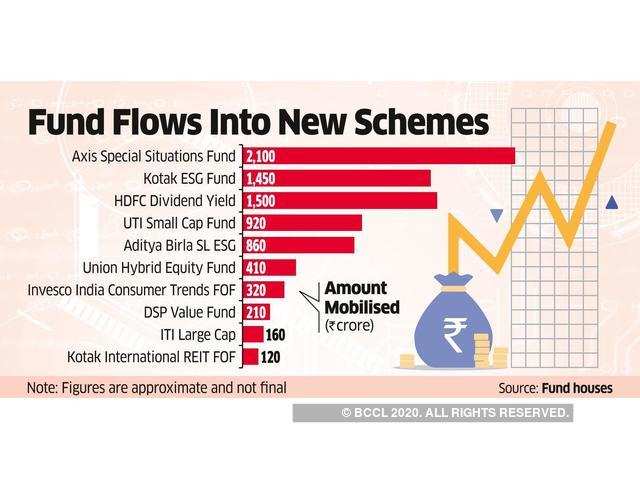

Wow, this NFO gravy train isn't stopping

BNP Paribas Mutual Fund has filed to launch BNP Paribas Aqua Fund of Fund. Underlying fund - BNP Paribas Aqua, which invests in companies with a focus on water. Clearly playing off on the hotness of ESG and global

sebi.gov.in/filings/mutual…

BNP Paribas Mutual Fund has filed to launch BNP Paribas Aqua Fund of Fund. Underlying fund - BNP Paribas Aqua, which invests in companies with a focus on water. Clearly playing off on the hotness of ESG and global

sebi.gov.in/filings/mutual…

The fund has marginally delivered over the benchmark. But the questions is, is it really worth all the hassle? Taking a fund manager risk, theme risk, style risk etc. Sure, you may get paid for it. But it's a hit or a miss.

In my it often pays to keep costs low and keep things uncomplicated as possible. One thing investors might not realize is that this trend of AMCs with foreign parentage or affiliations launching FOFs for useless global funds will pickup steam if the US performance continues.

Pointless costly diversification with sub-par funds, might not really be worth it when you have really good low-cost alternatives now. With these useless funds, you end up losing most of the juice in costs.

Take the example of the biggest US fund in India - Franklin India Feeder - Franklin U.S. Opportunities Fund. Here's how it has performed vs Nasdaq 100 ETF (N100). You can attribute it to whatever reason but it's useless.

It's very important not to let the recent US performance lead you astray. Great past performance most often than not means poor future returns. And in the case of poor performance, costs will just make it even worse.

I'm not saying all of the these global FOFs are bad, some might be good, but I'm a sceptic. This has nothing to with my preference for index funds as much as the misaligned inceptives to sell costly funds here.

If you look closely at the underlying global schemes of these FOFs, these tend to be orphan schemes that are shunned in that particular domestic market. Most often than not, it's just global garbage in new shiny domestic wrappers.

Look closely and know what you are getting. Costs will kill you. Don't over extrapolate the recent good performance of global themes and jump in.

• • •

Missing some Tweet in this thread? You can try to

force a refresh