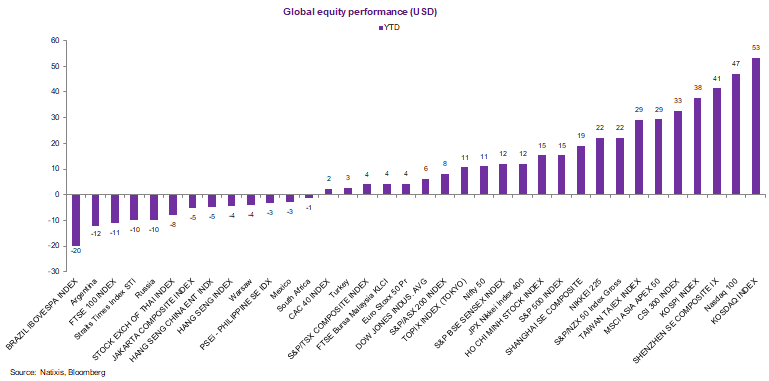

Hello. Today is 30 December 2020 & let's look at the year in review of asset performance. Here is a chart of key equity indices in 2020 in USD. Looking at this, it's difficult to see that we had one of the most devastating pandemics & economic contractions globally in decades.

Best is tech related indices, such as Kosdaq (Korean tech) & Nasdaq (American tech), Shenzhen (Chinese tech), Kospi & obviously Taiwan & the Nikkei.

Meaning, the Americans + North Asians, mostly Korean, Taiwanese, Japanese & Chinese tech.

Covid-19 = Tech windfall.

Meaning, the Americans + North Asians, mostly Korean, Taiwanese, Japanese & Chinese tech.

Covid-19 = Tech windfall.

Beyond sector driven indices (tech & the mother of all tech is American, Chinese, Korean & Taiwanese as they are all part of the supply chain), of course we have to look at who else did well beyond sectoral advantages & of course they would be VIETNAM, TAIWAN & CHINA 🇻🇳🇹🇼🇨🇳

Why?

Why?

Btw, while economics & markets may seem divorced, they are not. I'll explain that later on why that is the case but let's talk about VN, TW & CH.

These are the only POSITIVE growing economies in Asia (& major econs) in 2020 & their growth rates are in that order, as in VN best.

These are the only POSITIVE growing economies in Asia (& major econs) in 2020 & their growth rates are in that order, as in VN best.

This is GDP growth rates in Asia in 2020 (and I used only 1st 3 quarters even though VN had its Q4 as it's the only one so far) & best are VN, TW, CH, followed by SK.

Why VN so good? Well, it didn't believe in the WHO & so shut down its borders even in Jan (TW same). And also...

Why VN so good? Well, it didn't believe in the WHO & so shut down its borders even in Jan (TW same). And also...

Beyond Vietnam and Taiwan taking its on precaution vs waiting for the WHO to declare global pandemic on 12 March 2020 (Korea did the same), which saved these economies from lock-downs & relatively limited disruption to domestic mobility at the expense of tourism, which was wise.

But more importantly, Vietnam, as a frontier market, did something different than other Asian economies such as Indonesia, India & the Philippines, in that it had created a very diversified economy that didn't overly depend on a few sectors & also portfolio flows & have manu +FDI

While the global storm raged outside &countries blindly listened to the WHO & kept borders opened & let the pandemic rage & ravaged their economies & some even worse having to much dependence on few sectors, Vietnam did better & let's be honest best in Asia despite being frontier

Taiwan, of course, is a well known story. It's just Vietnam in a next level w/ the virus contained as it never took chances & took actions early on & was vigilant, not to mention having sectors crushing it during Covid-19 such as semiconductor & also policies of reshoring.

Finally China, which you know well. After having the infection in Wuhan going out of control and taking draconian measures in that province & beyond, it took its own steps w/ Covid & shut down the borders (against WHO recommendations) & so was able to normalize slowly after Q1.

Let's not forget, we started 2020 EUPHORIC & markets continued to be up until Feb despite news of a virus forcing China to do lockdown (after many travelers already fled abroad for LNY) as Western leaders (politicians + journalists) touting WHO recos vs following VN & TW.

Anyway, we know now what we know & hindsight is 2020 & this is the asset performance we get globally & to the left is the GDP.

I talked about the positive GDP story (still slowing) & we know the negative story too as countries got caught off guard cyclically & structurally.

I talked about the positive GDP story (still slowing) & we know the negative story too as countries got caught off guard cyclically & structurally.

In Asia, the worst performing economy is the Philippines, followed by India and then Hong Kong, where @Trinhnomics live. And HK is painful because we had a contraction in 2019 already.

Let's not forget, even in VN, TW, CH, the positive growth figures mask the unevenness/pain.

Let's not forget, even in VN, TW, CH, the positive growth figures mask the unevenness/pain.

Why did the Philippines & India do so poorly in juxtaposition to Vietnam? Well, it waited until the WHO declared pandemic mid March, which btw would mean that Covid-19 was already RAGING globally, to take actions so it went from hero to zero mobility through lockdowns.

And worse

And worse

Both the Philippines & India didn't just do its own intel (can we blame them as VN & TW & SK are the outliers not the norm of Covid-19 management) on Covid & relied on the WHO & that was a disaster. But they weren't blameless. These economies were ill prepared to begin w/ due to

Poor public health infrastructure, having a not diversified economies that don't have much manufacturing/diversified exports, too reliant on portfolio flows & remittances & not enough institutional capacity to deal w/ shocks. They suffered long lockdowns w/ few support measures.

Indonesia also falls into this category too & it also suffered greatly because it has a lot of external debt (relative to PH & India) & so when shocks came, it was hit very very hard. But don't lament. I argued in this op ed that 2021 is ripe for revival🤗

asiatimesfinancial.com/author/www.asi…

asiatimesfinancial.com/author/www.asi…

Hong Kong is a sad story despite being relatively successful in dealing w/ Covid-19 because of the structure of economies that is too dependent on tourism/external sources of service demand & also suppression measures hurting businesses. Breaks my heart seeing shuttered stores.

Thailand as well is a sad story despite having savings, manufacturing & plenty of buffers to deal w/ Covid-19 because its over reliance on tourism (double digits exposure to GDP) & also political challenges limiting the ability to deal w/ shocks & prepare for life beyond Covid.

Malaysia falls into that in betweener of dealing with Covid-19. Having a relatively decent Covid management (although still targeted lockdowns), savings to cope w/ shocks & also manufacturing & sectors that did well, Malaysia had too much oil/gas exposure & political issues.

South Korea veers towards the best of Covid but still will contract in 2020 thanks to being super vigilant & introduced control measures in January (lessons from MERS). Got savings, institutional capacity, sectors (tech + medicine products), & stimulus to offset + no lockdown.

But the South Korean story while shines brightly is one that is mostly a financial market/asset pricing one.

Unemployment has risen, household debt higher, gov debt higher (but still low relative to OECD) and fertility dropped further.

Dealt w/ the storm but challenges remain.

Unemployment has risen, household debt higher, gov debt higher (but still low relative to OECD) and fertility dropped further.

Dealt w/ the storm but challenges remain.

And of course, these are macro stories. Beneath the good/bad macro stories, there are winners & losers, although obvs some more than others depending on the economy.

Let's not forget, GDP isn't stock markets. Why?

Let's not forget, GDP isn't stock markets. Why?

If we look at this chart again, which is relative global equity performance in USD in 2020, we may find a huge disconnect w/ the news cycle talking about the misery of main street dealing with rising unemployment, insecurity & fractured society/psychology.

Let's talk about this.

Let's talk about this.

Diff b/n an economy & indices

*Publicly listed firms are not all represented in indices & publicly listed firms DO NOT represent all activities of economy

*Indices have only larger firms & few countries have tech

*EM = banks, real estate, commodities, consumer & energy & infra.

*Publicly listed firms are not all represented in indices & publicly listed firms DO NOT represent all activities of economy

*Indices have only larger firms & few countries have tech

*EM = banks, real estate, commodities, consumer & energy & infra.

So beyond the firm SIZE & SECTORAL composition of indices that differ from the real economy (for example South Korean economy is dominated by services & small firms but KOSPI is mostly Samsung Electronics tech, & tradeable firms vs domestic). Meaning, an index is not the economy.

That said, some indices are more representative of domestic economies than others as KOSPI relies on a lot of external revenue but say the Philippines PSEI is mostly domestic & they got BIG firms of the Philippines like banks, consumer goods etc.

Still, even so, they differ!

Still, even so, they differ!

Companies that are included in the index have something that you or a small firm don't have: ACCESS TO CHEAPER FINANCING & SHEER SIZE or balance sheet to cope w/ shocks.

As in, they are banked & get cheap rates & also get capital fund flows. So they are not you or smaller firms.

As in, they are banked & get cheap rates & also get capital fund flows. So they are not you or smaller firms.

So when central banks from far away like the Fed, ECB, BOJ, and central bank close by INJECT MASSIVE LIQUIDITY, they get access to cheap funding via the banks themselves via loans or investors buying stocks/bonds.

Not to mention they got deeper pockets or access to bailouts.

Not to mention they got deeper pockets or access to bailouts.

This is why people go on Twitter and lament the disconnect between jobless claims/unemployment etc and the all-time-high stock market.

But don't forget, these are just winners of Covid-19 & within the current price is also expectations of 2021 so both past & hope of the future.

But don't forget, these are just winners of Covid-19 & within the current price is also expectations of 2021 so both past & hope of the future.

For hope of 2021 while we're in the midst of a dark winter (hard to tell looking at the glorious weather here in Hong Kong despite the economic gloom), read @natixis 2021 outlook. We got global + Asia published.

But I am here because this anecdotal article by the @WSJ that made me cry, which is in some ways all of us even if we benefit from asset inflation, but more so those that suffer through deaths, illness & a worse present & future as 2021 looms.

wsj.com/articles/covid…

wsj.com/articles/covid…

For each of us cheering the rallying stock market 🥳🎉🍾as it rallies into the end of 2020 as we made the right call to, well, buy the dip, there is a sense of guilt of those we leave behind.

They are people that can't work from home. To deal w/ Covid, we made them unemployed.

They are people that can't work from home. To deal w/ Covid, we made them unemployed.

Their micro stories are a global one. The invisible people that we don't really talk about much as we celebrate low rates, QE & beyond injecting life into financial &real estate (yes, even Bitcoin). We owe something to them & their children for the suffering now & into the future

Let's end 2020 on a hopeful note. At the end of that @WSJ article, Maria ended up living in a car w/ her son cuz lost her nanny job & couldn't afford to move to Colorado for a new one despite setting up a Payme account.

I checked, she exceeded her goals🤗

gofundme.com/f/help-single-…

I checked, she exceeded her goals🤗

gofundme.com/f/help-single-…

At a systemic level, a $900bn stimulus was passed & people are getting checks again & extending unemployment benefits in response to the fact that the gov basically made many people unemployed through suppression measures.

But that's the US. For many in EM, no such safety net.

But that's the US. For many in EM, no such safety net.

• • •

Missing some Tweet in this thread? You can try to

force a refresh