Peeling back the layers of the $OZON -- a company striving to be Russian $AMZN.

Recent takeover interest from $SFTBY & $AMZN hints at its ability to do just that.

Unsurprisingly, a @JoeySolitro pick.

Time for a thread. 👇

Recent takeover interest from $SFTBY & $AMZN hints at its ability to do just that.

Unsurprisingly, a @JoeySolitro pick.

Time for a thread. 👇

$OZON's mission:

"Transforming the Russian consumer economy by offering the widest selection, best value & maximum online shopping convenience while empowering sellers to achieve greater commercial success."

"Transforming the Russian consumer economy by offering the widest selection, best value & maximum online shopping convenience while empowering sellers to achieve greater commercial success."

The value proposition:

a. For active buyers

--Widest multi-category selection

--"Exceptional value & convenience"

b. For active sellers

--Access to larger audience

--Ozon fulfillment

--"Advanced analytics tools"

--Lending options 👀

--ad & data services

a. For active buyers

--Widest multi-category selection

--"Exceptional value & convenience"

b. For active sellers

--Access to larger audience

--Ozon fulfillment

--"Advanced analytics tools"

--Lending options 👀

--ad & data services

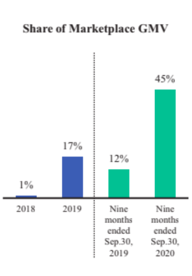

Revenue breakdown:

a) 3rd party

--45% of gross merchandise value (GMV)

--15% of revs

b) Direct Sales (1st party, higher margins)

--51% of GMV

--79% of revs

$OZON sells 3rd & 1st party items. Allows it to stock the most SKUs in Russia (9M) in categories including fresh food. 👀

a) 3rd party

--45% of gross merchandise value (GMV)

--15% of revs

b) Direct Sales (1st party, higher margins)

--51% of GMV

--79% of revs

$OZON sells 3rd & 1st party items. Allows it to stock the most SKUs in Russia (9M) in categories including fresh food. 👀

Network effect:

Widest product assortment, competitive prices, seamless shopping & a solid service record attracts more buyers.

More buyers draw in more sellers to juice GMV.

Wider product offerings via new sellers draws in more buyers.

& so on

... it seems to be working 👇

Widest product assortment, competitive prices, seamless shopping & a solid service record attracts more buyers.

More buyers draw in more sellers to juice GMV.

Wider product offerings via new sellers draws in more buyers.

& so on

... it seems to be working 👇

Building a Russian Giant (1/2)

a) Over last 3 Qs

--Active sellers up 182% to 18.1K

--Active buyers up 115% to 11.4M

b) 51M shopping app downloads (35% of Russian population)

c) 41M MAUs

d) Orders per buyer up 31% YOY to 5

a) Over last 3 Qs

--Active sellers up 182% to 18.1K

--Active buyers up 115% to 11.4M

b) 51M shopping app downloads (35% of Russian population)

c) 41M MAUs

d) Orders per buyer up 31% YOY to 5

Building a Russian Giant (2/2)

a) ‼️ 32% top-of-mind brand awareness for $OZON vs. 18% for 2nd place ‼️

--Per INFOLine & BrandScience

b) 1st 9 months of September: Russian e-commerce GMV grew 41% over the same period $OZON GMV grew 142%

c) Rapidly growing share of total GMV

a) ‼️ 32% top-of-mind brand awareness for $OZON vs. 18% for 2nd place ‼️

--Per INFOLine & BrandScience

b) 1st 9 months of September: Russian e-commerce GMV grew 41% over the same period $OZON GMV grew 142%

c) Rapidly growing share of total GMV

Importantly:

$OZON's net promoter score (NPS) spiked from 58 at the beginning of 2019, to 79 today.

Customer service ratings are meaningfully improving along with pandemic-related spikes in demand.

Impressive. 👍

$OZON's net promoter score (NPS) spiked from 58 at the beginning of 2019, to 79 today.

Customer service ratings are meaningfully improving along with pandemic-related spikes in demand.

Impressive. 👍

Financials:

1st 9 months of 2020

a) Revs up 70% to ~$876M -- ~7.3x 2020 p/s

b) Operating margin of -17.7% vs. -31.7% YOY

c) $ from operations improves to -$53M from -$152M YOY

d) GPM of 16.3% vs. 14.5% YOY

e) Adj. EBITDA margin of -6.7% vs. -21.1% YOY

1st 9 months of 2020

a) Revs up 70% to ~$876M -- ~7.3x 2020 p/s

b) Operating margin of -17.7% vs. -31.7% YOY

c) $ from operations improves to -$53M from -$152M YOY

d) GPM of 16.3% vs. 14.5% YOY

e) Adj. EBITDA margin of -6.7% vs. -21.1% YOY

Logistics -- offers:

a. "Fulfilled-by-Ozon" FBO -- Ozon leverages nationwide infrastructure

b. "Fulfilled-by-seller" FBS -- seller controls process

$OZON Infrastructure covers 40% of Russia w/next day delivery:

