🔟fantastic lessons for long-term (individual) investors from Peter Lynch.

h/t Capital Ideas Online. Original source :"The Great Investors" book by Glen Arnold.

cc: @dmuthuk @Gautam__Baid

1. Know the Facts

2. Diversify With Care

3. Accept Fluctuation

capitalideasonline.com/wordpress/less…

h/t Capital Ideas Online. Original source :"The Great Investors" book by Glen Arnold.

cc: @dmuthuk @Gautam__Baid

1. Know the Facts

2. Diversify With Care

3. Accept Fluctuation

capitalideasonline.com/wordpress/less…

4. Avoid the Latest Fads

5. Consistency

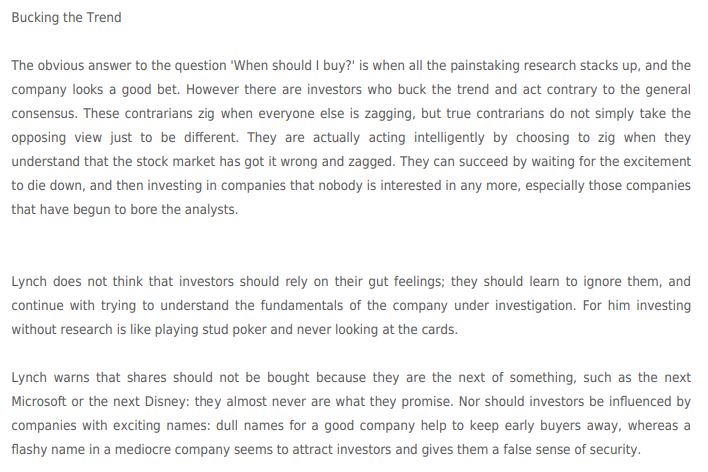

6. Bucking the Trend

7. Pay No Attention to the Science of Wiggles (Charts)

8. Do Not Try to Predict Short-term Ups and Downs in the Market

9. Pulling the Flowers and Watering the Weeds

10. No Derivatives

5. Consistency

6. Bucking the Trend

7. Pay No Attention to the Science of Wiggles (Charts)

8. Do Not Try to Predict Short-term Ups and Downs in the Market

9. Pulling the Flowers and Watering the Weeds

10. No Derivatives

My fav parts in the thread below. Comments in ( ) are mine.

1. Know the Facts (understanding your Companies well).

1. Know the Facts (understanding your Companies well).

4. Avoid the latest Fads (especially if you don't understand the Technology, and it's actual translation to Business & Shareholder benefits. Also be aware of the hype cycle).

5. Consistency (having a good consistent process that suits your goals/strengths, and improving it over time, not reacting/changing to every short term Market gyration).

6. Bucking the Trend (on being contrarian not for the sake of it, but when the facts align with your thesis and there's clear evidence that Market is temporarily incorrect).

• • •

Missing some Tweet in this thread? You can try to

force a refresh