1/ 2017 vs 2020 Economics

Whatever the many reasons for the coup. The aftermath has been an economic disaster. This is instructive, since Mugabe was a monumental failure in Economics.

I wish to stick to economic facts &figures. I restrict myself exclusively to GOZ & RBZ stats

Whatever the many reasons for the coup. The aftermath has been an economic disaster. This is instructive, since Mugabe was a monumental failure in Economics.

I wish to stick to economic facts &figures. I restrict myself exclusively to GOZ & RBZ stats

2/

To be fair to Mnangagwa, as President he is fed a lot of misinformation & politically convenient gibberish by those closest to him & security clusters bent on personal enrichment than national well being.

I say this, because some of the issues are too simple to understand.

To be fair to Mnangagwa, as President he is fed a lot of misinformation & politically convenient gibberish by those closest to him & security clusters bent on personal enrichment than national well being.

I say this, because some of the issues are too simple to understand.

3/

Mnangagwa can never commit harakiri ( Japanese suicide by cutting one’s belly) if facts & figures were honestly presented to him. Yet we saw Mugabe commit harakiri. He died a sad death while his lieutenants are now in power. Where the lieutenants honest to Mugabe...

Mnangagwa can never commit harakiri ( Japanese suicide by cutting one’s belly) if facts & figures were honestly presented to him. Yet we saw Mugabe commit harakiri. He died a sad death while his lieutenants are now in power. Where the lieutenants honest to Mugabe...

4/

Chinamasa was Mugabe’s finance Minister. Was he frank & honest? If so why would he benefit from Mugabe’s ouster? The same is true of Mugabe’s bureaucracy. Most benefitted from the coup. So we ask if they were honest with him during his reign?

ED suffers the same problem

Chinamasa was Mugabe’s finance Minister. Was he frank & honest? If so why would he benefit from Mugabe’s ouster? The same is true of Mugabe’s bureaucracy. Most benefitted from the coup. So we ask if they were honest with him during his reign?

ED suffers the same problem

5/

On Wallstreet, CEO’s are not protected from their critics & independent research. Often they rely entirely on this research & seek it out in developing their strategy.

Once, Patterson Timba kicked out an analyst from his investor briefing. Forgetting strategy is in critique

On Wallstreet, CEO’s are not protected from their critics & independent research. Often they rely entirely on this research & seek it out in developing their strategy.

Once, Patterson Timba kicked out an analyst from his investor briefing. Forgetting strategy is in critique

6/

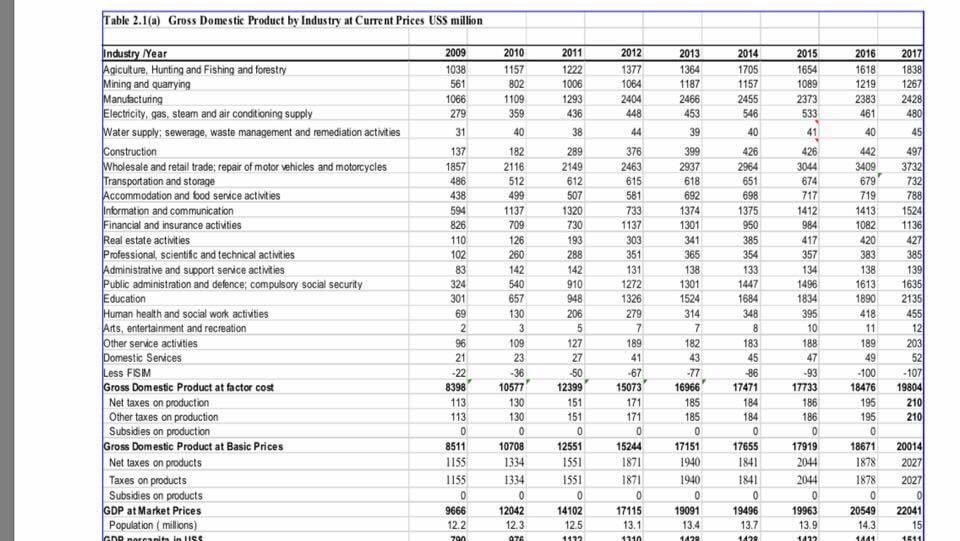

Zimbabwe’s economy is not etched in Agriculture. Agriculture only contributes 9% to GDP in a good year. Yet every year it gets a disproportionate share of resources.

Just writing this, many will defend Agriculture. Yet facts & figures tell us otherwise.

Zimbabwe’s economy is not etched in Agriculture. Agriculture only contributes 9% to GDP in a good year. Yet every year it gets a disproportionate share of resources.

Just writing this, many will defend Agriculture. Yet facts & figures tell us otherwise.

7/

Resources are scarce & competing. By directing them to areas of little utility like agriculture , we take away from other fast growing industries in the economy with much greater impact.

Mining contributes 6% to GDP. One is forgiven for not knowing this.

Resources are scarce & competing. By directing them to areas of little utility like agriculture , we take away from other fast growing industries in the economy with much greater impact.

Mining contributes 6% to GDP. One is forgiven for not knowing this.

8/

Infact Wholesale & retail trade contributes double agriculture at 19% of our GDP. It is followed by manufacturing & education. All above agriculture (#4)

Yet in policy, like 2% Mthuli tax affects the biggest GDP contributors. Moreso, the thin margins in these sectors.

Infact Wholesale & retail trade contributes double agriculture at 19% of our GDP. It is followed by manufacturing & education. All above agriculture (#4)

Yet in policy, like 2% Mthuli tax affects the biggest GDP contributors. Moreso, the thin margins in these sectors.

9/

In 10 years ICT output has grown 3X. It’s contribution could be the highest in 5 years if GOZ policies did not inhibit its growth. Already the restrictions on Mobile money Transfers & 2% will severely impact growth.

Why would GOZ jeopardize ICT growth consciously?

In 10 years ICT output has grown 3X. It’s contribution could be the highest in 5 years if GOZ policies did not inhibit its growth. Already the restrictions on Mobile money Transfers & 2% will severely impact growth.

Why would GOZ jeopardize ICT growth consciously?

10/

The answer we find in politics. Agriculture is supported because of its politics & not economics.

There is a disconnect between politics & economics. Bad economics doesn’t result in change of politics. The economy has no lever in power. As we shall see with coup economics

The answer we find in politics. Agriculture is supported because of its politics & not economics.

There is a disconnect between politics & economics. Bad economics doesn’t result in change of politics. The economy has no lever in power. As we shall see with coup economics

11/

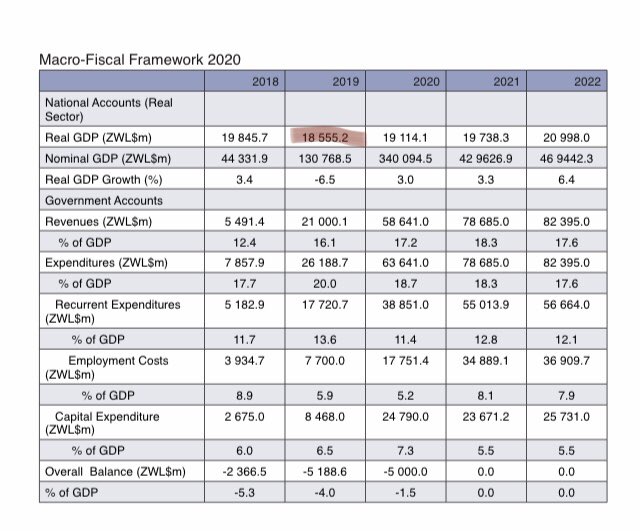

Broad Economic indicators

2017 vs 2020

GDP 19.8bn 18.2bn

GDP gwth 4.7%. -7%

Inflation 3% 402%

M-o-M 0.74% 3.15%

Exchange rate. 1.9 115

Wage avg. 290 165

Broad Economic indicators

2017 vs 2020

GDP 19.8bn 18.2bn

GDP gwth 4.7%. -7%

Inflation 3% 402%

M-o-M 0.74% 3.15%

Exchange rate. 1.9 115

Wage avg. 290 165

12/

Broad Monetary aggregates

2017 vs 2020

FX rate 1.9 115

M1 (bn) 6.5 145

M3 (bn) 8 153

Deficit(bn) 2.7 5

RBZ debt(USD)

869m 5bn

Broad Monetary aggregates

2017 vs 2020

FX rate 1.9 115

M1 (bn) 6.5 145

M3 (bn) 8 153

Deficit(bn) 2.7 5

RBZ debt(USD)

869m 5bn

13/

ZSE Market capitalization

2017. vs. 2020

ZWL $ 10.8bn. 180bn

USD $ 5.7bn. 1.6bn

ZSE Market capitalization

2017. vs. 2020

ZWL $ 10.8bn. 180bn

USD $ 5.7bn. 1.6bn

13/

Broad External Finances

2017 vs 2020

External debt 7bn. 8bn

FDI 692m 250m

Current a/c -1.4%. 6.3%

( as% ofGDP)

