(1/21) En attraktiv SPAC vars aktiekurs ännu inte svävat iväg är $OAC. O’et står för Oaktree, en fondförvaltare starkt förknippad med Howard Marks, mest känd för boken The Most Important Thing och sina memos.

https://twitter.com/stock_trap/status/1335888044927442944

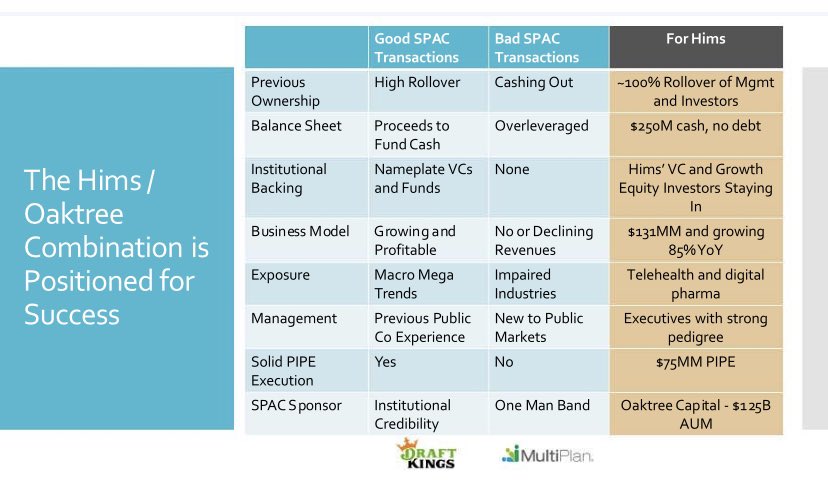

I oktober deklarerade Oaktree att man genom sin SPAC $OAC identifierat digitala hälsoföretaget ”Hims & Hers” som kandidat för fusion. Resten av tråden får bli på engelska då jag antar att amerikanska SPAC-jägare febrilt söker tickers.

October 1st Oaktree announced that $OAC (and don’t get confused - there’s two of them) had targeted Hims & Hers, a telehealth company, which they were planning a possible merger with. The deal valued Hims and Hers to $1.6 billion.

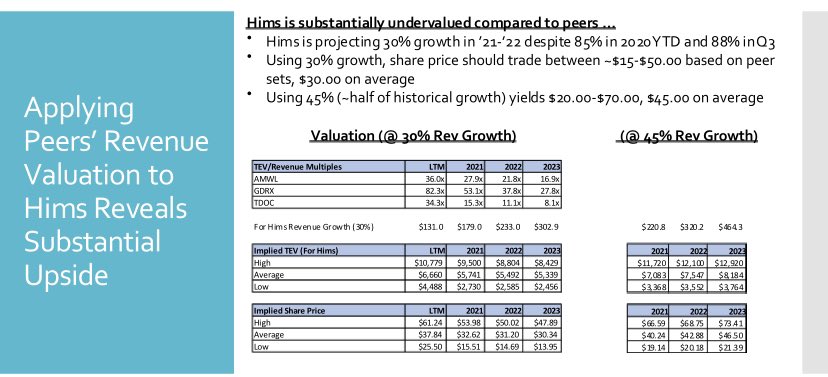

The company reports $27 million in rev during 2018, $83 million in 2019 and estimates it to be $138 million fy 2020 – a CAGR of 128%. It’s when comparing the growth numbers and the current valuation to publicly traded peers it gets really interesting. More about that later.

There’s so much to say about both the company as well as @AndrewDudum, the founder. I’d recommend everyone to listen to this podcast where he’s brilliant. I’ll make a thread just for that later. Definitely a business leader worth following, only 32 y/o. podcasts.apple.com/se/podcast/53-…

The SPAC deal is said to deliver Hims up to $280 million in cash - $205 million of which comes from $OAC and $75 million from the placement of stock at $10 a share. Hims' current equity holders will hold about 84% of the combined company. Good to know going forward.

Andrew Dudum founded Hims as late as in 2017. At the time, Hims sold mostly sensitive wellness, grooming and sexual health products to male consumers with the help of online consultations and ordering.

Since that, the company has grown a lot. It now operates across all 50 US states with over 250,000 recurring customer subscriptions and reports lifetime stats of more than 2 million telehealth consultations.

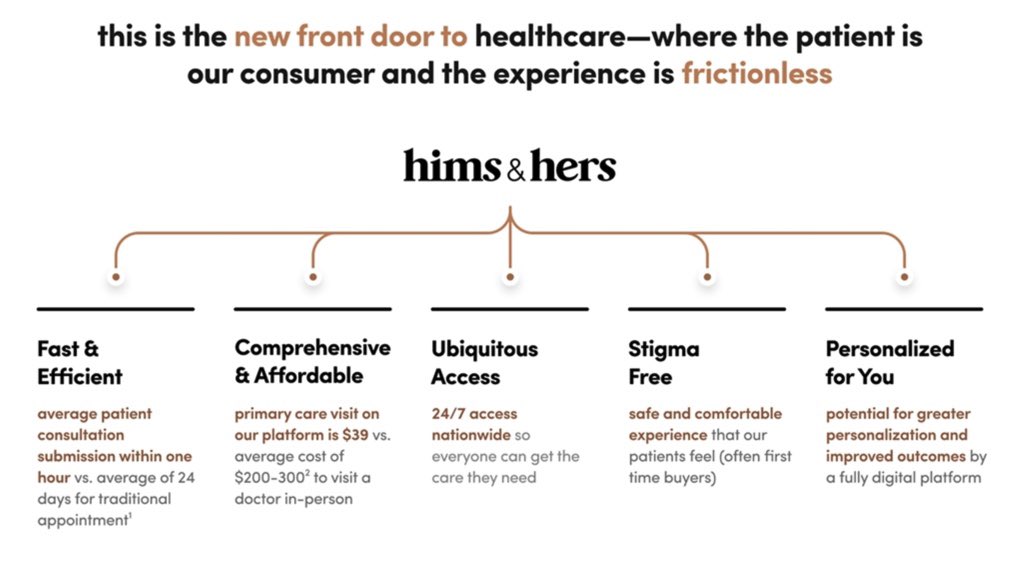

Hims aim to disrupt the traditional primary care market. This by sort of removing the insurance aspect, and doing a cash model where you get the help you need. A key element is that it’s stigma free - many feel more comfortable with telehealth than seeing an actual physician. ->

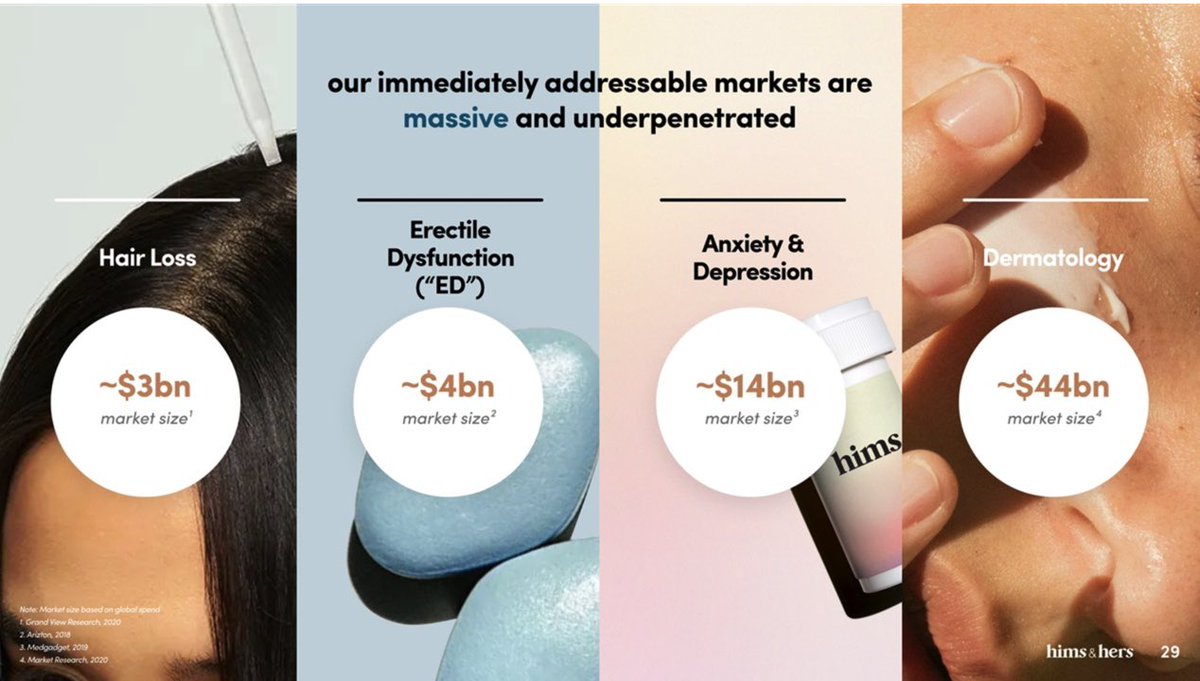

Especially when 57% of the revenue is sexual health related (ex erectile dysfunction). Also for many, it’s easier taking the step to speak about anxiety and other stigma related subjects over the phone. The TAM in this area, atm mostly belonging to trad primary care, is huge.

Dudum mentioned in his CNBC interview that a typical primary care visit at their platform costs $39 vs $200-$300 for a more traditional in person visit. That made me think a little, and my conclusion about their unit of economics is this: ->

H&H’s business model isn’t to make money on the primary care business. Instead, it’s the prescription based model that work as a cash cow. In other words, they are giving the visit economics to the physicians, but when you as a costumer need a prescription - they’ll make money.

It’s actually quite smart. They use a very attractive low cost version to get costumers through the door, as physicians become the gate way, and then they’ll make a stable income stream from the prescriptions.

”Come for the primary care - stay for the pills.”

”Come for the primary care - stay for the pills.”

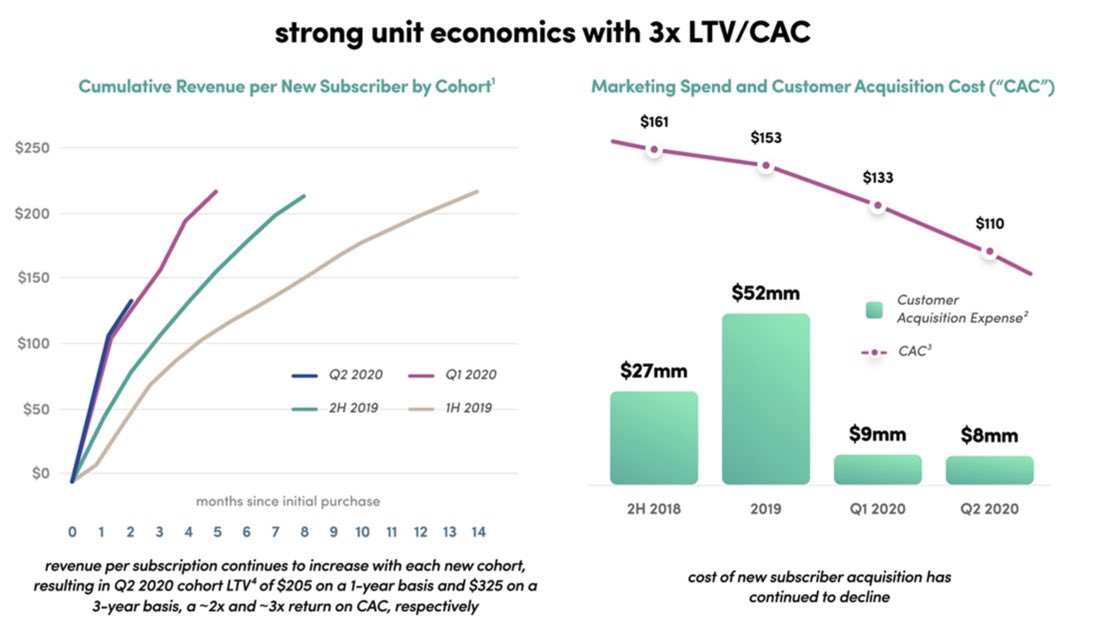

If you ask me, the most attractive part of the business is the declining numbers in CAC (costumer aquistion cost) as the LTV (life time value) of the costumers seems to improve. I guess a result of the sticky type of sales. We see them bragging about exactly this x times.

Looking forward, the co is projecting revenues to grow 30% in both 2021 & 2022, with gross margins landing at 73% and 75% those years. I don’t see why the rev would deacc in this way. I’d think this is kind of a ”we don’t really know where next year is heading”- type of guidance.

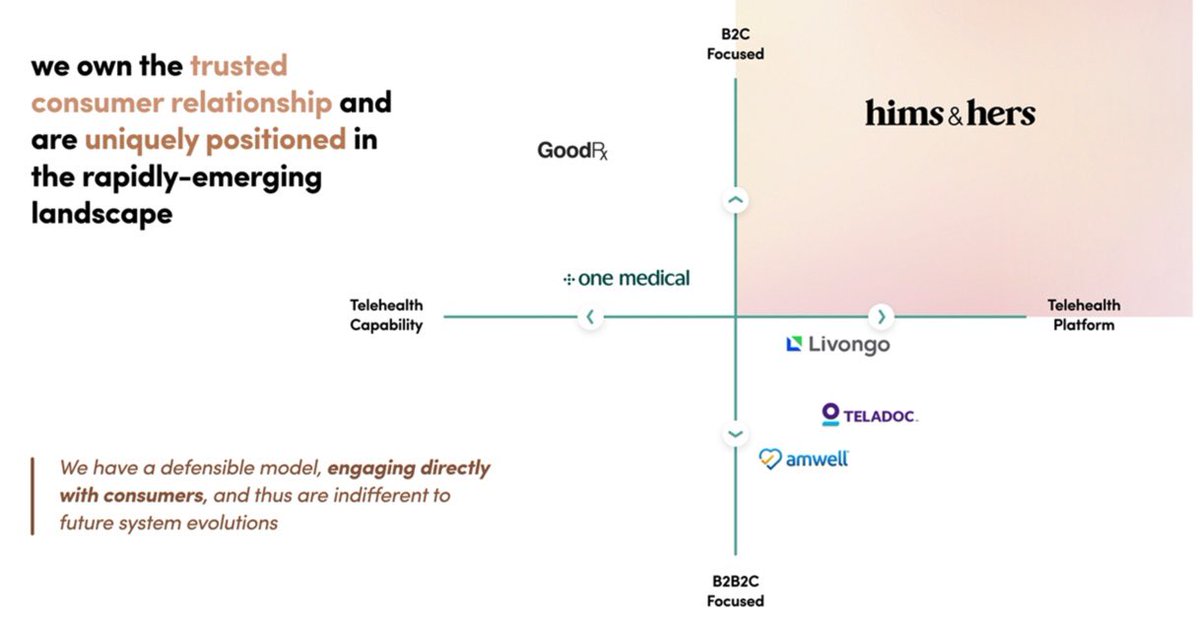

An attractive TAM will of course attract many more players. I’d say it’s as difficult for Hims as for Teladoc, or GodRx, to have a MOAT worth mentioning. The TAM enables more players to do business with just a small fraction of the market, and I like Hims’ sticky niche.

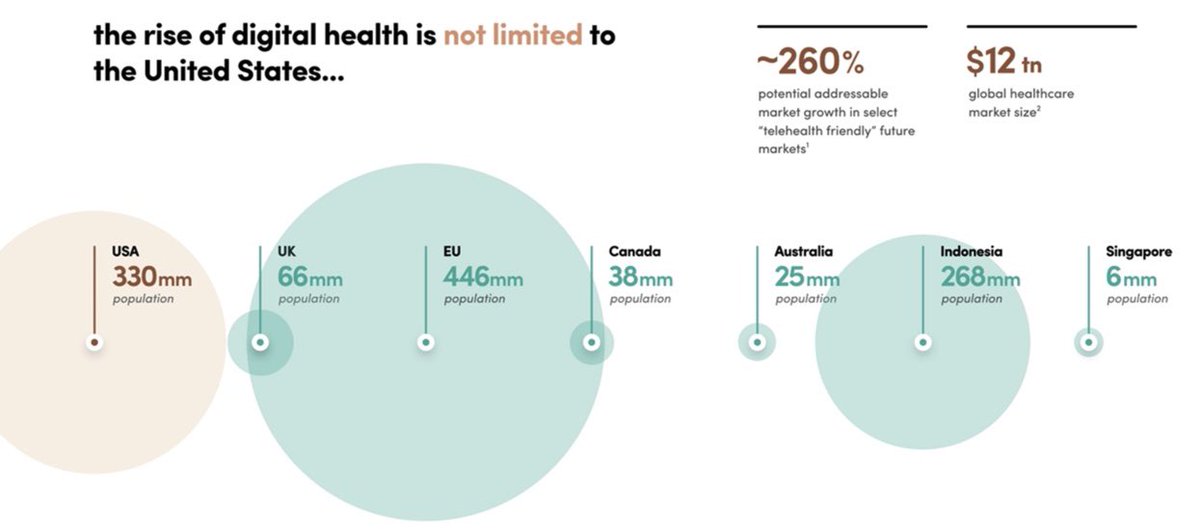

Furthermore, looking beyond the first couple of years, the growth prospects are huge. The team mentioned this in their presentation and they are looking across the Atlantic, and also more developed Asian countries.

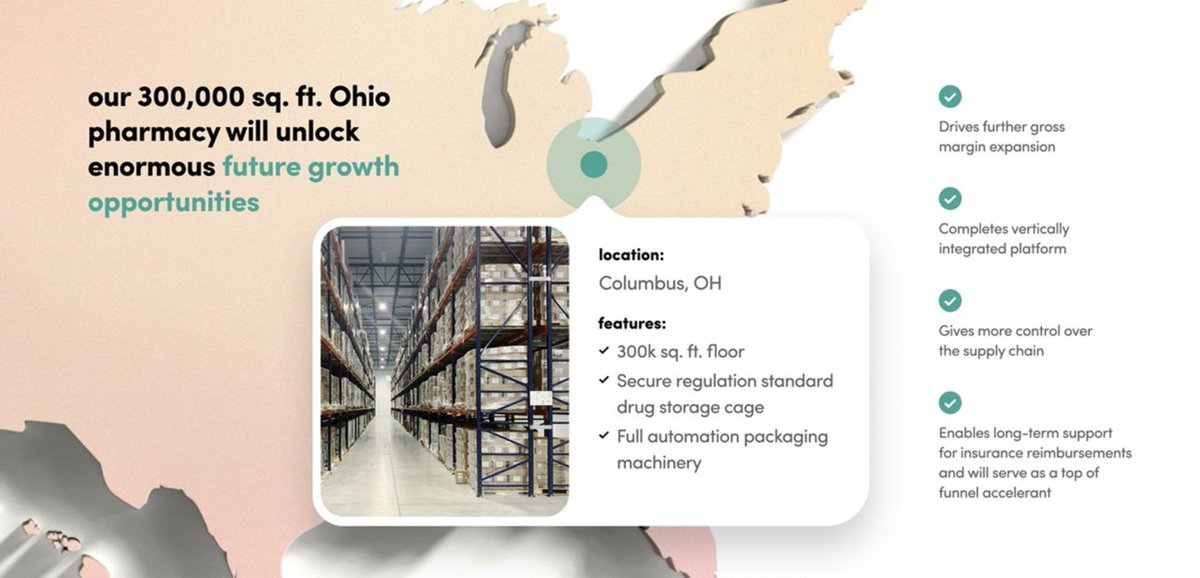

Andrew Durdum mentioned in the podcast above that maybe his biggest professional debacle was at launch when one of the suppliers withdrew. I guess the 300,000 sq ft warehouse is a result of that experience. Trying to own the supply chain.

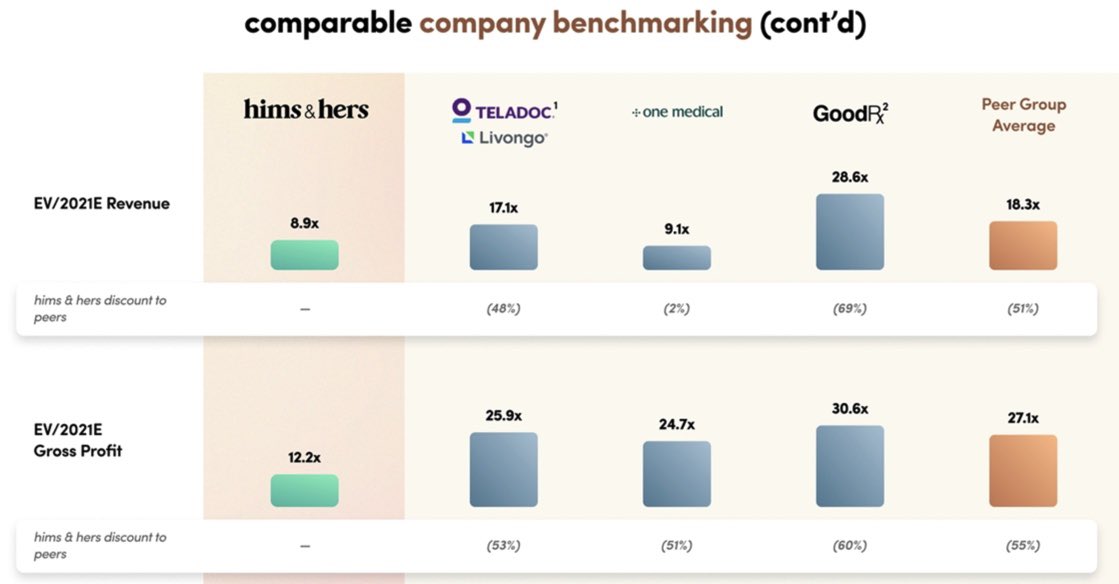

I’ve also mentioned the valuation. Here’s where it gets really interesting. The SPAC is up ~10% from these numbers. Counting the growth and the exceptional margins of the business - the discount is just too big here (2nd picture).

The merger was earlier said to be in Q4 but we’re still waiting for news about an exact date. It might be announced any day by now, or else in Q1. The stock is on it’s move and is now trading at about $12. I’m really eXCITE.

To summarize, Hims remove the complexity with insurance and billing in the existing health system bringing digitization to an outdated sector. Simple, affordable and stigma free. Scalability is great and finally, a sticky costumer base. I have a position. $OAC

• • •

Missing some Tweet in this thread? You can try to

force a refresh