Tweetstorm: weekend learning

The art of managing winning stocks

Have plan to reduce on weakness

Best companies wan to up.

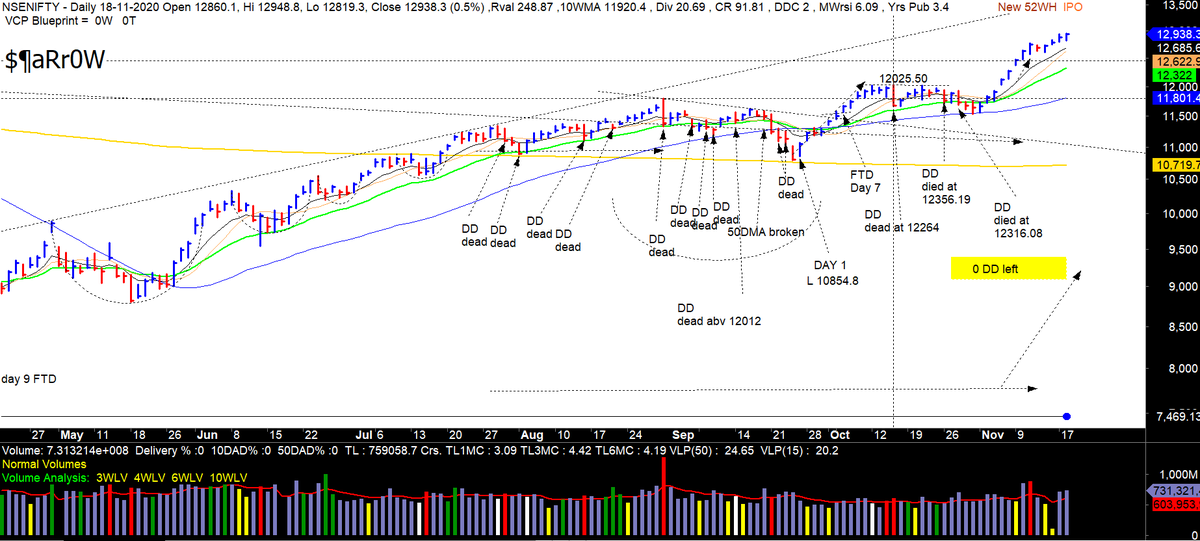

Best stocks can't avoid indexes

Market always fool u

Focus on wht u own and wht u wish to own.

Don't try to read too much into markets.

The art of managing winning stocks

Have plan to reduce on weakness

Best companies wan to up.

Best stocks can't avoid indexes

Market always fool u

Focus on wht u own and wht u wish to own.

Don't try to read too much into markets.

As vaccine goes out, more traditional companies getting into limelight.

Great trades don't require predictions.

U just have to see it and take action.

-->>Have a consistent routine:

-> weekend study

-> all fishing on weekends

-> u have full weekly bar

-> Sunday afternoon

Great trades don't require predictions.

U just have to see it and take action.

-->>Have a consistent routine:

-> weekend study

-> all fishing on weekends

-> u have full weekly bar

-> Sunday afternoon

U r always 4 days away from a potential rally(FTD).

Keep urself on the toes and keep training.

Once u catch a big name one time, u get hooked. U want to do that again.

Keep urself on the toes and keep training.

Once u catch a big name one time, u get hooked. U want to do that again.

