Excellent article on "Investing Mistakes".

h/t @basrars & Altais Advisors. 👏

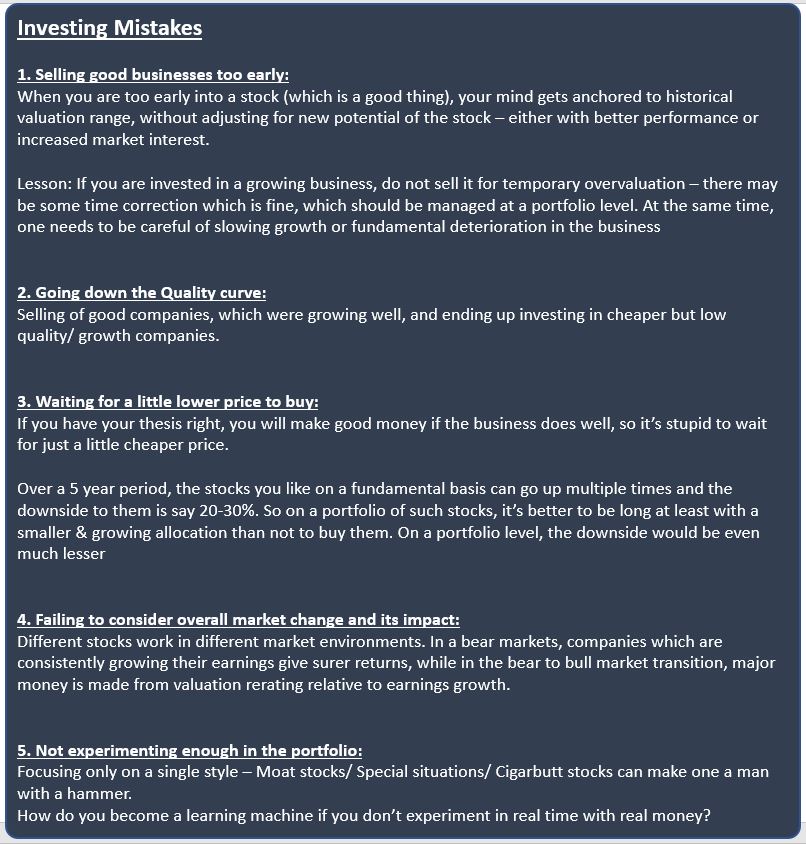

1⃣ Selling good businesses too early

2⃣ Going down the Quality curve

3⃣ Waiting for a little lower price to buy

4⃣ Failing to consider overall market change and its impact

altaisadvisors.com/some-mistakes/

h/t @basrars & Altais Advisors. 👏

1⃣ Selling good businesses too early

2⃣ Going down the Quality curve

3⃣ Waiting for a little lower price to buy

4⃣ Failing to consider overall market change and its impact

altaisadvisors.com/some-mistakes/

5⃣ Not experimenting enough in the portfolio

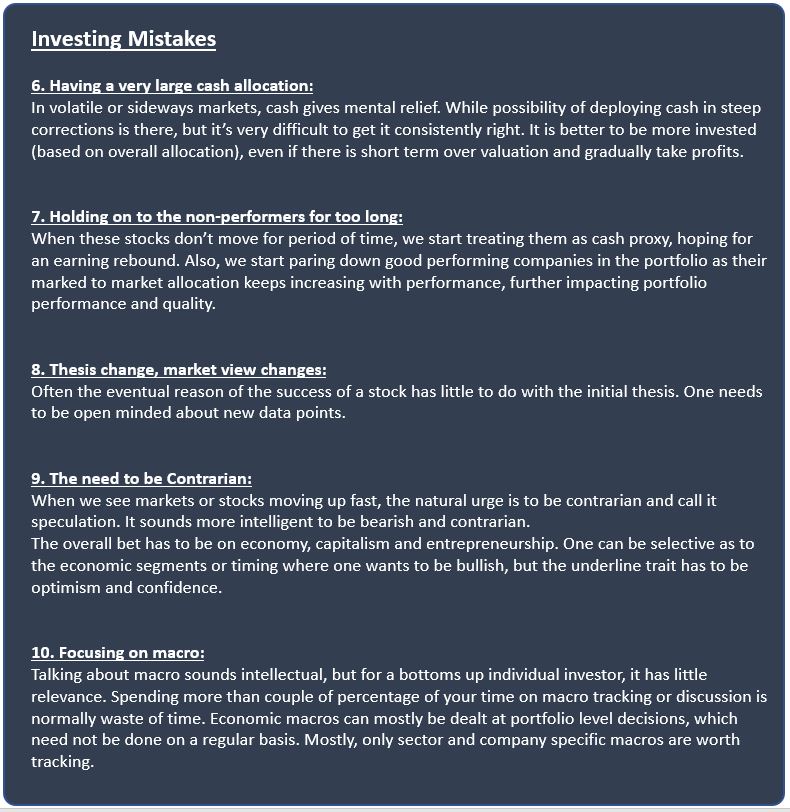

6⃣ Having a very large cash allocation

7⃣ Holding on to the non-performers for too long

8⃣ Thesis change, market view changes

9⃣ The need to be Contrarian

🔟Focusing on macro

I'm guilty of making most of these mistakes in the past.🤦♂️

6⃣ Having a very large cash allocation

7⃣ Holding on to the non-performers for too long

8⃣ Thesis change, market view changes

9⃣ The need to be Contrarian

🔟Focusing on macro

I'm guilty of making most of these mistakes in the past.🤦♂️

Investing advice is very subjective as it depends a lot on the specific investor's goals, capabilities, time horizon, risk tolerance etc. but these are some great lessons for business focused long-term investors in individual stocks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh