BREAKING: Rosemary Vrablic, the longtime @DeutscheBank official who oversaw the @realDonaldTrump relationship, has abruptly handed in her resignation from the bank, I'm told. She's leaving effective 12/31. nytimes.com/2020/12/22/bus…

The exact reasons for Vrablic's departure – as well as the resignation of her longtime associate, Dominic Scalzi – aren't clear.

She doesn't have a new job lined up. She says she is leaving voluntarily and is looking forward to retirement.

She doesn't have a new job lined up. She says she is leaving voluntarily and is looking forward to retirement.

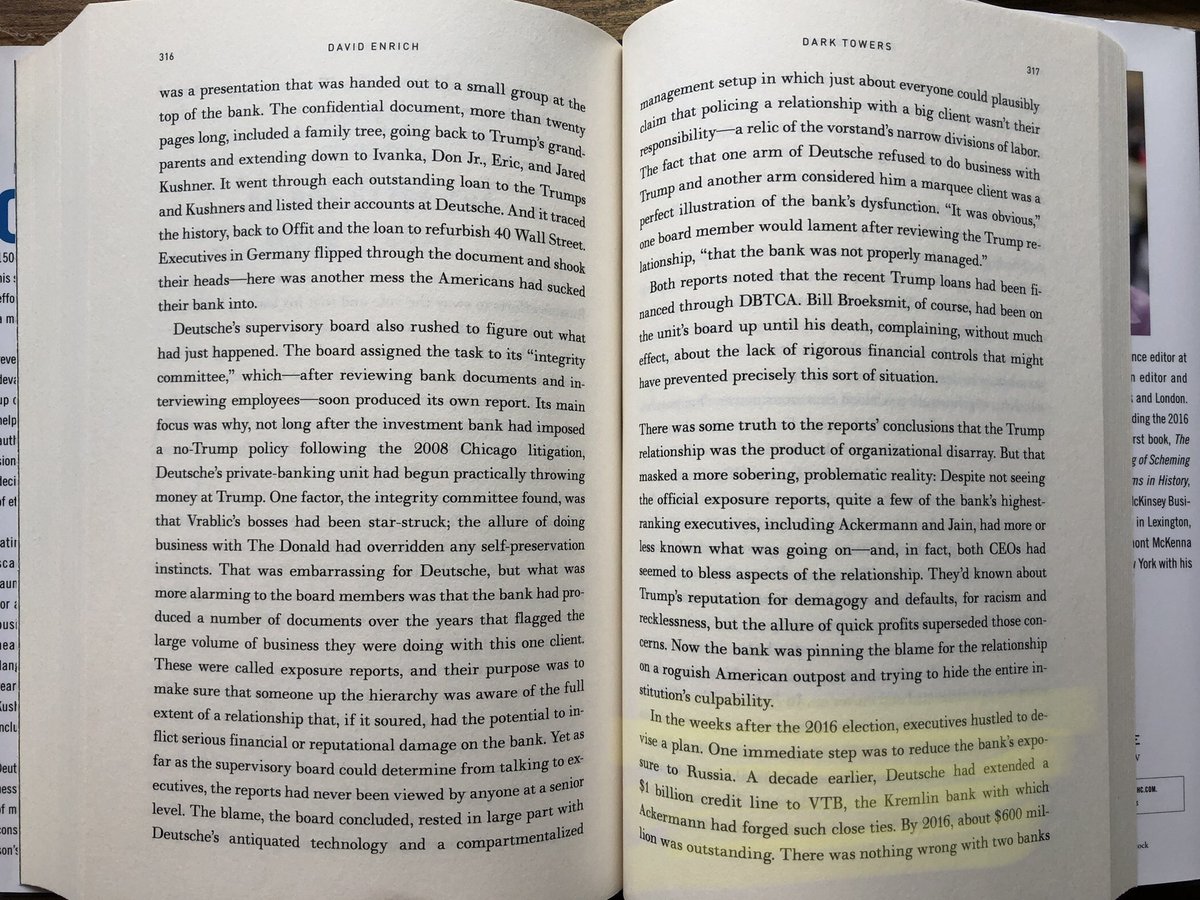

Vrablic has been under intense scrutiny because of her role facilitating huge loans to Trump and Kushners.