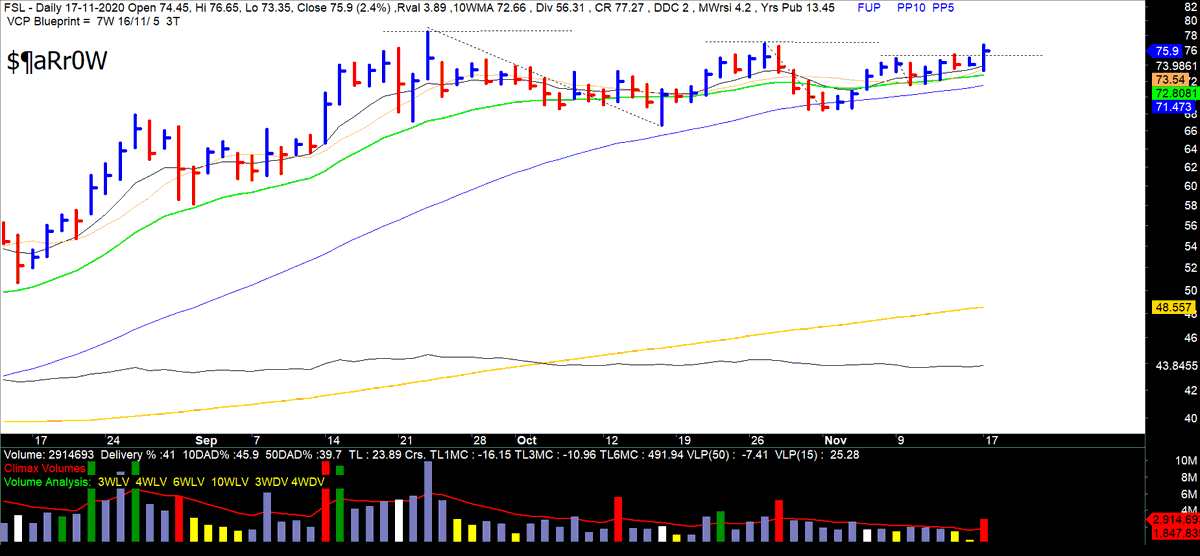

--->>>Stocks may surprise u:

Book recommendation: Market wizard

Good trader: Ability to manage configurations of the world that is different from today and really believe it can happen.

U need to have a vivid imagination of the stock u own.

Book recommendation: Market wizard

Good trader: Ability to manage configurations of the world that is different from today and really believe it can happen.

U need to have a vivid imagination of the stock u own.

U need to have the Courage to take the trade-patience to stay with it-vision where it can go- lastly execution.

When u have the urge to sell, curb it or sell some to release the pressure.

Rules-Rules-Rules !!!

When u have the urge to sell, curb it or sell some to release the pressure.

Rules-Rules-Rules !!!

Partial selling helps: sell 2/3rd with substantial profits and hold last 1/3rd to gauge large grounds.

If it's a bull market u stay with it and look for signals to get out.

If u have 10-20% position in 1 stock then u need to have some execution plans.

If it's a bull market u stay with it and look for signals to get out.

If u have 10-20% position in 1 stock then u need to have some execution plans.

Its much easier to buy something which u already own.

Legends not only take a big position but also, ride it for long.

System: U have to make it your own.

Companies selling expensive items and being traded on exchanges is a great buy.

Legends not only take a big position but also, ride it for long.

System: U have to make it your own.

Companies selling expensive items and being traded on exchanges is a great buy.

Take the time to know some of the stories.

Best stocks r always overvalued. When they become undervalued they fall.

Look for the big Institutions holding.

Software companies: net retention revenue (imp. Metric)

Investing is such a strangest things amongst all professions.

Best stocks r always overvalued. When they become undervalued they fall.

Look for the big Institutions holding.

Software companies: net retention revenue (imp. Metric)

Investing is such a strangest things amongst all professions.

Its very difficult psychology is to be wrong most often. When u r right, ur record is so heavy in ur favour.

Sometimes u take profits so early coz u hav been wrong so often.

Base ball and trading has big similarities.

Sometimes u take profits so early coz u hav been wrong so often.

Base ball and trading has big similarities.

When rotation happens then money flows into stocks which were traditional big winners other than growth.

So, be vigilant about the moves.

***The End***

So, be vigilant about the moves.

***The End***

• • •

Missing some Tweet in this thread? You can try to

force a refresh