1/ Thread: You are not a lottery ticket

Peter Thiel is a contrarian. In 2013, he spoke in SXSW pushing against the conventional wisdom of luck’s outsized role.

Peter Thiel is a contrarian. In 2013, he spoke in SXSW pushing against the conventional wisdom of luck’s outsized role.

2/ I like Thiel’s ideas not because I fully agree with them, but because he consistently pushes against ideas that seem settled.

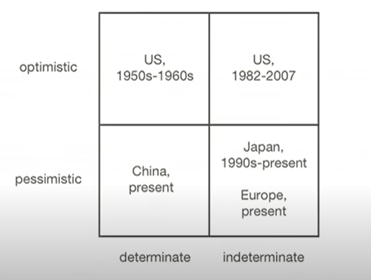

Peter showed a simple 2x2 framework to make his case.

Are we optimistic/pessimistic about the future?

Is the future determinate or indeterminate?

Peter showed a simple 2x2 framework to make his case.

Are we optimistic/pessimistic about the future?

Is the future determinate or indeterminate?

3/ Optimists think about the promises of the future whereas pessimists deeply fear the future.

If the future is determinate, you should have strong conviction. If it is not, you should heavily diversify.

If the future is determinate, you should have strong conviction. If it is not, you should heavily diversify.

4/ In the 50s-60s, Americans not only believed they would be at the forefront of progress but also had big, hairy audacious projects in mind that would materialize the definite future they had in mind.

5/ US, generally speaking, still remains optimistic perhaps by just extrapolating the past, but the future vision seems increasingly unclear.

Japan and Europe probably need no explanation at this point.

Japan and Europe probably need no explanation at this point.

6/ Thiel identified China in the “determinate pessimistic” quadrant and cited the demographic reality as his rationale, “much of China will get old before they can become rich”

I would push back a little on that.

I would push back a little on that.

7/ It is likely that the median Chinese will not have the same quality of life as the median person in the US in the 21st century.

But because of the sheer size of the population, it is not impossible that the # of millionaires in China (4.4M) may exceed the # in the US (11M).

But because of the sheer size of the population, it is not impossible that the # of millionaires in China (4.4M) may exceed the # in the US (11M).

8/ I will share two data points to make a case that the threat from China can potentially be more potent than some in the US like to think.

9/ Back to Thiel’s speech.

Thiel extends his framework to an interesting angle.

He introduced two new variables (investment and savings) into the framework and asked almost a rhetorical question on whether a low savings AND low investment can sustain optimism in the future.

Thiel extends his framework to an interesting angle.

He introduced two new variables (investment and savings) into the framework and asked almost a rhetorical question on whether a low savings AND low investment can sustain optimism in the future.

10/ Thiel argued a nation’s psyche can also play an instrumental role in determining which industries dominate in particular era.

You need “definite optimism” to undertake projects such as transcontinental railroad.

You need “definite optimism” to undertake projects such as transcontinental railroad.

11/ In indefinite optimism, as mentioned earlier, you are optimistic but don’t have clear vision of the future.

In such scenario, people would rather invest in index than pick stocks since picking stocks requires some sort of definite version of the future.

In such scenario, people would rather invest in index than pick stocks since picking stocks requires some sort of definite version of the future.

12/ “In a definite world, money is a means to an end because there r specific things u want to do with the money. In an indefinite world, u have no idea what to do with the money, so money simply becomes an end in itself which seems a little bit perverse-u just accumulate money”

13/ In an indefinite world, nobody has any idea what to do with the money, as illustrated in the below flow chart.

Since people are out of ideas, Thiel thinks they put up with negative real yields in 10-year UST.

Since people are out of ideas, Thiel thinks they put up with negative real yields in 10-year UST.

14/ Thiel mentioned it’s not surprising why Buffett’s portfolio consisted of banks/insurance cos in an indefinite optimism world.

Even beyond the world of investing, Thiel fit philosophers in this framework to distinguish these worldviews.

Even beyond the world of investing, Thiel fit philosophers in this framework to distinguish these worldviews.

15/ Thiel ends the speech mentioning how the big tech could become this big because of their founders’ definite optimism.

Because of their definite vision, none of them wanted to sell their companies.

Because of their definite vision, none of them wanted to sell their companies.

16/ A bit of a narrative violation: off the top of my head, I could think all of them wanted to sell their companies in the early stage (except Bezos, I cannot seem to remember reading any such musing).

17/ To be clear, Thiel is not too enamored with the big tech, especially Google.

His “grudge” is not that big tech has done damage to the society, rather they should have done much more with the resources they have.

His “grudge” is not that big tech has done damage to the society, rather they should have done much more with the resources they have.

• • •

Missing some Tweet in this thread? You can try to

force a refresh