As the next phase of evolution as a trader I started to do 1 to 3 days #swing #trading in fno stocks. I am doing in cash for longs and options for short. So strategy is a bit lop sided. Since shorting is my strength, i am comfortable with risk

with each chart logic explained.

with each chart logic explained.

Before actual trading, I have been practicing this with small quantities (long only) with #zerodha #60daychallenge.

I have 5 days to go, but result is known already ;-).

#NSE #FnO #experiment #learning.

I might succeed, I might fail. First week was good one.

I have 5 days to go, but result is known already ;-).

#NSE #FnO #experiment #learning.

I might succeed, I might fail. First week was good one.

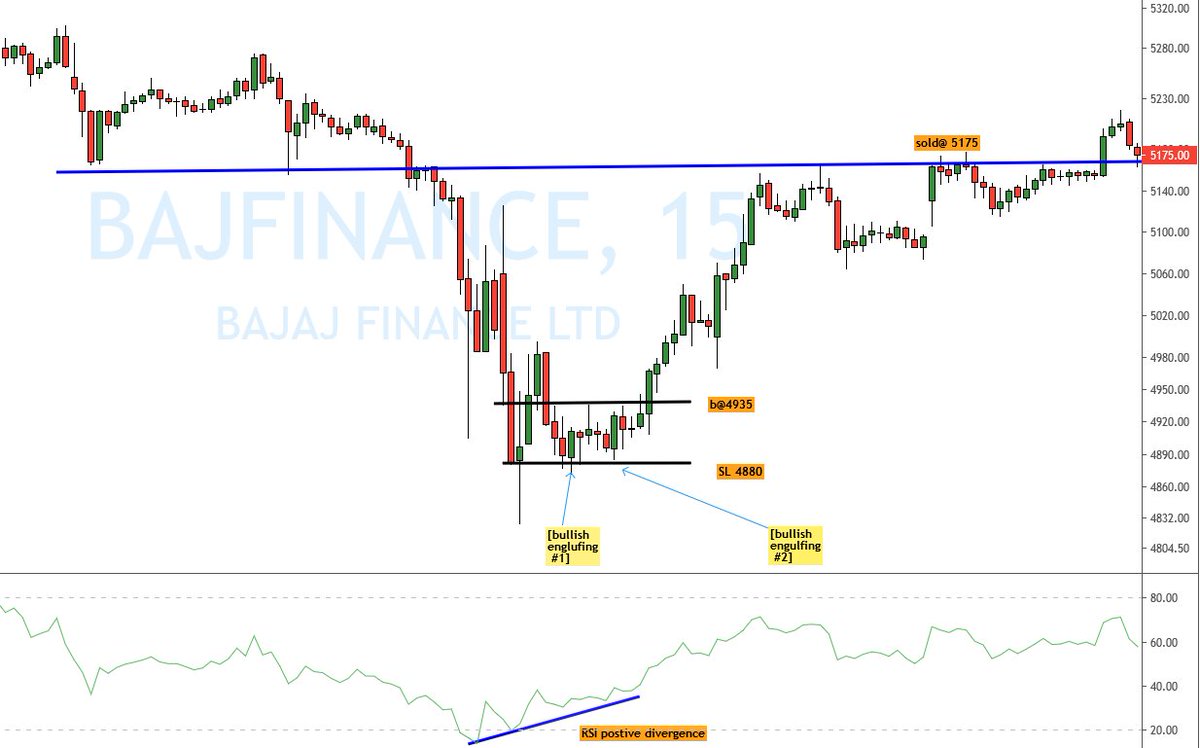

#BAJFINANCE.

1.multiple #bullish #engulfings at swing support area,

2. consolidation

3. rsi divergence

Risk reward 1:4

Result: Target achieved

#NIFTY #TradingView

1.multiple #bullish #engulfings at swing support area,

2. consolidation

3. rsi divergence

Risk reward 1:4

Result: Target achieved

#NIFTY #TradingView

trade #2 HDFC

#hattip @dtbhat who alerted me to possiblilty of reversal.

1. RSI divergence

2. Consolidation with bullish candles

3. Follow through with a bullish engulfing candle for add on

Risk Reward: 1:7

Result: target achieved

#priceaction #candlesticks

#hattip @dtbhat who alerted me to possiblilty of reversal.

1. RSI divergence

2. Consolidation with bullish candles

3. Follow through with a bullish engulfing candle for add on

Risk Reward: 1:7

Result: target achieved

#priceaction #candlesticks

trade #3 #TATAMOTORS

1. #gravestone #doji in eod charts

2. #bullish #engulfing for entry in PE

3. #rsi diveregence

4. consolidation with bearish candles and breakdown for exit

Risk Reward: 1:11.

Result: Trailing stop hit. I had much higher targets in mind.

1. #gravestone #doji in eod charts

2. #bullish #engulfing for entry in PE

3. #rsi diveregence

4. consolidation with bearish candles and breakdown for exit

Risk Reward: 1:11.

Result: Trailing stop hit. I had much higher targets in mind.

all 3 trades this week were successful.

I attribute it to #beginners luck.

Have initiated one yesterday.

Will log it after closure of trade.

@ChartingG advice taken :-)

Very simple strategy. Identify candlstick message, look for consolidation, look for break. minimum RR 1:2

I attribute it to #beginners luck.

Have initiated one yesterday.

Will log it after closure of trade.

@ChartingG advice taken :-)

Very simple strategy. Identify candlstick message, look for consolidation, look for break. minimum RR 1:2

how to deal with gap ups, gap downs, #noidea. in this phase of the experiment, I am keeping these variables aside.

if it gaps up/down below sl exit with loss.

First stabilize core then optimize.

#firstprinciples

if it gaps up/down below sl exit with loss.

First stabilize core then optimize.

#firstprinciples

• • •

Missing some Tweet in this thread? You can try to

force a refresh