SPAC $NOVS merging with AppHarvest (to be $APPH)

Looks very.. curious (cough)..

Short thread:

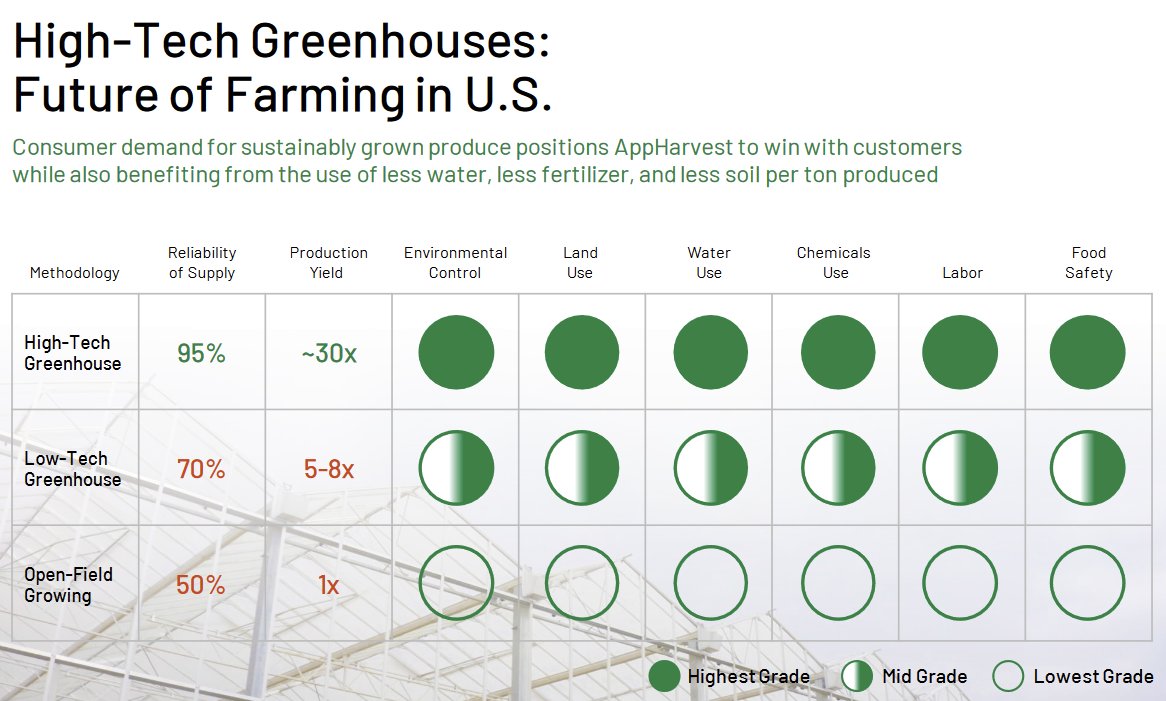

Its a "high-tech" greenhouse/hydroponic grow operation.

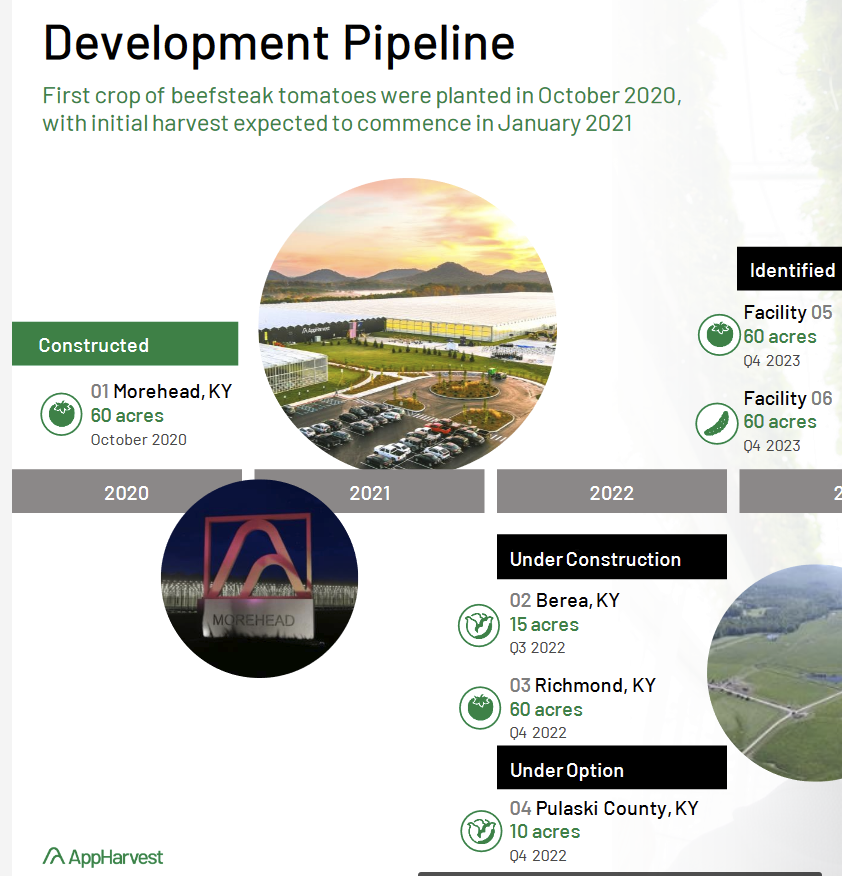

They just completed construction and planted their first harvest in their first building in October 2020 (2 months ago, yes)

Looks very.. curious (cough)..

Short thread:

Its a "high-tech" greenhouse/hydroponic grow operation.

They just completed construction and planted their first harvest in their first building in October 2020 (2 months ago, yes)

Can you spot any new automation/technology? Humans planting, humans caring for the plants, humans harvesting. Its farming, indoors.

The SPAC deal values them at a $1B market cap or a ~570M EV as the PIPE investors are bringing in most of the cash. SPAC holders only get ~10% of the company.

The SPAC is now at $16 representing a 1.13B EV or 1.6B market cap.

The SPAC is now at $16 representing a 1.13B EV or 1.6B market cap.

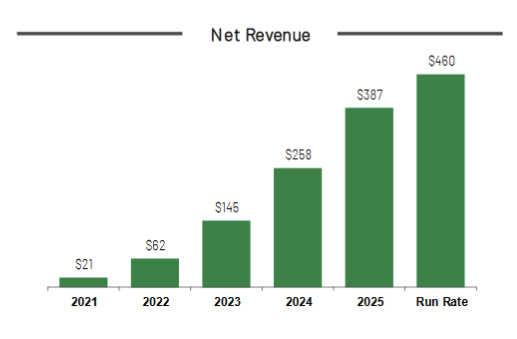

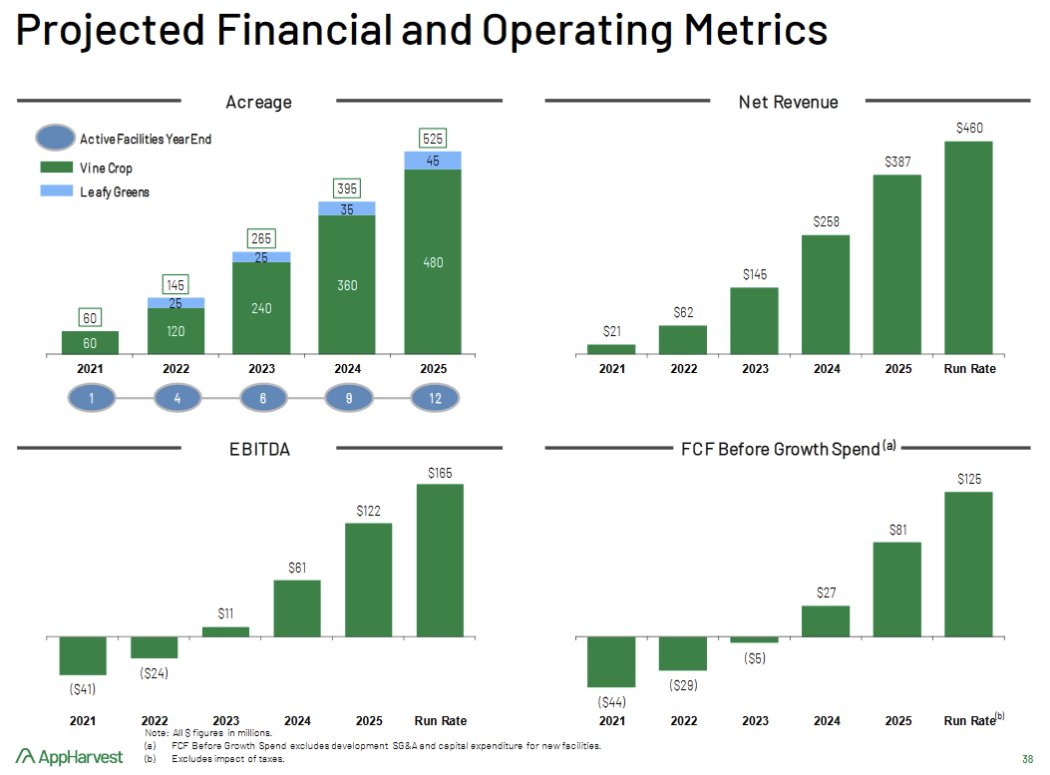

They anticipate the first year of (vine plant) production will generate 21M in revenue. Keep in mind, this is all assuming their yields are as expected as this is the first crop!

So the company is trading at 55x EV/NTM sales or 19x est 2022 sales.

So the company is trading at 55x EV/NTM sales or 19x est 2022 sales.

I'll leave the other forecasts here. Apparently 2023 to 2024 will be a big year, +110M in revenue will yield +55M EBITDA..

I'm passing on this one. I don't see any proprietary tech or moat. Legacy growers would buy the tech that they are buying if it works out, no?

I love the idea of bringing crop diversity back to the US, so I would be a buyer of the product if it works out. Just not the shares.

I love the idea of bringing crop diversity back to the US, so I would be a buyer of the product if it works out. Just not the shares.

Should mention, revenue expected to triple in 2022 as they are building two new facilities. Its farming, so yield is a 1 to 1 relationship to space/land. They need to build 9 (NINE!) of these facilities in the next 4 years to meet projections.

• • •

Missing some Tweet in this thread? You can try to

force a refresh