Rant!

I'm seeing a lot of responses to this tweet about too many traders, punters and so on. Will all due respect, these snappy takes are just plain wrong. It takes traders, investors, degenerate gamblers, Warren Buffett ka baap value investors, idiots like me,

I'm seeing a lot of responses to this tweet about too many traders, punters and so on. Will all due respect, these snappy takes are just plain wrong. It takes traders, investors, degenerate gamblers, Warren Buffett ka baap value investors, idiots like me,

https://twitter.com/RMantri/status/1341426949277720578

god level forensic accounting stock pickers to make a market. The most stupidest narrative to have come of this post pandemic boom in users among brokers & other investing platforms is this asinine "Robinhood traders" narrative, I had written bout it too.

nakedbeta.com/musings-rants/…

nakedbeta.com/musings-rants/…

The insinuation is that apparently, there's a horde of day traders, selling their houses, pledging their body organs and are gambling their money away. The replies in the tweet are an extension of the absolutely dumb narrative.

The worst part is that this narrative has caught on and has been co-opted by everyone from scammy product pushers to TV anchors. Some advisors have anointed themselves as the saviours of these retail traders, the salvation being an SIP in some overpriced mutual fund.

Coming back to the tweet. Ironically and I don't meant to be insensitive, this pandemic has been the best thing to have happened for financial inclusion. There has been no single event that has caused such a huge surge in first time investors since Indian govt banned porn.

While the glamorous side i.e. a rampaging horde of day traders get all the attention, millions of people have started investing too. This is the best outcome all the advocates of financial inclusion could've hoped for.

Some people still live in a wonderland where trading is taboo, it's like BDSM, while investing is an unblemished virtue. To these people, trading is a sin and would want it not to exist and the markets should only have investors.

I have a suggestion. These people should band together and petition the govt to make day trading a capital offence that is punishable by a hanging first and then a firing squad for the dead body.

What's more, I think they should petition the government to sponsor brain surgeries to cut out the part of the brain that is responsible for greed. This way, there will be no traders because, there's no greed. Also, they shouldn't stop there.

They should ask the gormint to introduce waterboarding to punish people who don't start SIPs. This way we will have 90% financial inclusion in 20 days flat! So simple instead of lamenting over "Robinhood Traders".

Now, to the platform blaming. These new age platforms are one of the best things to have happened to investors and traders in the past decade. They have singlehandedly bought millions of traders who otherwise would've invested in scammy LIC policies, chit funds and emu farms.

And I don't get this tendency to blame platforms for all the people coming and trading and making or losing money. Most traders have never made any money and that has been a universal truism.

What's more, SEBI has done a brilliant job in ensuring that platforms in India don't sell greed. In most of the developed markets CFD platforms, for example, blatantly sell greed. That doesn't happen in India.

And what should the platforms do if someone wants to trade? How can they stop people from losing money? To their credit, a lot of these guys have put up guardrails. They can't handhold everyone.

https://twitter.com/LT3000Lyall/status/1341206549012701184?s=20

For better or worse, people only learn by doing stupid shit. There's a reason why most investors would've tried their hand at trading and then become investors. Nothing teaches you about investing like losing money in trading. But some people will always be beyond redemption!

If you go to a gun store, buy a gun and shoot yourself in the bum, is your bum to blame or the gun seller? Although, that would make a thrilling cocktail story. In the absence of these platforms, they would be trading elsewhere or do dabba trading or online gambling.

Although, I wouldn't go so far as to say "once a gambler – always a gambler" I'd say, if there is an intent to gamble there is always an outlet. And moreover, how is all trading gambling or punting? These blanket assertion are wrong.

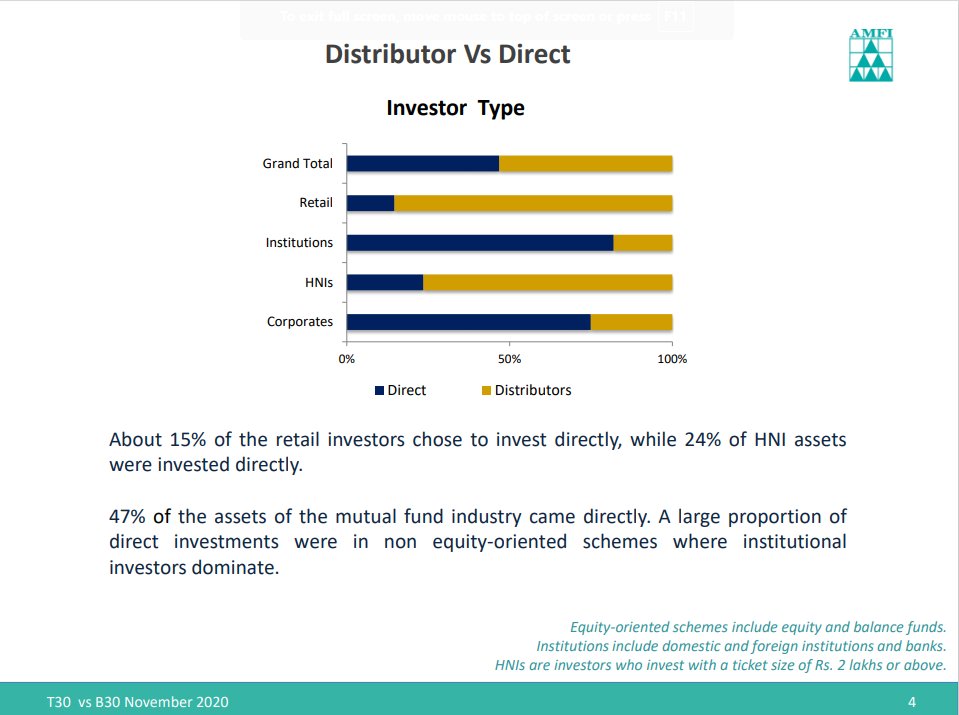

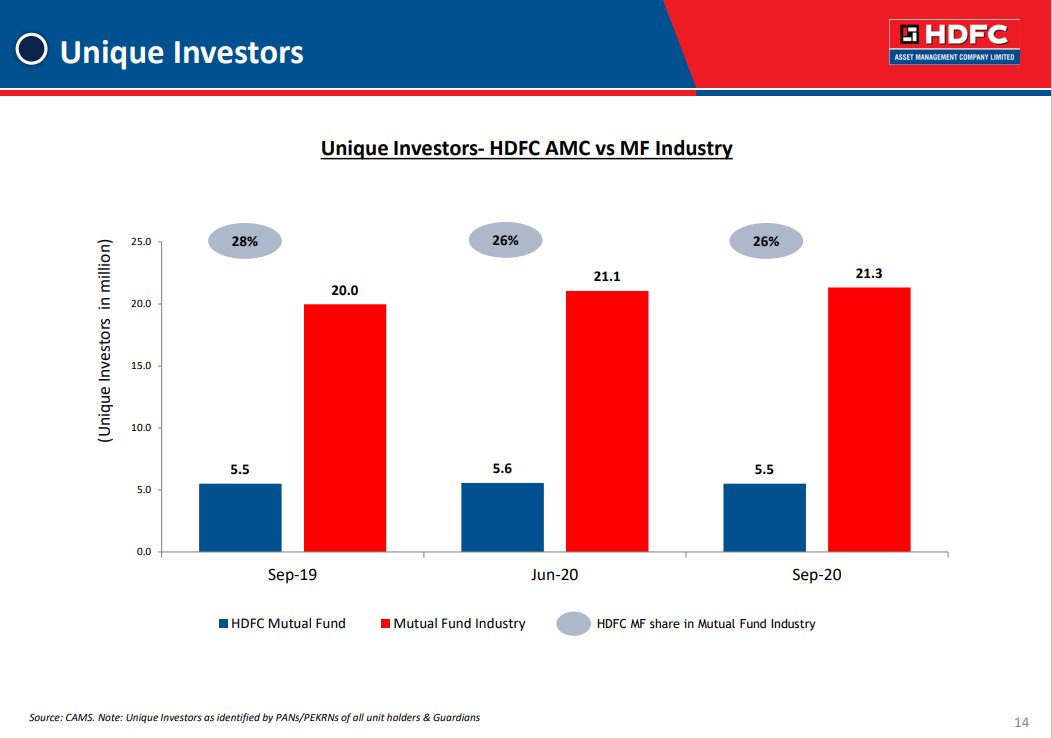

Now to the saviour complex that trading is bad, investing is good. What people don't realize is that most people don't have enough money to save to begin with. There is a reason why we just have 2 crore unique mutual funds.

https://twitter.com/ShyamNation/status/1338775628049305607?s=20

This whole notion of, come to the market, buy some long term compounding stocks, buy and die and become Buffett has to be the stupidest pipe dream being sold. Very few people are wired for this and I am not saying you shouldn't figure this this out.

Next, this while notion that financial literacy is a panacea and that people should be taught about finance and money in schools, people have hyped up the benefits of this.

Of course financial literacy is useful but the benefit of it has been overhyped in some ways. Just like research showing it helps, there's research showing financial literacy interventions have negligible impact. papers.ssrn.com/sol3/papers.cf…

So this idealistic notion that, people need to be taught about finance, they'll come to the markets, buy compounders and die with those compounders, compound while going potty and never trade and never succumb to greed is just that - a misguided notion!

If you want to say find an advisor, don't even bother. At best we might have some 10,000-15,000 good distributors and maybe 100 RIAs for 2 crore investors!

nakedbeta.com/musings-rants/…

nakedbeta.com/musings-rants/…

For all this sanctimonious preaching, mis-selling and greed have bought more new investors into the market than all the financial literacy initiatives put together! Let's not kid ourselves.

The easiest way to bring new investors is mis-selling, get them to trade and sell greed, ironically. Financial literacy is what you preach when you know you can't advocate for more mis-selling (by the way, mis-selling is a spectrum, there's good mis-selling too).

Coming back to the original point - traders, gamblers, investors make a market. It's a self correcting system, you make money you stay, if not you get out. The system can only save so many people. It's not possible to get everyone to behave.

• • •

Missing some Tweet in this thread? You can try to

force a refresh