSLA skeptics. ICE EVs suffer from inferior range, power, FSD/software, and brand taint. TSLA TAM continues to expand behind Model Y.

5/ Other inputs to $TSLA model:

1) Incr Auto GM% from 24.3% to 25.0% by FY’25 for higher vols

2) 2x SG&A/R&D spending betw FY’20 & FY’25 (was +40%)

3) No Reg Credits after FY’22 (was FY’23). $10K FSD at 33%.

4) Changed tax rate to 20% (from 25%) b/c no Reg Credits

5) $0 Robotaxi

1) Incr Auto GM% from 24.3% to 25.0% by FY’25 for higher vols

2) 2x SG&A/R&D spending betw FY’20 & FY’25 (was +40%)

3) No Reg Credits after FY’22 (was FY’23). $10K FSD at 33%.

4) Changed tax rate to 20% (from 25%) b/c no Reg Credits

5) $0 Robotaxi

6/ In keeping with past methodology, my $TSLA price target is the PV of my FY’25 target, equal to FY’25 EPS $24 x 50 P/E (2x PEG FY’23-‘30 growth)= $1,200.

I discount $1,200 back 4 years at 9.5%, equal to 10-yr Treas yld of 0.9%, plus 6% equity risk prem x exp 1.45 TSLA beta.

I discount $1,200 back 4 years at 9.5%, equal to 10-yr Treas yld of 0.9%, plus 6% equity risk prem x exp 1.45 TSLA beta.

7/ I expect $TSLA to peak between $650-$690 before S&P inclusion on 12/21, and retrace 10-20% on sell-the-news and profit taking after S&P inclusion. TSLA should resume rise in front of Biden inaugural speech (1/22) and 4Q EPS/FY’21 vol guide (1/27).

My $830 PT is over 6-12 mo.

My $830 PT is over 6-12 mo.

• • •

Missing some Tweet in this thread? You can try to

force a refresh