What is pyramiding?

In pyramiding we add on to a position when it is going in our direction. Its basically opposite of averaging down.

MOMENTUM - Success of a pyramiding trade depend on this ingredient, the more the momentum the better pyramiding.

In pyramiding we add on to a position when it is going in our direction. Its basically opposite of averaging down.

MOMENTUM - Success of a pyramiding trade depend on this ingredient, the more the momentum the better pyramiding.

There are many way to enter and exit in a stock-

1. ALL IN - ALL OUT

2. ALL IN - SCALE OUT

3. SCALE IN - SCALE OUT

4. SCALE IN - ALL OUT ( I use this one)

Why traders use Pyramiding ?

More than anything what pyramiding do is keep your losers small and your winners - Big.

1. ALL IN - ALL OUT

2. ALL IN - SCALE OUT

3. SCALE IN - SCALE OUT

4. SCALE IN - ALL OUT ( I use this one)

Why traders use Pyramiding ?

More than anything what pyramiding do is keep your losers small and your winners - Big.

Pyramiding in my view keeps your dd smaller as your losers are very small because you enters with only a fraction of what you would have entered Normally.

BUT, not necessarily it should be more profitable than ALL IN- ALL OUT, Where one enters all at once and sell all at once.

BUT, not necessarily it should be more profitable than ALL IN- ALL OUT, Where one enters all at once and sell all at once.

HOW TO DO PYRAMIDING-

There are various methods which are used by traders for pyramiding ,while keeping the basic concept of adding onto the strength.

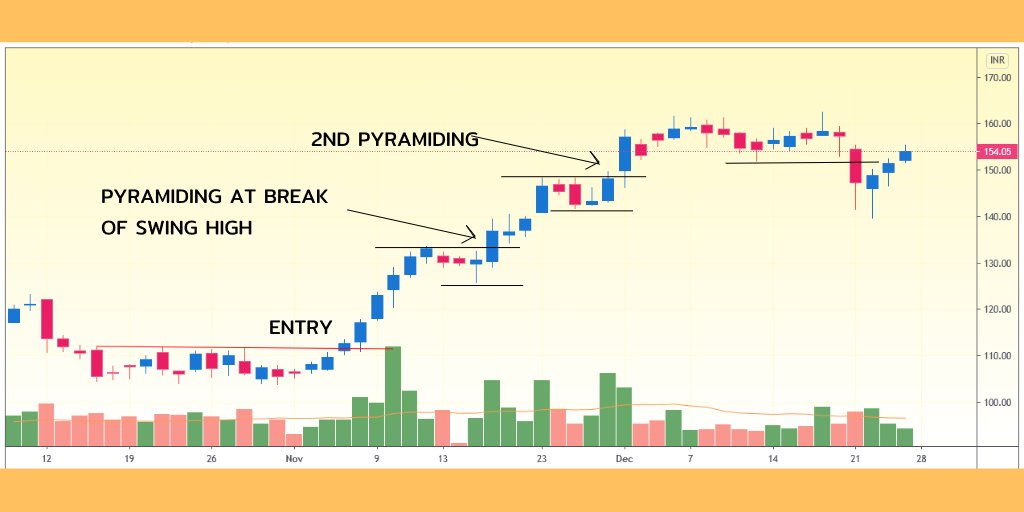

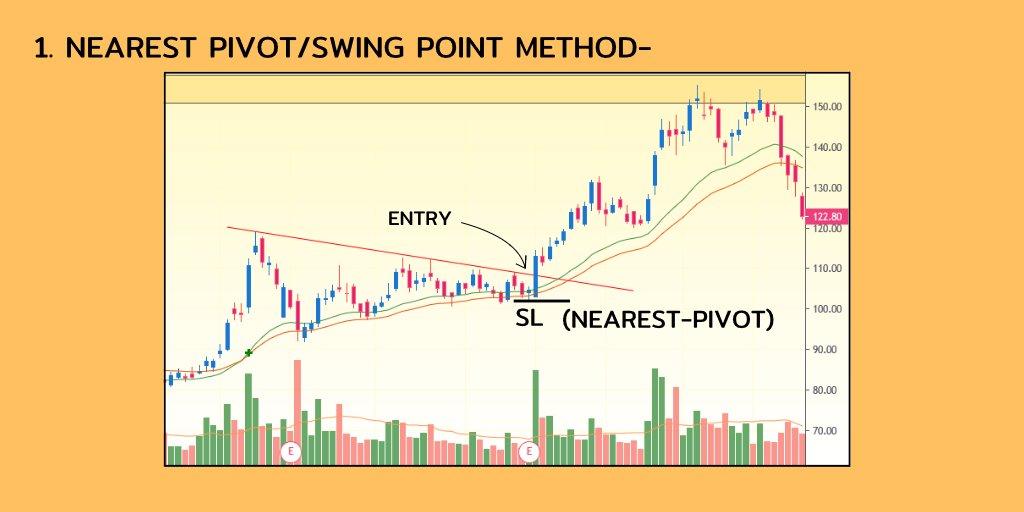

1. PYRAMIDING AND TRAILING BASED UPON STRUCTURE-

In this method we scale in or pyramid the qty when the stock breaks above

There are various methods which are used by traders for pyramiding ,while keeping the basic concept of adding onto the strength.

1. PYRAMIDING AND TRAILING BASED UPON STRUCTURE-

In this method we scale in or pyramid the qty when the stock breaks above

a swing point.

A swing point High is which is not tested or broken for next 5 candles and vice versa for a swing point low.

We are adding on to the strength as we know that if a swing point is broken ,there is High probability of a move coming into that direction.

A swing point High is which is not tested or broken for next 5 candles and vice versa for a swing point low.

We are adding on to the strength as we know that if a swing point is broken ,there is High probability of a move coming into that direction.

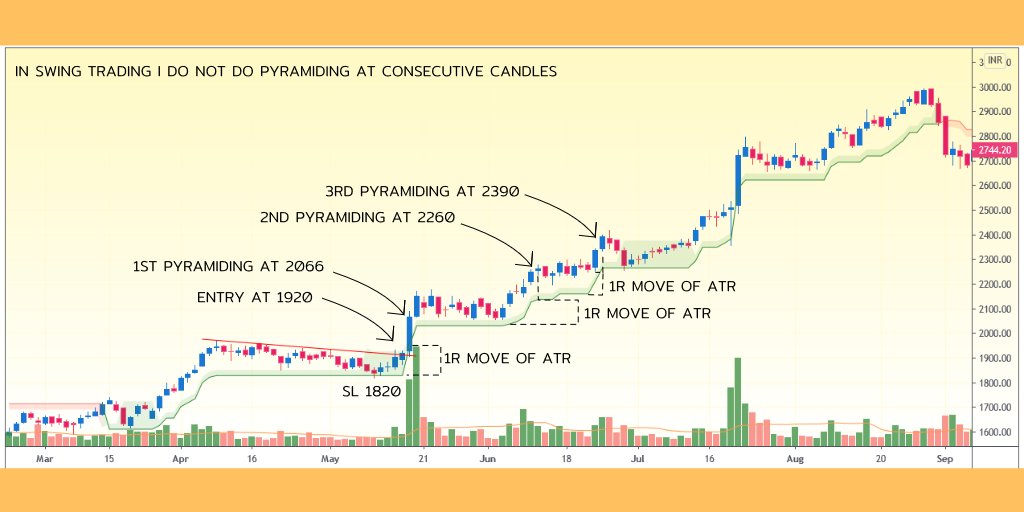

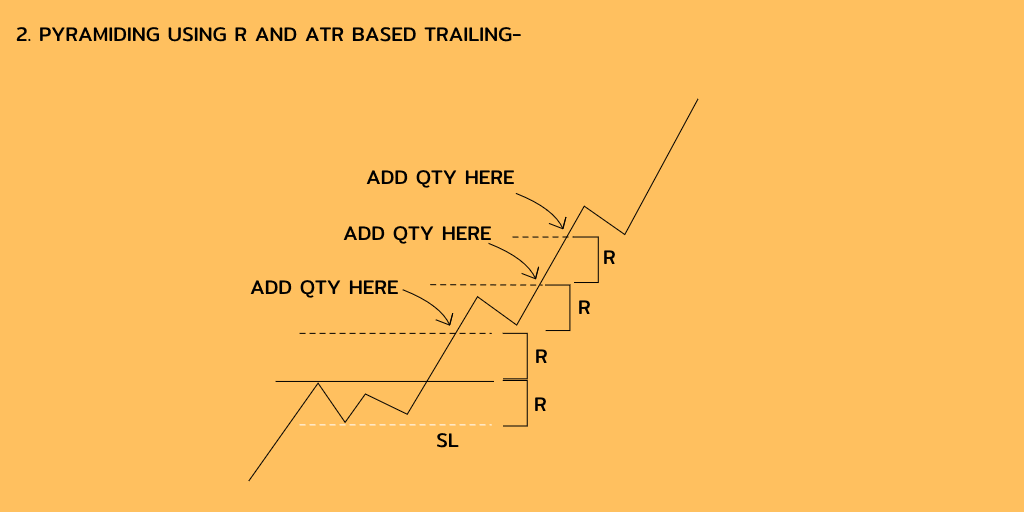

2. PYRAMIDING USING R AND STRUCTURE BASED TRAILING-

In this method we Pyramid the qty when the price increases by 1R or (X) R from our trade.

Trailing is done according to the structure.

In this method we Pyramid the qty when the price increases by 1R or (X) R from our trade.

Trailing is done according to the structure.

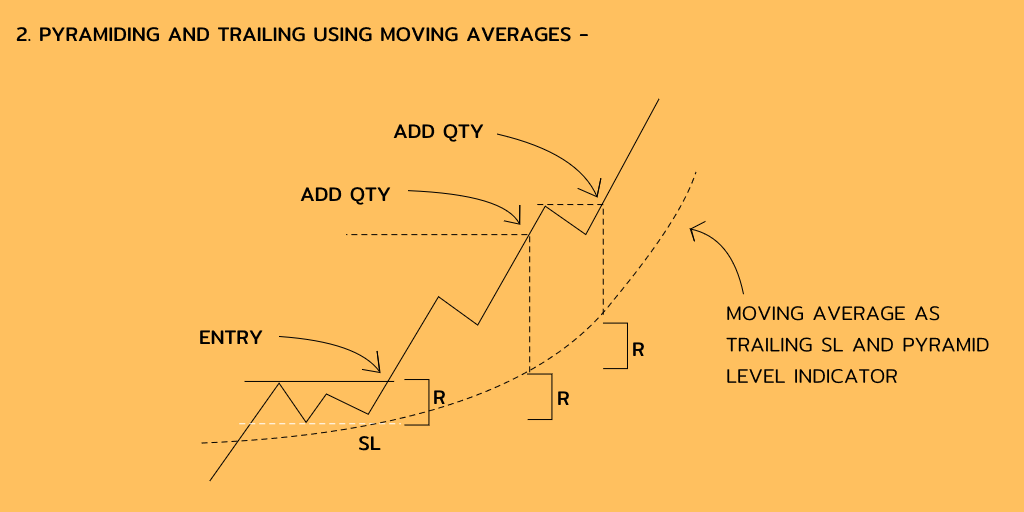

3. PYRAMIDING AND TRAILING USING MOVING AVERAGES-

In this method we use the moving average to decide the pyramiding level.

Say our SL was (x) rs below our entry , so we will pyramid when the moving average will move (x) rs in our direction.

In this method we use the moving average to decide the pyramiding level.

Say our SL was (x) rs below our entry , so we will pyramid when the moving average will move (x) rs in our direction.

We can use this method if we are using as moving average as an exiting as an exiting or trailing method.

Example-

Example-

4. PYRAMIDING AND TRAILING USING ATR INDICATOR-

This is similar to the previous one, where we used a Moving avg., we use this method if we want to use ATR indicator as our TSL method.

This is similar to the previous one, where we used a Moving avg., we use this method if we want to use ATR indicator as our TSL method.

In all the above methods , you can see that with increasing Pyramid your Risk may also increase.

After adding qty 3-4 times , Risk can also increase 2-3 times depending on How much qty you add each time and depending upon the structure.

After adding qty 3-4 times , Risk can also increase 2-3 times depending on How much qty you add each time and depending upon the structure.

