Apollo’s ties to Jeffrey Epstein are much greater than just Leon Black.

This will get crazy👇👇👇

This will get crazy👇👇👇

John J. Hannan, Apollo’s cofounder and senior partner, donated $166k to Epstein in 1999. Hannan also replaced Epstein on the Black Foundation Board in 2013.

Notably, Hannan was an executive at Drexel Burnham Lambert with Leon Black in the 1980s. This will be important later.

Notably, Hannan was an executive at Drexel Burnham Lambert with Leon Black in the 1980s. This will be important later.

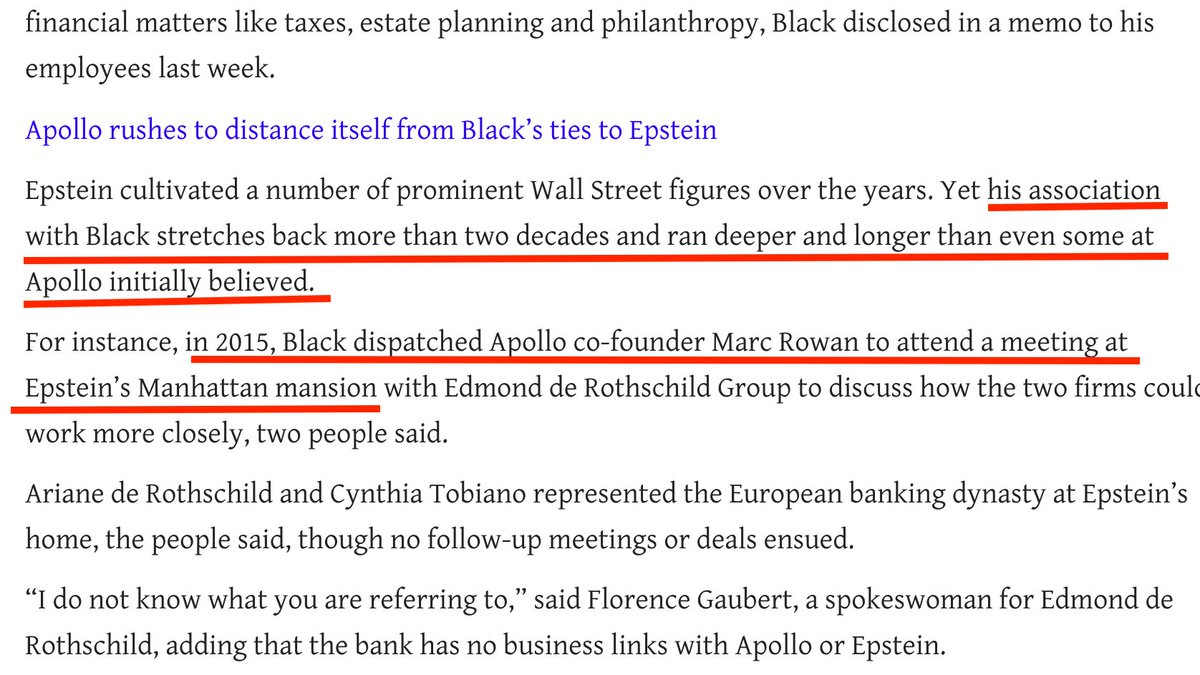

Marc Rowan, another Apollo co-founder that worked at Drexel in the 1980s, met with Epstein in his townhouse in 2015.

Earlier this year Rowan announced he was stepping away from day-to-day duties to make “more time for his Hamptons restaurants”

What else links Apollo & Epstein or Drexel & Epstein?

Well, one of Epstein’s defense attorneys, Gerald Lefcourt, also represented Drexel. Yet another tie between the two entities.

The 2008 article below says that Drexel’s founder Michael Milken and Epstein had close ties too.

Well, one of Epstein’s defense attorneys, Gerald Lefcourt, also represented Drexel. Yet another tie between the two entities.

The 2008 article below says that Drexel’s founder Michael Milken and Epstein had close ties too.

Of course, Leon Black, who also worked at Drexel in the 1980s, paid ~$50 million to Epstein for “advice” over the years.

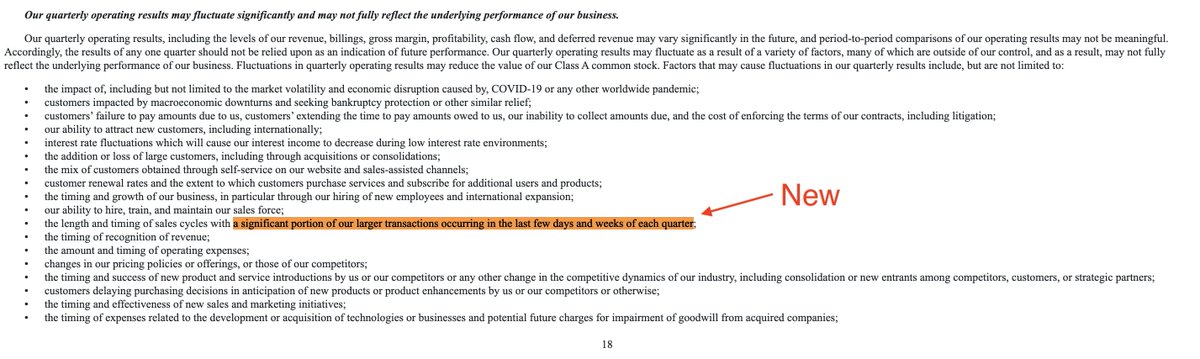

So fine, a lot of people at Apollo have ties to Epstein and worked at Drexel Burnham Lambert in the 1980s.

Why does this matter?

So fine, a lot of people at Apollo have ties to Epstein and worked at Drexel Burnham Lambert in the 1980s.

Why does this matter?

It matters because Epstein also hired his key employees from Drexel!

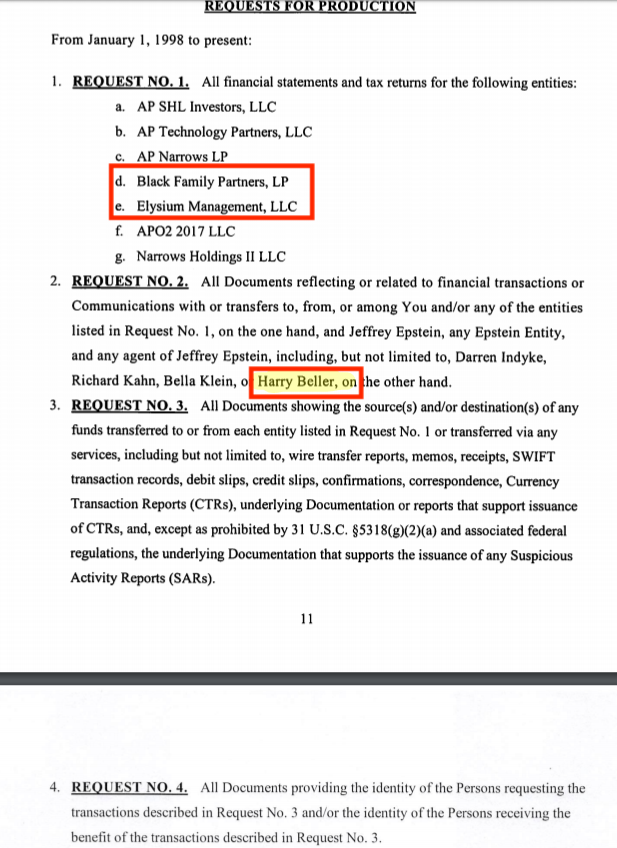

For example, Harry Beller, Epstein’s notary, worked at Drexel Burnham Lampert too (1985-1989) at the same time as John Hannan, Marc Rowan, and Leon Black.

For example, Harry Beller, Epstein’s notary, worked at Drexel Burnham Lampert too (1985-1989) at the same time as John Hannan, Marc Rowan, and Leon Black.

A COWORKER OF BLACK, ROWAN, AND HANNAN WAS EPSTEIN’s NOTARY.

According to some people, Harry Beller “holds the key to the kingdom."

According to some people, Harry Beller “holds the key to the kingdom."

https://twitter.com/Agenthades1/status/1281327908103925760

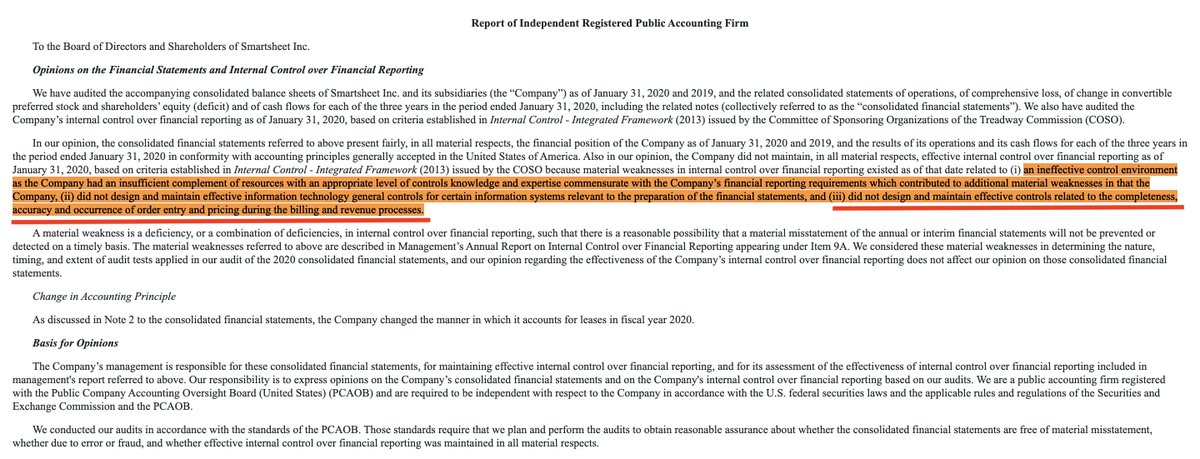

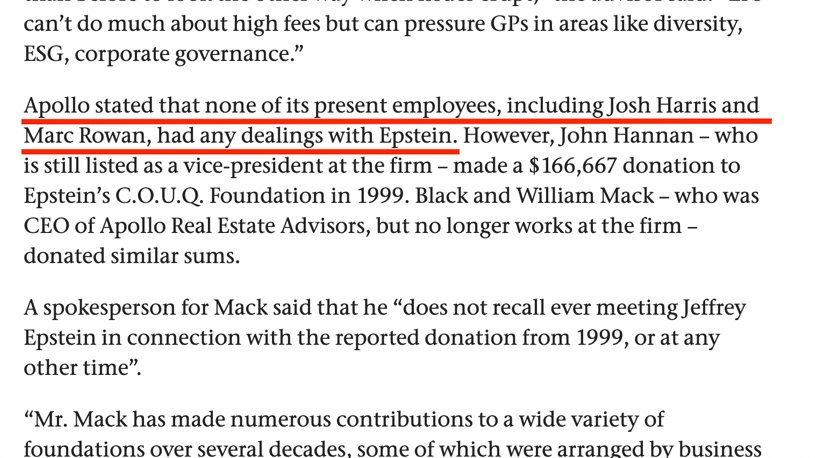

Moreover, this all seems to contradict Apollo’s original 2019 argument that none of its present employees (other than Black) had ties to Epstein, according to an article from PERE news.

Obviously, this is not true.

Obviously, this is not true.

If Harry Beller, Epstein’s longtime notary/accountant, worked closely with Black, Rowan, or Hannan this would take the story to a whole new level.

My guess is there is much more that has not been reported yet.

My guess is there is much more that has not been reported yet.

If you want to read more check out this thread by @quantian1

And if you have any information to share please DM me or email edwin@585research.com

And if you have any information to share please DM me or email edwin@585research.com

https://twitter.com/quantian1/status/1148303671857491968

• • •

Missing some Tweet in this thread? You can try to

force a refresh