Algorithmic stablecoins have been one of the most exciting parts of crypto recently. The design space is wide and there have been many innovations taking place. I have been following FRAX closely and want to take an opportunity to share my learnings here coingecko.com/en/coins/frax

FRAX is a decentralized stablecoin where its target peg is $1. Unlike over-collateralized crypto stablecoins like Dai and sUSD, it aims to be capital efficient by using fractional reserves via a 2 token model. Its other token is Frax Share (FXS) coingecko.com/en/coins/frax-…

Each FRAX is backed by USDC & FXS. The percentage of USDC & FXS backing FRAX is determined by a collateral ratio adjusted algorithmically each hour. FRAX started off with a 100% USDC collateral ratio. At this point in time, FRAX is backed 90.75% with USDC with the remainder FXS.

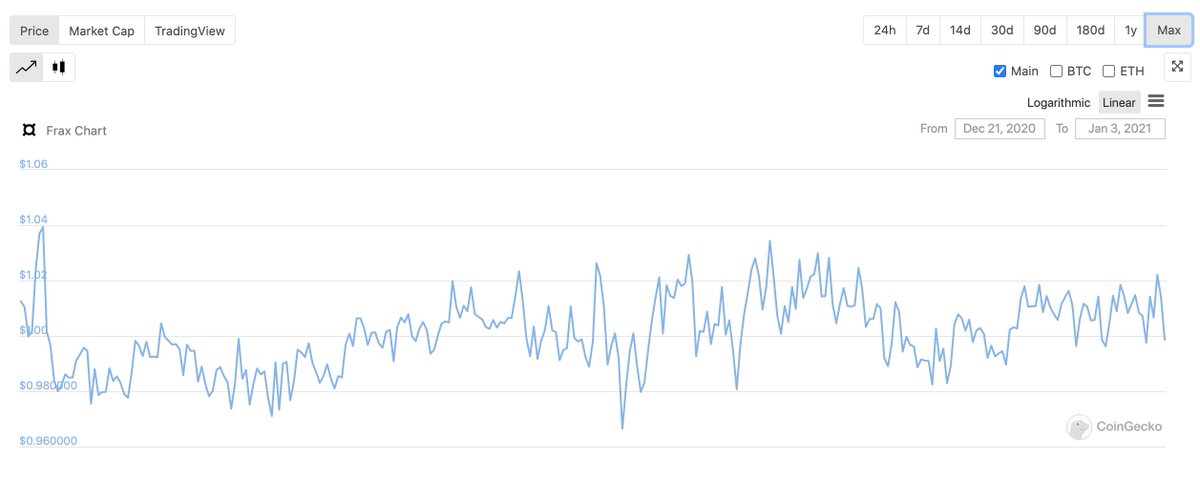

Unlike other supply-elastic stablecoins like Ampleforth or algo stablecoins like Empty Set Dollar and Basis Cash that has seen its price deviate wildly, FRAX price has been quite stable and did not deviate much from its $1 peg. It has stayed mainly around the $0.96-$1.04 range.

The reason for its close peg is the arbitrage opportunity if price deviates away from $1. If FRAX > $1, users can mint new FRAX by depositing $1 worth of USDC/FXS and sell newly minted FRAX in the market. If FRAX < $1, users buy cheap FRAX and redeem them for $1 worth of USDC/FXS

Let's now look at the collateral ratio (CR) backing FRAX. Each hour, any user can call a function to adjust CR by 0.25%. If FRAX >= $1, CR moves down 0.25% the next hour. If FRAX < $1, CR moves up 0.25% the next hour. Thus as CR goes down further, more FXS is needed to mint FRAX

The FXS that is used to mint FRAX is burned from the supply. The value of FXS is closely related to the demand for FRAX. As long FRAX demand stays buoyant, CR will go down and more FXS is needed to be burned to satisfy demand thus driving FXS price up. Inverse is true too.

It is possible that the system ends up with a CR of 0% where FRAX is backed entirely by algorithmic FXS. I don't find this scenario likely but I think that it is entirely possible that a steady state of 40-50% CR will be found in the medium run.

At its current 90% CR, I think FXS has a potential to run up further and many are not realising the opportunity that FXS is presenting. FRAX currently has mkt cap of $77m. Compare this to ESD ($438m), AMPL ($292m), DSD ($106m) - you have some good comparables of where this can go

FRAX was launched on 21 Dec and is currently 2 weeks old so it is still very much experimental. It is still going through its first phase so expect CR to contract & expand rapidly as its system is stressed-tested. As it becomes more stable, expect more improvements from the team.

FRAX does not need to take only USDC as its collateral. In the future, more volatile assets such as BTC/ETH can also be accepted. A third token model, Frax Bonds will also be introduced. Details are still scarce but my guess is that it will be similar to Basis Bonds / ESD Coupons

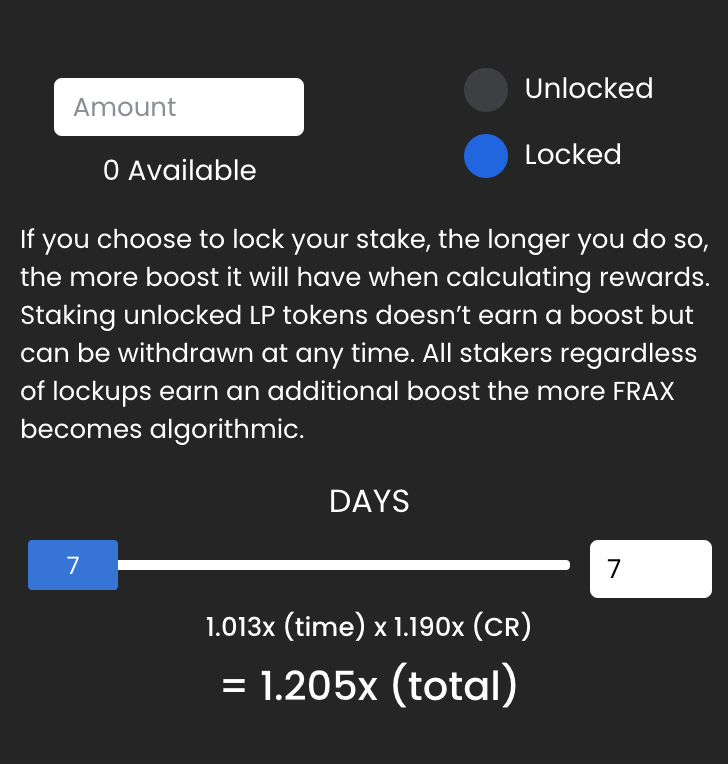

One final piece about FRAX that I like is in its liquidity mining program. It incentivizes long-term liquidity providers. Liquidity providers can lock their stake from 7 days up to 3 years to have increased rewards. 7 days will give a 1.2x multiplier and 3 years will give 3.57x

It also has a CR boost. As CR goes down, more FXS reward is given to yield farms. If CR = 0%, then there is a 3x multiplier. This helps to keep farms with the juicy APY as TVL goes up.

At current rates:

FRAX/USDC - 90%

FXS/FRAX - 252%

FRAX/WETH - 207%

vfat.tools/frax/

At current rates:

FRAX/USDC - 90%

FXS/FRAX - 252%

FRAX/WETH - 207%

vfat.tools/frax/

FRAX/USDC is exceptionally juicy at 90% for a stablecoin farm if you believe that FRAX's peg will stay strong near $1 and if FRAX will not have any smart contract bug that will render the entire system useless.

Talking about risks, again this is very experimental. A smart contract bug will break the entire system and will likely render FRAX/FXS to $0. There is an incentivized insurance pool on Cover that one can purchase but price is no longer competitive since Cover got exploited.

That's all that I have to share today on FRAX. Let me know if I missed out any key points for all you other IQ 200 people. Do refer to these useful docs:

docs.frax.finance

I find this article on algo stablecoins by @benjaminsimon97 extremely useful

insights.deribit.com/market-researc…

docs.frax.finance

I find this article on algo stablecoins by @benjaminsimon97 extremely useful

insights.deribit.com/market-researc…

Hopefully I covered all the key points here for your understanding. Let's see where FRAX and its collateral ratio takes us in the coming weeks. What an exciting time to be alive seeing innovations in money taking place from the front seat!

Disclosure: We did not participate in any private sale of FRAX. I am just a public participant with FXS exposure and also farming FRAX/USDC and FRAX/FXS for the high APY. Wrote this mainly to help arrange my thoughts and share what I have learn about FRAX with others.

• • •

Missing some Tweet in this thread? You can try to

force a refresh