1/ Thread: The danger of ridiculing early tech

Survivorship bias is real, but it is always humbling to look back and see how different revolutionary tech was perceived when they first came to the scene.

Let's look at telephones, cars, and social media.

Survivorship bias is real, but it is always humbling to look back and see how different revolutionary tech was perceived when they first came to the scene.

Let's look at telephones, cars, and social media.

2/ When Edison was working on the idea of telephone, he was trying to work out a way so that telegraph operators could talk to each other.

As telegraph operators were scattered all over the world, a telephone would be a great help for operators to coordinate with each other.

As telegraph operators were scattered all over the world, a telephone would be a great help for operators to coordinate with each other.

3/ What about ordinary people talking to each other?

"What are you smoking, Monsieur? Why would people from faraway places talk to each other? And do you know what it would cost you?"

"What are you smoking, Monsieur? Why would people from faraway places talk to each other? And do you know what it would cost you?"

4/ The idea of wide adoption of cars was ridiculed even more. JP Morgan didn't invest in Ford Motors because "cars are just toys of rich people."

5/ In the late 19th century, horse-drawn carriages were still reigning the streets. Some of the funniest regulations were written when cars came to the scene.

All road locomotives, including automobiles, were allowed to travel at max 2 miles/hr in the city.

All road locomotives, including automobiles, were allowed to travel at max 2 miles/hr in the city.

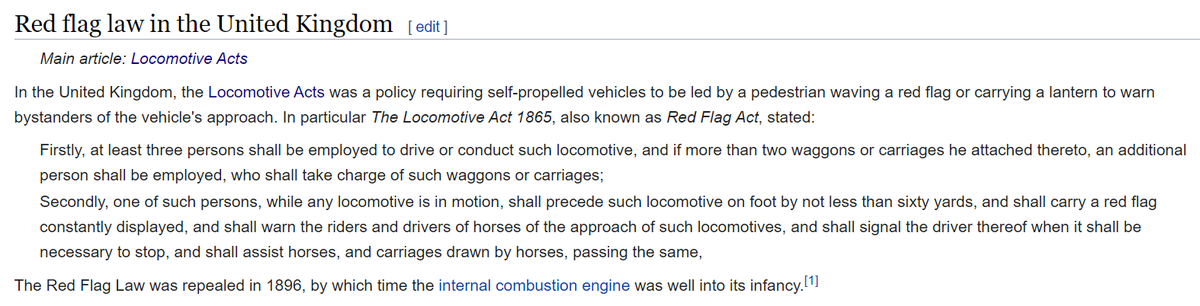

6/ UK had this regulation called "Redflag laws". Just read some sections of these laws (from wikipedia).

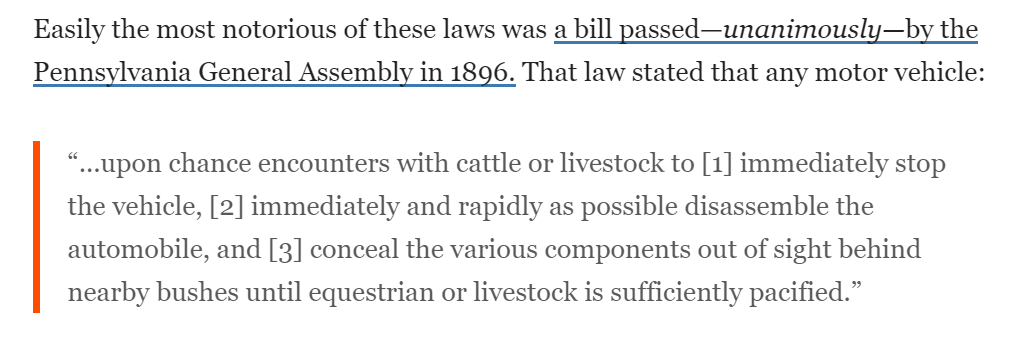

But what Pennsylvania enacted *unanimously* is probably the funniest one.

But what Pennsylvania enacted *unanimously* is probably the funniest one.

7/ I came across these examples from a debate between @peterthiel and @pmarca back in 2013 which I would recommend you to watch.

8/ Now let's talk about a more recent one: Social Media.

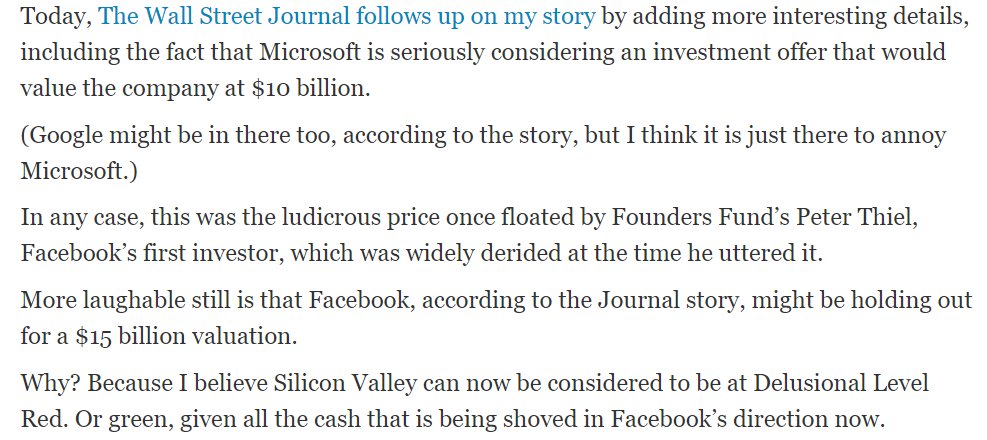

When $MSFT bought 1.6% position in $FB in 2007 at $15 Bn valuation, Kara Swisher could not hide her laugh. Take a moment to read this one.

When $MSFT bought 1.6% position in $FB in 2007 at $15 Bn valuation, Kara Swisher could not hide her laugh. Take a moment to read this one.

9/ This isn't meant to ridicule her, but to remind just how implausible it all seems in the early stage.

$ABNB was thought to be "the worst idea that ever worked".

$ABNB was thought to be "the worst idea that ever worked".

10/ Ridicule does not necessarily automatically mean free lunch waiting for you, but whenever you sense ridicule from some people, it's probably a good hunting ground.

End/ I want to be extra careful not to ridicule the new shiny thing.

As long-only investor when something doesn't make sense, my initial assumption is perhaps I don't get it, and I don't get it a lot of the time.

All my twitter threads: mbi-deepdives.com/twitter-thread…

As long-only investor when something doesn't make sense, my initial assumption is perhaps I don't get it, and I don't get it a lot of the time.

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh