0/Thread of Threads (2020).

Central banks around the world have accelerated their assault on the public. A tsunami of debt has been printed and there’s no end in sight.

They’re heating the house by setting it on fire.

Central banks around the world have accelerated their assault on the public. A tsunami of debt has been printed and there’s no end in sight.

They’re heating the house by setting it on fire.

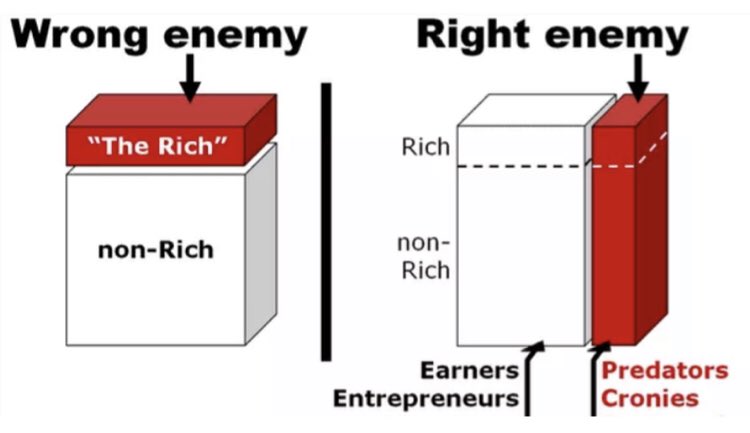

1/Savings have been obliterated. Today’s youth increasingly looks forward to a bleak future of have and have nots. The K shaped recovery will stand over them not as as monument but a wall against prosperity.

2/Bitcoin has emerged from its deep slumber, roaring back to life at the most opportune time. As it continues to monetize, subsuming fiat, we will begin to see overt manifestations of hyperbitcoinization.

3/Exactly how fiat unravels is far from certain but certainly central banks will play the leading role in defining the next several years of our lives.

Below are my 2020 threads exploring these issues.

Below are my 2020 threads exploring these issues.

5/Fiat Inflation vs Bitcoin Deflation

https://twitter.com/ObiWanKenoBit/status/1227299792906158080?s=20

6/FADE (Fiat Assured Destruction Event)

https://twitter.com/ObiWanKenoBit/status/1242890398189510656?s=20

8/The Decade of Discontent, Destruction and Debt Deflation: 2020-2030

https://twitter.com/ObiWanKenoBit/status/1270766046597672961?s=20

9/Hyperbitcoinization Redux (2020)

https://twitter.com/ObiWanKenoBit/status/1143522955357388801?s=20

15/Bitcoin, A Force for Good

“Close your eyes Luca. Look deep into yourself and trust your feelings. Bitcoin is a force for good.”

citadel21.com/bitcoin-a-forc…

“Close your eyes Luca. Look deep into yourself and trust your feelings. Bitcoin is a force for good.”

citadel21.com/bitcoin-a-forc…

Hyperbitcoinization 2020 (correct link)

https://twitter.com/ObiWanKenoBit/status/1276206899453517825?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh