Proud to release my first essay on Irish (global) econ history and its larger lesson on approaches to econ from international vs. nationalist perspectives.

Dangers of American Finance: Irish Revolutionary Attitudes Toward International Finance...

(1/15)

ryanresearch.co/post/dangers-o…

Dangers of American Finance: Irish Revolutionary Attitudes Toward International Finance...

(1/15)

ryanresearch.co/post/dangers-o…

It all starts w/ the Irish Revolution of 1919-1922. The Irish crowdfunded their startup gov't from Irish-Americans, totaling ~$6m (~$87m today).

They enthusiastically toured America publically soliciting support for an illegal war vs. an ally.

(2/15)

bit.ly/3mZf2EC

They enthusiastically toured America publically soliciting support for an illegal war vs. an ally.

(2/15)

bit.ly/3mZf2EC

After the Anglo-Irish Treaty ending the Revolution, institutional investors could legally fund the new gov't.

International finance / Wall Street immediately tempted the Irish with an offer of $20m worth of bonds on public markets in the NYtimes.

(3/15)

bit.ly/3mZf2EC

International finance / Wall Street immediately tempted the Irish with an offer of $20m worth of bonds on public markets in the NYtimes.

(3/15)

bit.ly/3mZf2EC

Two Irish revolutionaries would issue grave warnings that culminated in the rejection of this Wall Street deal.

The first, Joseph Connolly, Irish Consul General to the United States, warned of the "dangers of American finance".

(4/15)

bit.ly/3mZf2EC

The first, Joseph Connolly, Irish Consul General to the United States, warned of the "dangers of American finance".

(4/15)

bit.ly/3mZf2EC

The second, Harry Boland, Irish Special Envoy in the United States.

He would reinforce Connolly's citing of small nations getting exploited by the connection b/w US banks and the US military.

(5/15)

bit.ly/3mZf2EC

He would reinforce Connolly's citing of small nations getting exploited by the connection b/w US banks and the US military.

(5/15)

bit.ly/3mZf2EC

This connection was America's dollar diplomacy where "bankers became the new soldiers in the fight for American imperialism."

The Irish, in real-time, identified American financial imperialism and feared being colonized.

(6/15)

bit.ly/3mZf2EC

The Irish, in real-time, identified American financial imperialism and feared being colonized.

(6/15)

bit.ly/3mZf2EC

In Cuba, international finance:

> propped up an anti-populist dictator

> strangled the nation's economy into a single commodity exporter

> privatized national assets under debt traps

(7/15)

bit.ly/3mZf2EC

> propped up an anti-populist dictator

> strangled the nation's economy into a single commodity exporter

> privatized national assets under debt traps

(7/15)

bit.ly/3mZf2EC

In Haiti, City Bank took over the central bank & controlled all gov't funds. After populist push back, it called in the US military for occupation resulting in:

> election fraud

> foreign dictated constitution

> forced labor

> dissident repression

(8/15)

bit.ly/3mZf2EC

> election fraud

> foreign dictated constitution

> forced labor

> dissident repression

(8/15)

bit.ly/3mZf2EC

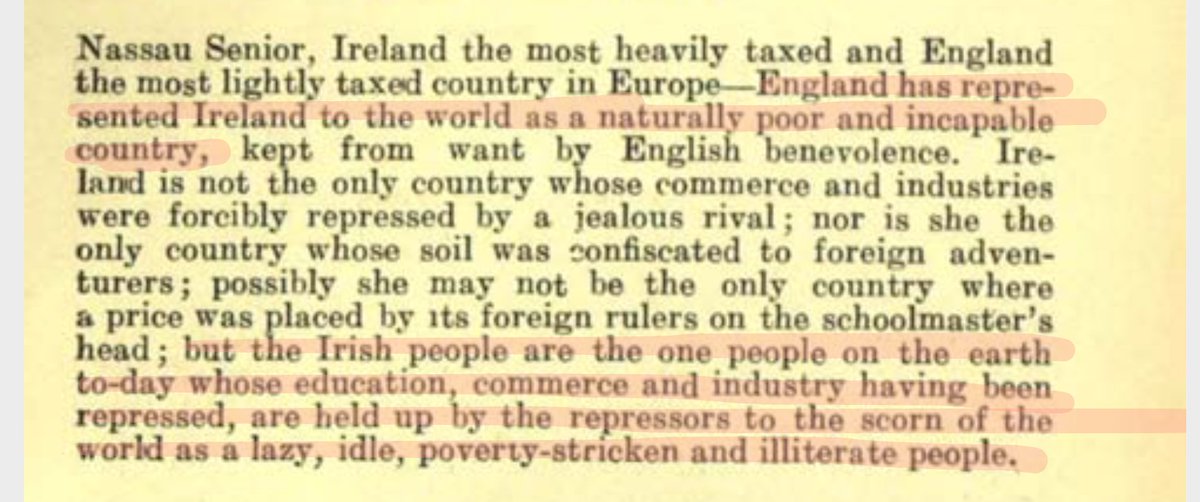

These examples showed international finance was a faustian bargain. Foreign debt was an imperial tool. Econ sovereignty was intertwined w/ political sovereignty.

Arthur Griffith, founder of Sinn Fein, shaped this thinking among the Irish.

(9/15)

bit.ly/3mZf2EC

Arthur Griffith, founder of Sinn Fein, shaped this thinking among the Irish.

(9/15)

bit.ly/3mZf2EC

He wrote “The Resurrection of Hungary: A Parallel for Ireland" as a manual for implementing Irish independence in line with the success of Hungary years earlier.

Among these tips were protectionist nationalistic banking.

(10/15)

bit.ly/3mZf2EC

Among these tips were protectionist nationalistic banking.

(10/15)

bit.ly/3mZf2EC

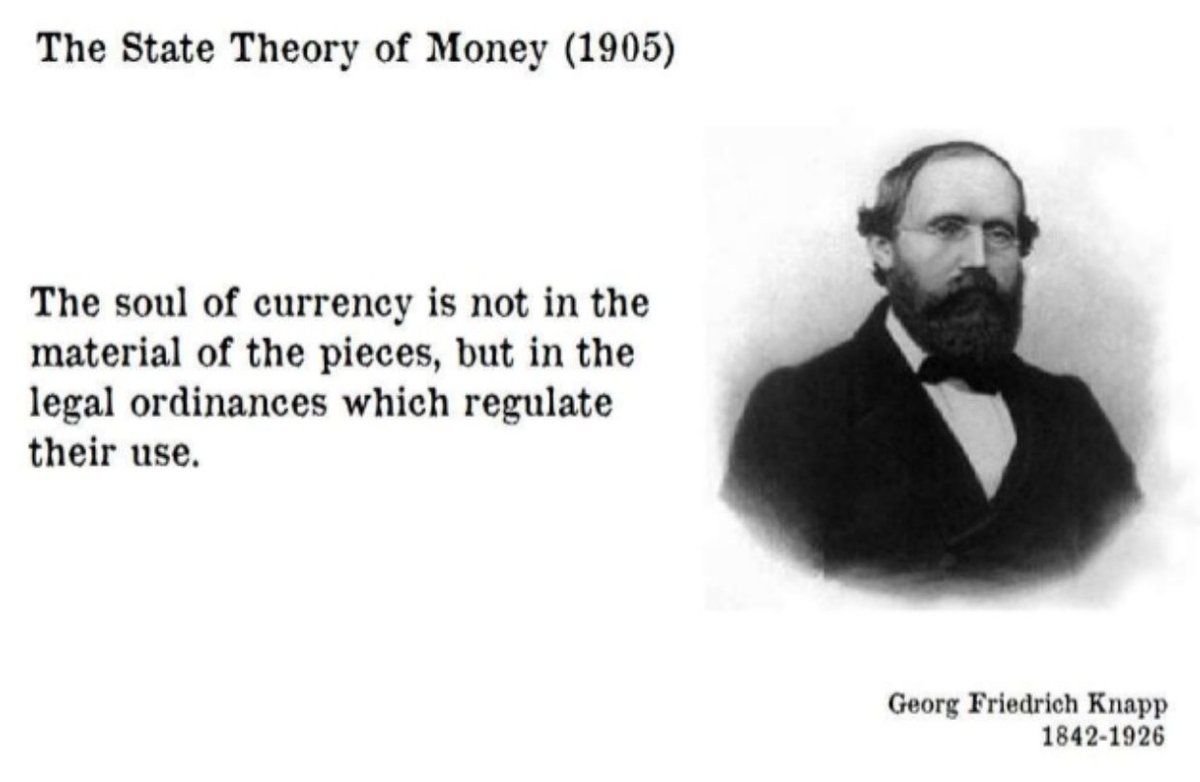

The nation's wealth shouldn't be lent outside the nation and instead invested in domestic industry. Also, the nation should prohibit international finance from subjugating national interests through debt and take an active role in credit markets.

(11/15)

bit.ly/3mZf2EC

(11/15)

bit.ly/3mZf2EC

Griffith credited Friedrich List & Henry Carey as influences. List & Carey are their respective intellectual originators of German & American protectionism. They each saw free trade / international finance as a system for "English world-conquest."

(12/15)

bit.ly/3mZf2EC

(12/15)

bit.ly/3mZf2EC

Global events would have shaped Irish thoughts too.

> Russian foreign debt repudiation and int. fin. backing of White Army

> Italian foreign debt crisis and Biennio Rossa

> German debt pile on at Versailles

Sovereignty corroded by int. fin.

(13/15)

bit.ly/3mZf2EC

> Russian foreign debt repudiation and int. fin. backing of White Army

> Italian foreign debt crisis and Biennio Rossa

> German debt pile on at Versailles

Sovereignty corroded by int. fin.

(13/15)

bit.ly/3mZf2EC

Int. fin. produced instability & weakened sovereignty. The Irish rejection of Wall St. was its early protectionism, later replaced by liberalization, ending in '08 crisis. "The dangers of American finance ring as true today as they did in 1921."

(14/15)

bit.ly/3mZf2EC

(14/15)

bit.ly/3mZf2EC

Further research needing to be done:

> evaluation of Irish protectionism

> uncovering why Irish flipped to liberalization post-WW2

> more docs relating to early revolutionary econ thought

All this should culminate in a book hopefully in a year.

(15/15)

bit.ly/3mZf2EC

> evaluation of Irish protectionism

> uncovering why Irish flipped to liberalization post-WW2

> more docs relating to early revolutionary econ thought

All this should culminate in a book hopefully in a year.

(15/15)

bit.ly/3mZf2EC

• • •

Missing some Tweet in this thread? You can try to

force a refresh