While it's true that the coronavirus relief bill doesn't have anything designated as state and local aid, there's actually about $127 billion in there that can shore up state budgets -- which, remember, were down only $37 billion total through the end of September. 1/

The $82B in additional education grants and $45B for transportation projects has to be spent on education and transportation, but it's not contingent on states maintaining their own spending levels. They can use that federal infusion to redirect their own revenues. 2/

This is the primary way the federal government provided aid to state governments during the Great Recession -- by upping its contribution to Medicaid, education, and transportation, freeing up state dollars for other uses (including backfilling budgets). 3/

The Family First bill upped FMAP, giving states about $50 billion to work with.

The CARES Act offered about $56 billion in fungible education and transit aid, and Treasury guidance on CRF money (the $150B) lets much of it go to existing expenses as well. 4/

The CARES Act offered about $56 billion in fungible education and transit aid, and Treasury guidance on CRF money (the $150B) lets much of it go to existing expenses as well. 4/

It's hard to get a handle on exactly how much of the $150 billion actually went to existing expenses (things like the salaries of public safety and public health officials), but if the new relief bill passes, flexible aid is easily over $250 billion, and probably much more. 5/

During the Great Recession, the total amount of flexible aid was $144 billion.

And this is without even considering all the other ways the federal government has propped up state budgets, like enhanced UI (taxable income) and PPP (props up employer and employee taxes). 6/

And this is without even considering all the other ways the federal government has propped up state budgets, like enhanced UI (taxable income) and PPP (props up employer and employee taxes). 6/

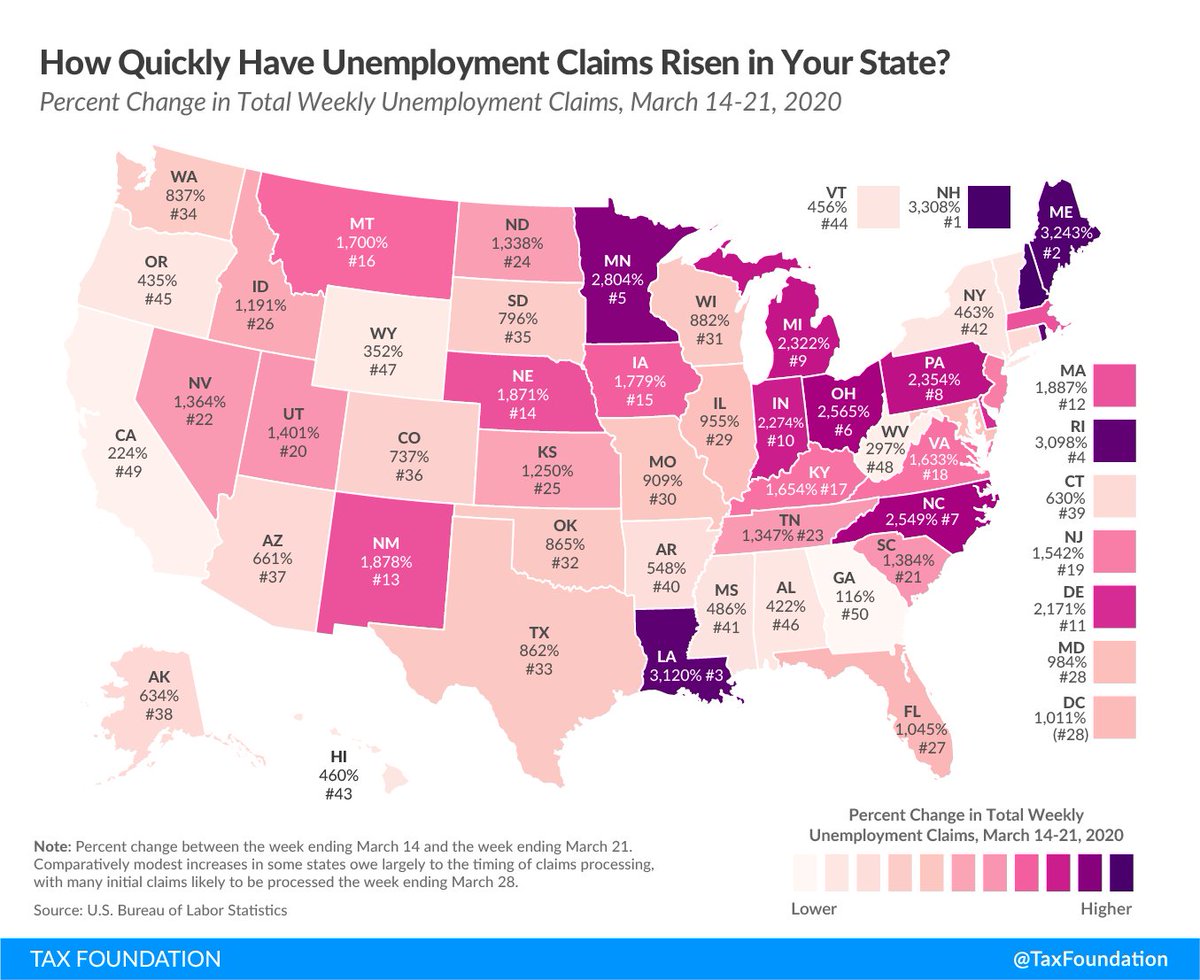

With state tax collections down $37.4 billion Jan-Sept, this is actually a fair bit of flexible aid. Yes, the final budgetary losses for states will be worse than $37B, with another hit coming in April, but $250B+ is sizable considering current losses.

taxfoundation.org/state-tax-reve…

taxfoundation.org/state-tax-reve…

Here's a more detailed summary of the above, which uses a slightly lower number ($106 billion) because some of the transportation money is designated for things that wouldn't be as fungible. taxfoundation.org/relief-bill-co…

• • •

Missing some Tweet in this thread? You can try to

force a refresh