1/ One of the systems I am testing since September - has yielded the results (~22%) in the screenshot so far.

It's based on futures (trading through 2xATM options).

So, you could say this is a leverage oriented system.

The maximum drawdown as per the backtest was around 5%.

It's based on futures (trading through 2xATM options).

So, you could say this is a leverage oriented system.

The maximum drawdown as per the backtest was around 5%.

2/ I began live-testing trading this on September 9th, 2020.

I was supposed to begin by September 1st. But I chickened out, a little afraid.

Then, I buckled up, decided to consider this as an investment and started testing.

The starting capital: 2,00,000

I was supposed to begin by September 1st. But I chickened out, a little afraid.

Then, I buckled up, decided to consider this as an investment and started testing.

The starting capital: 2,00,000

3/ I didn't want to test on Futures because BNF has superb slippage and spread. So, decided to test small with options.

Started with 1xITM option. On average this had like 0.57-0.6 delta when trades ended.

I did this for 18 trades.

Started with 1xITM option. On average this had like 0.57-0.6 delta when trades ended.

I did this for 18 trades.

4/ In these 18 trades, I also did two small optimisations that I implemented from the 5th or 6th trade.

Prior to optimisation, the system had about 7% historical drawdown. After optimisation, the system had about 5% historical drawdown.

The backtest was for one lot per 2L.

Prior to optimisation, the system had about 7% historical drawdown. After optimisation, the system had about 5% historical drawdown.

The backtest was for one lot per 2L.

5/ I did all possible mistakes I could have - in these trades.

Manual execution is hard, you have to be on-point.

There were many mistakes I did over the last 39-40 trades.

Manual execution is hard, you have to be on-point.

There were many mistakes I did over the last 39-40 trades.

6/ Some of the mistakes I did are as follows:

i) Mistakenly entered the strike based on spot instead of futures, not looking at the right chart.

ii) Accidentally trading monthly option instead of weekly (very first trade).

i) Mistakenly entered the strike based on spot instead of futures, not looking at the right chart.

ii) Accidentally trading monthly option instead of weekly (very first trade).

On IBKR i had to enable the weekly options in the chain. I hadn't done that and absent-mindedly entered the monthly option, realising only after entering.

iii) When the price was around xxx50 levels, and was very close, unable to monitor exactly, I had entered a higher strike.

iii) When the price was around xxx50 levels, and was very close, unable to monitor exactly, I had entered a higher strike.

iv) Regularly made the mistake of adding current weekly expiry options instead of next weekly on wednesdays before expiry.

Did this mistake at least 3-4 times. Absent-mindedness!

Did this mistake at least 3-4 times. Absent-mindedness!

v) Didn't think of quarterly settlement and on that day 2 trades happened, but IBKR had sent all the account cash to my bank.

I recharged Zerodha account through UPI and tried trading, Zerodha didn't even let me to.

By the time i sent money to IBKR, it was 2pm, and I gave up.

I recharged Zerodha account through UPI and tried trading, Zerodha didn't even let me to.

By the time i sent money to IBKR, it was 2pm, and I gave up.

The two trades counteracted each other and end of the day there was like 10-20 points profit only. So, not much lost opportunity there, yet a mistake nonetheless.

vi) I found that trading 2xATM regularly made 0.85-0.98 delta on decent winning trades, and 1.5-1.8 on losing ones.

vi) I found that trading 2xATM regularly made 0.85-0.98 delta on decent winning trades, and 1.5-1.8 on losing ones.

The catch was that, there were at least two winning trades a month that balanced the skewed delta, and brought the points made with options in sync with futures.

In fact, in the 40 trades, the number of points made in futures is 2325, and with options is 2520.

In fact, in the 40 trades, the number of points made in futures is 2325, and with options is 2520.

Accounting for the fact that the first 18 trades were with 1xITM with a delta of about 0.55-0.6, the futures points and options point are more or less in sync.

This is the result of the one lot trading I have done to test the system.

This is the result of the one lot trading I have done to test the system.

7/ The reason I am sharing this is because, it's important to know what all pitfalls are there in trading a specific system.

Especially when you're manually executing, it's even harder to identify before hand what all things you'll come across.

Especially when you're manually executing, it's even harder to identify before hand what all things you'll come across.

8/ Coming to max drawdown, actual trades have resulted in a maxDD of ~7.1%. The historical maxDD was about 4.8%.

I didn't take one of the explosive trades in September, chickening out. That would have set the maxDD well below 4%.

So, I consider the system in-line so far.

I didn't take one of the explosive trades in September, chickening out. That would have set the maxDD well below 4%.

So, I consider the system in-line so far.

9/ I will be scaling up to the next lot based on my compounding requirements, which I will discuss later.

That too will be based on backtested results - and the specific compounding rules I use going forward will also be thoroughly backtested.

That too will be based on backtested results - and the specific compounding rules I use going forward will also be thoroughly backtested.

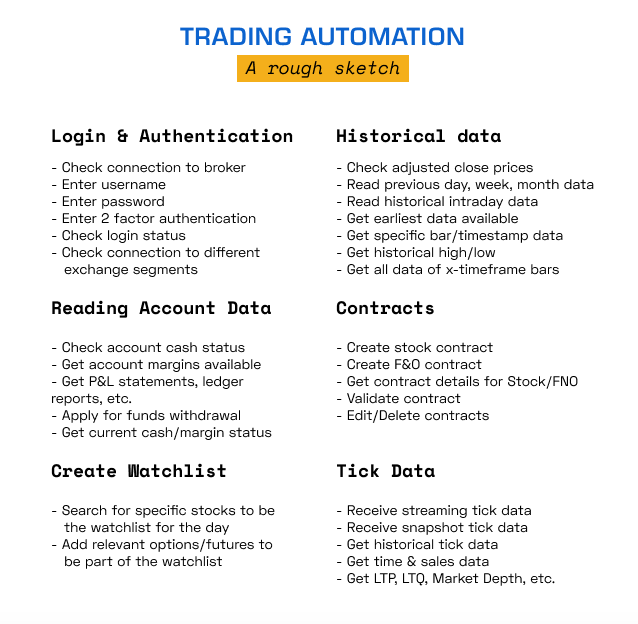

10/ The screenshot in this shows the backtest results for the one lot test. This is what I have been testing so far, and will be scaling going forward (hopefully once I am out of the current drawdown).

https://twitter.com/theBuoyantMan/status/1333656848864473089?s=20

11/ The pitfalls I have faced so far in manual execution has convinced me to look towards automation. I'll soon be automating this and one other strategy I am trading.

That said, my intention with this thread is to show you how important forward/live-testing is.

That said, my intention with this thread is to show you how important forward/live-testing is.

12/ After backtesting thoroughly, don't jump with full capital.

Start with one lot, and test live for at least 40-50 trades.

25 trades should be enough, but being conservative, I keep a 50-trade benchmark to verify live results being in line with backtest.

Start with one lot, and test live for at least 40-50 trades.

25 trades should be enough, but being conservative, I keep a 50-trade benchmark to verify live results being in line with backtest.

13/ Forward testing will show you the holes in your backtest and assumptions.

That should eventually help you decide whether you should take the trading of the system forward or not.

I am not an expert, but this is what I have done so far.

Hope this helps.

That should eventually help you decide whether you should take the trading of the system forward or not.

I am not an expert, but this is what I have done so far.

Hope this helps.

14/ A word of caution though. The current forward test has yielded more than optimistic results and I am very well aware of it. Don't think it's easy to make 22% in 3 months. It's not.

The market is very favorable currently + favorable for the system too. So, keep that in mind.

The market is very favorable currently + favorable for the system too. So, keep that in mind.

15/ When your system does much better than backtest in forward test - assume the best case always - which is that the market is favorable.

Don't take undue risk and lose your pants when tide goes out.

Don't take undue risk and lose your pants when tide goes out.

• • •

Missing some Tweet in this thread? You can try to

force a refresh