0/There is a pervasive undercurrent which seeks to undermine the very root of the capitalistic ethos inherent in Bitcoin’s design. Many question the accumulation of bitcoins by early adopters & reframe early ownership as form of inequality:

The Bitcoin Baron. A thread ⤵️

The Bitcoin Baron. A thread ⤵️

1/The quest to right inequalities or establish equality has expanded beyond mere social and political discourse. Many seek to upend real and perceived imbalances in the economy through regulation and social exclusion.

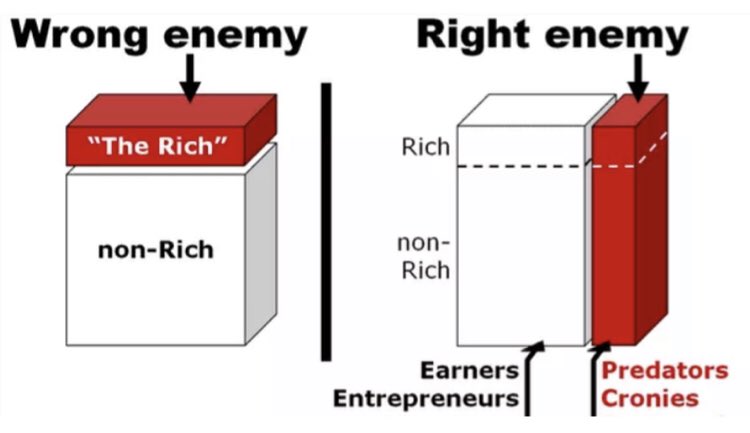

2/Yet these misplaced attacks on wealth accumulation take aim at beneficiaries of a corrupt system instead of addressing the root cause of the widening wealth gap.

3/The systemic war on individual wealth began in 1971 after the US abandoned the gold standard. It has resulted in a government sponsored debasement of currency, debilitating erosion in savings, and a fiat fueled a wealth disparity engine.

wtfhappenedin1971.com

wtfhappenedin1971.com

4/But the government has laid the blame of its economic failures at the feet of globalism and compounded bad outcomes through central bank driven inflation. The 2008 Great Financial Crisis offered an opportunity for citizen enlightenment.

5/Indeed the narrative shifted and identified a target. Yet instead of seeking monetary reform those who were shrifted attacked, sought reparations and revenge against any who knowingly and mostly unknowingly benefited from a distorted economic environment.

6/Occupy Wall St., Tax the Rich, Ban Billionaires are now common refrains in this quest for equality. This “democratic” shift mistakenly seeks to equate equity with equality. This is not equal opportunity — they seek to establish a system which guarantees equal outcomes.

7/Entrepreneurs and other risk takers with any modicum of success are considered unfair economic actors, social outliers and the fair target of politicians and their supporters. Their insight, perseverance and work has been discounted to 0.

8/Yet guaranteed equal outcomes for all erodes the very foundation of capital markets. It turns the economy from one powered by individual drive to reliance on committees with little real world experience.

9/The effort to build and create wealth (and jobs) becomes vilified and the state’s economic control mechanisms are empowered. Indeed they are elevated and celebrated as fair and good referees who ensure every one wins, equally.

10/Excess wealth is seized, assigned and lost to the state’s purveyance. Yet excess itself is an unknown and moving target. Today it’s billionaires. Tomorrow millionaires. Then one day savings and your very home or job.

11/Like entrepreneurs, early Bitcoin adopters assumed a variety of degrees of risk. Many times it outweighed the benefit inherent in the network. Forgotten seed phrases, deleted wallets, lost coins, Mt. Gox fiasco are just a few examples.

12/It was a treacherous time. New alt coins promised the allure of riches. Scams were rampant. Developers worked on a nascent monetary network that couldn't promise long term rewards. The public laughed at this magic internet money. Price crashed. Many abandoned Bitcoin.

13/Of course, today we look back and marvel at the insight and fortitude of these pioneers and imagine we too would spend time and money in accumulating bitcoins. Or devote endless hours coding and participating in Bitcoin’s community. But soon these efforts will be devalued.

14/And as Bitcoin continues to gorge itself on traditional markets absorbing the Fed’s printing press output many (detractors) will point to Bitcoin and seek to regulate, control and tax. Their fear of missing out is expressed in outrage.

15/When Bitcoin begins to penetrate the heart of the fiat financial system: central banks, it will be perceived & reframed as yet another tool to control the public. Few will understand how Bitcoin’s 2nd and 3rd order effects radically reshape the economy for them.

16/Long term hodlers will come under increasing attack. As Bitcoin steamrolls traditional markets and reforms the financial world, calls for redistribution of bitcoins and sats will become more commonplace and eventually reach an urgent pitch.

17/Yet hodlers took great financial risk and effectively bootstrapped the network when no one else would. They nurtured Satoshi’s vision and supported it at every turn. During brutal bear markets and the euphoria of the bull they stood steadfast in their conviction.

18/They have weathered every argument, personal attack, and a host of pretenders. Hodlers have created a slew of resources educating those new to Bitcoin. Books, podcasts and technical services have exploded. Bitcoin’s knowledge base reaches far and wide.

19/This effort is driven by a deep set of convictions whose cumulative effect seeks to liberate the world from the scourge of fiat and inflation. Bitcoin will restore the natural order of markets and mute business cycle extremes. Individuals save without fear of debasement.

20/Bitcoiners have expended their most precious resource: time. Even in the face of what seems to be insurmountable odds, a constant stream of FUD, allure of alts, and years of bear markets, they have doubled down and renewed their commitment.

21/Time spent is time lost. Yet for those who have spent time on Bitcoin their time return has compounded. They are witnesses to the transformation of a vision once faint and hardly imaginable now solidifying into a brightly lit full moon.

22/A bitcoin is no longer “cheap.” As of this writing it has made new ATHs and ready to begin a manic bull run. As price climbs the Bitcoin Baron will become a new scapegoat and the cries for equality will go from a whisper to a roar.

23/The road has been paved. Do not forget the builders and the first who took the risk to walk the road, many alone. They paid in time, accepted uncertainty, missed life opportunities and made personal sacrifices. Many were lost on the journey.

Fin/These Bitcoin Barons had the fortitude to survive and thrive. They are monetary entrepreneurs who will drive the next phase of Bitcoin innovation and growth. Collectively they will upend 100+ years of central bank oppression and usher in a new era of prosperity.

• • •

Missing some Tweet in this thread? You can try to

force a refresh