1/ Are there topics you would like to see discussed in a tweetstorm? With links that lead you to new reading material? What do you know about the DCFs that Warren Buffett does in his head? We discussed many topics in this week’s podcast. DCF was just one. infiniteloopspodcast.com/tren-griffin-e…

2/ "When we invest, we defer current consumption in order to consume more (after taking inflation into account) in the future. Most investment opportunities don’t guarantee you’ll have more in the future than you do today, but that’s the motivating driver."forbes.com/sites/kevinhar…

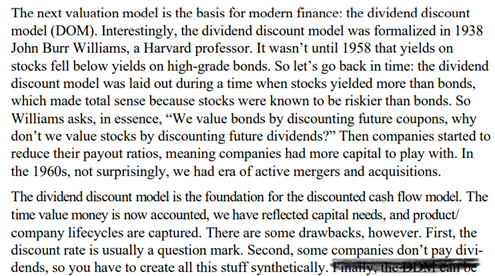

3/ "The value of a stock is based on the same principle. The problem is that there is no coupon or maturity. ..The intellectually correct way to value stocks is similar to bonds, and that is a discounted cash flow (DCF) model." kellogg.northwestern.edu/faculty/korajc…

4/ “Investor returns come from two sources of cash—dividends and changes in share prices. But a company cannot pay dividends unless it is able to produce positive cash flows. So without the prospect of future cash flows, a company commands no value.” expectationsinvesting.com/about.shtml

5/ “The present value of future free cash flows, including a residual value, equals corporate value.” web.iese.edu/jestrada/PDF/C…

6/ "Cash flow is the profit the business earns after paying

taxes minus the investments the company makes. Investments are outlays today with the expectation of profits tomorrow that make the investments worthwhile." morganstanley.com/im/publication…

taxes minus the investments the company makes. Investments are outlays today with the expectation of profits tomorrow that make the investments worthwhile." morganstanley.com/im/publication…

7/ This thread is all to easy for you? You know all this? I'm writing for everyone. If you want to go deeper, there are 18 pages here: "The Trouble with Earnings and Price/Earnings Multiples." expectationsinvesting.com/pdf/earnings.p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh