We are short $MVIS. In a market gone mad, this $1.2 billion market cap corporate husk with almost no revenue or intellectual property value is a standout.

It has risen 5,000% from lows this year on misguided retail euphoria over its LiDAR IP portfolio amid a broad EV bubble.

It has risen 5,000% from lows this year on misguided retail euphoria over its LiDAR IP portfolio amid a broad EV bubble.

Retail investors have latched onto the company's portfolio of 250+ active patents, but an IP attorney we engaged found that only ~10 $MVIS issued patents even mention LiDAR.

Of those, many are oriented toward consumer/non-automotive use.

Of those, many are oriented toward consumer/non-automotive use.

These patents haven't faced inter partes review (IPR) challenges yet, significantly reducing their value.

“No one buys patents these days for any real money unless the patents have been put through the test of at least an IPR,” our IP attorney told us.

“No one buys patents these days for any real money unless the patents have been put through the test of at least an IPR,” our IP attorney told us.

The recent excitement all belies the fact that $MVIS is essentially a science project that has gone nowhere after 25 years.

It was trading around $0.20 in April of this year and contemplating sale or liquidation.

It was trading around $0.20 in April of this year and contemplating sale or liquidation.

But EV mania presented an opportunity.

In November, the company put financing documents in place then announced the very next day that it hopes to have a LiDAR demo product by April 2021.

In November, the company put financing documents in place then announced the very next day that it hopes to have a LiDAR demo product by April 2021.

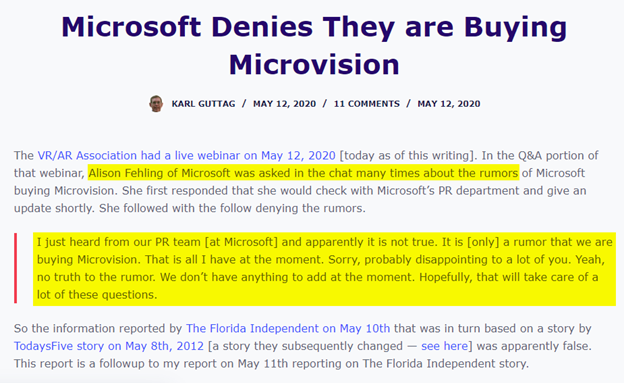

Adding to this, a chorus of second-tier blogs have pushed the narrative that the company could be acquired by Microsoft or other “tech giants” – an extremely unlikely proposition given the company’s astronomical valuation.

In fact, overzealous $MVIS shareholders had a coup of sorts during a May 12, 2020 Microsoft webinar, in which they forced a Microsoft PR rep to deny that it was buying $MVIS.

Regardless, these perpetual buyout rumors are a factor in the stock’s meteoric rise.

Regardless, these perpetual buyout rumors are a factor in the stock’s meteoric rise.

We have absolutely no doubt that $MVIS will take advantage of this holiday gift and dilute investors through an equity offering as quickly as it can raise money.

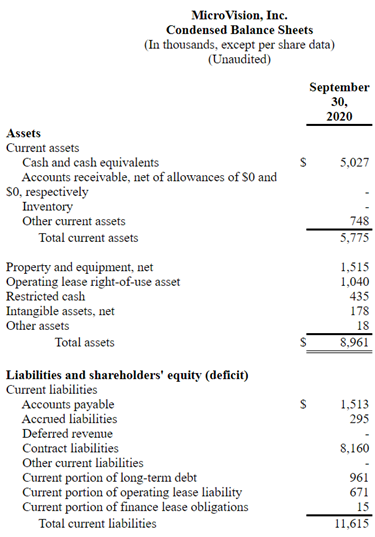

As of September 30, 2020, the company notes it has racked up an accumulated deficit of $582.7 million.

As of September 30, 2020, the company notes it has racked up an accumulated deficit of $582.7 million.

This furthers our belief that $MVIS has near-zero long-term intrinsic value.

We assign a short-term price target of $1.50 to $MVIS, representing 80% downside from current levels.

We assign a short-term price target of $1.50 to $MVIS, representing 80% downside from current levels.

• • •

Missing some Tweet in this thread? You can try to

force a refresh