In his Macron Doctrine, @EmmanuelMacron promised a post-colonial, post-financialisation Afro-European Axis.

Yet, @nssylla & I show, in Africa, France pushes a 'development as derisking' paradigm that financialises development & privatises public goods.

geopolitique.eu/en/2020/12/23/…

Yet, @nssylla & I show, in Africa, France pushes a 'development as derisking' paradigm that financialises development & privatises public goods.

geopolitique.eu/en/2020/12/23/…

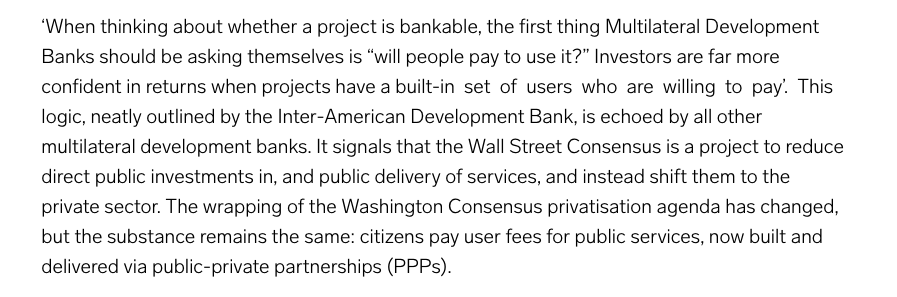

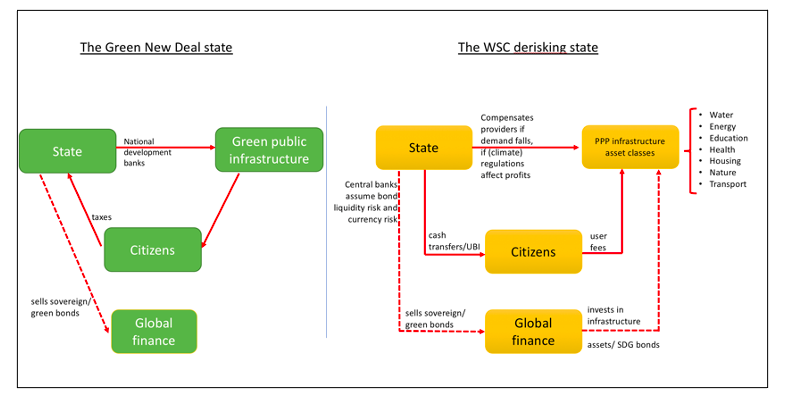

The #WallStreetConsensus is a new paradigm that frames development as a question of 'producing bankable projects' that can attract institutional investors.

Development asset classes = privatisation of social and physical infrastructure via PPPs.

Development asset classes = privatisation of social and physical infrastructure via PPPs.

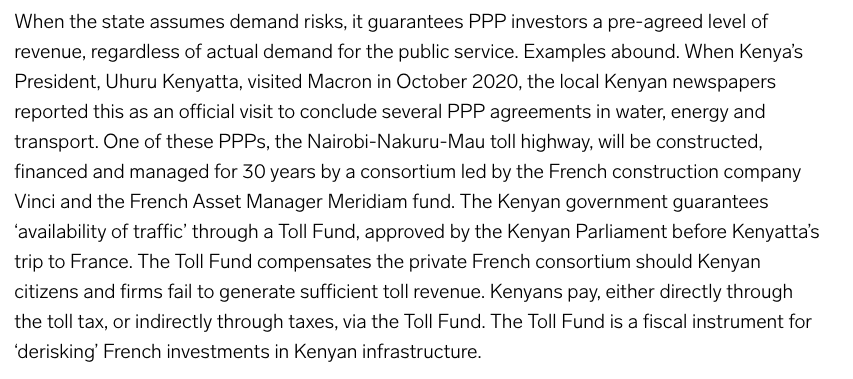

But 'Development as Derisking' is not just about privatization. It rather seeks to transform the state, to reduce statecraft to derisking investments for global financiers. A bankable project is one where the state commits to put a safety net under investors.

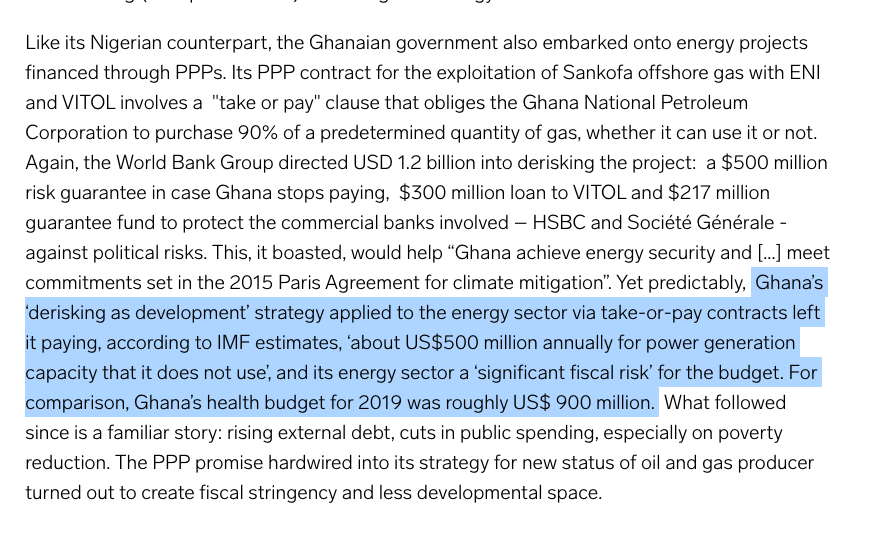

In Africa, the turn to derisking plants budgetary time bombs. Ghana is an excellent example: it spends half of its health budget on derisking gas PPPs for power it cannot use.

Ivory Coast, one of Macron's pet PPP projects has become a white elephant, very expensive for the taxpayer, yet very profitable for the French companies.

derisking is not only about state guaranteeing demand for PPP services. It also relies on colonial practices of currency derisking for imperial companies.

if you think this is a conspiracy theory, think again:

Mark Carney's COP26 proposals on private finance call for Development as Derisking to address the climate crisis in developing countries

Mark Carney's COP26 proposals on private finance call for Development as Derisking to address the climate crisis in developing countries

What Macron denounces in Europe, he champions in Africa. There, Macron government has promoted financialisation, more aggressively than his predecessors, through a Grand Development Bargain with private finance.

Three dangers in this new Bargain:

1. Post Covid pressure on African governments to extend safety net for private investors in ‘development’ asset classes.

2. Macron Doctrine reinforces stereotype that African state should not be trusted to provide quality public services.

1. Post Covid pressure on African governments to extend safety net for private investors in ‘development’ asset classes.

2. Macron Doctrine reinforces stereotype that African state should not be trusted to provide quality public services.

3. The climate politics of the Wall Street Consensus - I'll let you read about that in the piece, but it's the most significant one.

longer story of the Wall Street Consensus here

https://twitter.com/DanielaGabor/status/1280081449748750336?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh