1/ Notes from @danielgross episode at @InvestLikeBest

This one is packed with meaty insights. I wish it were a longer episode. At the very least, I hope @patrick_oshag invites Dan again.

Here are my notes.

This one is packed with meaty insights. I wish it were a longer episode. At the very least, I hope @patrick_oshag invites Dan again.

Here are my notes.

2/ Asking people about their opinions on certain movies can reveal a lot about them. It's a fun, relaxing way to get to the answer you want to know, but much more difficult to ask in a direct manner.

3/ This is a simple point, but I have been surprised before how few people get it.

In creative pursuits, the delta between median and the peak is astonishingly large. It also means if you are slightly better than others in these pursuits, the convexity leads you to win big.

In creative pursuits, the delta between median and the peak is astonishingly large. It also means if you are slightly better than others in these pursuits, the convexity leads you to win big.

4/ Just like in investing, when you are building company, it's not the batting average that matters, but the slugging ratio that makes all the difference.

6/ A neat point about how to take your insecurities and convert them into things that's beneficial for society. Find the right thing/person you are performing for.

7/ In a sense, I have immigrated twice in my life: once from a small city in Bangladesh to the capital Dhaka where I had no relative, and then from Dhaka to the US, and just in a few months will move from the US to Canada...(cont. to next tweet)

8/ It's a mixed feeling leaving behind current friends and also exciting to immerse yourself in a new city.

It's terrifying and thrilling at the same time.

But the point about "would you wish this to your child" is just so fascinating. It's a difficult one.

It's terrifying and thrilling at the same time.

But the point about "would you wish this to your child" is just so fascinating. It's a difficult one.

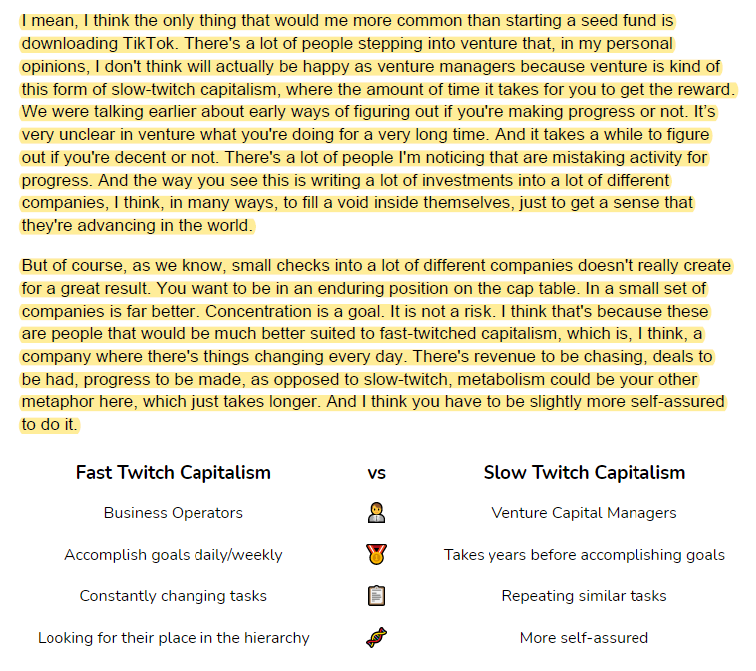

9/ VC has become so viscerally "cool" that I don't think most people realize how ill-suited many are in that space.

"Fast Twitch" and "Slow Twitch" capitalism are great mental models to figure what suits you best.

"Fast Twitch" and "Slow Twitch" capitalism are great mental models to figure what suits you best.

10/ Image I: What is GPT-3?

Image II: Is it overhyped? Even if it is, it's probably not a bad thing to be overhyped about.

Image II: Is it overhyped? Even if it is, it's probably not a bad thing to be overhyped about.

11/ "It's worth mentioning that I feel like a lot of founders forget that everything big starts small. The reason people forget this is, there's media teams responsible for making sure you forget this."

13/ Is the venture game a picker's game or an access game?

It's a pickers game in early stage, and in late stage i.e. public market. But in between, it's primarily an access game.

Fascinating idea about seed-to-leech ratio. Anyone who used BitTorrent would get this instantly.

It's a pickers game in early stage, and in late stage i.e. public market. But in between, it's primarily an access game.

Fascinating idea about seed-to-leech ratio. Anyone who used BitTorrent would get this instantly.

14/ Good interview question: "What is something weird or unusual you built or did early on in life?"

15/ The narrative that we tell ourselves and what the reality is can be very very different even when we talk about *us*.

The problem with Thiel's famous question is it might lead to performative answers.

The problem with Thiel's famous question is it might lead to performative answers.

End/ Episode link: investorfieldguide.com/daniel-gross-f…

Transcript link: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

Transcript link: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh