Tweetstorm: Weekend Learning

Having a growth mindset.

Covid-19: people went broke-people also saved much

spending would be unleashed

supercycle coming

Innovation cycle of digital revolution

U r the architect of ur own life

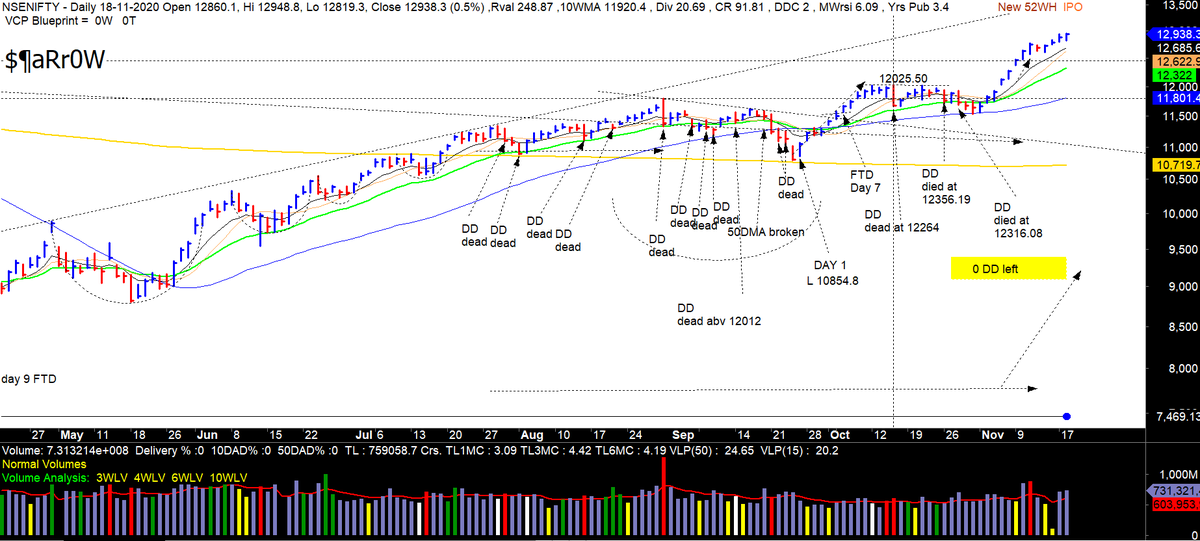

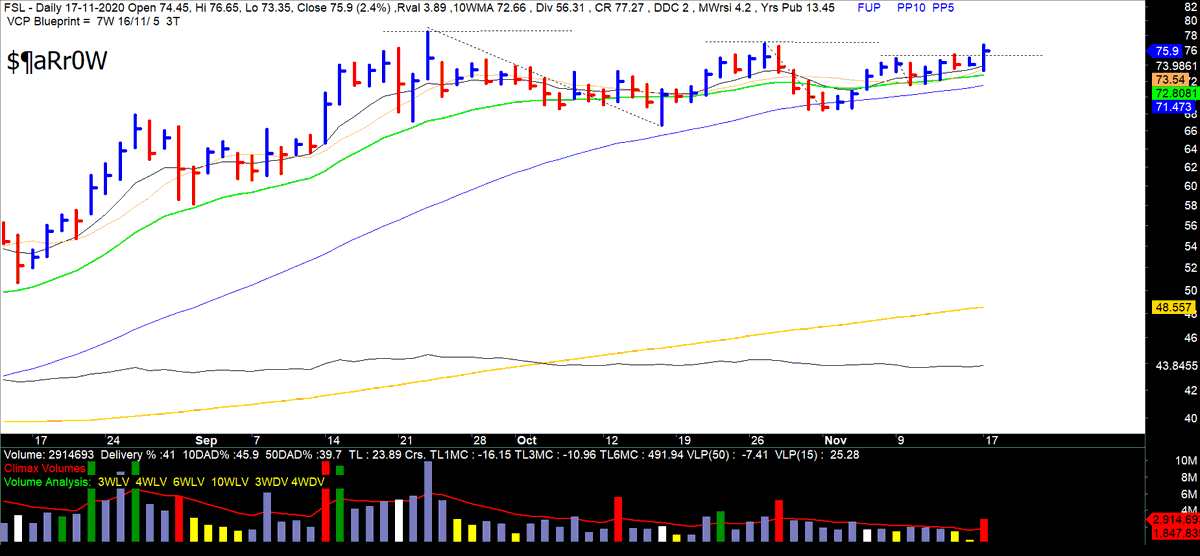

TML: True Market Leader

How many TML's are extended?

Having a growth mindset.

Covid-19: people went broke-people also saved much

spending would be unleashed

supercycle coming

Innovation cycle of digital revolution

U r the architect of ur own life

TML: True Market Leader

How many TML's are extended?

Concern: short term excesses

long term: super-cycle

Economic boom-secular supercycle-FED-people wanna spend.

Short term super volatile pullback~f(rapid ascend)

Currently, there is institutional adaption is high in Bitcoin

long term: super-cycle

Economic boom-secular supercycle-FED-people wanna spend.

Short term super volatile pullback~f(rapid ascend)

Currently, there is institutional adaption is high in Bitcoin

Never violate the trend.

Be very cautious about people who become ur mentor.

position sizing

shortening losses

sector allocation

keep these as ur guard rail.

Crypto Update: Etherium might jump back.

Be very cautious about people who become ur mentor.

position sizing

shortening losses

sector allocation

keep these as ur guard rail.

Crypto Update: Etherium might jump back.

Trader Evolution:

1. Cutting ur losses

2. Better selection criteria

3. Getting a mentor

4. Understanding the value of a cushion

5. Risk management is the bedrock.

6. Spend the money on keeping urself up and running

1. Cutting ur losses

2. Better selection criteria

3. Getting a mentor

4. Understanding the value of a cushion

5. Risk management is the bedrock.

6. Spend the money on keeping urself up and running

People sell out of fear.They don't have the experience of a triple-digit winner

People don't believe their system.

Not being fearful, understand the system.

It takes 18 months for a TML to get there.

People don't believe their system.

Not being fearful, understand the system.

It takes 18 months for a TML to get there.

Earnings strategy: 50-80% of the gains occur in earnings

6 qrtrs in a row creates a lifetime opportunity

u need to b in A game in ur life

how ur home life?

consistently do one thing for 30 yrs. Consistency and Discipline is key.

Doing the research for urself.

6 qrtrs in a row creates a lifetime opportunity

u need to b in A game in ur life

how ur home life?

consistently do one thing for 30 yrs. Consistency and Discipline is key.

Doing the research for urself.

Smart people learn from their own mistakes.

Wise people learn from other people's mistakes.

u wud always make mistakes, it's part of the game.

u don't have to be perfect, recognize mistakes early.

reversing mistakes quickly. ur default is that u wud hit stops in all ur trades.

Wise people learn from other people's mistakes.

u wud always make mistakes, it's part of the game.

u don't have to be perfect, recognize mistakes early.

reversing mistakes quickly. ur default is that u wud hit stops in all ur trades.

Greats even fail 6-7 out of 10.

To fly in a private jet u need to have 4-5 stocks working starting for 5 beats/raise quarter with good position size.

Great traders accept the mistakes. They are real people.

To fly in a private jet u need to have 4-5 stocks working starting for 5 beats/raise quarter with good position size.

Great traders accept the mistakes. They are real people.

3-5 stocks climaxing in a day is a rare scenario.

Buying extended is a classic rookie mistake

U have to know when is the special occasion to break rules

u have to be composed 95% of the time and not to break rules.

Buying extended is a classic rookie mistake

U have to know when is the special occasion to break rules

u have to be composed 95% of the time and not to break rules.

Anything trading below 50dma 4-5% below it on Friday close is a red flag.

never sell a stock with 100% earnings before 50dma. True elite gems.

Buy at breakout + position size. Not before 50dma.

Once u get in and u have a cushion, and trusting 50dma is no lock.

never sell a stock with 100% earnings before 50dma. True elite gems.

Buy at breakout + position size. Not before 50dma.

Once u get in and u have a cushion, and trusting 50dma is no lock.

Understanding liquidity and cushion r two great things.

Meditate when u lose ur mind.

One cannot say a stock would not go higher.

U don't learn until u get crushed.

once u r trapped u never buy a piece of junk.

smallcap+low liquidity stock.

Meditate when u lose ur mind.

One cannot say a stock would not go higher.

U don't learn until u get crushed.

once u r trapped u never buy a piece of junk.

smallcap+low liquidity stock.

A big part of the money is made where midcaps transition into large caps.

If u don't have self-responsibility ur never going to make it.

I make decisions and execute it

***THE END***

If u don't have self-responsibility ur never going to make it.

I make decisions and execute it

***THE END***

• • •

Missing some Tweet in this thread? You can try to

force a refresh