Time for a Scorecard📊and thesis📑updates for purchases done in Feb/Mar 2020. Last review done in late April. How far things have come since then.😯

Not taking any drastic actions, other than few sells in fully valued, slower growth Co.'s.

Not taking any drastic actions, other than few sells in fully valued, slower growth Co.'s.

Events since then

✔️Co's reporting two Qtrly reports

✔️Accelerating growth for few sectors

✔️Understandable problems for few others

✔️Crazy run-ups & valuations in the last 9 mo's, supported by biz growth in some cases, but mostly due to Monetary factors & Investor enthusiasm...

✔️Co's reporting two Qtrly reports

✔️Accelerating growth for few sectors

✔️Understandable problems for few others

✔️Crazy run-ups & valuations in the last 9 mo's, supported by biz growth in some cases, but mostly due to Monetary factors & Investor enthusiasm...

I usually buy for two scenarios

1⃣Leading Co's within strong secular trends, that also have strong Management Teams and solid Financials (Rev growth, Profitability or improving Margins/FCF prospects, no balance sheet risk...).

1⃣Leading Co's within strong secular trends, that also have strong Management Teams and solid Financials (Rev growth, Profitability or improving Margins/FCF prospects, no balance sheet risk...).

These are bought with the intention of holding for the long-term as long as the thesis is intact or getting better. Strongly intend to add along the way. Ex : $ROKU $PINS $TWLO $DOCU $W $NOW $WDAY $NVCR $MTCH in the above table.

2⃣More mature and stable Co.'s but with some growth left (no Financial risk), mainly bought for their current under-valuation, with the intent to sell when the Market or those stocks recover. Ex : $BIP $BUD $VTR $BR $BA in above table.

Occasional unplanned sells like

- $W one lot in late May, as the stock 8X'ed in 2 months after bottoming in March.

- $UBER after 3X (but unfortunately, just before the Vaccine news started coming out) as I was more interested in under-valuation in March, than for long-term.

- $W one lot in late May, as the stock 8X'ed in 2 months after bottoming in March.

- $UBER after 3X (but unfortunately, just before the Vaccine news started coming out) as I was more interested in under-valuation in March, than for long-term.

I'm guilty of usually squeezing bulk of my buys in high Volatility periods.

Few purchases made after this (not recommendations)

$CRM (Dec, $220)

$ZM (Dec, $380)

$DOCU (Nov, $201)

$ETSY (Nov, $120)

$TDOC (Nov, $197)

$MDB (Sep, $209)

$FSLY (Sep, $76)

Few purchases made after this (not recommendations)

$CRM (Dec, $220)

$ZM (Dec, $380)

$DOCU (Nov, $201)

$ETSY (Nov, $120)

$TDOC (Nov, $197)

$MDB (Sep, $209)

$FSLY (Sep, $76)

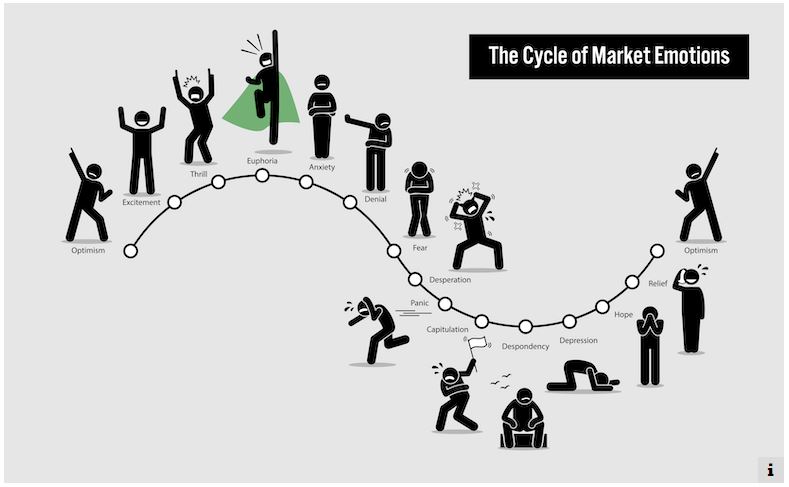

Updating my favorite investing concept & illustration for high volatility periods.

When good Co.'s are heavily discounted and put for you on a platter, given that you have a Watchlist &

✔️done your research

✔️developed thesis/conviction

✔️not worried about further downside

When good Co.'s are heavily discounted and put for you on a platter, given that you have a Watchlist &

✔️done your research

✔️developed thesis/conviction

✔️not worried about further downside

Every one needs their own toolkit for high volatility periods and bear markets. This is what will

✔️ensure you won't let fear drastically change your long-term plans and strategy

✔️get you thru to the other side

✔️maybe even take advantage of the low prices

✔️ensure you won't let fear drastically change your long-term plans and strategy

✔️get you thru to the other side

✔️maybe even take advantage of the low prices

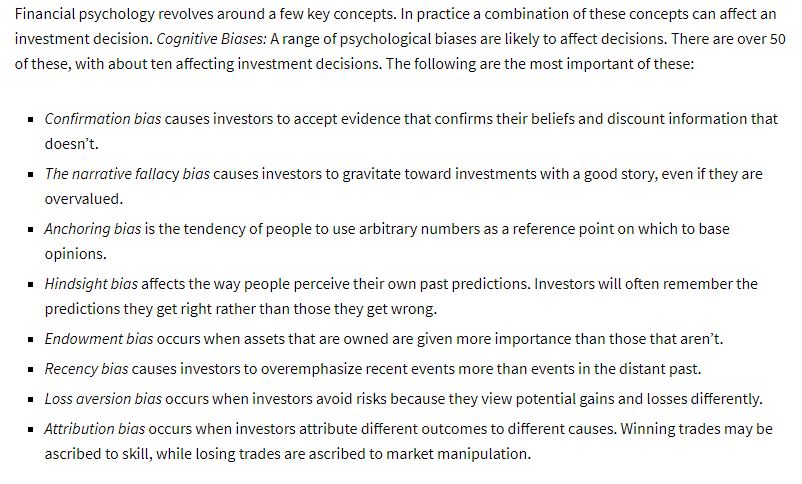

Here are few concepts that have helped me in the past high volatility periods.

✔️Ben Graham's Mr Market: He's mostly pretty smart/stable but high VIX (fear/uncertainty) & extremely low VIX (complacency) are when you need to be little contrarian & take advantage of his behavior.

✔️Ben Graham's Mr Market: He's mostly pretty smart/stable but high VIX (fear/uncertainty) & extremely low VIX (complacency) are when you need to be little contrarian & take advantage of his behavior.

✔️"You make a lot of money (by investing in good Co's) during Bear Markets, You just don't realize it at the time" - Shelby Davis.

✔️When the price of a Stock (in a good Company) falls a lot, it actually becomes less risky (Howard Marks)

✔️When the price of a Stock (in a good Company) falls a lot, it actually becomes less risky (Howard Marks)

✔️Hyperbolic discounting : Fear causing time horizons to shrink, and Market valuing good Co's with bright future prospects as if they're mature/declining businesses. h/t @IntrinsicInv

✔️Cash and Courage during a crash are invaluable (Buffett).

✔️Cash and Courage during a crash are invaluable (Buffett).

Anyway, this is just a random collection of thoughts about high volatility periods (like March), some results/updates, and some concepts that help during those periods.

/END. 👍

/END. 👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh