Here's a breakdown of our Q3 report...

bit.ly/2UgEiZT

bit.ly/2UgEiZT

bit.ly/2UgEiZT

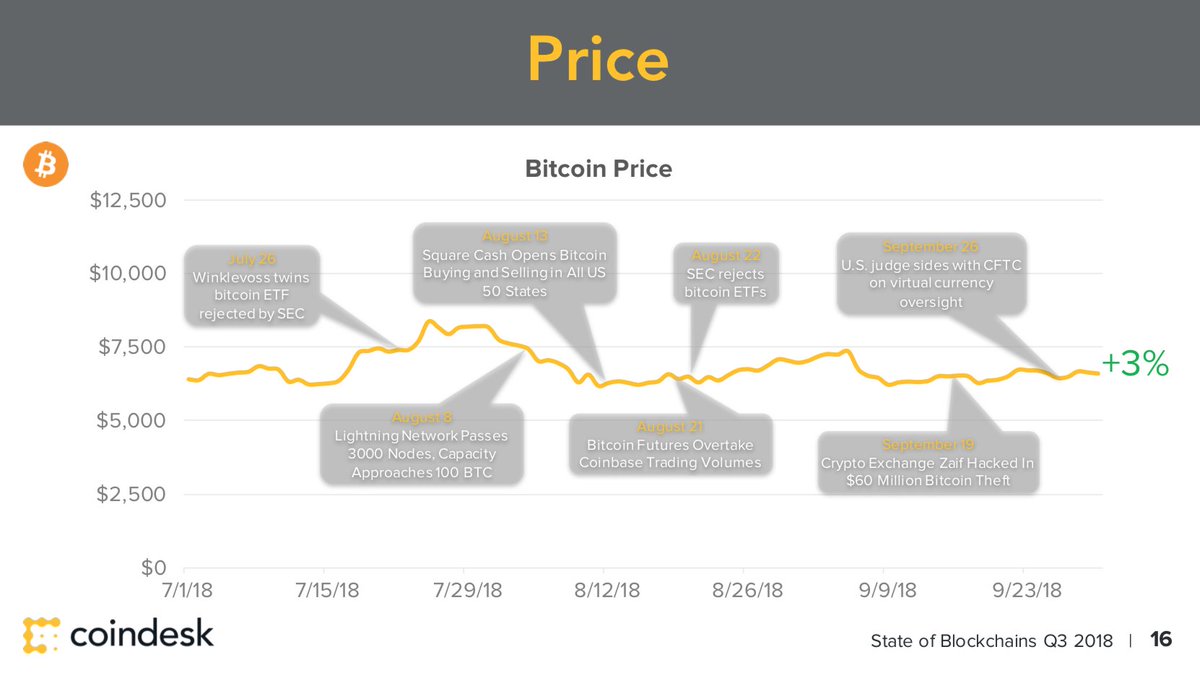

Bitcoin’s (BTC) price grew by 3% with news of positive adoption development on the Lightning Network and Square Cash however the ETF rejection might have slowed growth.

bit.ly/2UgEiZT

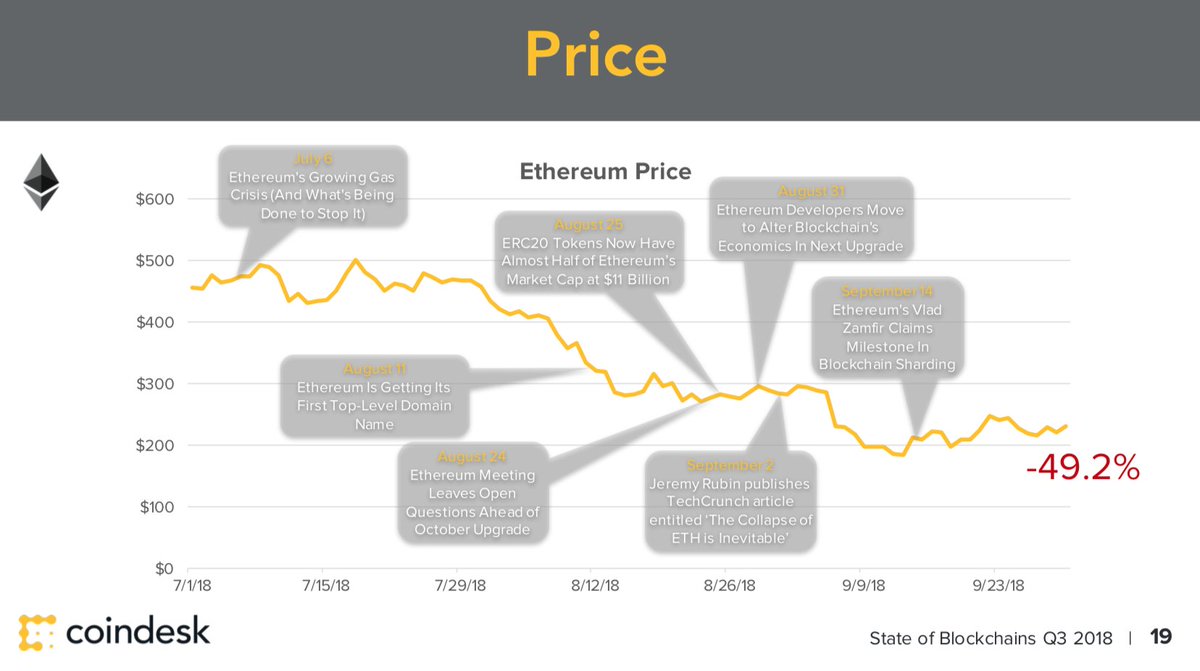

Ethereum’s (ETH) price fell by 49.2% with news of future development breaking milestones as pundits criticize the smart contract technology.

bit.ly/2UgEiZT

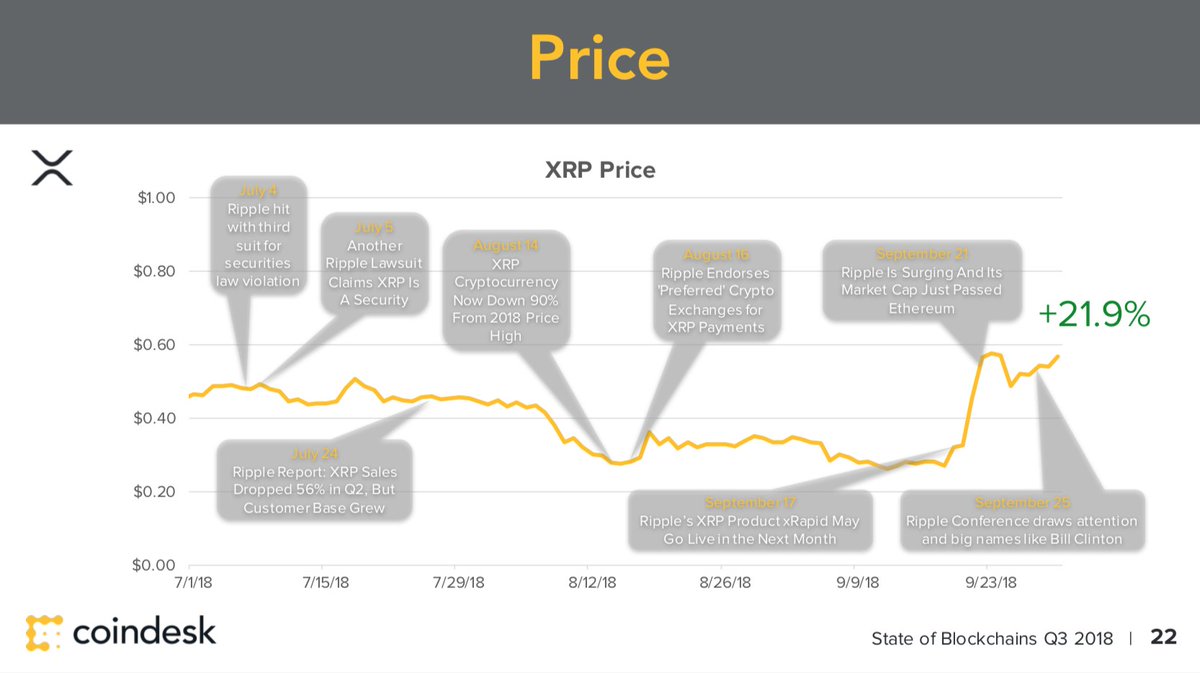

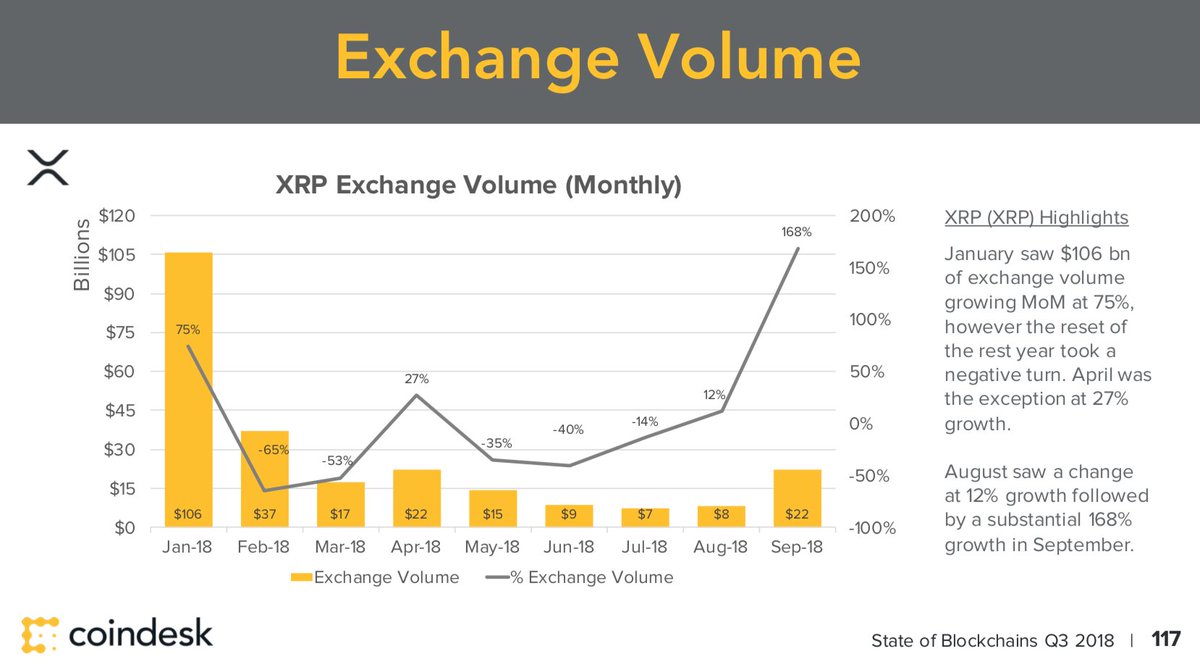

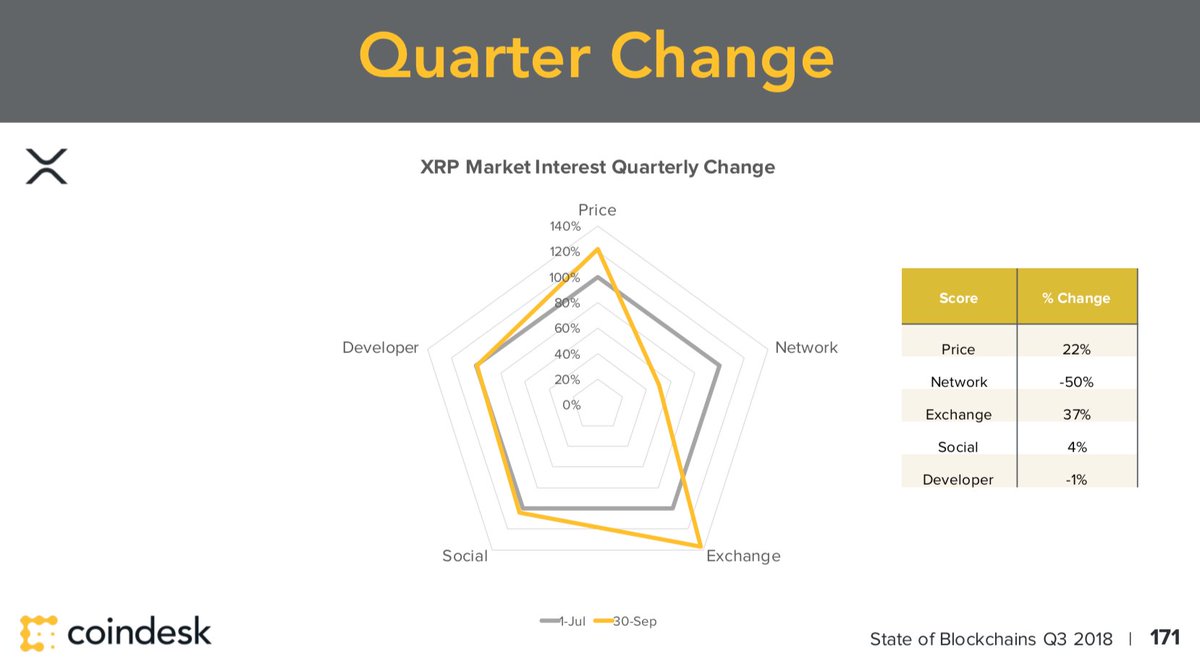

XRP’s price grew by 21.9% with a big bump in late Sept. At the beginning of Q3, the news consisted of legal troubles and slow progress only to be followed by the launch of a new product: xRapid and high profile conference both led by Ripple

bit.ly/2UgEiZT

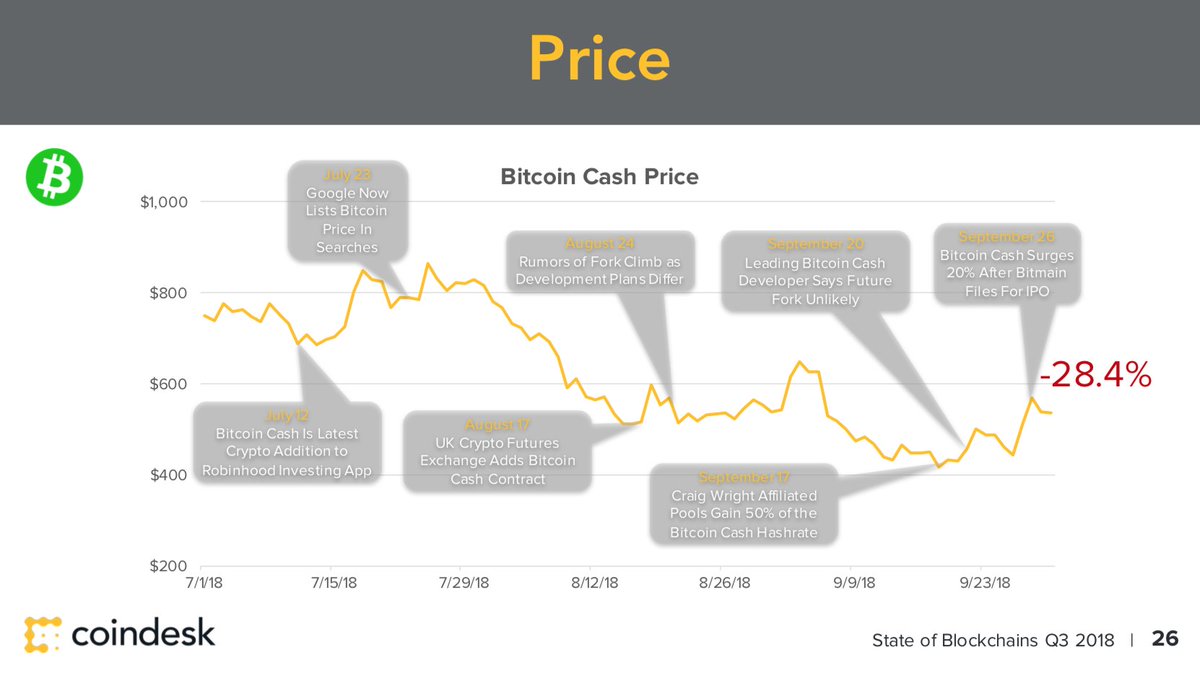

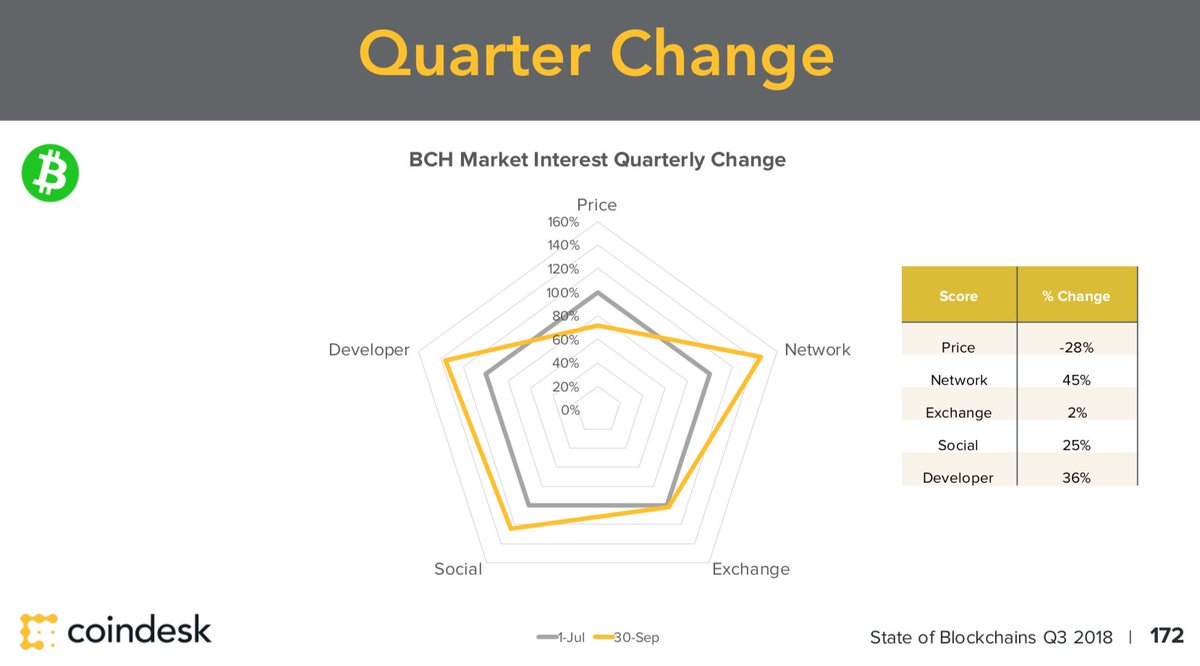

BCH's price declined by 28.4% with news of business like Google and Robinhood adding features for them followed by a bitcoin cash futures contract. Although news soured towards the end of Q3 with the fork rumors emerging between development camps.

bit.ly/2UgEiZT

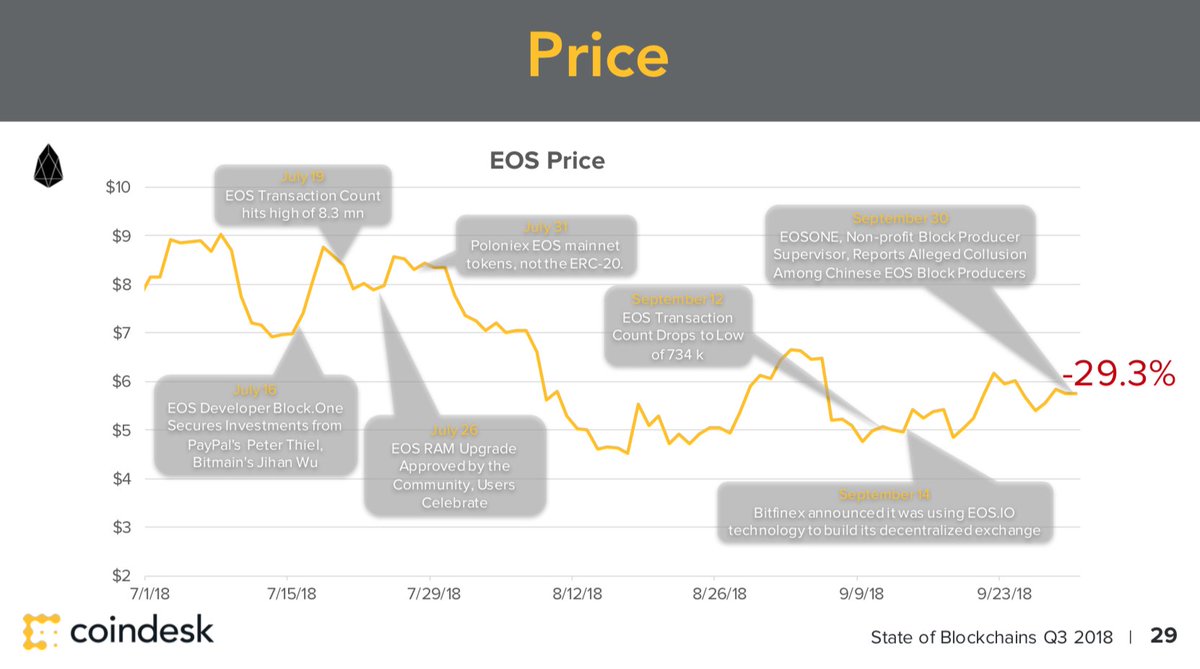

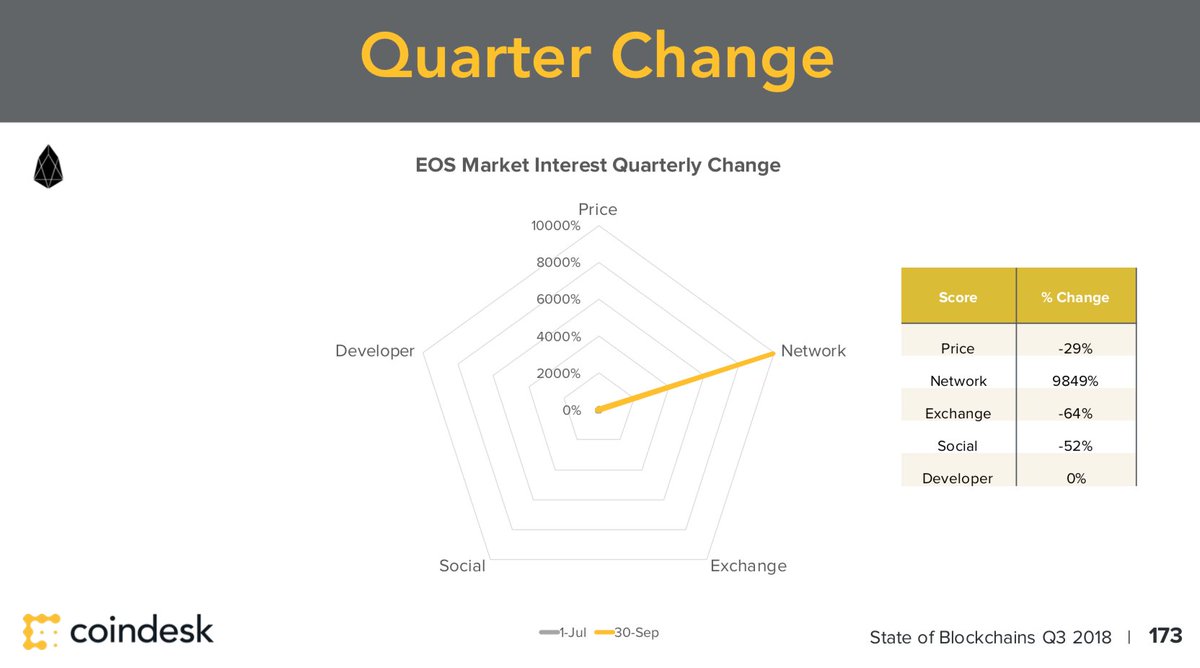

EOS’s price fell by 29.3% with news of fundamental metrics hitting record highs and big investors backing the project followed by those metrics hitting peculiar lows and controversy over governance of the blockchain towards the end of the quarter.

bit.ly/2UgEiZT

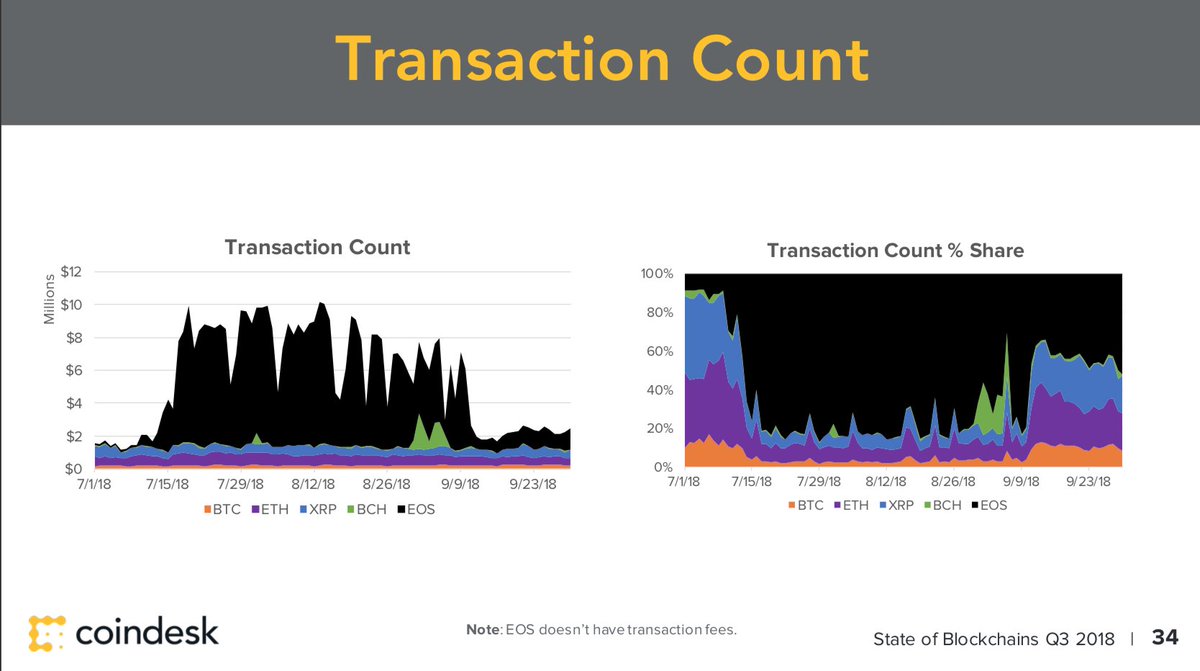

EOS had the most notable transaction count growth. It launched its blockchain in June and dominated the share of transactions by late July. XRP also saw a bounce due to product announcements. BCH shot up for a short time due to a stress test

bit.ly/2UgEiZT

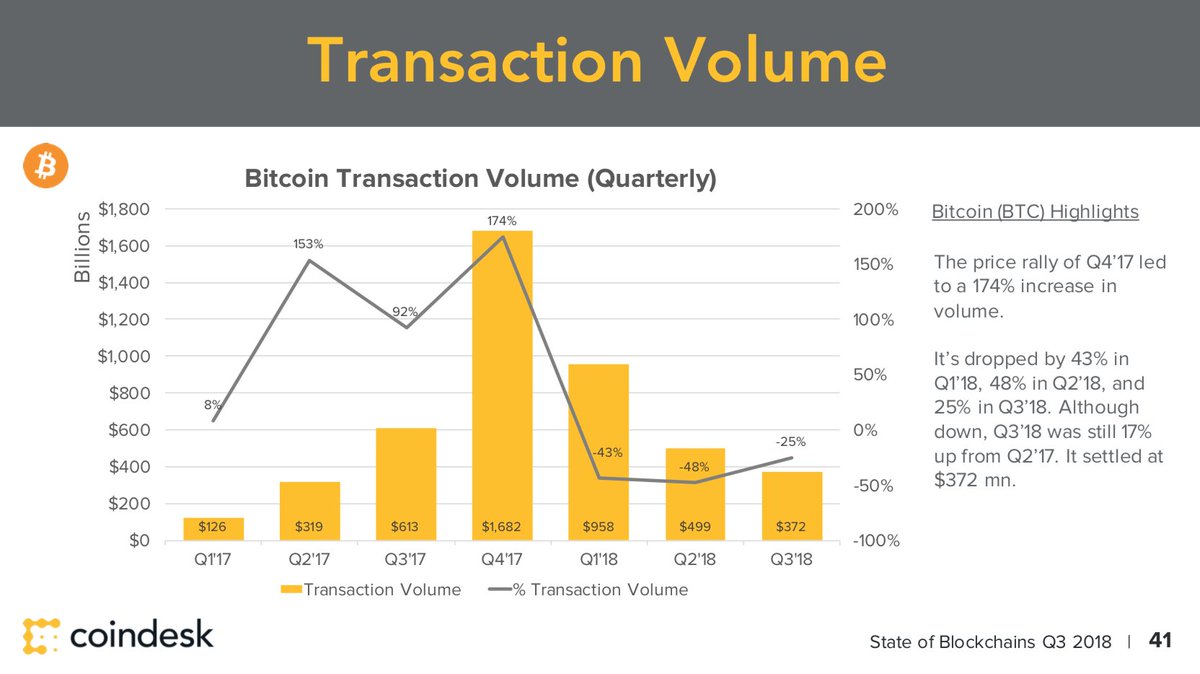

BTC transaction volume saw a record setting 174% growth in Q4 of 2017 but saw negative growth below -40% for the first two quarters of this year. Q3 shows a slowing of that negative growth to just -25%.

bit.ly/2UgEiZT

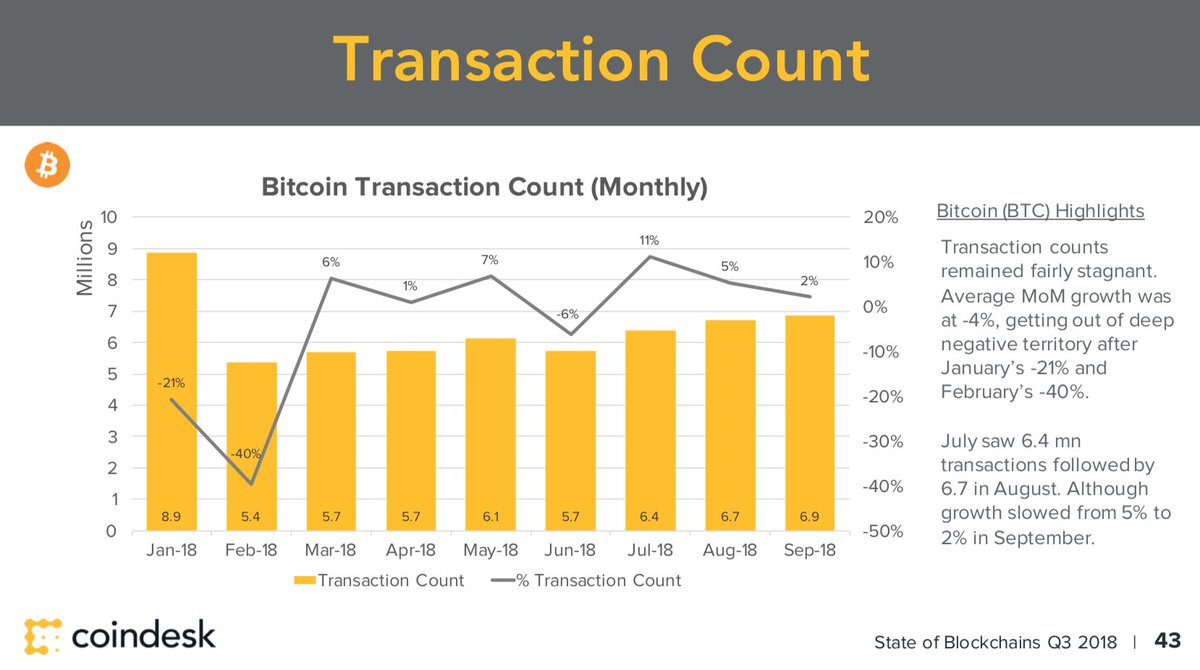

BTC transaction counts looked pretty stable in comparison to the declining volume. Average growth was -4% but once it got out of the winter most months had positive growth and rose to 6.9 mn transactions in September.

bit.ly/2UgEiZT

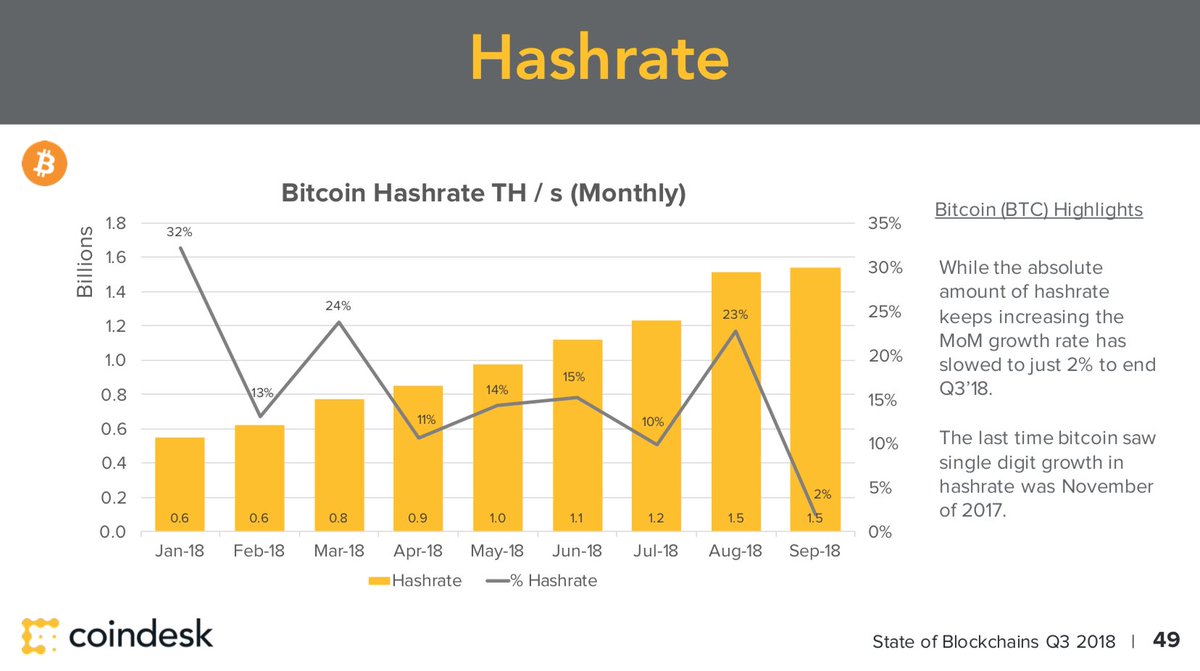

Most surprisingly, BTC hashrate growth slowed to a small 2%. The last time BTC saw single digit growth was November of 2017. Signs of the eventual November hashrate declines were evident in September.

bit.ly/2UgEiZT

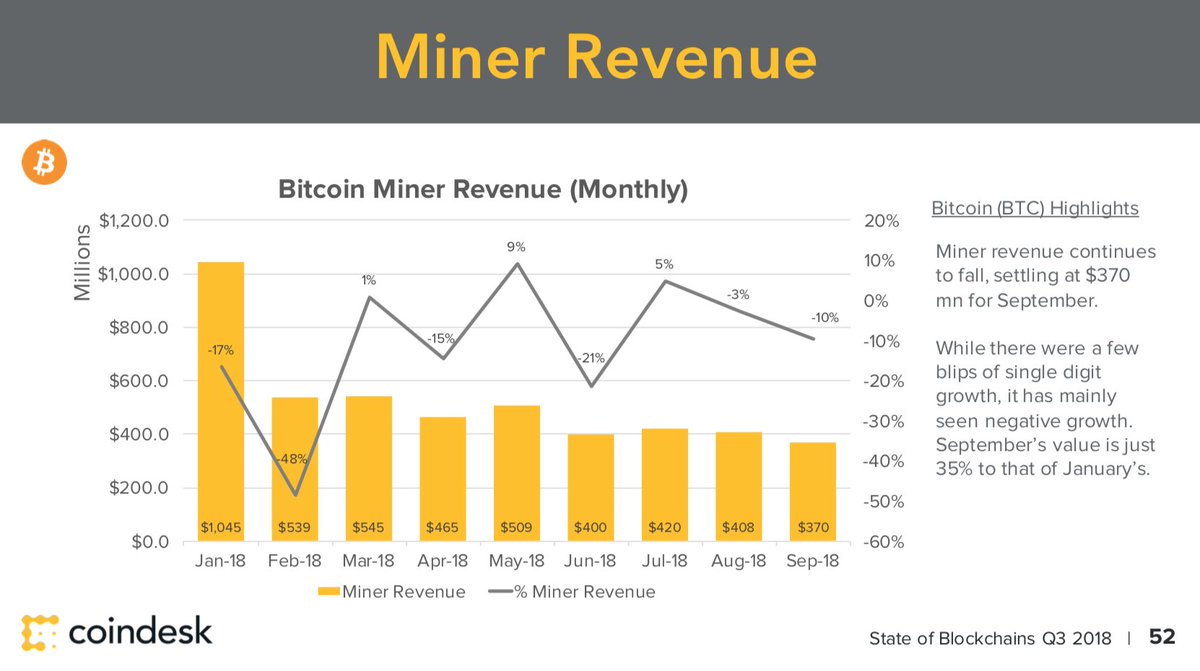

Miner revenue, in comparison to hashrate, was trending negative with September’s total only 35% to that of January.

bit.ly/2UgEiZT

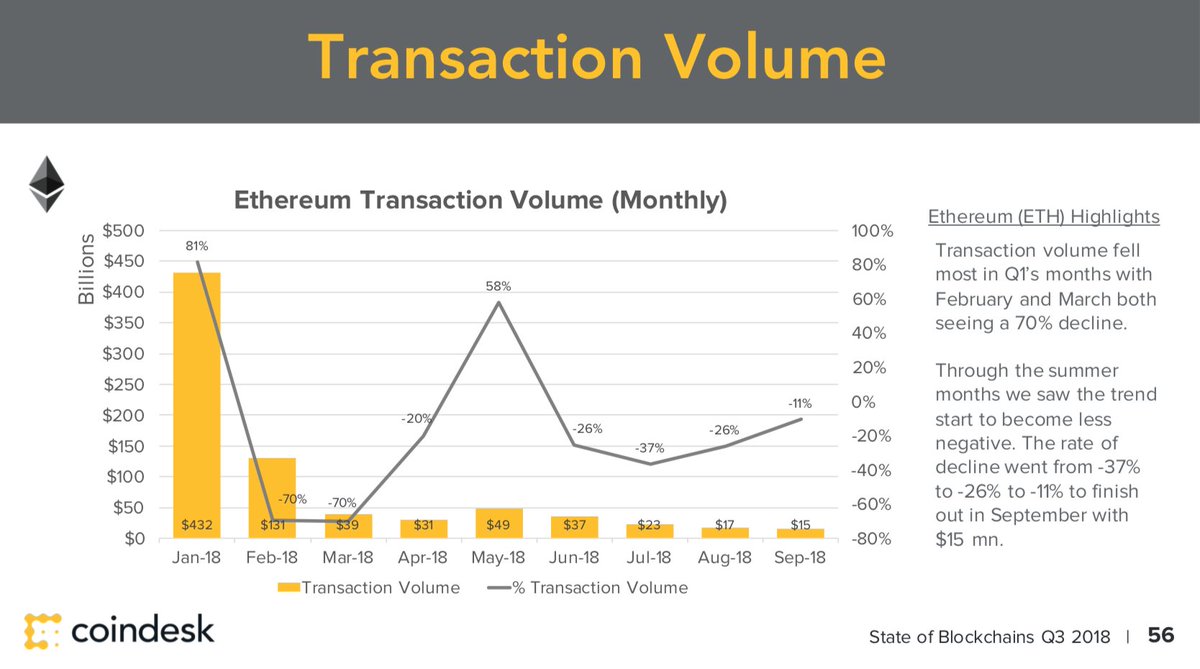

ETH’s transaction volume fell a great deal from January of $432 bn to September of $15 bn. The steepest declines, both -70%, occurred in February and March.

bit.ly/2UgEiZT

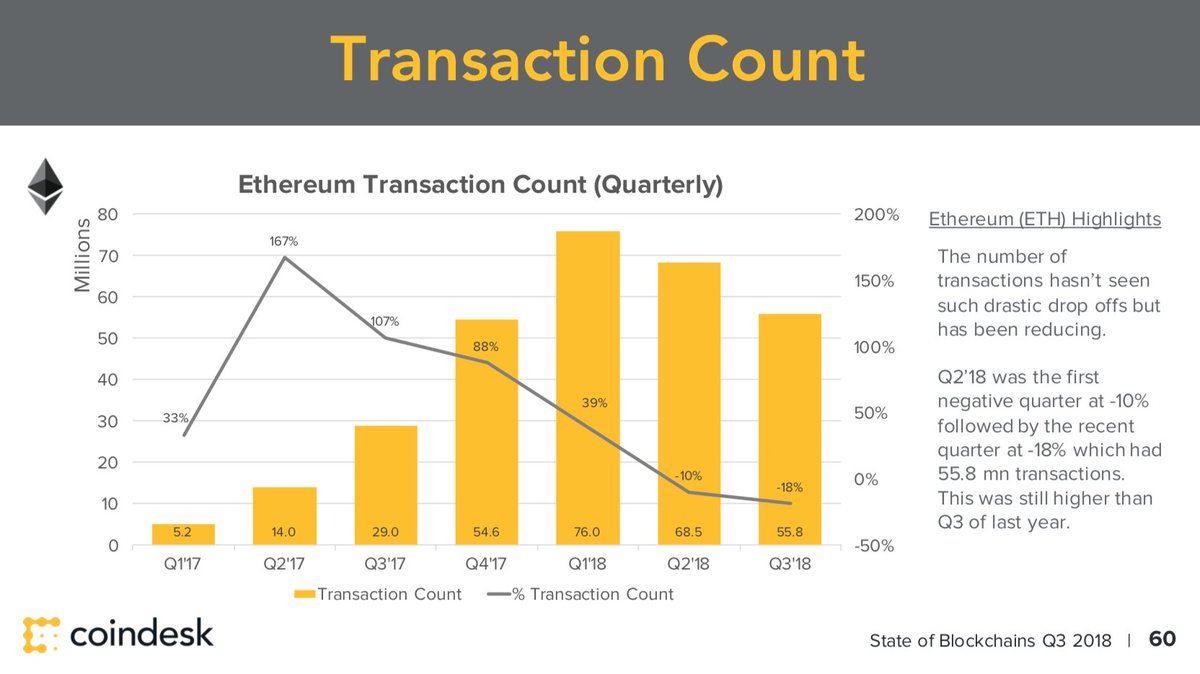

ETH transaction counts didn’t seem to be as affected by there was clearly a slowing of growth from Q2’17 to eventual negative growth in Q2’18 and this most recent one.

bit.ly/2UgEiZT

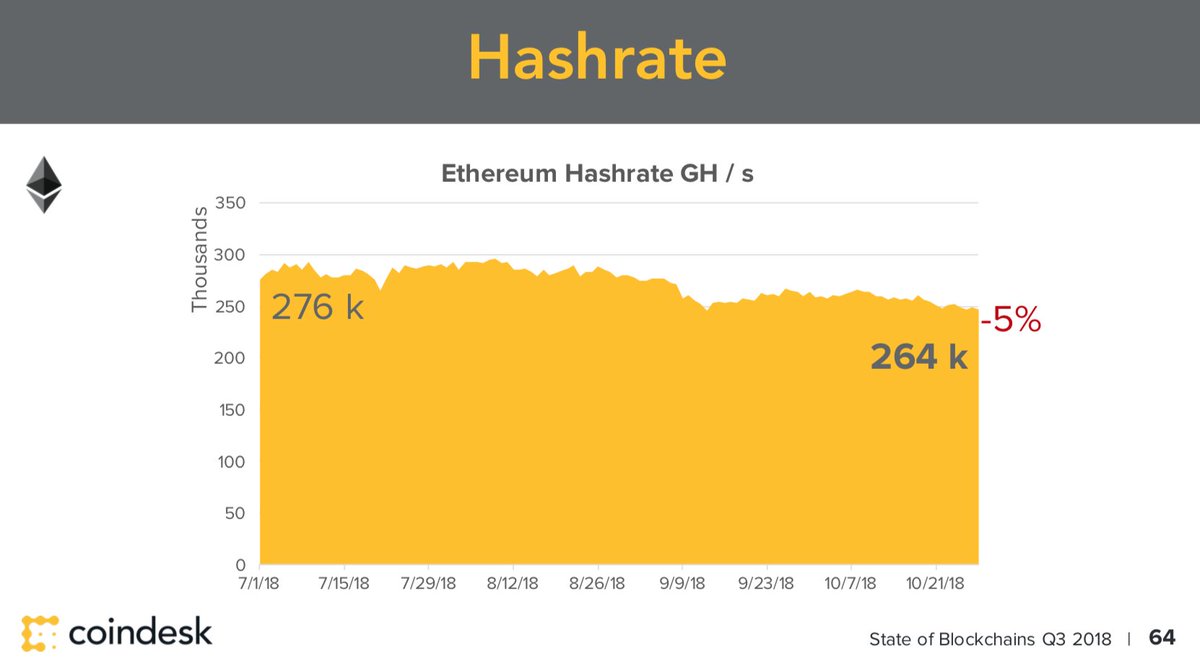

ETH’s hashrate declined by 5% over the quarter. This could be indicative of sentiment of non-PoW updates coming up on the software development roadmap.

bit.ly/2UgEiZT

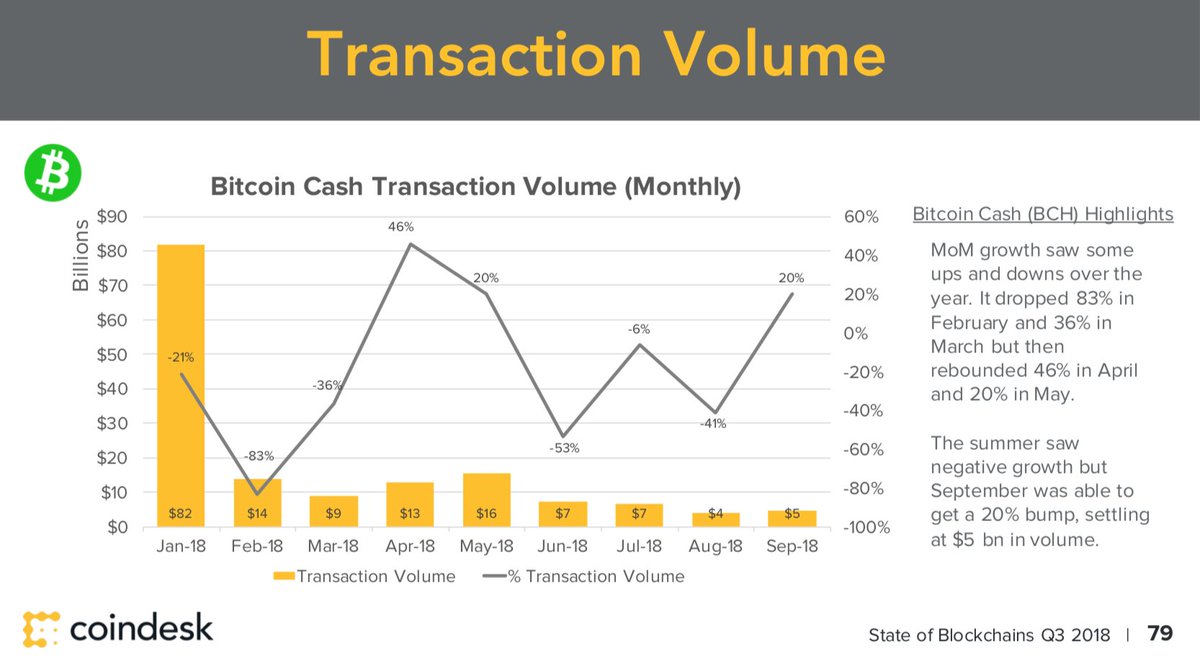

BCH’s transaction volume dropped 83% in February to $14 bn. Since then it has fallen down to about $5 bn with growth rates jumping from -53% to 20%.

bit.ly/2UgEiZT

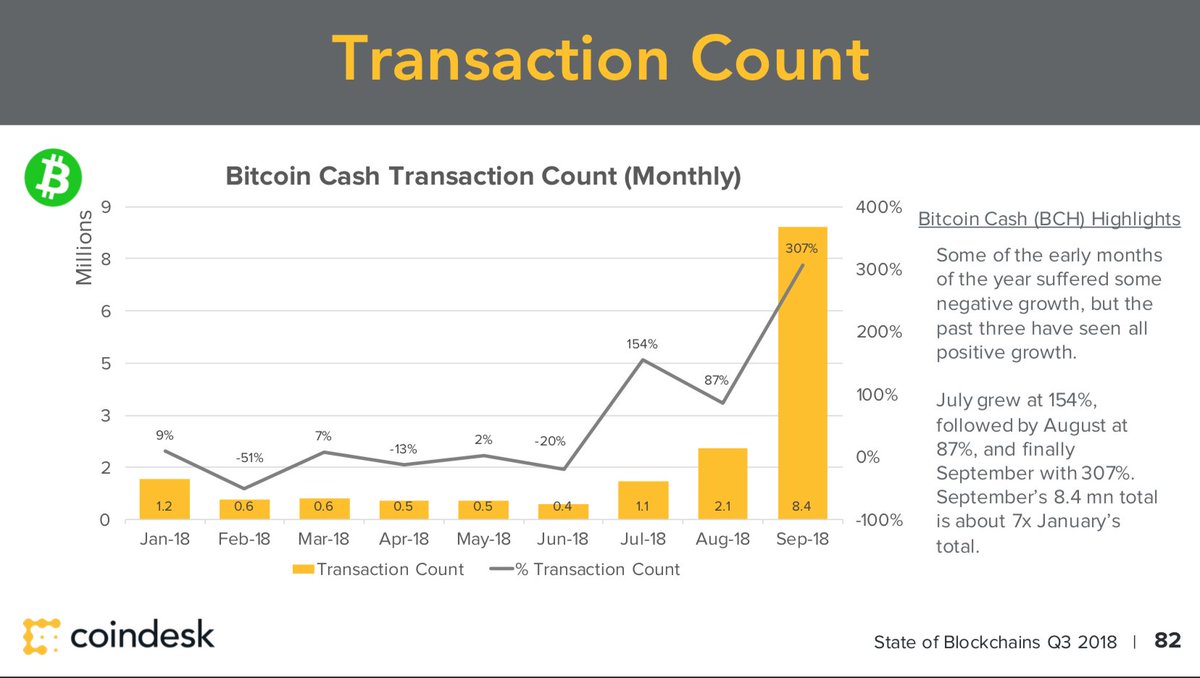

BCH transaction counts saw a massive increase of 307% thanks to an inorganic stress test in Sept, but July & August saw similar growth rates with no stress tests. Excluding Sept, Q3 would have still topped all previous quarters’ totals.

bit.ly/2UgEiZT

EOS transaction volume saw an all-time-high in May, most likely due to late investors right before the blockchain launch. This was followed by negative MoM growth until September.

bit.ly/2UgEiZT

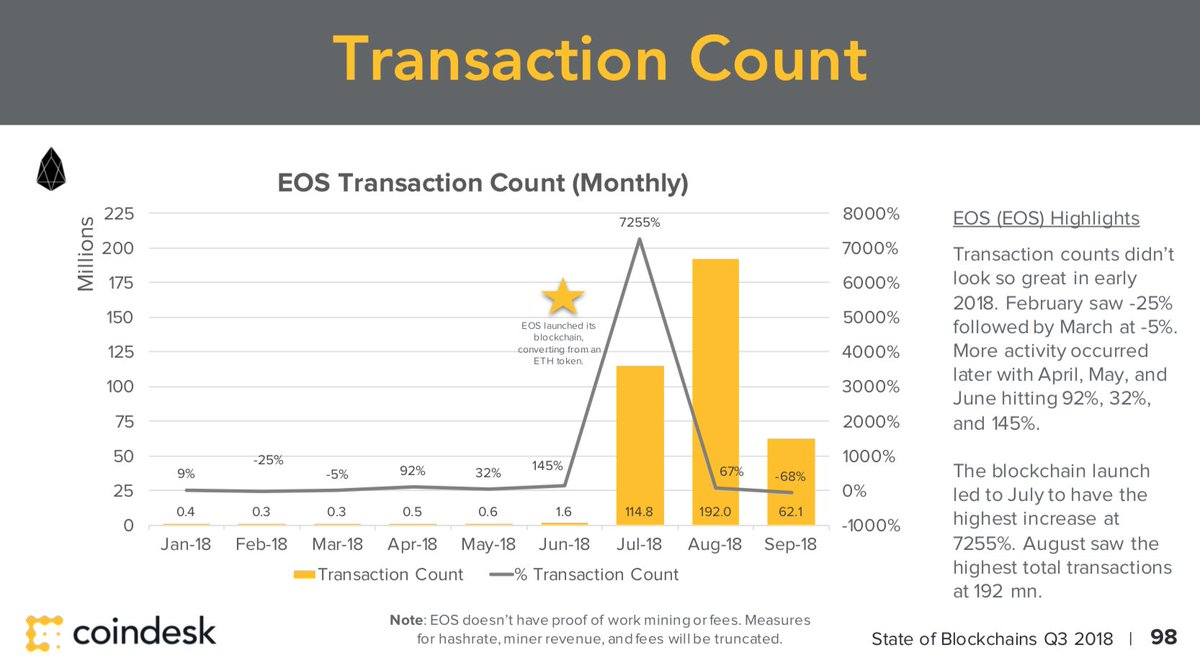

EOS transaction counts jettisoned 7255% in July. This is the result of its blockchain launching in June. It hit negative growth of 68% in September.

bit.ly/2UgEiZT

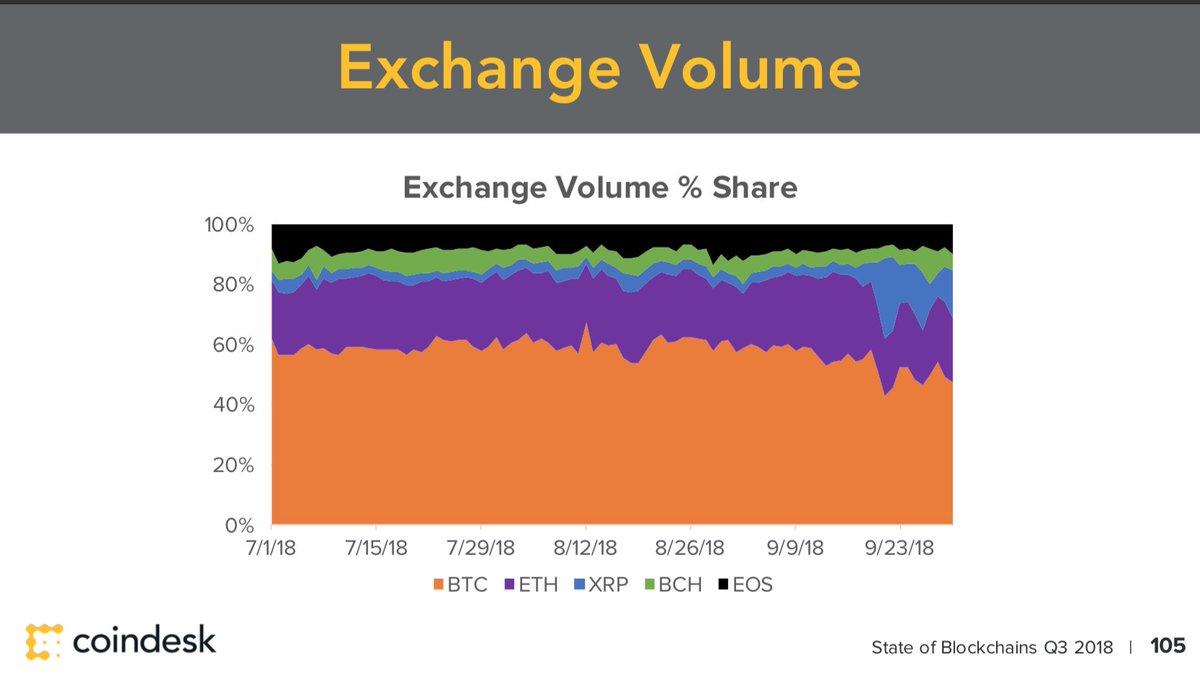

Exchange volume % share stayed relatively stable until XRP took a large chunk at the end of the quarter. This was most likely because of the jump of 168% in September’s exchange volume.

bit.ly/2UgEiZT

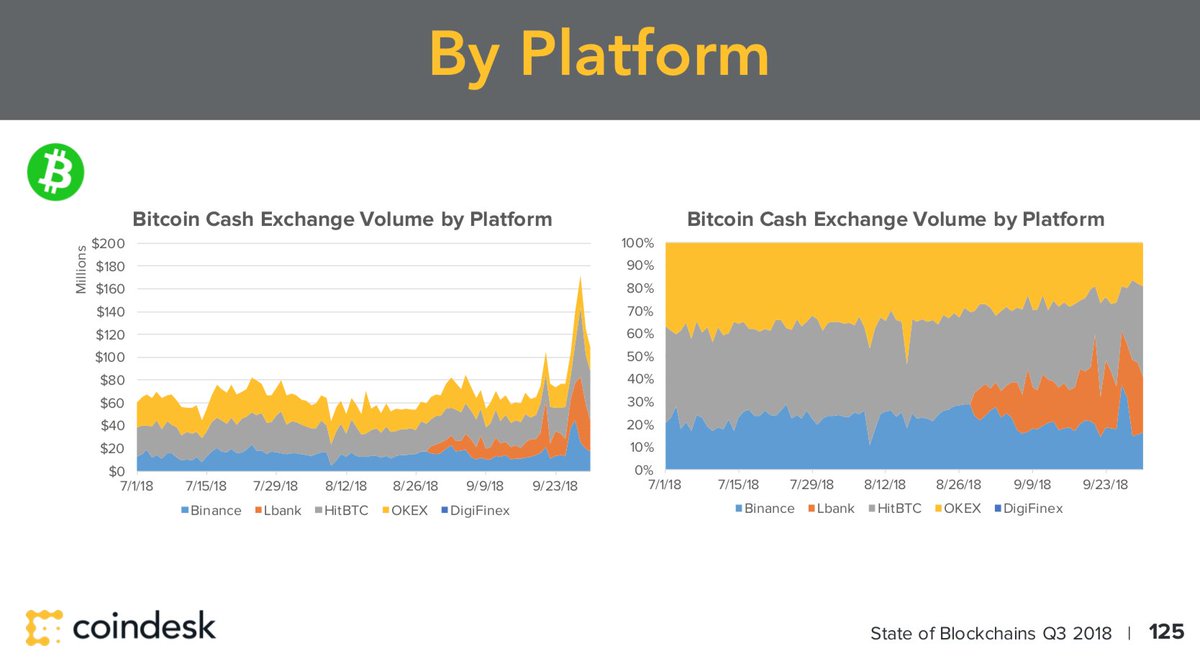

BCH exchange volume jumped at the end of September to just under $180 mn, the highest of Q3. Lbank started taking substantial % share of that volume in late August.

bit.ly/2UgEiZT

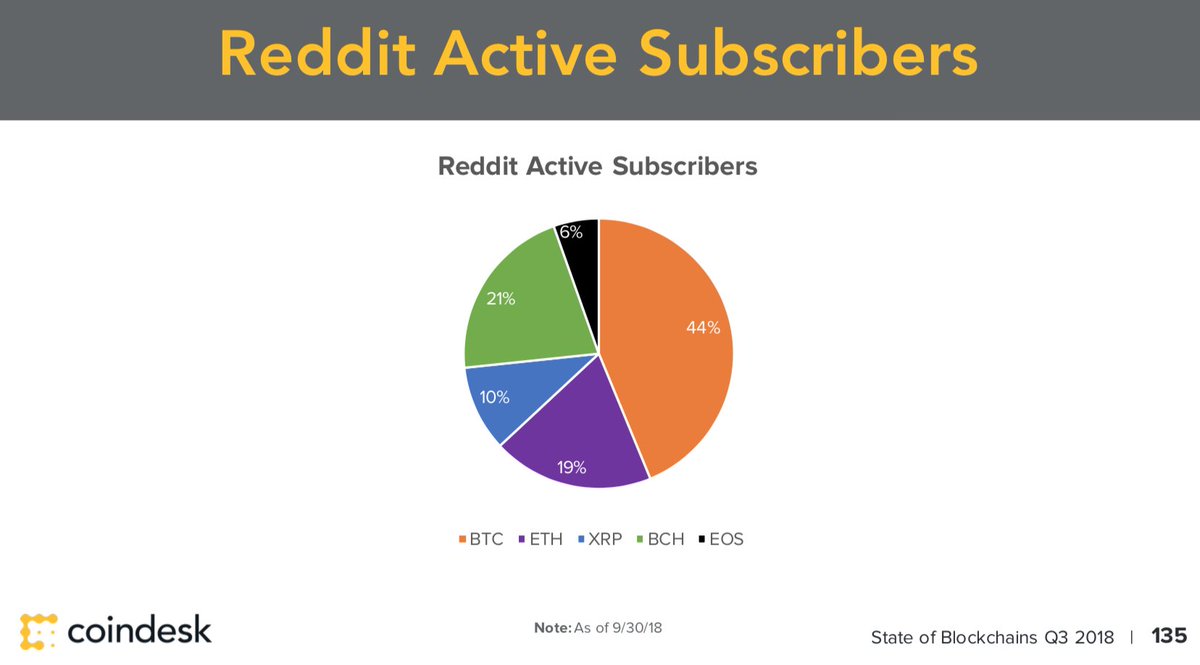

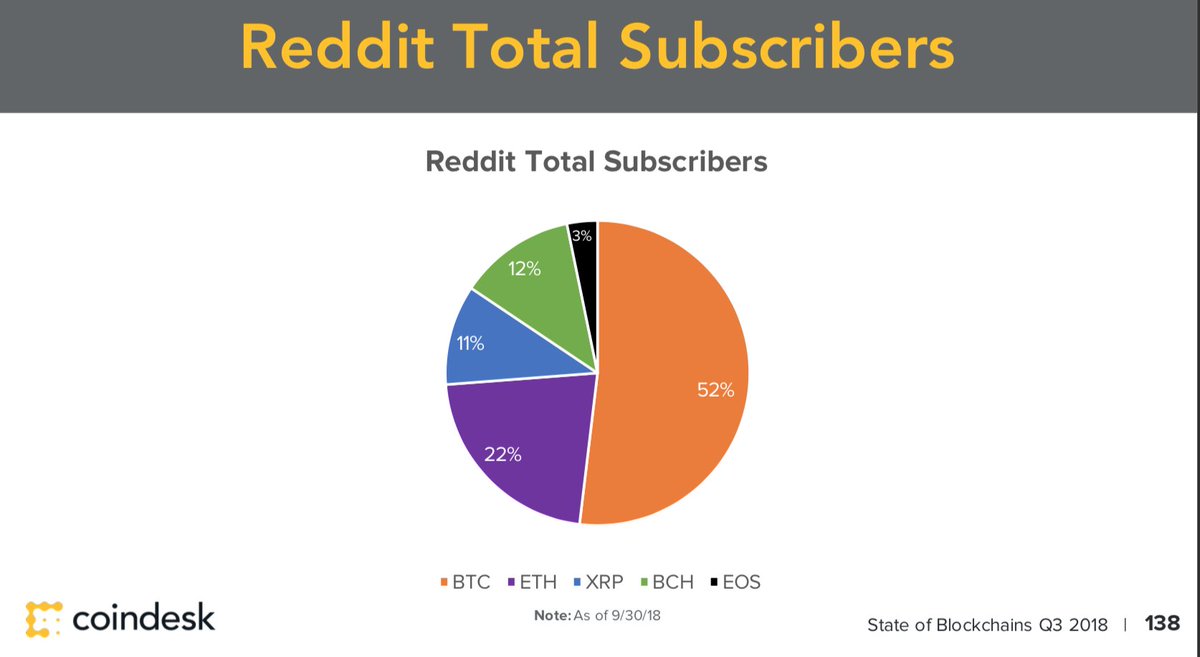

Active vs total subscribers to each subreddit allows us to see engagement levels. The underperformers were BTC (44-52), XRP (10-11) and ETH (19-22), while the overperformers were BCH (21-12) and EOS (6-3).

bit.ly/2UgEiZT

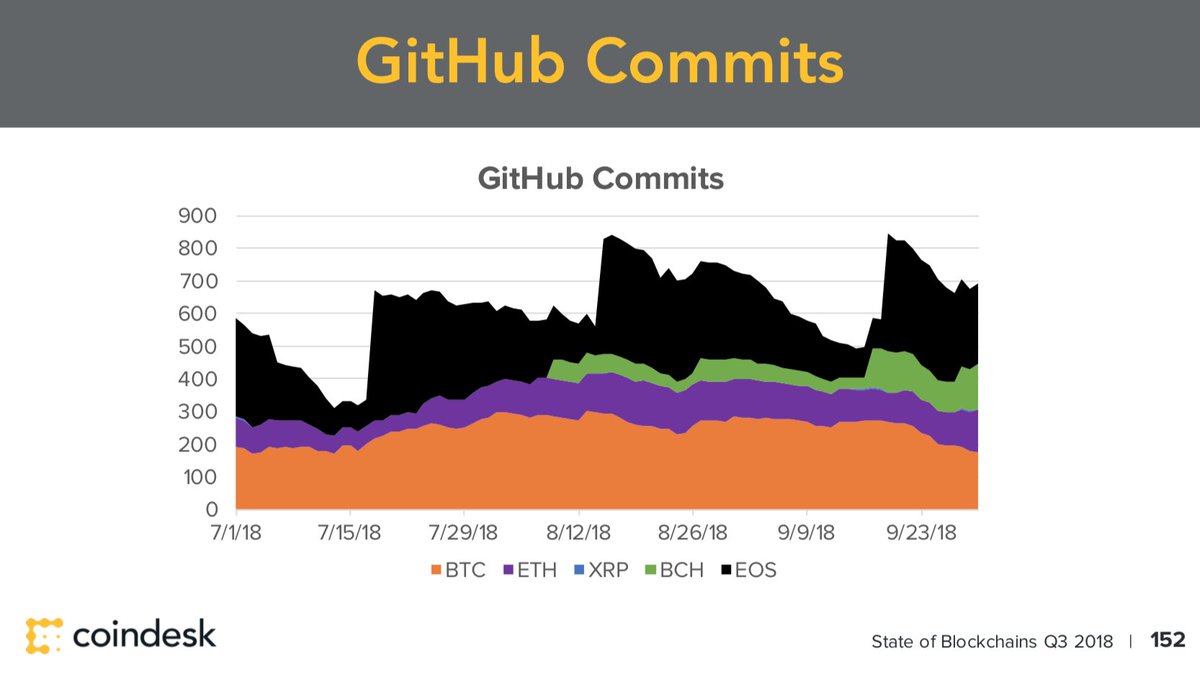

GitHub commits indicated that EOS had high some of the highest developer activity while ETH and BTC maintained usual commit levels. BCH sprouted up from marginality with 20% by the end of Q3

bit.ly/2UgEiZT

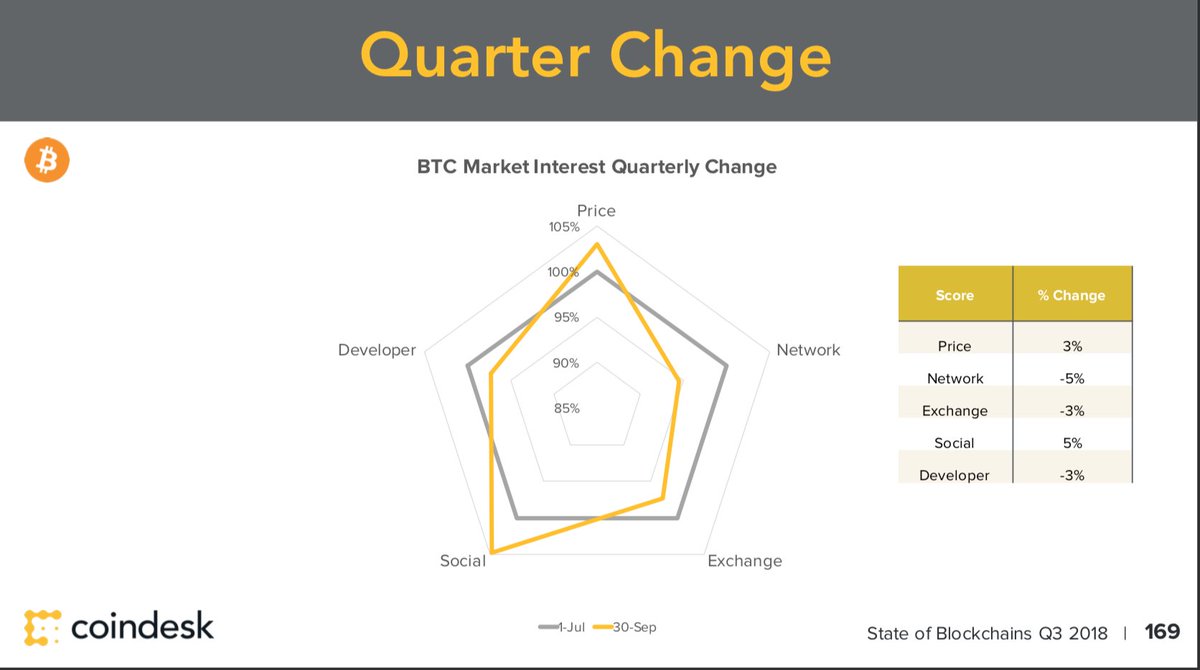

BTC grew 3% in price and 5% in social activity but fell 5% in network, 3% in exchange and developer.

bit.ly/2UgEiZT

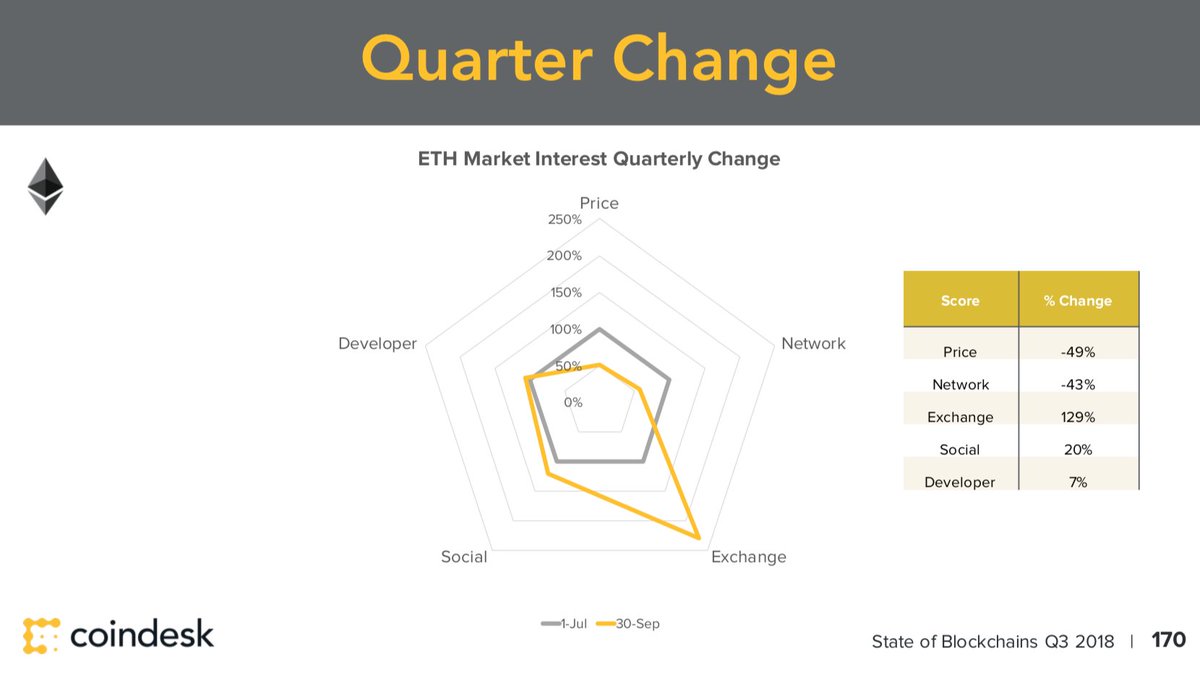

ETH’s price fell -49% along with a drop of 43% in network activity. Although exchange activity boasted a 129% increase along with social at 20% and developer at 7%.

bit.ly/2UgEiZT

XRP’s network activity fell by 50% but exchange pressure at 37% growth could have helped increase the price by 22%.

bit.ly/2UgEiZT

BCH suffered a drop of 28% in price but grew in all other categories. Network rose 45%, exchange by 2%, social by 25%, and developer by 36%.

bit.ly/2UgEiZT

This sounds extreme but EOS’ network activity grew by 9849% from the beginning of Q3, largely due to their blockchain launching from nothing in the summer. However, others fell like price by 29%, exchange by 64%, and social by 52%.

bit.ly/2UgEiZT

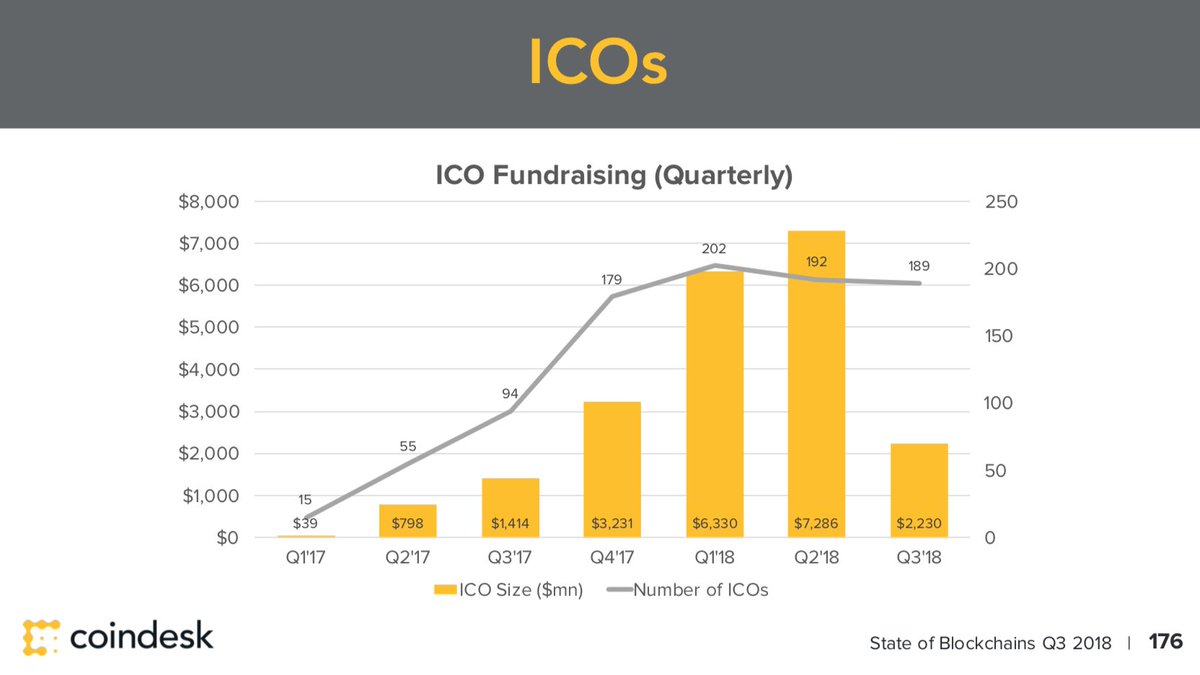

Q3 raised $2.23 bn in ICO fundraising through 189 ICOs. The number of deals decreased by an inconsequential amount, but the total dropped by 70% QoQ.

bit.ly/2UgEiZT

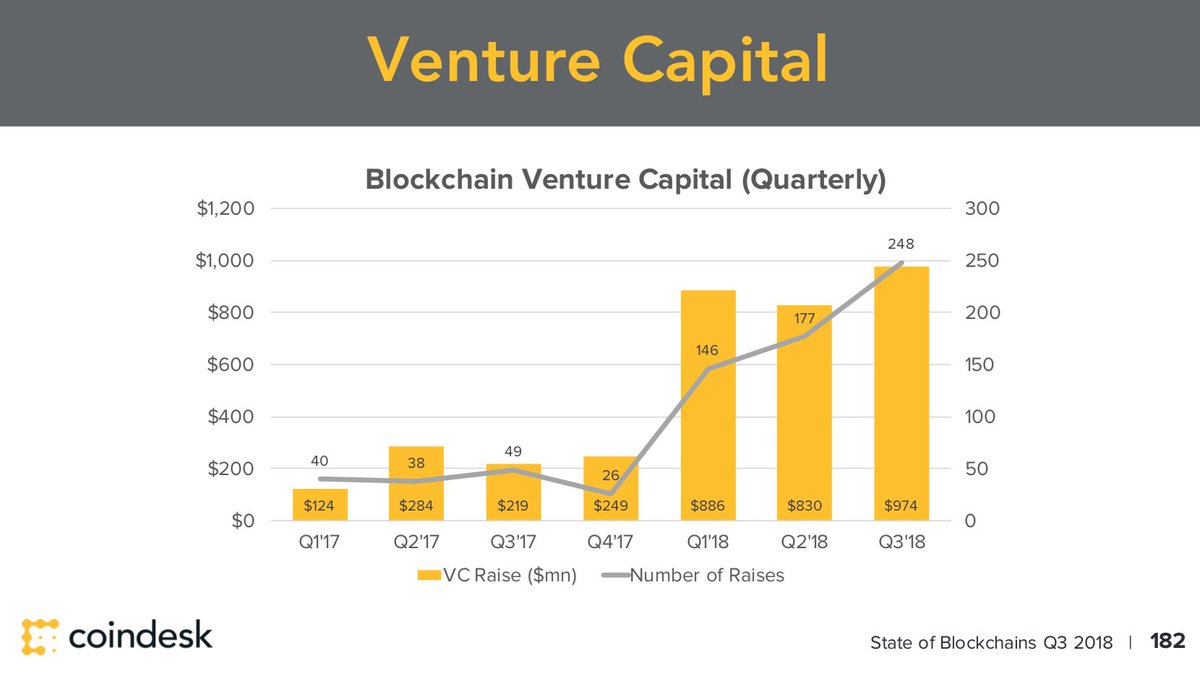

Q3 raised $974 mn in blockchain venture capital fundraising through 248 deals. This represents an increase of 17% in the total and 40% in the number of deals QoQ.

bit.ly/2UgEiZT

The big news of the enterprise side was Chain getting acquired by Lightyear.io, a Stellar protocol oriented startup.

bit.ly/2UgEiZT

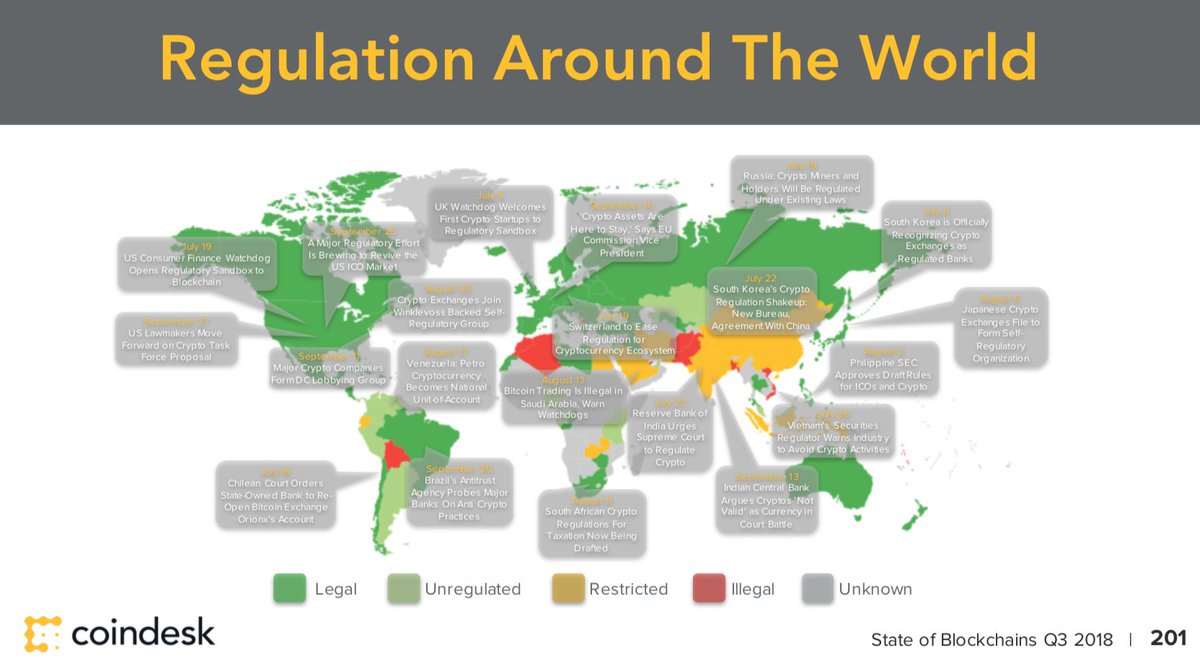

Experts: @valkenburgh @AmyDavineKim, on the regulation side, are suggesting that crypto has never been so keenly watched and are hopeful for smart rules on the horizon.

bit.ly/2UgEiZT

US businesses forming a self-regulatory group, South Korea sees exchanges as regulated banks, Brazil probes banks on anti-crypto practices, and more on the regulatory new front.

bit.ly/2UgEiZT

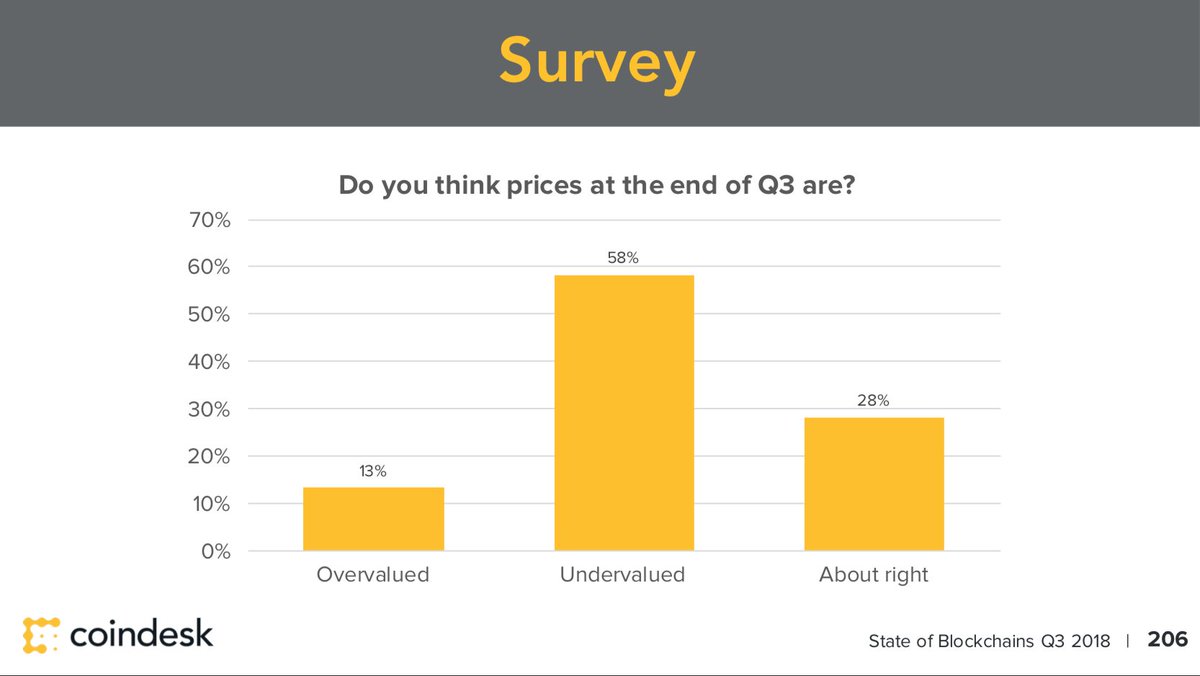

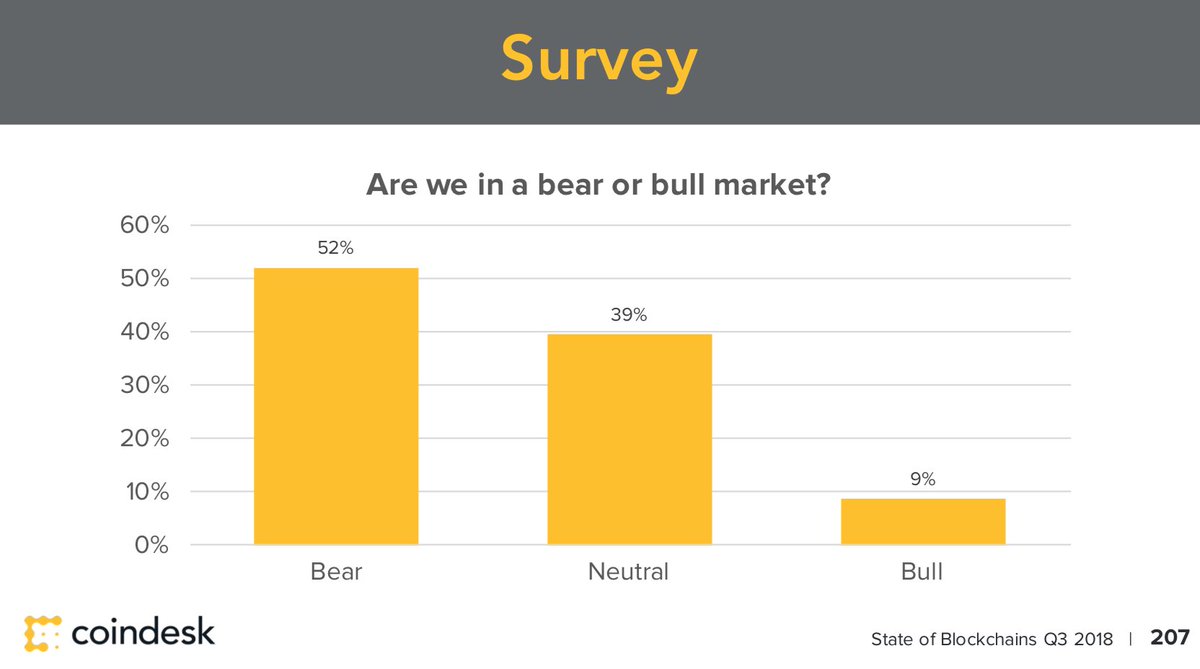

58% of survey respondents considered prices undervalued while 52% suggested we were in a bear market.

bit.ly/2UgEiZT

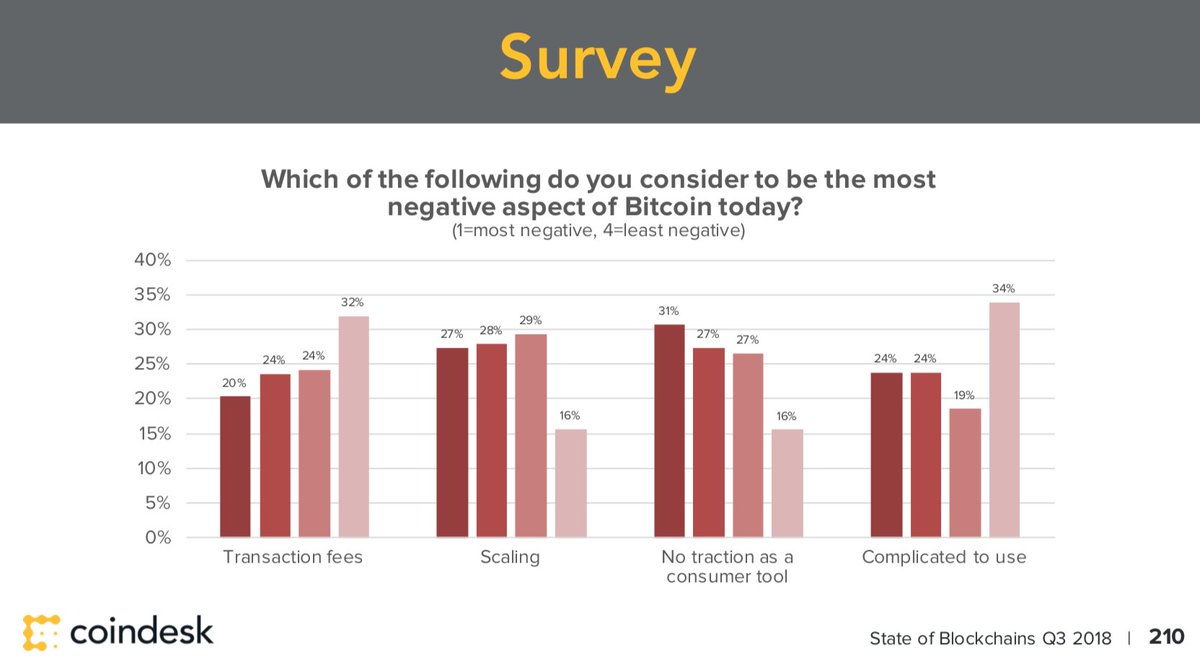

The dominant positive aspect of BTC is that it is a hedge against central bank monetary policy, while the dominant negative aspect of BTC is that it’s complicated to use.

bit.ly/2UgEiZT

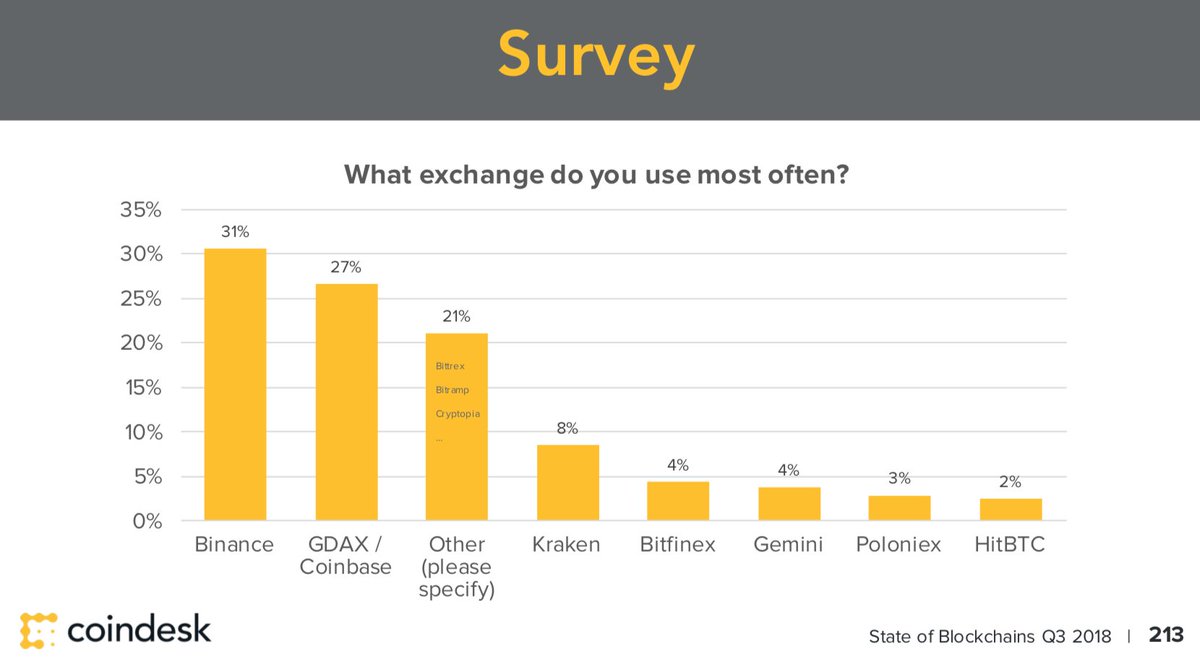

The top 3 exchanges by survey responses are @binance at 31%, @coinbase at 27% and “Other” at 21%. The top three submitted exchanges in “Other” were @BittrexExchange, @Bitstamp, and @Cryptopia_NZ.

bit.ly/2UgEiZT

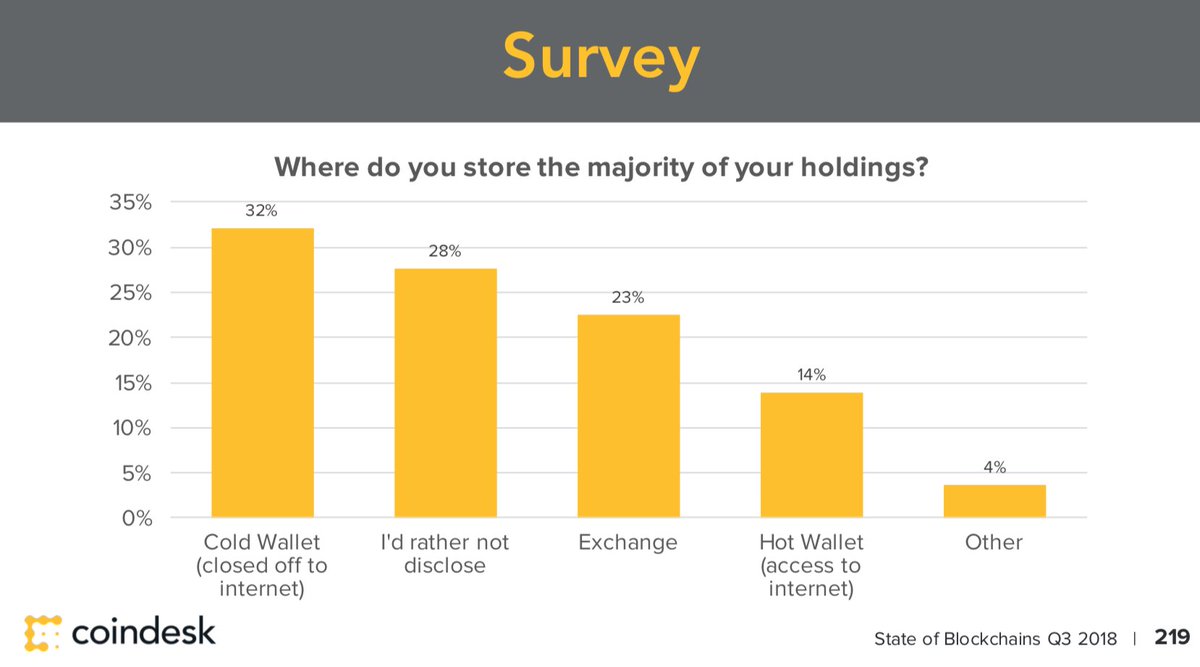

32% of survey respondents reported storing the majority of their holdings in a cold wallet, compared to 23% in an exchange and 14% in a hot wallet.

bit.ly/2UgEiZT

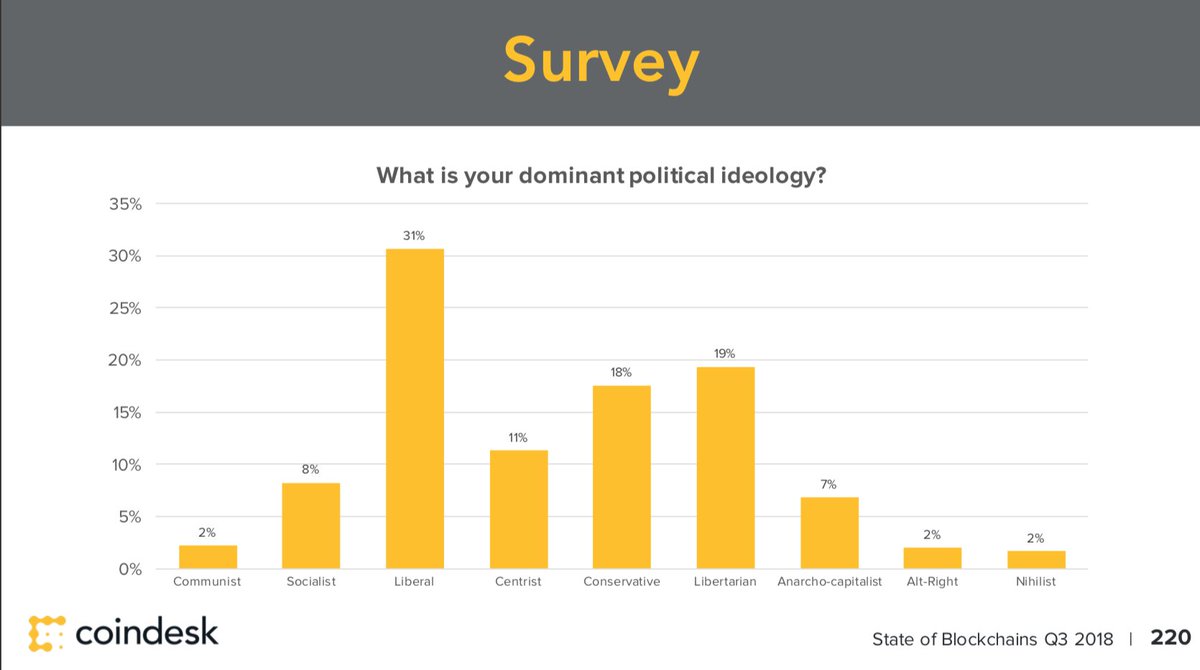

Liberals made up 31% of survey respondents followed by libertarians at 19%. Although if you were to add conservatives and libertarians to form a mainstream right total you would get 37%.

bit.ly/2UgEiZT

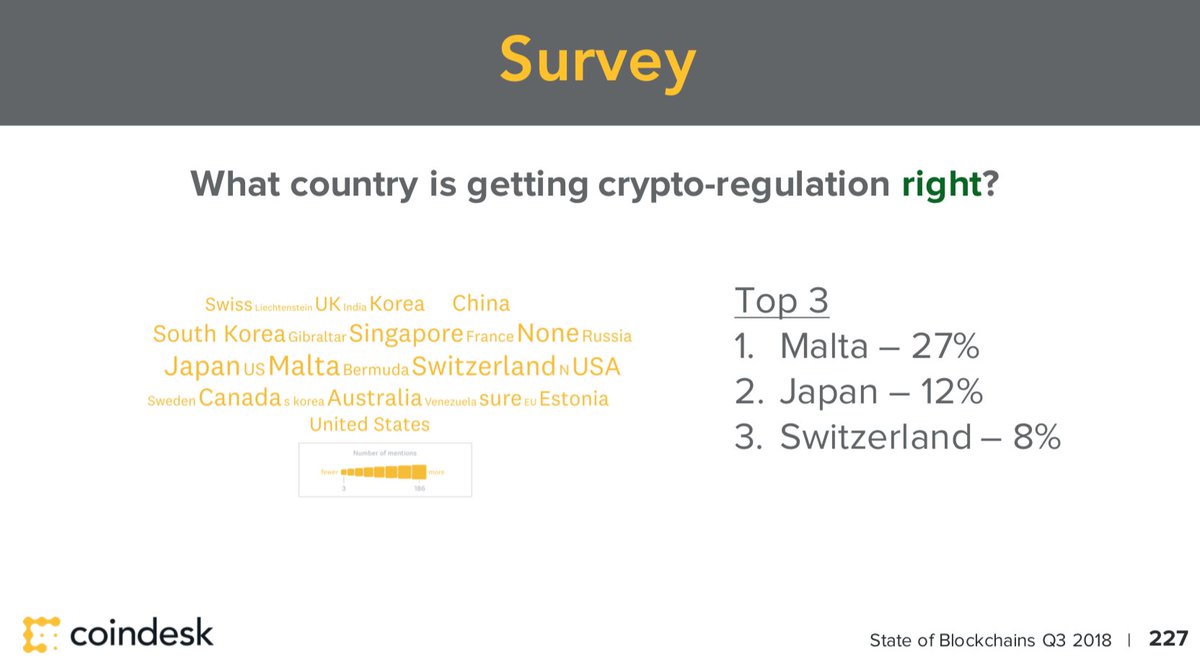

Malta, Japan, and Switzerland were the top countries getting crypto regulation right while the USA, China, and Switzerland were the top ones getting it wrong.

bit.ly/2UgEiZT

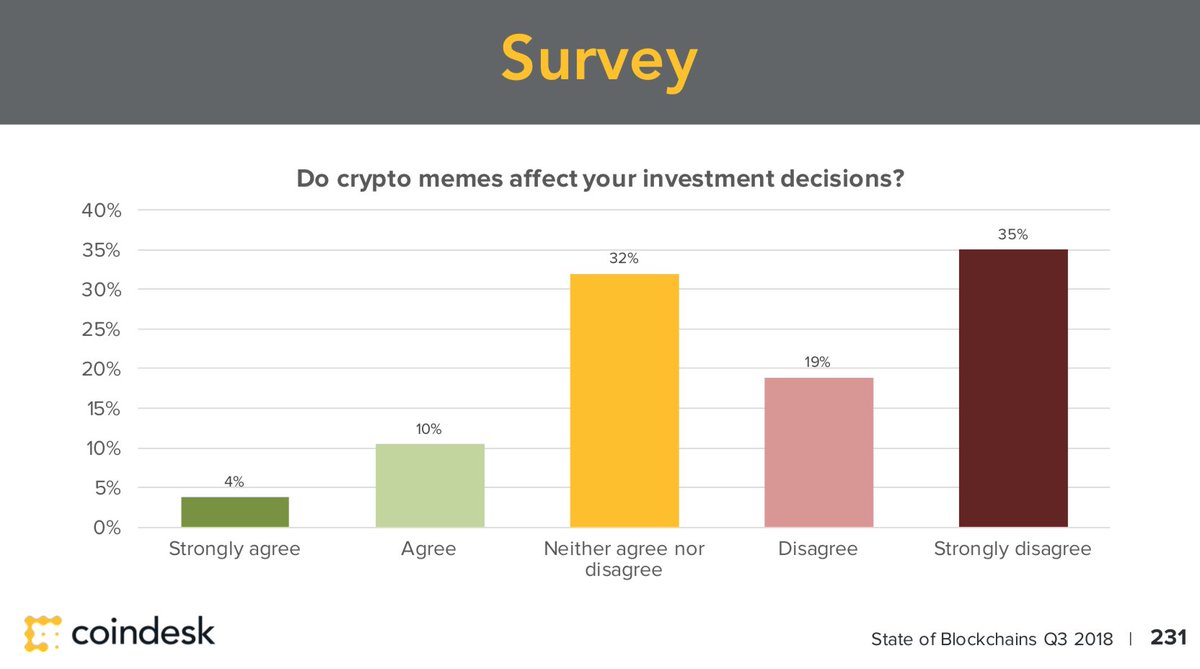

Unfortunately, crypto memes don’t appear to affect investment decisions of survey respondents. So they say…

bit.ly/2UgEiZT

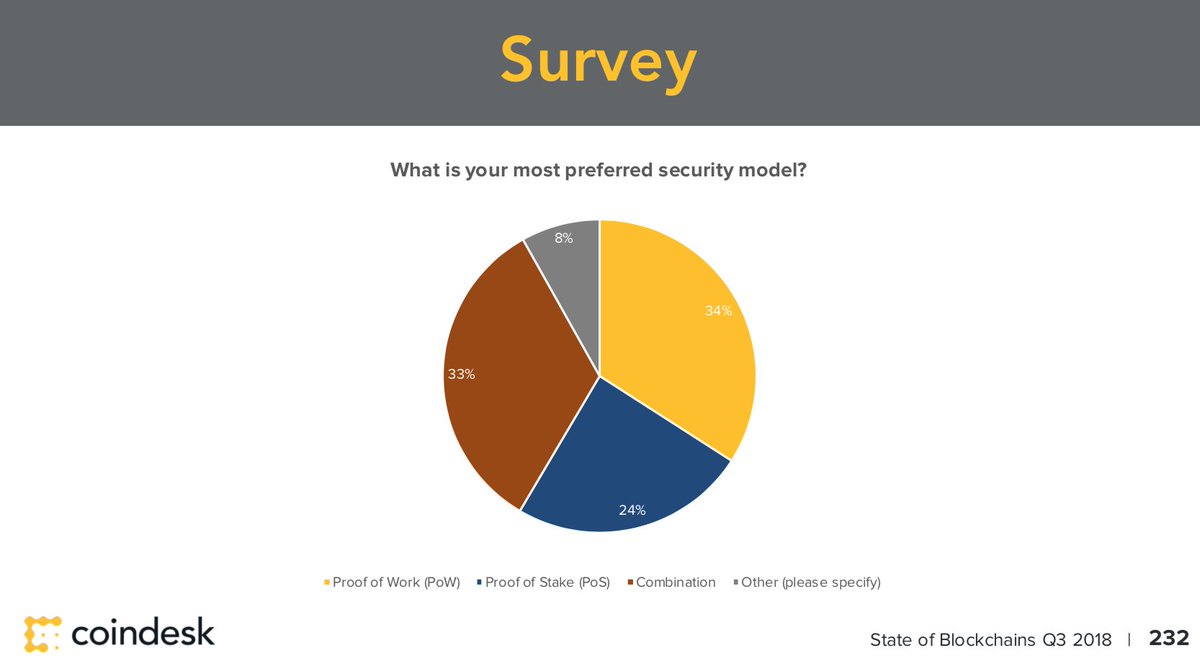

The classic security model of crypto, Proof-of-Work (PoW), is only most preferred by 34% while Proof-of-Stake (PoS) is at 24% and a combo is 33%.

bit.ly/2UgEiZT

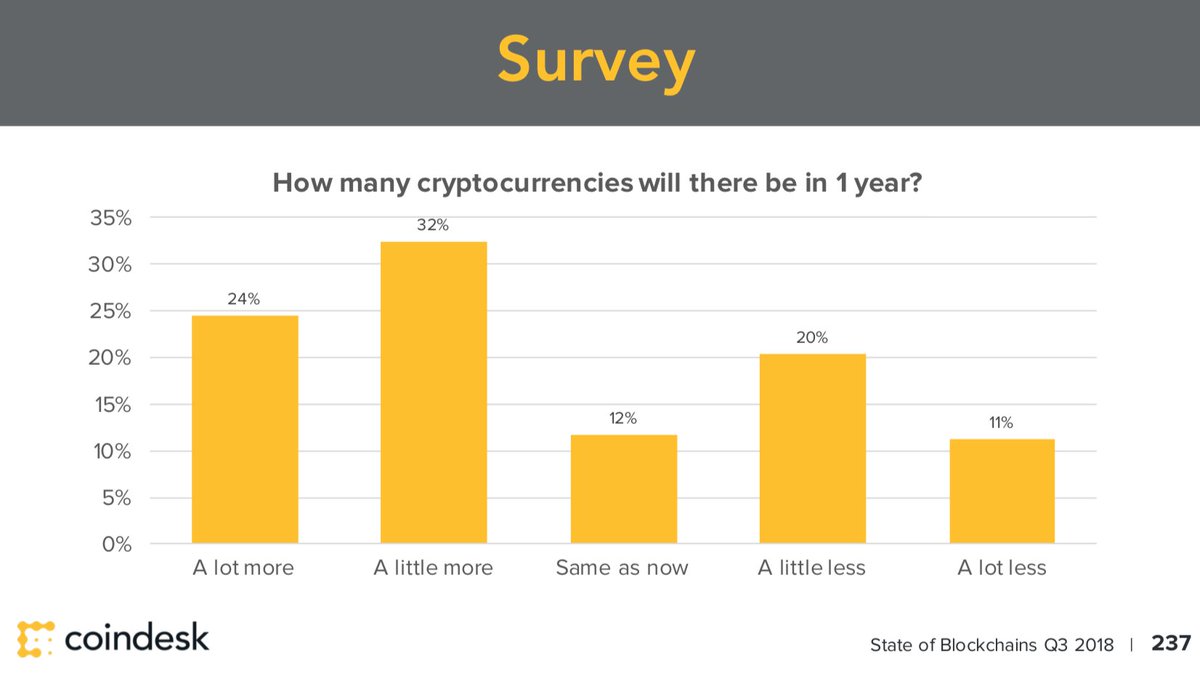

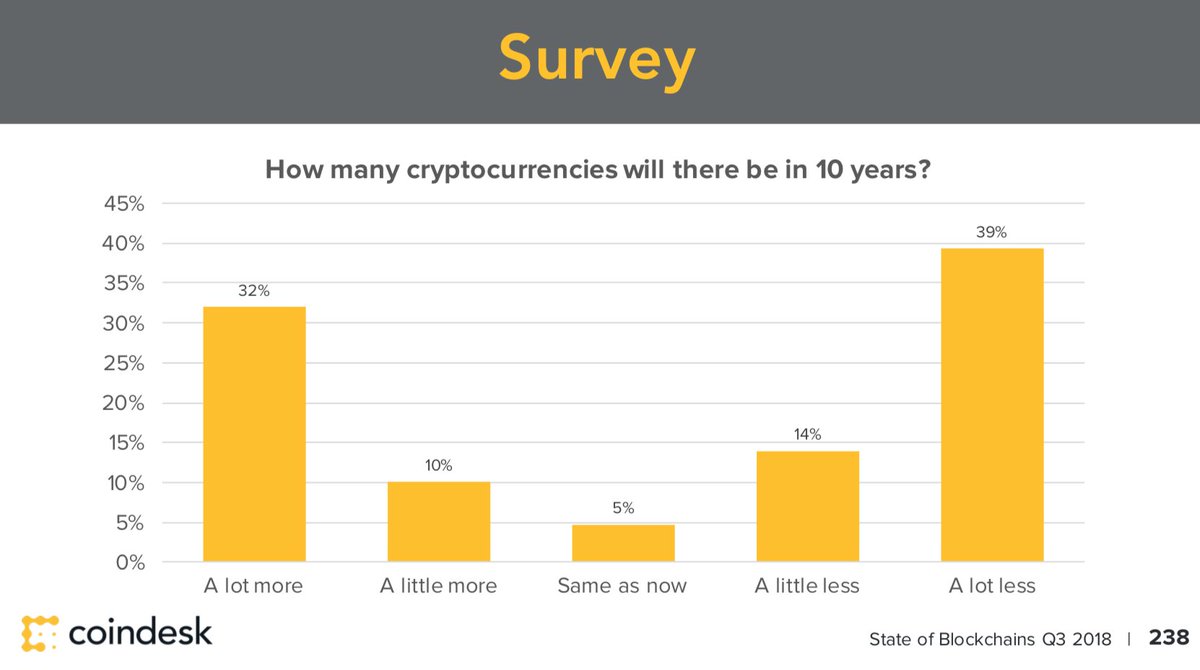

Opinion leaned to more cryptocurrencies launching in the short term, while in the long term a sharp divide arises between maximalist and multicoinist theories. "A lot less" was the dominant long term position.

bit.ly/2UgEiZT

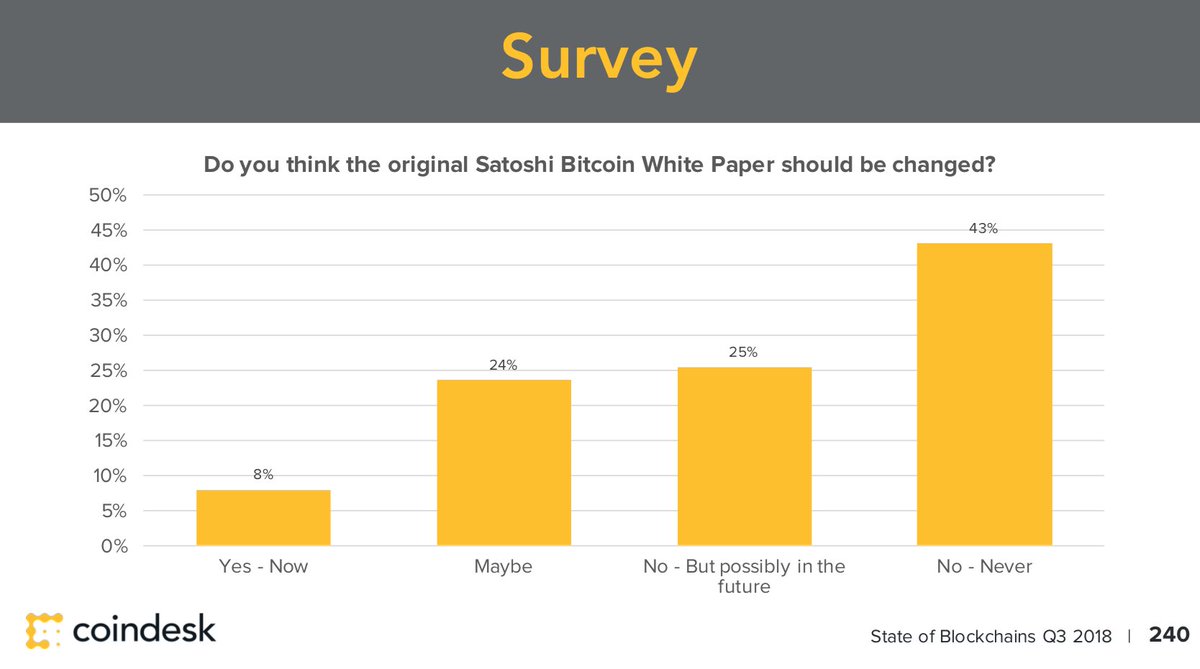

43% thought the Satoshi White Paper should never be changed with the remaining 57% majority suggesting that it perhaps should.

bit.ly/2UgEiZT

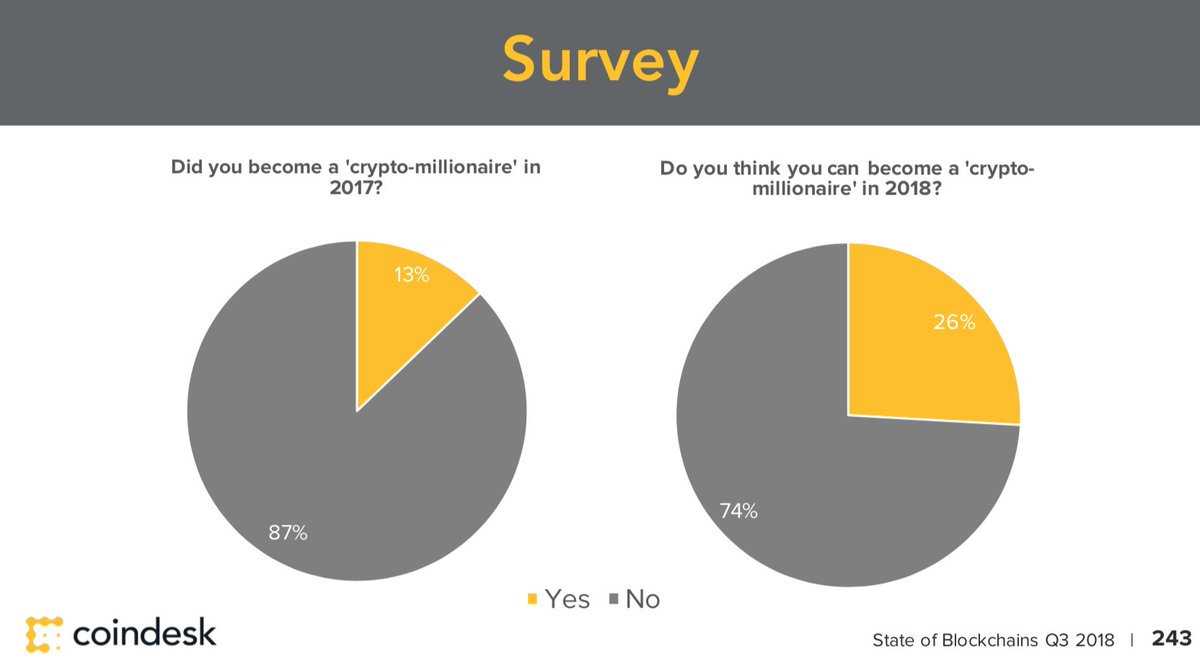

While 13% became crypto-millionaires in 2017, 26% thinks they can become one before 2018 ends.

[lambo engine revs in the background]

bit.ly/2UgEiZT

bit.ly/2UgEiZT