Capital a/c(US$) 286m -500m

Broad External Finances

2017 vs 2020

External debt 7bn. 8bn

FDI 692m 250m

Current a/c -1.4%. 6.3%

( as% ofGDP)

Capital a/c(US$) 286m -500m

14/

Broad External Finances

2017 vs 2020

External debt 7bn. 8bn

FDI 692m 250m

Current a/c -1.4%. 6.3%

( as% ofGDP)

Capital a/c(US$) 286m -500m

Broad External Finances

2017 vs 2020

External debt 7bn. 8bn

FDI 692m 250m

Current a/c -1.4%. 6.3%

( as% ofGDP)

Capital a/c(US$) 286m -500m

15/

Salient points;

(1) In 2017 Zim was headed in the wrong direction. In 2020, the destruction is worse.

(2) Wholesale & retail trade is propelled principally by Diasporian remittances. The 5m or so Zimboes living abroad are now the anchor of the economy.

Salient points;

(1) In 2017 Zim was headed in the wrong direction. In 2020, the destruction is worse.

(2) Wholesale & retail trade is propelled principally by Diasporian remittances. The 5m or so Zimboes living abroad are now the anchor of the economy.

16/

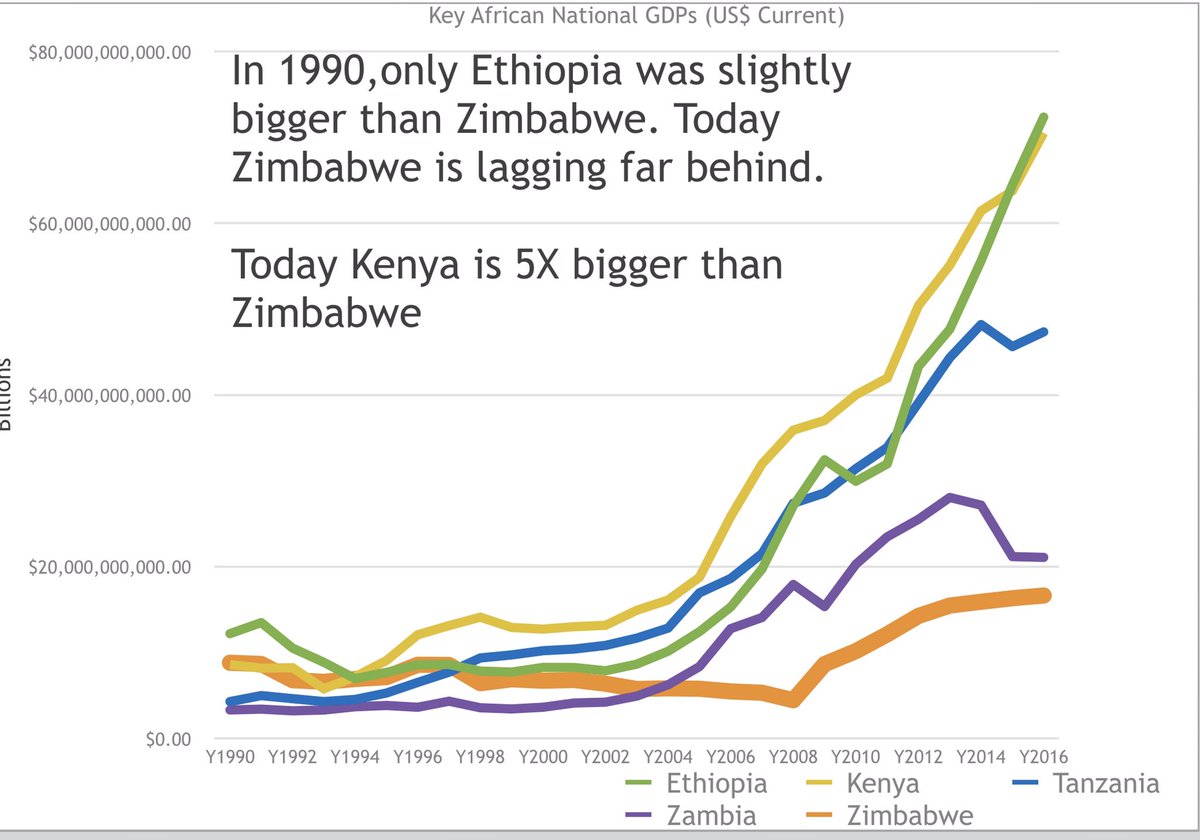

(3) In SA & Bots Agriculture contributes less than 4% to GDP. So people should not be surprised.

(4) In 1990 Zim was bigger than Kenya. 30yrs later Kenya is 5X bigger than Zim, a lot more using market rates. What did Kenya do right?

(3) In SA & Bots Agriculture contributes less than 4% to GDP. So people should not be surprised.

(4) In 1990 Zim was bigger than Kenya. 30yrs later Kenya is 5X bigger than Zim, a lot more using market rates. What did Kenya do right?

(17)

Instead of comparing ourselves to Kenya & South Africa, Zim finds company in much smaller economies like Rwanda, Malawi & Mozambique.

Yet the smaller economies are growing while Zim declines further.

Instead of comparing ourselves to Kenya & South Africa, Zim finds company in much smaller economies like Rwanda, Malawi & Mozambique.

Yet the smaller economies are growing while Zim declines further.

18/

There is a disconnect between politics & economics in Zimbabwe. Like Mugabe, ED is working hard to destroy the economy. He gets information & strategy from those that directly benefit from the disaster. As a successful farmer himself his equally blinded of the reality in ICT

There is a disconnect between politics & economics in Zimbabwe. Like Mugabe, ED is working hard to destroy the economy. He gets information & strategy from those that directly benefit from the disaster. As a successful farmer himself his equally blinded of the reality in ICT

19/

The purpose of this thread is for the public to engage the facts. Mugabe left RBZ with less than a billion in foreign debt. It’s now $5bn.

All Listed firms have a market cap of $1.6bn. Once upon a time that was just Delta.

We must reflect on this.

THE END

The purpose of this thread is for the public to engage the facts. Mugabe left RBZ with less than a billion in foreign debt. It’s now $5bn.

All Listed firms have a market cap of $1.6bn. Once upon a time that was just Delta.

We must reflect on this.

THE END

**misunderstand.

The guy who got kicked out by Timba is one of Zim best analysts. The guy had done his research & was asking hard questions.

I used to enjoy Strive being grilled on analyst calls. You could literally see the sweat off his brow.

Does anyone listen to Elon calls esp a year ago?

I used to enjoy Strive being grilled on analyst calls. You could literally see the sweat off his brow.

Does anyone listen to Elon calls esp a year ago?

Post thread reflections 🤔

# It is true there are qualitative problems with the calculation of GDP. But whatever inherent error with our measuring yardstick it’s consistent across all sectors & countries. Mthuli tried to rebase by 40%, but the economic indicators could not....

# It is true there are qualitative problems with the calculation of GDP. But whatever inherent error with our measuring yardstick it’s consistent across all sectors & countries. Mthuli tried to rebase by 40%, but the economic indicators could not....

... justify the wild claim. Nigeria & Egypt faced similar problems.

# Agriculture in 9 yrs went up by 77%. That’s a fast growing sector. Unfortunately not fast enough nor will it ever be faster than ICT etc. Zim avg yield is 1ton per ha. Even if through GMO’s & capital.....

# Agriculture in 9 yrs went up by 77%. That’s a fast growing sector. Unfortunately not fast enough nor will it ever be faster than ICT etc. Zim avg yield is 1ton per ha. Even if through GMO’s & capital.....

... it improves to 5ton/ha. It’s not fast enough. With excess maize the price will drastically fall. Exporting means getting $160/ton. Similarly with tobacco. The more we produce the less the average factor price.

This doesn’t mean Agriculture is not profitable....

This doesn’t mean Agriculture is not profitable....

Infact those who introduce massive amounts of capital become the winners. They’re farmers in Zim that produce at 15ton/ha. They tend to have a certain skin tone. GMB pays US$490. Even if it comes down to US$200 due to rate movement . It’s still 33% above world rates....

... having said this. Let me be emphatic enough. Agriculture nor Mining for that matter is the anchor of the Zim economy.

If one applies their mind it turns out Diaspora remittances now anchor of the Zim economy! In a bad year it’s $1bn and a good year it’s $2bn.

If one applies their mind it turns out Diaspora remittances now anchor of the Zim economy! In a bad year it’s $1bn and a good year it’s $2bn.

Diaspora remittances are unencumbered. Exports require at least 70% imports. The more we export the greater our imports. While in the very least $1bn remittances as cash for that matter float in Zim.

Aggregate Demand in Zim is greatly driven by remittance!

Aggregate Demand in Zim is greatly driven by remittance!

It makes little political sense to acknowledge this. Plus remittances are supply inelastic. They’ll come in regardless.

But with the right GOZ policy there is potential to double remittances.

Imagine US$4bn unencumbered dollars floating in Zim.

Pafunge!

But with the right GOZ policy there is potential to double remittances.

Imagine US$4bn unencumbered dollars floating in Zim.

Pafunge!

• • •

Missing some Tweet in this thread? You can try to

force a refresh