--9 fulfillment centers

--43 sorting hubs

--4600 pick-up points

a. "Fulfilled-by-Ozon" FBO -- Ozon leverages nationwide infrastructure

b. "Fulfilled-by-seller" FBS -- seller controls process

$OZON Infrastructure covers 40% of Russia w/next day delivery:

--9 fulfillment centers

--43 sorting hubs

--4600 pick-up points

$OZON believes its mobile first approach:

a) Boosts buyer retention

b) improves efficiency & conversion of marketing programs

c) accelerates the growth of the business

Orders made through its Shopping App have accounted for 70% of total orders vs. 51% YOY

a) Boosts buyer retention

b) improves efficiency & conversion of marketing programs

c) accelerates the growth of the business

Orders made through its Shopping App have accounted for 70% of total orders vs. 51% YOY

Pursuing new revenue streams -- launched:

a) Several financial products & services

b) Advertising & logistics services

c) An online travel booking service "OZON. Travel"

"We will continue to enhance our existing products as well as expand our range of offerings to our users."

a) Several financial products & services

b) Advertising & logistics services

c) An online travel booking service "OZON. Travel"

"We will continue to enhance our existing products as well as expand our range of offerings to our users."

Quick note per Aeroflot (Russian carrier):

Domestic Russia travel was down just .4% year over year as of a few months ago.

Good news for $OZON's travel booking service.

simpleflying.com/aeroflot-domes…

Domestic Russia travel was down just .4% year over year as of a few months ago.

Good news for $OZON's travel booking service.

simpleflying.com/aeroflot-domes…

New products are working:

The OZON.Card is the company's branded debit card

a) Offers benefits to buyers

b) Card holders order 1.6x more frequently than non-holders

c) 260K activated cards vs. 57K YOY

The OZON.Card is the company's branded debit card

a) Offers benefits to buyers

b) Card holders order 1.6x more frequently than non-holders

c) 260K activated cards vs. 57K YOY

"Unique" ownership structure:

a) Sistema (Russian PE) owns 37.9% of $OZON

b) Baring Vostok (Russian PE) owns 37.9% of $OZON

a) Sistema (Russian PE) owns 37.9% of $OZON

b) Baring Vostok (Russian PE) owns 37.9% of $OZON

Sistema:

a) Vladimir Evtushenkov owns the majority of Sistema

b) He is included on a list of 96 oligarchs kept by the U.S. federal government

c)This means $OZON is likely connected to the Russian Government

--probably (& unfortunately) a good thing

a) Vladimir Evtushenkov owns the majority of Sistema

b) He is included on a list of 96 oligarchs kept by the U.S. federal government

c)This means $OZON is likely connected to the Russian Government

--probably (& unfortunately) a good thing

Leadership:

a) CEO Alexander Shulgin:

--previously served as a $YNDX exec

b) CFO Daniil Fedorov:

--previously a head analyst at $GS

c) CTO Anton Stepanenko

--previously worked as head of technical projects at $YNDX

a) CEO Alexander Shulgin:

--previously served as a $YNDX exec

b) CFO Daniil Fedorov:

--previously a head analyst at $GS

c) CTO Anton Stepanenko

--previously worked as head of technical projects at $YNDX

Notable board members:

a) Vladimir Chirakhov

--CEO & Charmain of Sistema

--previously has served as the CEO of a few Russia retailers

b) Lydia Jett

--Founding investment partner of the $SFTBY Vision fund

--Previously with $GS & $JPM

a) Vladimir Chirakhov

--CEO & Charmain of Sistema

--previously has served as the CEO of a few Russia retailers

b) Lydia Jett

--Founding investment partner of the $SFTBY Vision fund

--Previously with $GS & $JPM

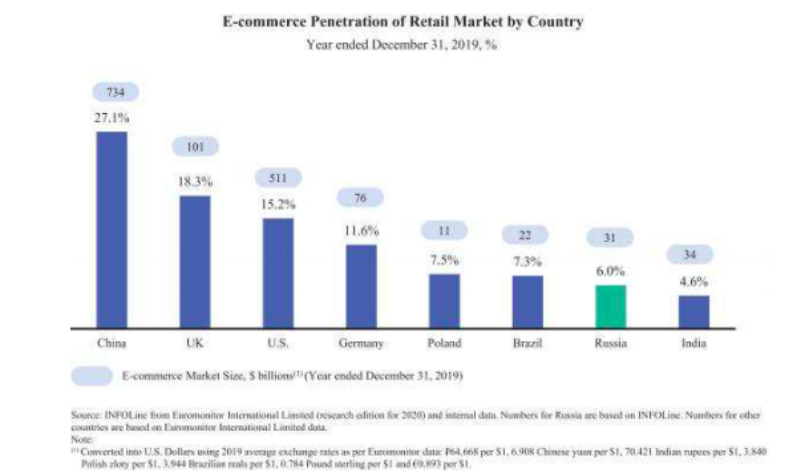

Russia:

-11th largest economy in 🌎

-113M interest users

-75% smartphone usage to 92% by 2025

-2019 domestic e-commerce sales $18.4B

--30% CAGR through 2025

-Market less penetrated vs G7 nations

--E-commerce penetration est. to jump from 6% in 2019 to 10% in 2020 per Bloomberg

-11th largest economy in 🌎

-113M interest users

-75% smartphone usage to 92% by 2025

-2019 domestic e-commerce sales $18.4B

--30% CAGR through 2025

-Market less penetrated vs G7 nations

--E-commerce penetration est. to jump from 6% in 2019 to 10% in 2020 per Bloomberg

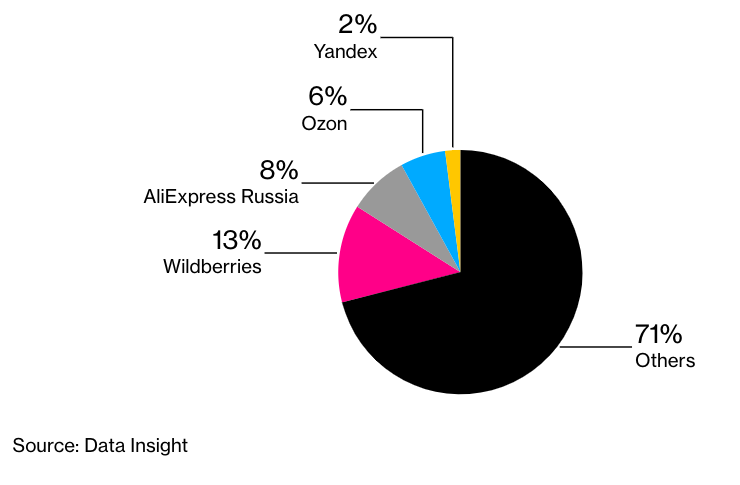

Competitive landscape & market share -- Many different sources that say different things based on measuring Russian e-commerce/internet sales in different ways.

Here are 3:

a) Russian E-commerce market share per Bloomberg:

bloomberg.com/news/articles/…

Here are 3:

a) Russian E-commerce market share per Bloomberg:

bloomberg.com/news/articles/…

b) Per eCommerceDB "Top online stores" market share

1) Wildberries 17.6%

2) "Mvideo" 7.8%

3) $OZON 4.9%

ecommercedb.com/en/markets/ru/…

1) Wildberries 17.6%

2) "Mvideo" 7.8%

3) $OZON 4.9%

ecommercedb.com/en/markets/ru/…

c) Statista suggests the "internet retail" market shares look more like this:

1) Beru ( $YNDX owned)

--16% in 2018

--20% 2020

--25% est. by 2023

2) $OZON

--9% in 2018

--12% 2020

--16% est. by 2023

3) Wildberries

--Flat at 7% from 2018-2023

statista.com/statistics/104…

1) Beru ( $YNDX owned)

--16% in 2018

--20% 2020

--25% est. by 2023

2) $OZON

--9% in 2018

--12% 2020

--16% est. by 2023

3) Wildberries

--Flat at 7% from 2018-2023

statista.com/statistics/104…

Risks:

a) Corruption in Russia is prevalent. The F-1 could be misleading

b) Geopolitical tensions

c) Economic sanctions

d) Strengthening US$

e) Ties to an oligarch

f) Russia's economic consumption tied to oil

g) new entrants/strengthening existing competition

a) Corruption in Russia is prevalent. The F-1 could be misleading

b) Geopolitical tensions

c) Economic sanctions

d) Strengthening US$

e) Ties to an oligarch

f) Russia's economic consumption tied to oil

g) new entrants/strengthening existing competition

1 more risk -- COVID-19 boost?

Russian e-commerce grew by 51% over 1st 6 months of 2020... a meaningful acceleration.

COVID-19 is not permanent.

Normalization could lead to growth reverting to pre-pandemic levels at least partially.

Russian e-commerce grew by 51% over 1st 6 months of 2020... a meaningful acceleration.

COVID-19 is not permanent.

Normalization could lead to growth reverting to pre-pandemic levels at least partially.

Plan:

The opportunity is too juicy to pass on.

There is undeniably extreme geopolitical risk that could result in the investment failing.

Win big or miss small on this 1 like many of my others.

Position to start at 1% cost basis tomorrow & stay below 2%.

Will be long $OZON.

The opportunity is too juicy to pass on.

There is undeniably extreme geopolitical risk that could result in the investment failing.

Win big or miss small on this 1 like many of my others.

Position to start at 1% cost basis tomorrow & stay below 2%.

Will be long $OZON.

✅

• • •

Missing some Tweet in this thread? You can try to

force a refresh