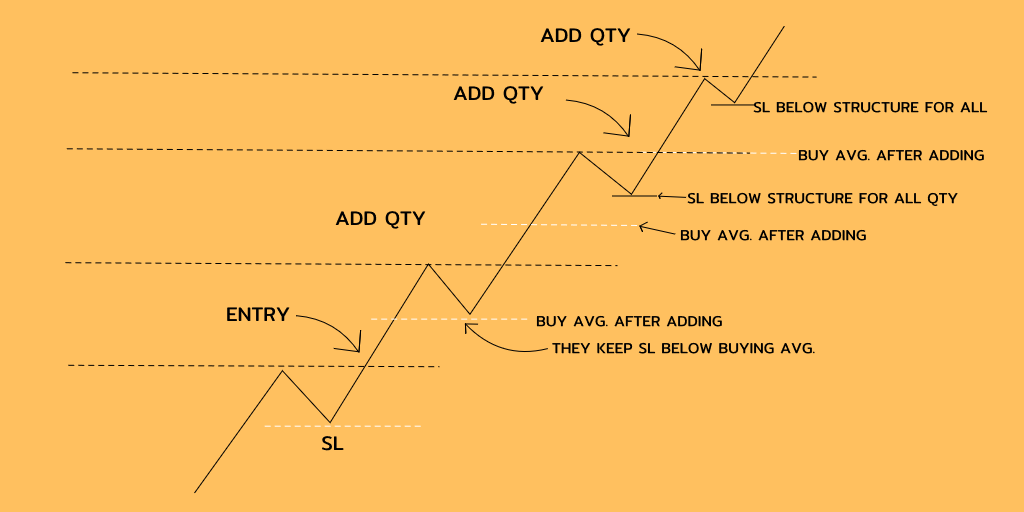

• So to counter this some traders use a different trailing method in which they do not increase the risk Even after pyramiding.

What they do is when they pyramid for the first time they place the sl at same level as the buying average.

What they do is when they pyramid for the first time they place the sl at same level as the buying average.

And then eventually they Trail the SL according to the structure, so after 2-3 Pyramidings , the trade will have almost no risk and if the trade gains momentum , returns will be Huge.

So they are adding qty without adding more risk and increases rewards.

So they are adding qty without adding more risk and increases rewards.

But in doing this many times , whipsaws Takes out there trailing stop losses, so they get out from a trade at breakeven even when they got the direction right

Re-entry is very useful in these type of methods

But this method focuses on those trades which moves With high momentum

Re-entry is very useful in these type of methods

But this method focuses on those trades which moves With high momentum

• PITFALLS OF PYRAMIDING-

1. Though it increases our Returns and decreases our DD In most cases, but when you are dealing with swing trading your biggest Risk are gaps.

With pyramiding 3-4 times your overnight risk also increases exponentially.

1. Though it increases our Returns and decreases our DD In most cases, but when you are dealing with swing trading your biggest Risk are gaps.

With pyramiding 3-4 times your overnight risk also increases exponentially.

HOW TO COUNTER THIS-

1. Cap the max no. of times you would pyramid.

2. Pyramid more at start of a trend rather then when it is stretched.

3. Take less risk in your initial position, so that overall risk will not wipe out your account overnight.

1. Cap the max no. of times you would pyramid.

2. Pyramid more at start of a trend rather then when it is stretched.

3. Take less risk in your initial position, so that overall risk will not wipe out your account overnight.

4. Don’t pyramid on consecutive candles after one pyramiding.

* Can Pyramiding make a strategy with NO edge into a profitable one?

• Pyramiding is like leverage, it will only work when you have an edge even if you are trading with single tranche (only entry and no pyramiding)

* Can Pyramiding make a strategy with NO edge into a profitable one?

• Pyramiding is like leverage, it will only work when you have an edge even if you are trading with single tranche (only entry and no pyramiding)

• So only think of using it if you have an edge without it.

• SOME MORE IMPORTANT POINTS-

1. Pyramiding works best on Momentum, Trend following strategies , some traders try to use it in Mean reversion and scalping, it may not work in those methods.

• SOME MORE IMPORTANT POINTS-

1. Pyramiding works best on Momentum, Trend following strategies , some traders try to use it in Mean reversion and scalping, it may not work in those methods.

2. You have to leave many 2-3 R trades if you are opting for using Pyramiding, so as your winner will be huge, so keep that in mind.

3. I said previously that it is not necessarily that one makes more by using pyramiding.

3. I said previously that it is not necessarily that one makes more by using pyramiding.

- If you check most of the Nifty intraday trend following systems will work better with ALL IN - ALL OUT approach, because it has less momentum.

- Pyramiding works better with Nifty bank as it has more momentum.

- Pyramiding works better with Nifty bank as it has more momentum.

- I mostly use pyramiding on stocks as they generally have more momentum

• Some traders also use scale in and scale out method,mostly a discretionary trader would choose this method in my view,will explain that some other day

These are my opinions and not necessarily be yours

• Some traders also use scale in and scale out method,mostly a discretionary trader would choose this method in my view,will explain that some other day

These are my opinions and not necessarily be yours

Thanks for reading till here.

Cheers,

Trader knight.

Cheers,

Trader knight.

• • •

Missing some Tweet in this thread? You can try to

force a refresh