Excellent article by @CBinsights on #SPACs. 👏

✔️The basics

✔️Why now? For Private Companies & Investors

✔️Challenges & concerns

✔️Looking ahead

The article clarified few things well for me.👍

cbinsights.com/research/repor…

✔️The basics

✔️Why now? For Private Companies & Investors

✔️Challenges & concerns

✔️Looking ahead

The article clarified few things well for me.👍

cbinsights.com/research/repor…

My notes.

-SPAC structure adds Sponsor Risk (incentives, capabilities, their later actions dictated by Market conditions) on top of (prospective) Company Risk.

-SPAC structure adds Sponsor Risk (incentives, capabilities, their later actions dictated by Market conditions) on top of (prospective) Company Risk.

-Best case scenario for the target Co is

✔️Getting a great sponsor (including strategic guidance & operational experience)

✔️Getting a good price & a much faster path to Public Markets.

Downside is the high equity loss due to Founder shares to sponsor (usually 20% of SPAC).

✔️Getting a great sponsor (including strategic guidance & operational experience)

✔️Getting a good price & a much faster path to Public Markets.

Downside is the high equity loss due to Founder shares to sponsor (usually 20% of SPAC).

-Retail investors don't get warrants to buy more shares (if they like the target Company) and don't get to redeem their shares (if they don't like the merger). 🤷♂️

Other than the occasional & quick chance of the SPAC acquiring a great Company that is not going the IPO route or Direct Listing, retail investors are assuming most of the risk and little of the rewards.

My biggest takeaway :

Down the road (might be pretty soon), If there are too many SPACs chasing too few opportunities (of good/interested Co's that want to be SPAC-ed), the quality criteria might come down, leading to poor acquisitions and bad final results

Down the road (might be pretty soon), If there are too many SPACs chasing too few opportunities (of good/interested Co's that want to be SPAC-ed), the quality criteria might come down, leading to poor acquisitions and bad final results

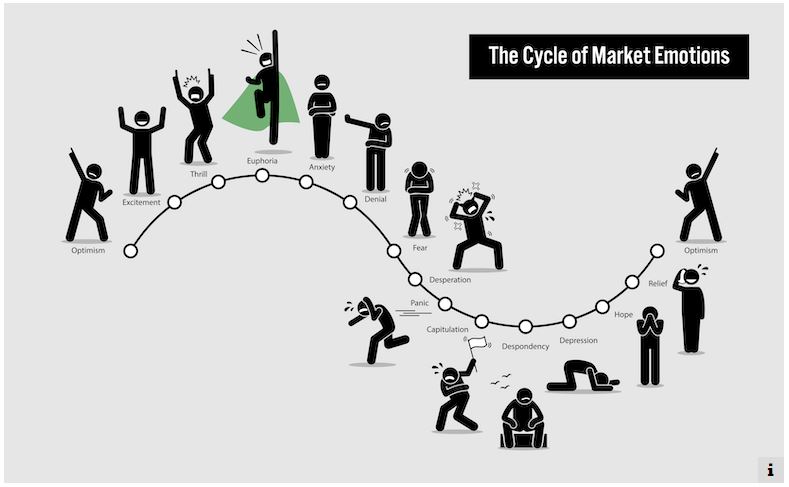

Remember the GFC...

1⃣A specific Financial Asset performing well initially📊

2⃣Too much Demand/Capital chasing those assets 💰💰

3⃣Obviously leading to higher supply but poor quality❌

4⃣Finally horrible results. 🤮

I'll learn for now, but stay away.🚫

Thanks, but no Thanks.👎

1⃣A specific Financial Asset performing well initially📊

2⃣Too much Demand/Capital chasing those assets 💰💰

3⃣Obviously leading to higher supply but poor quality❌

4⃣Finally horrible results. 🤮

I'll learn for now, but stay away.🚫

Thanks, but no Thanks.👎

• • •

Missing some Tweet in this thread? You can try to

force a refresh