People keep talking about how insane the valuations in the markets are right now. Let's look at some ridiculous math. Maybe it's not what you think.

Here's the M3 money supply at the beginning of the year.

Here's the M3 money supply at the beginning of the year.

Also, the total market capitalization of the U.S. stock market is $36,258,650,900,000 (9/30/2020).

The 3.4 trillion dollar increase, if you do maths, is 9.4% of the entire stock market.

The 3.4 trillion dollar increase, if you do maths, is 9.4% of the entire stock market.

And we know that when a government prints money, the smartest thing to do is buy assets with it. And the stock market is one of the easiest places to buy assets. This might make you think the stock market should go up nine percent.

But there's another factor.

But there's another factor.

A dollar in a business is worth more than a dollar, because dollars move around and that adds value. The velocity of money is roughly 1.44. So multiply the percent increase by the velocity of money and you get 13.5%.

So maybe the stock market went up 13.5%, if we did indeed just toss our money in the market.

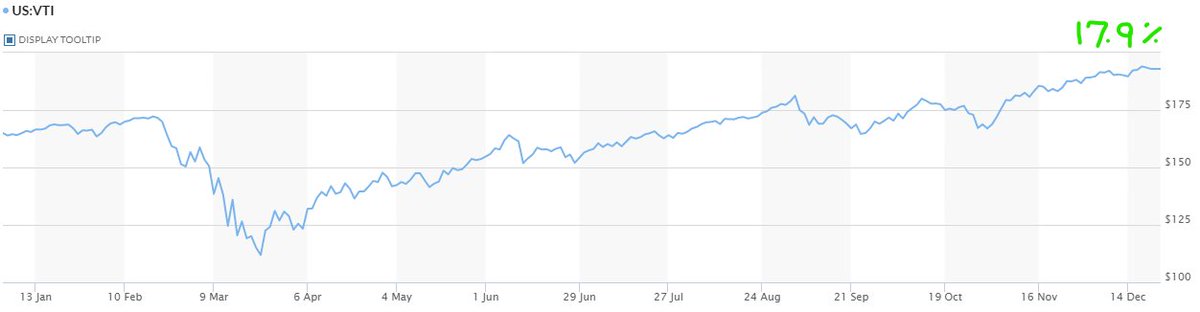

Well, VTI, the Vanguard Total Stock Market ETF is up 17.9%.

Well, VTI, the Vanguard Total Stock Market ETF is up 17.9%.

Which is definitely not 13.5%. But what about from January to February? That was already growth that was factored in before we started printing money. We were up 5.23% in February. So let's remove that from how much the stock market is up.

12.67% is awfully close to 13%.

Which is pretty crazy. Because I didn't do any of the math before writing this.

I just guessed there might be a similarity in the stimulus and the market movement.

So maybe we did indeed just throw all our money in the stock market.

Which is pretty crazy. Because I didn't do any of the math before writing this.

I just guessed there might be a similarity in the stimulus and the market movement.

So maybe we did indeed just throw all our money in the stock market.

And the valuations aren't as weird as they seem.

Except that last .33%, which was obviously me hodling bitcoin.

Except that last .33%, which was obviously me hodling bitcoin.

disclaimer: This is not financial advice, it's just an expose on the ridiculousness of earth. I am indeed both hodling bitcoin and investing in a market that is being propped up and is also, I believe, bullish in certain sectors... why wouldn't I?

Here's year 2020 money and markets summarized in video form, part one. #investing #StockMarket

• • •

Missing some Tweet in this thread? You can try to

force a refresh