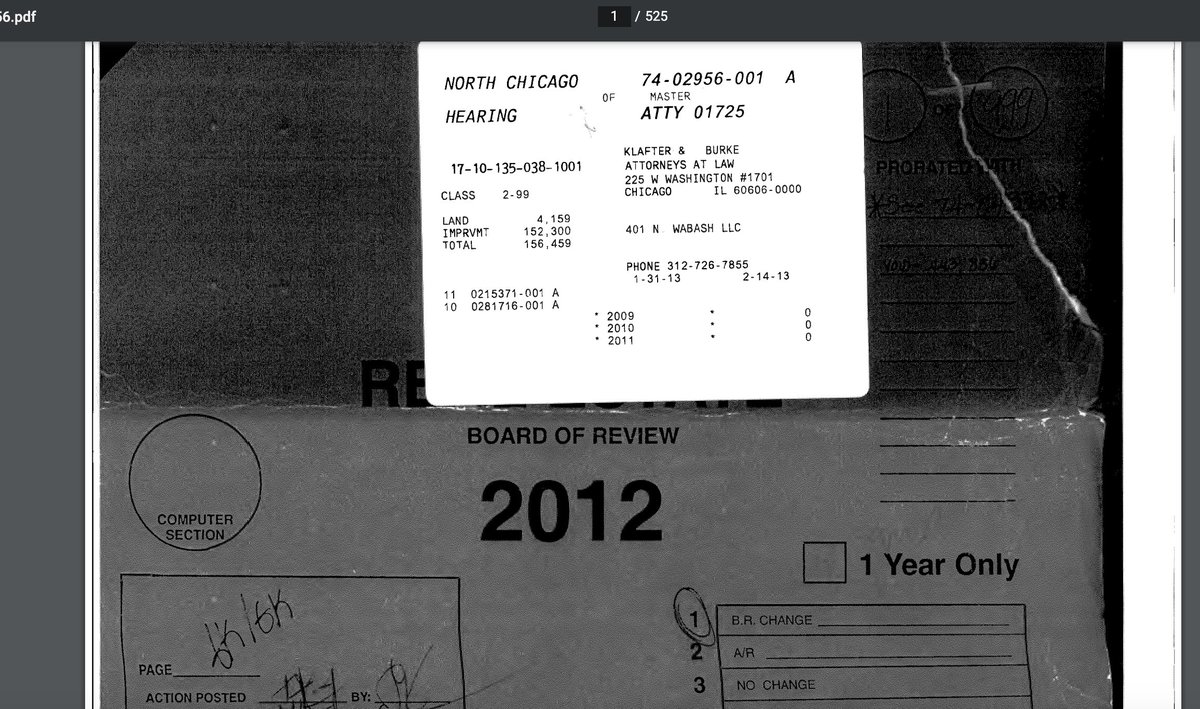

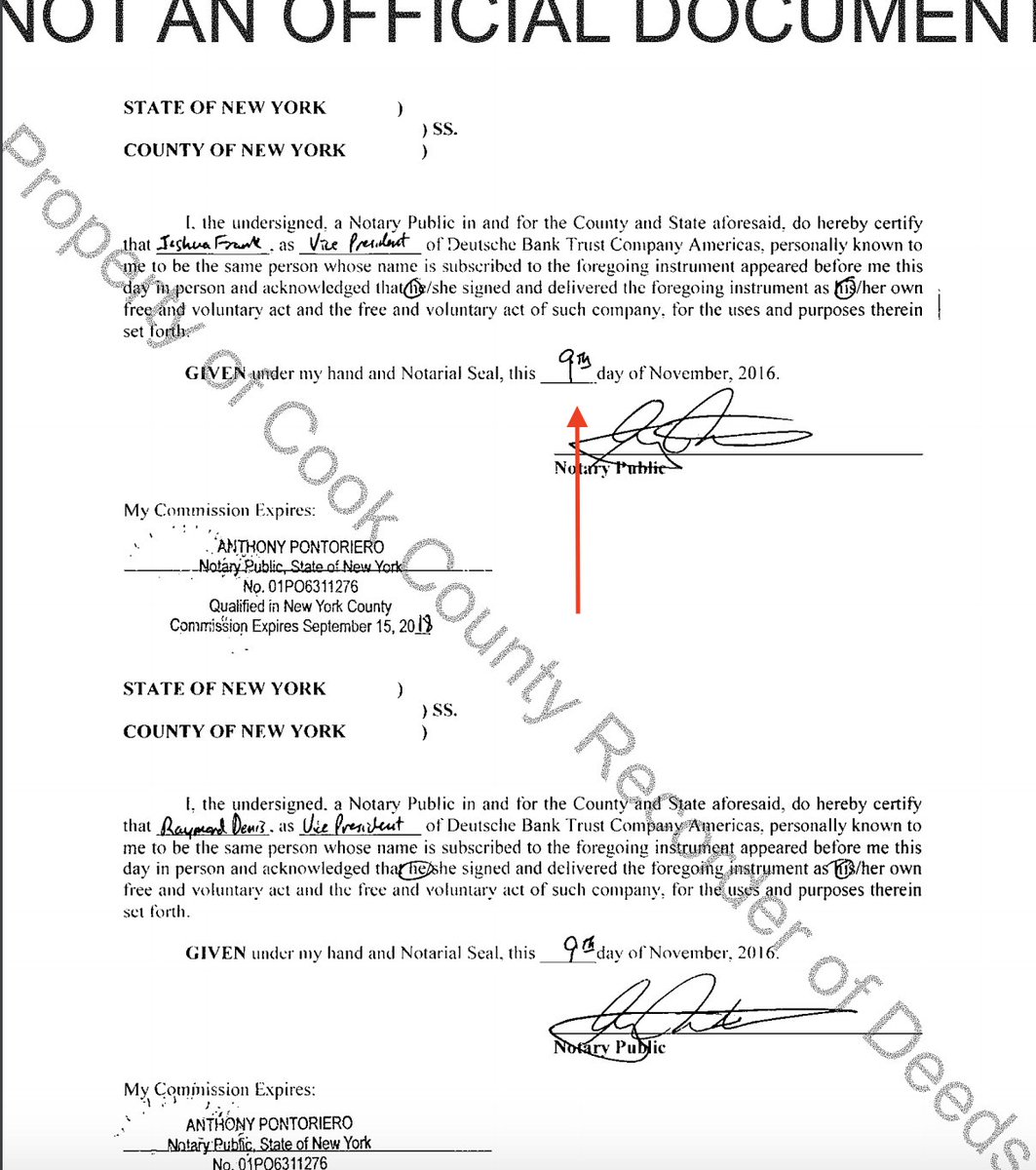

Deutsche has been conducting a months-long internal review of a 2013 real estate deal involving her and a company part-owned by Jared Kushner.

Deutsche has been conducting a months-long internal review of a 2013 real estate deal involving her and a company part-owned by Jared Kushner.

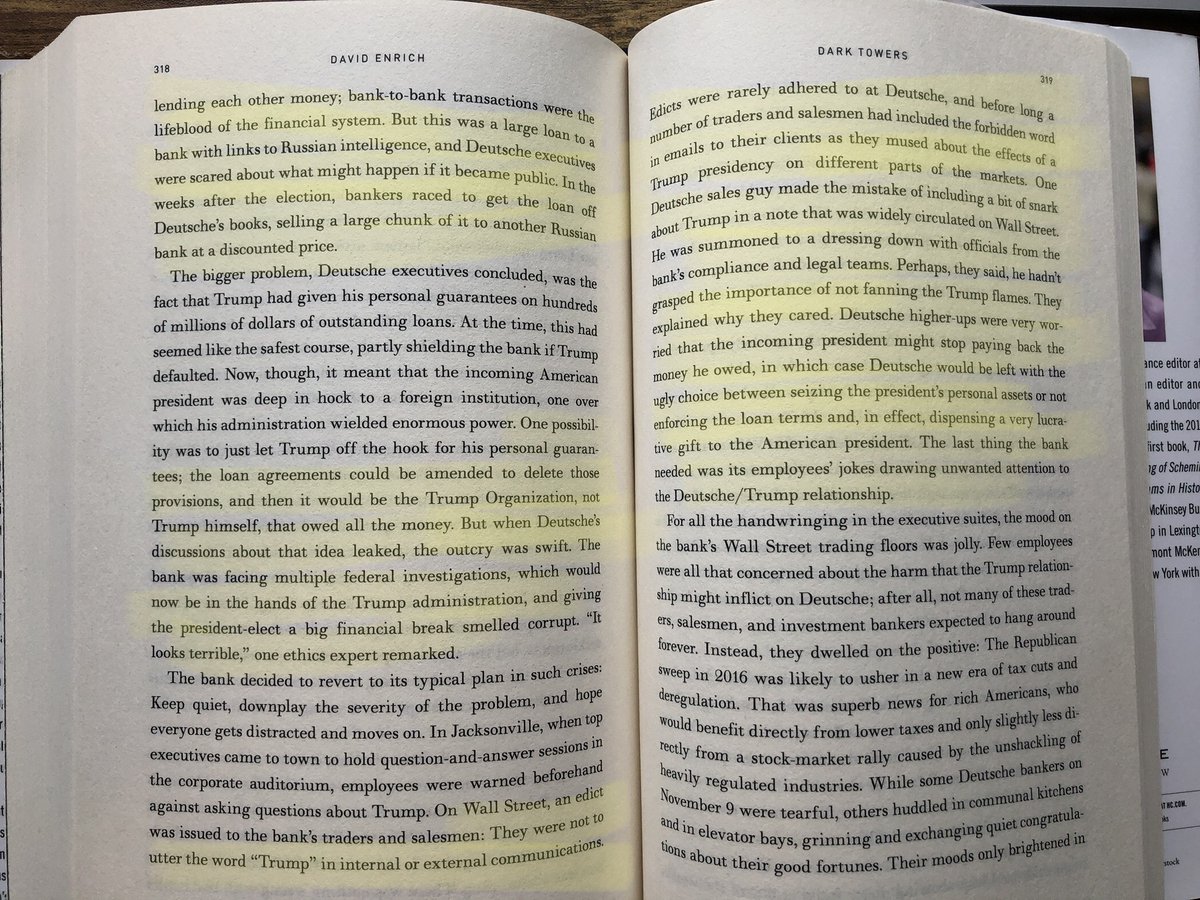

The timing on Vrablic's departure is awful for @realDonaldTrump. He has about $330M in personally-guaranteed loans to Deutsche Bank coming due in the next few years.

With Vrablic gone, Trump's chances of refinancing those loans with Deutsche Bank just dropped precipitously.

With Vrablic gone, Trump's chances of refinancing those loans with Deutsche Bank just dropped precipitously.

Trump and Vrablic were pretty tight. In a NYT interview in early 2016, he repeatedly (and falsely) described Vrablic as "the head of Deutsche Bank." nytimes.com/2016/05/24/bus…

When he won the election, Trump got her VIP seating at his inauguration.

When he won the election, Trump got her VIP seating at his inauguration.

Updated story with lots more details on the circumstances of Vrablic's abrupt departure and the bank's internal review into potential conflict of interest. nytimes.com/2020/12/22/bus…

• • •

Missing some Tweet in this thread? You can try to

force a refresh